The bull market breakout for Greentech continues! U.S. policymaker action earlier this month coincided with a turn toward bullishness that was already building this summer to give our stocks some room to run.

We have three stocks featured this issue – both to watch and to buy: high tech batteries with a global market, a U.S.-focused solar play, and a niche player with a solution to global water issues and one set of greenhouse gas emissions.

Also this issue: our ESG Three, market commentary and an update on our portfolios.

Cabot SX Greentech Issue: August 17, 2022

Greentech’s Outlook

Commentary on current investing conditions and the Greentech Timer

In the current economy, my take is that Greentech stocks are a leading indicator of the stock market, which itself is a leading indicator of the economy. Regardless of that, the breakout we’ve seen this month in the Greentech sector provides some decent room for our sector to advance before pushback. By my reading of the stock charts, resistance should come in about 15% higher than current levels, where the former floor of much of 2021 now sits as a ceiling that may take a bit of time to work above.

Other analysts disagree on if this is a bull market emerging: There is plenty of chatter that this is an extended bear trap – a temporary rally in a larger bear trend – or maybe it’s just a shift out of bearishness to range-bound trading, rather than a bull move. Others say the overall market rally doesn’t reflect inflation and the tight labor market, which weigh on the economy. To the latter sentiment, it probably deserves a longer more philosophical discussion than we’ll give it today, but my view is that consumers making more money is a positive, not a negative, in a free market economy driven by consumer spending. Fossil fuel energy prices, which account for much of inflation, are easing and inflation ex-fuel and food (which, some of you will recall, is how inflation used to be commonly presented in the past), was 5.7% month over month in June, the last period of data from the Federal Reserve Bank. That’s a level at which plenty of bull markets have flourished in the past. Of course, no one can be certain what the market’s future holds – but widespread consensus is usually a warning sign, not a buy sign. For now, we’re buyers with a cautious eye on the lookout for a step back that, if too large, could crack support levels.

Greentech Timer

Our Greentech Timer is bullish when the index is above the 20-day and 40-day moving average and those averages are upward trending. (Ideally, the index is also above an upward-trending 200-day moving average too, but not essential.)

We’re bullish based on our definition. Our benchmark, the Wilderhill Clean Energy index, is more broad-based than other Greentech indexes and is less bullish than other Greentech indexes, which rely more heavily on fewer, larger stocks in the segment.

The main subsectors are all bullish too – solar, nuclear, water and wind are all firmly bullish, though wind is the weakest of the group. Other than Tesla (TSLA), EV makers are by and large quite negative, held back by delivery shortfalls or struggles to still get to production stage.

Featured Stock: Enovix (ENVX)

Overview

Lithium batteries are a $48 billion market this year, worldwide, according to data compiled by Grand View Research. That’s seen growing at a compound annual rate of 10% annual through the end of the decade, at which point it would be a $183 billion market. Lithium-ion batteries are preferred because they have a high power density – more charge in a lighter package – and they charge faster and hold a charge longer than traditional batteries. They do have downsides, as you’ve undoubtedly heard, such as a tendency to thermal runaway (excessive heat to fire) and difficulty in efficient use of the raw lithium input, with as much as a third of lithium being discarded during the battery manufacturing process for poor quality. More importantly in Greentech, the traditional graphite anode used in li-ion batteries has trouble handling the high heat of applications such as EVs and chargers.

Business Model

Enovix (ENVX) is a battery maker that claims it has built a better mouse trap: It uses silicon instead of graphite as its anode and a manufacturing process that it says makes the overall lithium battery safer and more efficient.

Silicon has been identified for some time now as a potentially better anode than graphite for its specific capacity to handle charges and its cheap abundance as a raw material. The trouble has been building a silicon anode that wouldn’t degrade quickly over time for various technical reasons: silicon expands a lot on first charge, the silicon has a tendency to degrade quickly through recharging, much of the potential charge is trapped in silicon and repeated charging also has a lot of swelling cycles too.

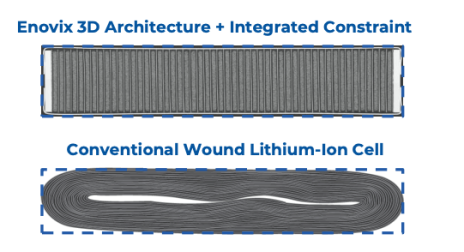

Enovix says it has solved all those problems, producing a battery that can store twice as much as traditional lithium batteries in the anode. Simplistically, it boxes in the battery components so they can’t swell very much and don’t degrade. To do so, Enovix restructured how its batteries are built – using a stacking process rather than the traditional winding of cells, as pictured.

