Lithium Leads While Steel Strengthens

Gold and silver remain laggards in the broad metals market (no surprise there!). Thankfully for investors, however, other industrial metals are starting to strengthen after the setbacks of recent months and are picking up the slack in the precious metals market.

Of all the ones we track, the leading metal right now is lithium, which is just 3% under its all-time high that was established in March. Rebounding economic activity in China has boosted demand for battery electric vehicles (EVs), while in the U.S., the recently passed “Inflation Reduction Act” extends tax breaks for EV buyers.

What’s more, governments around the world are doubling down on EV initiatives, underscored by California’s move to ban gas-powered vehicles by 2035. This has created a huge opportunity for lithium miners, even as global supplies of the critical battery metal are forecast to be in “acute” shortage by that same year (according to a report from Boston Consulting Group).

More recently, Trading Economics reports that China’s energy crisis, which has been exacerbated by “record-setting heat waves,” has resulted in multiple lithium producers in the Sichuan province suspending operations. This is expected to put even more upside pressure on already soaring lithium costs in the near-term—in turn boding well for lithium miners and, presumably, the major mining stocks.

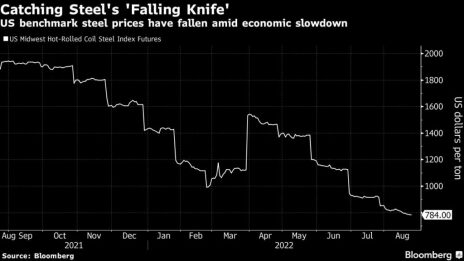

Steel, meanwhile, is in the early stages of what is shaping up to be an impressive rebound. After plunging 30% between May and July, steel rebar prices are on the mend while the iron ore market looks to have bottomed out after this summer’s series of Covid-related setbacks in top consumer China. The country is now on the comeback trail as Beijing is introducing measures to stimulate the economy. China is also about to enter its peak construction season, which is expected to see increased steel demand.

Reports from China indicate that domestic steel producers are ramping up output as prices rise and profit margins improve. Mills are also said to be low on stock, with the bigger mills slow to increase production. All told, the industry’s current fundamental backdrop supports a steady improvement in commodity steel prices.

An additional boost to steel market sentiment was provided by the CEO of Canada’s Stelco Holdings (STZHF), Alan Kestenbaum, who had previously predicted “falling knife”-style carnage for the market at the beginning of this year. He’s now calling a bottom for steel, noting that his company’s order book has been filling up quickly in recent weeks despite the downturn in the domestic construction industry.

Longer-term, the building metal’s demand outlook is even brighter. Last week, management at ArcelorMittal (MT) predicted that Brazil’s steel consumption will double within the next 10 years. The accelerating demand is expected to be led by “gigantic opportunities” in real estate construction, renewable energy, ports and oil-and-gas projects.

ArcelorMittal itself is investing around $4 billion in Brazil, with nearly 40% of that for expanding production capacity by 2024. Moreover, the company is spending over $2 billion to buy Brazilian steelmaker CSP from shareholders, according to Mining.com.

Between lithium and steel, then, there should be plenty of profit opportunities for investors in the coming months—even if gold and silver prices remain suppressed.

Updates

Alliance Resource Partners (ARLP) is a producer of metallurgical coal (for the steelmaking industry) and thermal coal (for electrical utilities), with approximately two billion tons of coal reserves in several U.S. midwestern and southern states. Alliance is currently the second-largest coal producer in the eastern U.S. with additional mineral and royalty interests in the highly productive Permian, Anadarko and Williston basins. (The company markets its mineral interests for lease to operators in those regions and generates royalty income from the leasing and development of those mineral interests.) Management indicated that coal operations have delivered “significant” year-over-year per-ton margin expansion, adding that it sees ARLP well positioned to see further margin growth in 2023 and 2024. While metallurgical coal demand is weakening due to softer global economic conditions, thermal coal demand is expected to remain supported going forward by lower exports from major suppliers like Australia (more than 50% of met coal supply) and Russia as more countries turn to coal to meet an energy crisis brought on by natural gas shortages. On a technical note, I suggest raising the stop-loss on the remaining position (after our recent profit-taking move) to slightly under 20.90 on a closing basis, where the 50-day line currently resides. HOLD A HALF

