A Too-Tight Fed Could Push Investors Back to Gold

While metals like lithium and uranium remain buoyant, gold is still in the proverbial doghouse despite having several good reasons to strengthen. This consideration has prompted investors to wonder what exactly it will take to turn the yellow metal around.

I won’t pretend to know exactly what set of circumstances will serve as a catalyst to gold’s next extended rally, but I do have a good idea as to what must happen before gold can even begin to move ahead. (Hint: it involves the U.S. dollar.)

For too long, gold has had to contend with a steadily strengthening dollar—and this is in spite of a 40-year peak in the U.S. inflation rate. The problem with this atypical dollar/inflation rate relationship is that gold would normally benefit from high inflation, but instead, the dollar is acting as the world’s safe haven du jour, attracting “hot” money inflows from around the world as investors worry about losing even more purchasing power.

As more than one economist has already observed, the problem isn’t that the U.S. economy is strengthening (thereby driving the dollar higher). Rather, it’s that so many other economies (and currencies)—including several in Europe—are weakening, making the dollar more attractive by default.

The result isn’t hard to predict: a strengthening greenback has put downward pressure on gold since the metal is obviously priced in dollars. Moreover, rising U.S. interest rates have created an additional headwind for non-yielding bullion as investors are more attracted to the continued rise in interest rates.

On the subject of rates, it didn’t help gold’s case last week when Cleveland Fed President Loretta Mester said the central bank would likely raise the fed funds rate above 4% by early next year and leave it there through 2023. As Bloomberg observed, “That’s the latest in a series of hawkish messages coming from U.S. policy makers,” which in turn has sent gold investors looking for value elsewhere.

My take on the gold-versus-inflation conundrum is that gold’s impressive strength in 2020-21 was the result of the precious metal anticipating the soaring increase in the inflation rate. Gold, much like the stock market, is a forward-thinking asset and responds to what it sees coming down the line. Gold’s bull market in 2020 and continued strength into this year’s March initially preceded the runaway inflation the U.S. has experienced in the last couple of years but also peaked out when it became obvious that the inflation rate was about to peak.

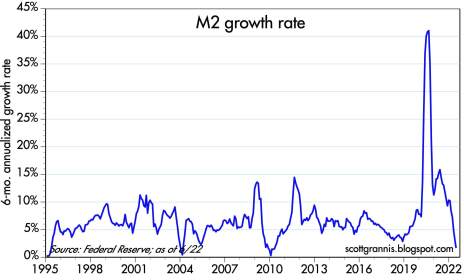

You’ve seen this chart before, but I can’t help coming back to the growth rate of the M2 money supply, which perhaps explains gold’s dilemma better than any other chart or indicator. When the M2 growth rate peaked out last year and began its rapid return to earth, it signaled that it was only a matter of time before runaway commodity prices would also do the same.

There is a danger, however, that the dollar’s continued strength is sending another important message that investors need to pay heed to. As the economist Scott Grannis is wont to point out, a dollar that keeps strengthening is the classic sign of a Fed policy that’s too tight. And with the Fed signaling that it has no intention of loosening its monetary policy anytime soon, the danger here is that an overly tight Fed could end up pushing the U.S. economy into recession.

The classic reason for any bull market is basically “too much demand meeting too little supply.” By continuing to tighten, the Fed is essentially restricting the supply of dollars for investors worldwide that are desperate to own more of them. If Fed tightness becomes too much for the economy to bear, investors would likely be forced to take a closer look at gold in the desperate search for a haven in a period of economic turmoil.

In the meantime, demand in the overall metals market is mainly concentrated around battery metals like lithium and, increasingly, into the energy metal uranium. Uranium prices have just hit their highest since May as war-related uncertainty regarding energy supplies is pushing governments around the world to seek alternative energy sources. Japan’s latest move back into nuclear energy is also giving the uranium market a major demand (and sentiment) boost.

All told, I look for both metals to remain in the leadership position going forward with uranium likely to supersede lithium in terms of capturing more news headlines in the coming weeks and months. For gold, however, the waiting game continues.