The result of this restructuring of the battery – necessitated to keep the silicon from degrading – results in a battery that is also safer. Recent tests by the U.S. Army of the Enovix battery found it to be the first and only lithium battery to pass its nail penetration test. In that, the Army pierces a battery with nails as a proxy for various things that can occur on a battlefield. That passing grade means Enovix is now in play to supply the Army. The average U.S. soldier now carries some 20 pounds of batteries into the field. A lithium battery that is lighter and safer has obvious appeal.

In Enovix’ favor is its manufacturing footprint: Its first factory is in Fremont, California. The company has equipment on order for a second factory which will presumably be in the U.S., although the announcement of the location hasn’t been made. The Inflation Reduction Act’s incentives for domestic battery production – and the potential for an Army contract, which requires domestic production – will probably ensure the second factory is U.S.-based– though the company has identified factories in Asia and Europe it could acquire and retool for its purposes.

Business Outlook

In the Greentech space, I prefer looking at exciting start-ups like EVs and battery makers through the filter of production: actually getting a product on the market means the company has hurdled a series of financial, proof-of-concept and manufacturing challenges.

Enovix just shipped its first commercial battery packs in June, moving the company from the realm of start-up to an actual supplier. That obviously helps commercially and is starting to generate what management says is a type of fear-of-missing-out among tech companies – no one wants to miss out on securing capacity for a product that can improve performance.

That U.S. Army testing has generated some excitement – the Army is a significant if not gigantic battery customer, with an estimated annual battery demand of about $350 million. More significant is the interest among big tech companies. Enovix management says they have had conversations with three mega-cap tech companies. Mega-cap probably means to them $200 billion or more market cap, which should include Apple, Tesla, Samsung, Facebook, Microsoft and a handful of others. Two of these unnamed mega-caps told Enovix it is the best battery technology they tested and the third wants to move the battery through its testing process quickly – or so Enovix management told analysts on its earnings call last week.

The company is aiming its batteries at a lot of industries, first primarily at small consumer products, such as wearables, smartphones, Augmented Reality (AR) products and the EV ecosystem. Management feels that while it could see its packs supplant others in existing products, it is more likely their batteries will be used to bring to market concept products that have been waiting for batteries of a certain efficiency and reliability – which implies deployment in AR products.

The excitement around Enovix is for its potential. For this year, it’s still very much a small business, with total sales expected to be about $7 million while spending will be $170 million, half of which will be capital expenditures for equipment and the coming factory.

The existing factory has the capability to produce some 45 million batteries a year; the next factory should be larger and more automated and produce 89 million a year. A third factory will be focused on EV batteries.

Issues to Consider:

- Enovix management could be overstating interest from potential customers.

- Enovix came public by SPAC in 2021. SPACs generally have been overly optimistic in business projections.

- Enovix projected $173 million in 2023 sales in its going-public presentations with the SPAC last year. Management has since not reiterated that figured and has sounded more modest about 2023 since coming public.

- The business did, however, meet the Q2 target for production and revenue it told SPAC investors last year.

- There are a lot of expectations built into the stock: failure to land a mega-cap client this year likely is bearish.

- Battery stocks are volatile, and the underperformance of peers like QuantumScape (QS) probably affects sentiment.

- There are no SPAC warrants remaining – they were retired by the company in late 2021.

Technical Analysis

ENVX went public on July 15, 2021 through a SPAC merger. Shares have been well supported for much of that time – prices didn’t break the 10 SPAC price floor until April this year and bottomed out at 7.51, very good performance compared to other SPACs. Shares broke out of a double bottom early this month and gapped to 20, the projected target price level from its double-bottom breakout, on the company’s first quarter of earnings. Technically, ENVX is the best-looking Greentech stock right now – it has the best relative performance to the S&P 500 of the sector, excellent signs of accumulation by funds, and its general sector – electrical equipment – is one of the better sectors in the market. Shares are over their 200-day line and the shorter moving averages are upward trending. The 25-26 area where shares are right now offers some resistance. A breakthrough would mean the all-time post-merger high of 36 is the next target. Shares look very overbought, but a technical overbought condition is more indicative of a pullback in a stagnant market – an overbought condition can be extended in an uptrending market.

What to Do Now

It’s a bull market and momentum shows that Enovix is enjoying a lot of investor attention right now. It’s risky given the hopes built into shares, but we’re going to add a position in a bullish market for Greentech. Give some space for volatility, a conservative sell-stop for that would be around 20. We’re going to set our sell-stop for the portfolio initially around 16.25, which would be below the 200-day line and the spot where support from the recent price gap will have been eroded. BUY

Enovix Corp. (ENVX)

Revenue (trailing 12 months): $5.1 million

Earnings per share (TTM): (0.80)

All-time high (intraday): 39.48

Market cap: $3.9 billion

Recommendation: Buy

Intended Portfolio: Real Money

Featured Stock: Sunrun (RUN)

Overview

About 3 million U.S. homes have solar, equal to about 5.4% of the housing stock in the country. That leaves a lot of growth to be had off of a base that is large enough that accelerating growth could be anticipated. There are a lot of opinions on what the so-called tipping point for residential solar is for it to attain even faster adoption, but it’s clear there is momentum for homeowners to explore solar given higher utility bills plus the Inflation Reduction Act, which provides a decade’s worth of incentives for domestic solar, a cost certainty that had been missing from the market for many years.

