Gold Stocks Near Inflection Point

With the gold price just slightly above its lowest level of the year, it has been difficult to be upbeat on the gold mining stocks.

The PHLX Gold/Silver Index (XAU), the industry benchmark for the actively traded North American miners, is also near a multi-month low and still below its 50-day moving average. In fact, almost every actively traded U.S.-listed gold stock is under the 50-day line—a feat seldom achieved except in the most voracious of bear markets.

Unfortunately, bear territory is where the gold mining and exploration stocks find themselves right now (i.e. down 20% or more from their nearest high). The potentially good news, however, is that gold stock investors appear to be throwing in the towel. And that normally bodes well for the intermediate-term (six-to-12 month) outlook.

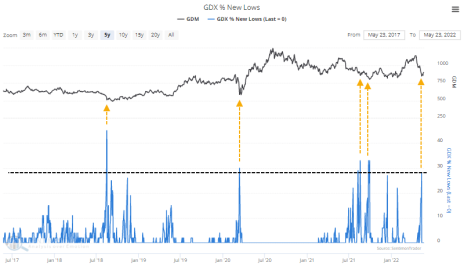

One of the analysts I follow regularly is Jason Goepfert of SentimenTrader, who performs some outstanding statistical studies on several major markets, including gold and silver. He recently observed that during the worst point of the latest selling pressure, more than 25% of all gold stocks dropped to a 52-week low. “Over the last five years,” said Goepfert, “that has meant a bottom.”

Be forewarned, though, there is a caveat to this indicator. While future gold stock returns were historically bullish over the six-to-12 months following the signal, those returns were inconsistent in terms of the duration and magnitude of the rallies. Moreover, it sometimes took several weeks—or even a couple of months—before the miners were ready to turn higher after bottoming.

With that in mind, I think we should begin looking very closely at the gold mining and exploration stocks after months of basically shunning them due to underperformance. There are some undoubted bargains—from both a technical and fundamental perspective—among the mid-tier and senior gold mining stocks, as well as some early signs of relative strength.

My focus in this report is mainly on relative performance (versus both the XAU and the S&P 500), so that’s what I’ll be looking for in the days and weeks ahead. With that in mind, I’ve assembled a short list of gold stocks that have the potential to be leaders once the gold price confirms a bottom and turns up decisively again.

That list includes the following names: Agnico Eagle Mines (AEM), Barrick Gold (GOLD), Newmont Mining (NEM), Nomad Royalty (NSR) and Teck Resources (TECK).

I need to see a lot more improvement in the gold price before pulling the trigger and formally recommending any of these stocks. But if the historically bullish 52-week lows signal mentioned here is any indication, it shouldn’t be much longer before we get another great buying opportunity.

Updates

Kronos Worldwide (KRO) is a leader in the production of titanium dioxide pigments, the world’s primary pigment for providing whiteness, brightness and opacity (used in two-thirds of all pigments). In Q1, the company reported another solid, consensus-beating quarter. Revenue of $563 million was 21% higher from a year ago, while per-share earnings of 50 cents beat estimates by 23 cents, driven by higher titanium dioxide prices. Titanium dioxide segment profit was a whopping 129% higher, due to higher selling prices and higher sales volumes. Going forward, analysts see sales rising 9% and earnings soaring 23% for 2022, which will likely prove conservative. Kronos also declared a 16-cent dividend (4% yield), in-line with the previous one. Meanwhile, Deutsche Bank just raised its price target on the stock from $18 to $20. On May 19, I advised traders to take 50% profit in KRO after its 18% rally from our initial entry point. I also recommend raising the stop-loss on the remaining position to slightly under 16.25 (closing basis). HOLD A HALF

Natural Resource Partners (NRP) is a master limited partnership engaged in owning and managing a diversified portfolio of mineral reserve properties, including steelmaking coal and other natural resources (mainly gas and timber). Approximately 65% of the firm’s coal royalty revenues and around 45% of coal royalty sales volumes were derived from metallurgical coal in the latest quarter, making the stock a good proxy for steel demand. NRP posted Q1 revenue of $90 million (up 142% from a year ago) and per-share earnings of $3.11 that handily beat estimates, led by rising demand for steel, electricity and renewable energy. NRP also said it generated $52 million of free cash flow in the quarter and $152 million over the last year (up 120% and 85%, respectively). This allowed the company to return additional cash to shareholders through a dividend increase (to 75 cents per share from 45 cents). Management is sanguine about the year-ahead outlook, with plans to generate even more “robust” free cash flow in the coming months while paying down debt and solidifying its capital structure. Participants recently purchased a conservative position in NRP, and after a 10% rally, I recommended selling a half and raising the stop on the remaining position to slightly under 34.50. I now suggest raising the stop a bit higher to slightly under 45.15 (closing basis) where the 50-day line comes into play. HOLD A HALF