Updates

Alliance Resource Partners (ARLP) is a producer of metallurgical coal (for the steelmaking industry) and thermal coal (for electrical utilities), with approximately two billion tons of coal reserves in several U.S. midwestern and southern states. Alliance is currently the second-largest coal producer in the eastern U.S. with additional mineral and royalty interests in the highly productive Permian, Anadarko and Williston basins. (The company markets its mineral interests for lease to operators in those regions and generates royalty income from the leasing and development of those mineral interests.) Management indicated that coal operations have delivered “significant” year-over-year per-ton margin expansion, adding that it sees ARLP well positioned to see further margin growth in 2023 and 2024. While metallurgical coal demand is weakening due to softer global economic conditions, thermal coal demand is expected to remain supported going forward by lower exports from major suppliers like Australia (more than 50% of met coal supply) and Russia as more countries turn to coal to meet an energy crisis brought on by natural gas shortages. On a technical note, I suggest raising the stop-loss on the remaining position (after our recent profit-taking move) to slightly under 21.75 on a closing basis, where the 50-day line currently resides. HOLD A HALF

We were stopped out of our conservative long position in Cleveland-Cliffs (CLF), North America’s largest flat‑rolled steel and iron ore pellet maker, on September 1 after our stop-loss slightly under 17 was violated on a closing basis. I’ll be keeping an eye on CLF and related steel stocks going forward, as demand for the industrial metal is expected to rebound if China’s manufacturing picks up. SOLD

Our recent examination of the copper/gold ratio revealed that copper tends to rally when the ratio falls under 0.19, which it did recently. A 14-year statistical survey further shows that in every case without exception, copper posted a meaningful price gain (i.e., between 30% and 50%) in the six to 12 months following the signal. With that in mind, participants who don’t mind the short-term volatility risk recently purchased a conservative position in the Global X Copper Miners ETF (COPX) using a level slightly under 28 as the initial stop-loss on a closing basis. BUY A HALF

We were stopped out of our conservative trading position in the Global X Lithium & Battery Tech ETF (LIT) on September 1 after our stop-loss slightly under 73.75 was violated on a closing basis. As with steel, lithium is expected to strengthen in the months ahead, which means I’ll be on the lookout for a better opportunity in this space in the coming weeks. SOLD

Multiple factors—including energy security concerns, government-sponsored green energy initiatives and rising uranium prices (prompting miners to seek more capital)—have combined to make the uranium stocks more attractive than they’ve been in a while. Given the relatively attractive risk/reward scenario for the miners, I recently recommended that we get some exposure to our favorite uranium-tracking ETF. Consequently, participants purchased a conservative position in the Global X Uranium ETF (URA) using a level slightly under 19.50 as the initial stop-loss on a closing basis. BUY A HALF

Reliance Steel & Aluminum (RS) is the largest metals service center operator in North America, providing metals processing, inventory management and delivery services for several industries, including construction, energy, electronics, automotive and aerospace. Reliance expects its average selling price per ton sold for the third quarter of 2022 to be down 5%, due to recent weakness in aluminum and steel prices. Despite this, however, the company sees improving demand and pricing for higher-value products sold into the aerospace, energy and semiconductor end markets. Wall Street expects Q3 sales to increase 8% with full-year sales expected to jump 20%, both of which could prove too conservative if the dollar weakens and the industrial metals market reignites. In view of the strong relative performance of this dual steel/aluminum company in recent weeks, traders recently purchased a conservative long position in RS using a level slightly under 175 as the initial stop-loss. I now suggest raising the stop to slightly under 183.30 (closing basis) where the 50-day line currently resides. HOLD

| Stock | Price Bought | Date Bought | Price on Sep. 2 | Profit | Rating |

| Alliance Resource Partners (ARLP) | 18.75 | 7/5/22 | 25.5 | 36% | Hold a Half |

| Cleveland-Cliffs (CLF) | 18.3 | 8/8/22 | 16.8 | -8% | Sold |

| Global X Copper Miners ETF (COPX) | 30.5 | 8/2/22 | 29.2 | -4% | Buy a Half |

| Global X Lithium & Battery ETF (LIT) | 80.85 | 8/15/22 | 73.7 | -9% | Sold |

| Global X Uranium ETF (URA) | 21.2 | 8/24/22 | 22.5 | 6% | Buy a Half |

| Reliance Aluminum & Steel (RS) | 190 | 8/2/22 | 188 | -1% | Hold |

Buy means purchase a position at or around current prices.

Buy a Quarter/Half means allocate less of your portfolio to a position than you normally would (due to risk factors).

Hold means maintain existing position; don’t add to it by buying more, but don’t sell.

Sell means to liquidate the entire (or remaining) position.

Sell a Quarter/Half means take partial profits, either 25% or 50%.