Business Model

Sunrun (RUN) is the leader in residential solar installations in the U.S., with 724,000 customers – so roughly a fifth of the market. The business was enjoying a strong start to 2022 before the Inflation Reduction Act passed, with new installations up 33% in the second quarter. The company should produce $2.06 billion in sales this year with a net loss of 55 cents per share that should swing to a slight profit next year.

Most of Sunrun’s customers are subscriptions, where they lease their equipment. The company says the value of each subscriber added in the second quarter was $7,910 and sees a path toward pushing that to $10,000 each in Q3, with the addition of battery storage offerings. In Q2, each subscriber reprsented a gross value of $38,712, through a combination of upfront government rebates to Sunrun, customer payments under leases, plus tax and renewal benefits. Costs – the upfront charge for equipment, installation costs and other services, were close to $31,000.

Sunrun benefits from the general tailwinds for solar in the U.S., especially California, and in the long run its heft should allow it to benefit from expected consolidation of smaller solar installers over time. The business does face some headwinds from tariffs on Chinese solar panels, which has gummed up its costs and supply chain somewhat – though Sunrun is panel agnostic, as long as they meet its specifications. Still, removal of tariffs would be bullish for Sunrun.

Much of Sunrun’s market position comes from its relationship with new home builders, so the company is affected by any slowdowns in new home construction. Management says it is seeing good uptake from existing homeowners nationally, especially in the Northeast as well as the Midwest.

As with all solar businesses, customer acquisition hits the bottom line early given the capital costs of equipment and installation they are taking in the immediate quarter, while the 20- or 25-year recurring revenue from customer leases are spread out over the contract period.

Business Outlook

As with seemingly every Greentech company that touches a consumer’s home these days, Sunrun is expanding beyond its initial product to providing whole-home solutions, including energy storage.

In a neat marketing arrangement that may or may not end up being material, Sunrun and Ford (F) have teamed up to offer specially designed systems allowing the all-electric F-150 to act as a two-way power management system for the house, sending energy back into the home when needed. The system will also fully charge the truck in 8 hours using an 80-amp charge station from Sunrun, or 30 miles of range for every hour of being plugged in. If consumers want, they also can work with Sunrun to get a rooftop system installed with $0 down. The Ford system, without rooftop solar, sells for almost $4,000. Many investors have high expectations for the Ford partnership, with Credit Suisse analysts saying the partnership could add as much as $5 a share value to RUN. Still, even if it disappoints, the general shift toward EVs will benefit residential solar installers, as consumers will want to expand their rooftop capacity to support power-hungry add-ons like EVs and whole-home energy storage.

Also positive is Sunrun’s plan to offer solar panels in Puerto Rico in a joint venture with SPAN, a California company that sells a smart home electrical panel for optimizing solar and EV operations. This is expected to find good reception given the island’s lingering electrical problems from Hurricane Maria. The SPAN system is said to be able to allow backup energy storage to gain as much as 40% more operating time through intelligent load management.

Also on tap is a Level 2 EV charger. Level 1 chargers are basically household outlet chargers; level 2 are faster, usually home-based ones that can add up to 80 miles of range an hour, depending on the vehicle. Level 3 would be faster, like a Tesla (TSLA) Supercharger or the faster charger offered by another holding of ours, ADS-Tec Energy (ADSE). Sunrun is selling the charger under its own brand starting in California, New Jersey and Vermont next month, and nationally in all its markets by year-end.

Issues to Consider:

- The impact of the Inflation Reduction Act may already be priced into shares.

- Residential installation is a highly competitive market. Rival SunPower (SPWR) is another well-run installer that also looks excellent, from a technical standpoint.

- Benefits from the inflation act may not come to fruition as expected.

Technical Analysis

RUN gapped higher in late July on news of the now-passed climate bill, rallying from 23 to a recent peak of 34. That sliced through layers of resistance for shares and puts them on mostly bullish footing. The 200-day line below shares at 31 remains downtrending, but the shorter-term averages are moving higher, with a bullish Golden Cross – where the 40-day average crosses over the 200-day – set up to come in the next two weeks. The gap higher also broke shares out of a pattern, implying a rally to 42 should come. That price coincides with the next level of resistance. Shares are still well below their all-time high of 93.44, touched at the peak of the post-pandemic Greentech rally.