SFL Corp. (SFL) is one of the world’s largest ship owning companies, with investments in the tanker, dry bulk, container and offshore segments and boasting a significant charter backlog. Its cargoes include iron ore and metallurgical coal, and the outlook for this segment is bullish as increased trade volumes and potential effects from continued port congestion are expected to absorb fleet capacity, while few newbuild deliveries are scheduled in the second half of 2022. In Q1, operating revenue of $152 million was slightly above the year-ago level and beat estimates by 10%. Per-share earnings of 37 cents, meanwhile, beat estimates by 13 cents. The company has a strong cash position and expects to continue building its business platform through new asset acquisitions and investments in order to enhance cash flows and maintain its generous dividend payouts (8% yield). Traders can purchase a conservative position in SFL using a level slightly under 9.70 as the initial stop-loss on a closing basis. BUY A HALF

Sociedad Química y Minera de Chile (SQM) is a Chilean supplier of fertilizers, iodine, lithium and industrial chemicals. It’s also the world’s fourth-largest lithium producer by market cap and holds a 19% share of the global market for lithium and lithium derivatives. Lithium supply was unable to keep pace with demand in 2021, a trend that SQM’s management expects to continue this year. Additionally, the company is in the midst of a capacity expansion (up to 180,000 tons, and with plans to spend $900,000 this year) which SQM believes will allow it to increase its market share in 2022. SQM posted a stellar 12-times increase in net income for Q1 on the back of strong revenue thanks to higher lithium prices. The results pushed SQM to a string of new highs in late May, prompting us to book some profit in our trading position in this stock. I now recommend that traders raise the stop-loss to slightly under 83.50 (closing basis.) HOLD A HALF

New Positions

Fluor (FLR) is a leading engineering firm, providing construction, maintenance and project management services for the oil and gas, industrial and infrastructure and power generation (including nuclear) industries. The company also offers process expertise in metals and mineral mining, including for gold, copper, coal, nickel and uranium and provides support for fertilizer producers. Management has indicated that dividends and share repurchases are possible as the firm builds its backlog and improve the quality of earnings in cash generation. Analysts project double-digit earnings and revenue growth for this year and next. Participants can buy a conservative position in FLR here using a level slightly under the 24.70 level (closing basis) as the initial stop-loss. BUY A HALF

Steel prices are showing relative strength after the recent price correction. Record demand from the automobile, construction and appliance industries have prompted top steelmaker U.S. Steel (X) to guide for its “best-ever” second quarter after recently delivering its best-ever first quarter. One of my favorite ways of leveraging steel strength is by owning an actively traded exchange-traded fund that closely tracks the steel price, namely the VanEck Steel ETF (SLX), which tracks the overall performance of major companies involved in the steel sector. Participants can purchase a conservative position in SLX here using a level slightly under 57 as the initial stop loss on a closing basis. BUY A HALF

Portfolio

| Stock | Price Bought | Date Bought | Price on 5/30/22 | Profit | Rating |

| Fluor Corp. (FLR) | 27.2 | NEW | 27.2 | 0% | Buy a Half |

| Kronos Worldwide (KRO) | 15.25 | 4/12/22 | 18.8 | 23% | Hold a Half |

| Natural Resource Partners (NRP) | 34.75 | 1/16/22 | 48.2 | 37% | Hold a Half |

| SFL Corporation (SFL) | 11.5 | 5/17/22 | 11.25 | -2% | Buy a Half |

| VanEck Steel ETF (SLX) | 62.9 | NEW | 62.9 | 0% | Buy a Half |

| Sociedad Química y Minera (SQM) | 83.5 | 5/17/22 | 107.15 | 28% | Hold a Half |

Buy means purchase a position at or around current prices.

Buy a Quarter/Half means allocate less of your portfolio to a position than you normally would (due to risk factors).

Hold means maintain existing position; don’t add to it by buying more, but don’t sell.

Sell means to liquidate the entire (or remaining) position.

Sell a Quarter/Half means take partial profits, either 25% or 50%.