What to Do Now

Internal price timing signals (stochastics, for those familiar with technical analysis) suggest shares may need to ease back here before advance. At 35 recently with support at 31, look for a step back of a couple of dollars to enter more optimally. WATCH

Sunrun Inc (RUN)

Revenue (trailing 12 months): $1.95 billion

Earnings per share (TTM): (0.55)

All-time high (intraday): 100.93

Market cap: $7.39 billion

Recommendation: Watch

Intended Portfolio: Real Money

Featured Stock: Energy Recovery (ERII)

Overview

By 2030 the world will have a 40% shortfall of the fresh water it needs, according to the United Nations. The most logical solution is desalination – making seawater potable. Already there are more than 16,000 desalination plants operating globally, with nations such as the Bahamas, Malta and the Maldives generating all their freshwater from seawater. Another 174 countries generate some portion of fresh water from desalination. Making drinkable water can be done by distillation, usually sped along by boiling in what’s called thermal desalination, or by reverse osmosis. Seawater reverse osmosis (SWRO) is increasingly a popular choice because it’s less energy intensive than boiling. That’s where Energy Recovery (ERII) comes in.

Business Model

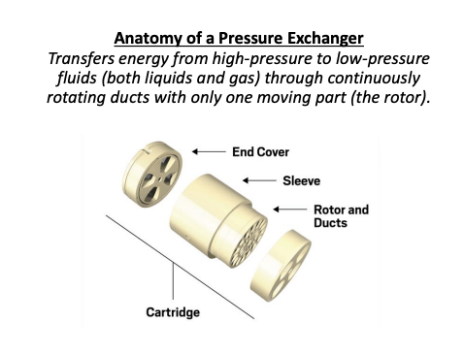

ERII is a California company that has a virtual monopoly on pressure exchangers used in SWRO plants. SWRO facilities take in sea water, pressurize it greatly (to roughly 1,000 PSI) and push it through a filter that removes salt and other impurities. About 40% of the water comes out as drinkable while the rest, the brine, is discharged. Pressurizing the water take energy, of course. Energy Recovery’s flagship product, the pressure exchanger (PX), allows the energy from pressurization to be reused, vastly slashing energy usage.

It’s a simple design, as pictured here:

In Energy Recovery’s design, the pressurized brine is diverted to hit new low-pressure sea water coming in and ratcheting that new batch up almost to the power needed (the PX is 98% efficient). That results in a lot less additional energy needed for pressurization. It’s classic energy transference, like the cue ball in pool hitting its target.

Growth in PX exchanger demand comes from two areas. One is the addition of new desalination efforts. The other is replacing existing thermal desalinization plants. Largely due to energy demands, thermal desalinization got overtaken by SWRO about 20 years ago, to the extent almost no thermal plants are built today. Existing ones are being replaced at the end of their lives with SWRO. Over the next decade, those replacements are a $500 million market opportunity for ERII.

Energy Recovery’s PX works exceptionally well: It has four ceramic parts just one of which moves, and it never needs to be replaced in the 25- to 30-year life of a desalinization plant. Overall, the company’s customers save about $2.5 billion in energy costs and the equivalent of 2.5 million auto emissions annually.

Right now, Energy Recovery is the dominant player in SWRO, losing out on very few bids. As investors, that actually presents something like a problem: While it has a high, 68%, gross margin in the water business, the product is so effective and reliable there’s not a lot of recurring revenue or follow-on sales from customer plants.

Business Outlook

The good news is Energy Recovery is looking to capitalize on its niche in pressurizers to expand beyond desalination.

The company launched a wastewater PX exchanger in late 2020 to take advantage of mandates in many markets for zero liquid discharge. That means all waste is stripped from water used in industrial processes and only clean water is discharged back into the environment. This affects industries ranging from textiles, steel, coal and so on and is a regulatory focus in India and China. In those two countries, wastewater PX should bring about $100 million in one-time replacements and about $10 million a year continuing business afterward. The PX for this process is slightly less efficient than its salt water cousin, but still high at around 93%.

Energy Recovery is also seeing gains in lithium processing, seeing clients gain sizeable energy cost reductions using a PX Exchanger in mining, processing and recycling. It’s a small business for the company right now, but should become a $200 million addressable market by decade’s end, according to management. A similar, industrial effort to use a type of exchanger in the oil and gas industry in a joint effort with Schlumberger (SLB) was ended earlier this year, which we view as a positive.

Perhaps most promising is the company’s potential in refrigeration, where there is a pressing need to eliminate hydrofluorocarbons – HFCs – a manmade gas which pound for pound are 1,000 times more potent greenhouse gases than carbon. Naturally occurring gases, such as carbon dioxide itself, can work for refrigeration in the same method as HFCs. The sole – but major – difference being that HFCs don’t need to be pressurized very much to work. CO2 needs to be pressurized much more to be as effective, especially when weather is very hot. Energy Recovery’s system is very effective at generating this high pressurization. Recent installations in Europe have been very positive under high summer heat, with management indicating a grocery chain client may want to expand use of CO2 refrigeration to other stores. Refrigeration probably is the largest market the company is in, at least $1 billion globally each year.

Taken altogether, Energy Recovery is expecting to boost sales 25% annually to $130 million this year to $330 million by 2026. Much of the growth in coming years is seen coming from refrigeration, perhaps 30% of business in that year, as well as industrial wastewater, at about 10% of the business in 2026.

Issues to Consider:

- ERII is a small stock, with a market cap of $1.36 billion. It will be more volatile.

- While its core desalination market is somewhat predictable, management could be incorrect in its business projections for industrial (textile) wastewater and refrigeration.

- We see the company as a potential takeover target for a larger industrial company that would see its business as a tuck-in addition to existing business – think DuPont or similar. However, there have been no discussions of any mergers or acquisitions.

- The company is profitable – $0.25 EPS in 2021 – and has no debt.

Technical Analysis

ERII is nearing completion of a rounding pattern it has been forming all year, with the breakout point at 25. Shares are among the best performing of Greentech on a relative strength basis against the S&P 500 and show excellent indications that funds are building positions in the stock.

The all-time high, on a closing basis, is 24.18, which is resistance, along with the top of the rounding formation at 24.99. A break over 25 would be a buy signal.

What to Do Now

Wait for confirmation that ERII will break out of the trading range and complete the bottoming action. Buy at 25 or higher. We will likely look to take profits rather quickly should the breakout occur. BUY at 25 or higher

Energy Recovery Inc. (ERII)

Revenue (trailing 12 months): $107.2 million

Earnings per share (TTM): $0.20

All-time high (intraday): 24.99

Market cap: $1.36 billion

Recommendation: Buy at 25 or higher

Intended Portfolio: Real Money

ESG Three

The ESG Three are three technically strong stocks to explore for further investing. We choose from among the 200 most-held stocks by ESG funds, and further screen out companies for clear environmental, social and/or governance issues such funds often overlook. As a general rule, we exclude fossil fuel producers from ESG consideration given their clear environmental impacts.

Apple (AAPL)

What is it?

A computer hardware and software maker.

Why is it ESG?

Apple appears to have robust ethics and policies and mechanisms in place and scores on average with peers on environmental and social metrics. ESG funds own $3.9 billion of shares.

Why now?

Subscriptions and services revenue is rising, and 5G mobile network rollouts in developing markets should spur demand for late-generation iPhones.

W.W. Grainger (GWW)

What is it?

A distributor of industrial and commercial supplies.

Why is it ESG?

Strong market position in a still-fragmented U.S. market positions it for further growth. ESG funds own $268 million of shares.

Why now?

Shares are at an all-time high. A renewed focus on North America should allow it to push higher-margin “high-touch” services.

Cardinal Health (CAH)

What is it?

A drug distributor and manufacturer of healthcare and laboratory products.

Why is it ESG?

Better than peers on environmental and social metrics. ESG funds own $66 million of shares.

Why now?

Expanded access to healthcare and health insurance in the U.S. and worldwide benefits the business. Diversification beyond pharmaceutical distribution exposes it to faster-growing healthcare segments.

Current Portfolio

Real Money Portfolio

| Stock | Ticker | Buy Date | Buy Price | Price on 8/16/22 | Gain/Loss | Rating | Sell-Stop |

| Clean Earth Shares | CLIN | 3/4/22 | 9.69 | 9.92 | 2.37% | Hold | None. Trust is 10.10 |

| Clean Earth Warrants | CLINW | 3/4/22 | 0.23 | 0.12 | -47.83% | Hold | None |

| Clean Earth Rights | CLINR | 3/4/22 | 0.2 | 0.22 | 10.00% | Hold | None |

| Clearway Energy | CWEN.A | 3/17/22 | 33.41 | 37.34 | 11.76% | Hold | Around 28 |

| Enphase Energy | ENPH | 8/11/22 | 298.56 | 292.16 | -2.14% | Buy | |

| Growth for Good Shares | GFGD | 2/3/22 | 9.44 | 9.80 | 3.81% | Hold | None. Trust is 10 |

| Growth for Good Warrants | GFGDW | 2/3/22 | 0.18 | 0.11 | -38.89% | Hold | None |

| Growth for Good Rights | GFGDR | 2/3/22 | 0.17 | 0.12 | -29.41% | Hold | None |

| Li Auto | LI | 7/21/22 | 36.01 | 30.95 | -14.05% | Hold | None |

| Montauk Resources | MNTK | 8/11/22 | 15.51 | 15.68 | 1.10% | Buy | |

| Natural Grocers by Vitamin Cottage | NGVC | 15.60 | Dropped | ||||

| Onsemi | ON | 8/11/22 | 67.32 | 70.54 | 4.78% | Buy | |

| Ormat Technologies | ORA | 8/1/22 | 86.72 | 95.81 | 10.48% | Buy | around 83.50 |

| Vertex Energy | VTNR | 6/1/22 | 13.88 | 7.04 | -49.28% | Hold | None |

* Buy prices for Clean Earth and Growth for Good components are adjusted to reflect unit splits

* Returns don’t include dividends of $0.3536 per share for CWEN/A

Excelsior Portfolio

| Security | Ticker | Buy Date | Buy Price | Price on 8/16/22 | Gain/Loss | Rating | Note |

| ADS-Tec Energy Warrant | ADSEW | 10/20/21 | 1.66 | 1.18 | -29% | Hold | |

| Altus Power Warrant | AMPS.WS | 5/19/22 | 1.06 | 2.91 | 175% | Hold | |

| Constellation Energy | CEG | 4/21/22 | 64.23 | 81.51 | 27% | Hold | around 64.25 |

| ESS Tech Warrant | GWHWS | 6/9/22 | 0.53 | 0.82 | 55% | Buy | |

| FuelCell Energy | FCEL | 1/6/22 | 5.20 | 4.93 | -5% | Hold | Half-sized position |

| Origin Materials Warrant | ORGNW | 6/16/21 | 2.43 | 1.33 | -45% | Hold | |

| Ree Warrant | REEAW | 6/16/21 | 1.10 | 0.15 | -86% | Hold | |

| ReNew Power warrant | RNWWW | 6/16/21 | 1.81 | 1.53 | -15% | Hold | |

| Volta Warrant | VLTA.WS | 6/16/21 | 2.21 | 0.70 | -68% | Hold |

Sold positions

| Stock/Security | Ticker | Buy Date | Buy Price | Sell Price | Gain/Loss | Sell Date | Note |

| Advanced Water Systems | WMS | 1/6/22 | 130.65 | 96.70 | -26% | 5/9/22 | sell includes dividend |

| Aecom | ACM | 2/17/22 | 73 | 74.36 | 2% | 4/25/22 | sell includes dividend |

| Aemetis, Inc. | AMTX | 9/24/21 | 14.63 | 14.76 | 1% | 12/14/21 | |

| Aptiv | APTV | 11/18/21 | 177.01 | 148.55 | -16% | 1/19/22 | |

| Archaea Energy | LFG | 12/2/21 | 18.27 | 19.93 | 9% | 5/10/22 | |

| Array Technologies | ARRY | 11/18/21 | 25.30 | 17.95 | -29% | 12/1/21 | |

| Aspen Aerogels | ASPN | 10/6/21 | 45.99 | 50.12 | 9% | 12/21/21 | |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 69.66 | 108% | 11/17/21 | Half sold this date |

| Centrus Energy | LEU | 9/21/21 | 33.46 | 49.68 | 49% | 12/4/21 | Half sold this date |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 4.47 | -14% | 4/7/22 | Half sold this date |

| Charah Solutions | CHRA | 2/3/22 | 5.22 | 4.00 | -23% | 4/21/22 | Half sold this date |

| Darling Ingredients | DAR | 4/21/22 | 84.94 | 73.06 | -14% | 6/15/22 | |

| Daseke | DSKE | 2/3/22 | 11.23 | 7.32 | -35% | 5/26/22 | |

| Energy Vault | NRGV | 4/8/22 | 18.87 | 10.14 | -46% | 5/12/22 | Half-sized position |

| Enphase Energy | ENPH | 11/10/21 | 228.73 | 188.94 | 49% | 12/22/21 | |

| ESS Tech | GWH | 11/18/21 | 14.97 | 10.33 | -31% | 1/6/22 | |

| Infrastructure Energy Alternatives | IEA | 3/24/22 | 13.25 | 10.15 | -23% | 4/25/22 | |

| KraneShares China Green Energy | KGRN | 2/10/22 | 41.38 | 42.89 | 4% | 9/21/21 | |

| Li-Cycle Warrant | LICY.WS | 6/16/21 | 2.42 | 2.52 | 4% | 12/27/21 | |

| Lithium Americas | LAC | 1/20/22 | 27.60 | 26.14 | -5% | 4/25/22 | |

| MP Materials | MP | 3/9/22 | 45.01 | 40.86 | -9% | 4/25/22 | |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 6.68 | 160% | 11/18/21 | 3/4s sold this date |

| Navitas Semiconductor Warrant | NVTS.WS | 6/16/21 | 2.57 | 3.26 | 27% | 2/10/22 | 1/4 sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 57.60 | 29% | 1/20/22 | Half sold this date |

| Onsemi | ON | 8/4/21 | 44.63 | 56.68 | 27% | 1/26/22 | Half sold this date |

| Wolfspeed | WOLF | 11/4/21 | 129.99 | 117.38 | -10% | 12/3/21 |

Real Money Portfolio

Our primary portfolio is the Greentech Real Money Portfolio – we invest alongside subscribers in the picks we make. That portfolio is designed to be fully invested at 12 stocks of equally sized initial investments. When the sector is bullish, we keep our cash in the ETF based on our benchmark index – the Wilderhill Clean Energy ETF (PBW). When bearish, we keep our cash in U.S. Treasury bills. We prefer to execute sell-stops on daily closes at or below our sell-stop mark rather than intraday lows – but either way will work fine in the long-term.

Clean Earth Acquisitions Corp. Shares, Warrants and Rights (CLIN, CLINW, CLINR)

No news on the Greentech SPAC, which is searching for a merger. We bought the units at 10.01, and later split into shares, warrants and units. The shares have claim to 10.10 in trust cash; warrants are trading around 12 cents and rights at 15 cents. HOLD

Clearway Energy (CWEN/A)

Shares are making the move toward 40 as we said we expected in last week’s update. CWEN/A is at all-time highs, which means no pent-up selling wanting to come in. The next ex-dividend date is August 31. BUY

Enphase Energy (ENPH)

We moved Enphase from Watch to Buy in last week’s update, and the portfolio added a full-sized position Thursday at 298.56, the midpoint of the day’s high and low. Shares are inching higher, working against a mild overbought condition here. BUY

Good for Growth Shares, Warrants, Rights (GFGD, GFGDW, GFGDR)

No news from the ESG SPAC, which is searching for a merger. We purchased its units in March at 9.99. Shares have claim to 10 in trust cash, warrants are trading around 11 cents, rights around 12 cents. HOLD

Li Auto (LI)

Li disappointed in its Q2 earnings out Monday, with a loss of 8 renminbi (1 cent) versus expectations of a loss of 4 renminbi. Supply chain troubles related to the pandemic crimped sales – they still were up 63% year-over-year but led to a lower outlook for sales this quarter, which appears to be about 33% lower than analyst consensus going into the call. Management seemed generally confident about the road ahead in the call – but Chinese executives always are. We’re switching our recommendation from Buy to Hold, given the headwinds from the pandemic in China. MOVE FROM BUY TO HOLD

Montauk Renewables (MNTK)

MNTK has seen good follow-through from positive earnings last week, with shares facing some resistance at the all-time high of 16.56. We shifted our recommendation from Watch to Buy with last week’s update and the portfolio added a full-sized position at 15.51, the midpoint of the session’s high and low prices. BUY

Natural Grocers by Vitamin Cottage (NGVC)

Natural Grocer broke downward out of a tightening formation last week and still looks bearish now. We said in last week’s update we were dropping the grocer from our Watch List. Shares in the 15 area face resistance up through 17 now. DROPPED

Onsemi (ON)

We shifted ON to buy last week in our regular update and the portfolio added a full-sized position at 67.32, the midpoint of Thursday high and low prices. ON closed at a new high Monday and looks strong. Management celebrated the expansion of its New Hampshire silicon carbide facility last week. BUY

Ormat Technologies (ORA)

ORA is showing good momentum higher, recently hitting its highest price since February 2021. Shares are technically overbought, but that’s a condition that can sustain itself in a bull market. BUY

Vertex Energy (VTNR)

VTNR is still suffering from last week’s awful earnings call, in which management lost well over $100 million in bad hedging. We’re holding in part because of the long-term picture of renewable diesel production at scale at its Alabama refinery. Trading around 7, shares are at a natural place of some technical support, by my reading, so we’re looking for VTNR to firm up here and stanch the bleeding. HOLD

Excelsior Portfolio

Excelsior is our special opportunities portfolio, and is managed without consideration to the Real Money Portfolio. We may or may not recommend sell-stops in Excelsior. In June 2021 we purchased five SPAC warrant positions as a basket trade: Navitas, Li-Cycle, ReNew, Ree and Volta. Of these, Li-Cycle was closed at a 4% profit in December. Navitas was closed in February at a total of a 127% return.

ADS-Tec Energy (ADSEW)

Positive action in the EV charger maker. Warrants are still under water for us, but have moved well off the bottom of recent weeks. HOLD

Altus Power (AMPS/WS)

Commercial real estate firm CBRE announced a sustainability program to scale development of solar projects in its portfolio, name checking Altus as the partner in the effort. The companies earlier announced Altus was working on a Maryland property of CBRE’s. CBRE is the sponsor of the SPAC that took Altus public, so it’s effectively helping its own investment in the business by choosing to work with Altus. That announcement Monday rallied AMPS shares over 10 and if shares trade over 10 for any 20 of 30 days, management can call for a cashless conversion of warrants. That helps our warrants, which are now around 2.90, a roughly 175% gain on our position. That’s around fair value now for the conversion of warrants to shares, so we should start thinking about exiting the position. For now, let’s see if the momentum continues. HOLD

Constellation Energy (CEG)

Credits for existing nuclear power generation in the Inflation Reduction Act benefit Constellation, which we felt was already undervalued as a spin-off earlier this year. We’re moving our sell-stop up to ‘around 70’ from around our buy price, to ensure we take some profits if the trade turns. Everything looks bullish for CEG, aside from an overbought condition, but as mentioned earlier, overbought/sold conditions can sustain themselves in a trending market. HOLD

ESS Technology (GWH.WS)

ESS finally booked revenue in the quarterly results it announced last Thursday, but interestingly, not the San Diego utility units that are in the field, the lack of revenue from which sparked the sell-off last quarter. It doesn’t seem to cause concern this quarter. Management generally sounded positive in the call and announced it is selling its product into Australia. In the long run, a local firm will build the bulk of the storage unit, while ESS will supply its proprietary proton pump – which keeps the iron flow batteries from clogging up – and other high-tech parts from Oregon while also collecting a fee for the intellectual property of the whole unit. Orders have already shipped to Australia, with a gigawatt worth of the company’s Energy Warehouses expected to sell in the next five years. At a recent 70 cents, we’re nicely profitable on this position. Technically GWH doesn’t seem like a fast mover, though its progress of late has been good. Like AMPS, this trade is based on the difference between the current price and the potential conversion ratio if GWH shares trade over 10. Shares are under 5 now, so taking some money off the table to book profits may not be a bad idea. At 70 cents, warrants would still be in the black on the conversion until about the start of 2026 (the conversion rate of warrants to shares declines each month until the warrants expire in October 2026). BUY

FuelCell Energy (FCEL)

FCEL is looking good, but hit resistance at its 200-day line this week. We are close to break-even on the half-sized position, which we expect should continue to benefit from the Greentech bull market. HOLD

Origin Materials (ORGNW)

No news for Origin, which is trending nicely. Our warrants look bullish and are seeing fine volume. HOLD

Ree Automotive (REEAW)

Ree released Q2 earnings Tuesday before trading, reporting no revenue and a loss of $25.3 million. Operationally, the company “expects firm orders” in coming months from evaluations of its truck with JB Poindexter. In the meantime, Ree filed to sell $200 million of shares, which at current prices would increase the shares outstanding by more than one-third. That’s an overhang that will weigh on prices. HOLD

ReNew Energy Global (RNWWW)

ReNew will release Q1 earnings after the close of trading Thursday, with 6 cents per share earnings expected. HOLD

Volta Inc (VLTA.WS)

Volta released earnings Thursday. Sales were up 121% over last year to $15.3 million, with the loss per share of 22 cents, a penny worse than expected. The company has 2,900 EV charging/ad stalls. Management says ad sales average $4,000 a charging stall, which means advertisements were about $11.6 million of the $15.3 million sales – selling electricity isn’t its main business. About 10,000 screens is considered a mark where national ad sales can command a premium, and Volta says there are 8,100 charging stalls to be built in backlog or under technical evaluation. We’re under water at 70 cents each, basically unchanged over the past week. HOLD

Thank you for being a subscriber. Our next SX Greentech Advisor issue will be published Wednesday, September 7. Weekly updates are published every non-issue Wednesday, and any timely notices get distributed as needed. Get in touch with comments, suggestions and questions any time. Reach me at brendan@cabot.net.

The estimated carbon generated in the production and distribution of this newsletter is offset by CO2 removal with Climeworks at its plant in Iceland.

The next Cabot SX Greentech Advisor issue will be published on September 7, 2022.

About the Analyst

Brendan Coffey

Brendan Coffey, Chief Analyst of Cabot SX Greentech Advisor, has been immersed in investing for more than 25 years, including as an investment advisory editor, investor, markets reporter and writer about and for a wealth of Wall Street’s most influential minds. He’s discussed investing strategy with the likes of Carl Icahn, Mark Cuban and Leon Cooperman and collaborated with hedge fund managers and entrepreneurs on books and essays. He’s written about investments and markets for Forbes, Bloomberg, Fortune, The Wall Street Journal and numerous other outlets.

Brendan is a Certified Financial Technician (CFTe), representing extended study and achievement in technical analysis of securities. He combines technical and fundamental analysis in pursuit of a long-held passion for environmental and ESG stocks that began with the study of environmental law as an undergraduate at Boston College. Brendan’s also been a fellow at the Scripps Howard Institute on the Environment, served on a municipal energy planning board and, last decade, was editor of Cabot Green Investor and Cabot Global Energy Investor. In addition to ESG, he conducts proprietary research into billionaire-owned stocks, SPACs, sports-related equities and other sectors.