Cleveland-Cliffs (CLF), North America’s largest flat‑rolled steel and iron ore pellet maker, just reported mostly upbeat second-quarter earnings. The company, which enjoys a leadership position in providing steel for the U.S. automotive industry, expects the enormous backlog for vehicles will result in higher steel demand in the coming quarters, which could help push prices for the metal higher. Last week, the company increased spot market basis prices for all carbon steel hot rolled, cold rolled and coated steel products by a minimum of $75 per ton, according to Dow Jones. The higher prices are effective immediately with new orders in North America. With more exposure to the auto industry than any other steelmaker, analysts are speculating that the firm’s spot market price hike could mean that the stalled production rates of recent months are improving. The stock, meanwhile, could soon be subjected to short-covering squeeze as 8% of CLF’s float is currently sold short. Traders recently purchased a conservative position in CLF using a level slightly under 17 as the initial stop-loss on a closing basis. BUY A HALF

Our recent examination of the copper/gold ratio revealed that copper tends to rally when the ratio falls under 0.19, which it did recently. A 14-year statistical survey further shows that in every case without exception, copper posted a meaningful price gain (i.e. between 30% and 50%) in the six-to-12 months following the signal. With that in mind, participants who don’t mind the short-term volatility risk recently purchased a conservative position in the Global X Copper Miners ETF (COPX) using a level slightly under 28 as the initial stop-loss on a closing basis. BUY A HALF

Ratings firm Fitch pointed out in a recent report that the small presence of major lithium miners in the development of new projects—with undercapitalized junior exploration companies mainly undertaking them—poses a risk to the execution of those projects. In other words, the tight supply situation that has characterized the market since at least 2020 will likely continue. Fitch expressed confidence that most new lithium projects will eventually pan out in the coming years as more experienced players enter the market. However, Fitch cautioned that several of these projects will “face delays” in the intermediate-term with some of them “unlikely to be developed due to the characteristics of the competitive landscape and the location of a number of projects in markets facing significant economic, political, operational and mining risks.” The fundamental backdrop for lithium accordingly remains tight, which supports the strong recovery witnessed in lithium stocks in recent weeks. To that end, I recently placed the Global X Lithium & Battery Tech ETF (LIT) back on a buy. Participants purchased a conservative position in LIT earlier this month using a level slightly under 73.75 as the initial stop-loss on a closing basis. BUY A HALF

Multiple factors—including energy security concerns, government-sponsored green energy initiatives and rising uranium prices (prompting miners to seek more capital)—have combined to make the uranium stocks more attractive than they’ve been in a while. Given the relatively attractive risk/reward scenario for the miners, I recently recommended that we get some exposure to our favorite uranium-tracking ETF. Consequently, participants purchased a conservative position in the Global X Uranium ETF (URA) using a level slightly under 19.50 as the initial stop-loss on a closing basis. BUY A HALF

Reliance Steel & Aluminum (RS) is the largest metals service center operator in North America, providing metals processing, inventory management and delivery services for several industries, including construction, energy, electronics, automotive and aerospace. Reliance expects its average selling price per ton sold for the third quarter of 2022 to be down 5% due to recent weakness in aluminum and steel prices. Despite this, however, the company sees improving demand and pricing for higher value products sold into the aerospace, energy and semiconductor end markets. Wall Street expects Q3 sales to increase 8% with full-year sales expected to jump 20%, both of which could prove too conservative if the dollar weakens and the industrial metals market reignites. In view of the strong relative performance of this dual steel/aluminum company in recent weeks, traders recently purchased a conservative long position in RS using a level slightly under 175 as the initial stop-loss. I now suggest raising the stop to slightly under 181 (closing basis) where the 50-day line currently resides. BUY A HALF

| Stock | Price Bought | Date Bought | Price on Aug. 29 | Profit | Rating |

| Alliance Resource Partners (ARLP) | 18.75 | 7/5/22 | 25.5 | 36% | Hold a Half |

| Cleveland-Cliffs (CLF) | 18.3 | 8/8/22 | 18.75 | 2% | Buy a Half |

| Global X Copper Miners ETF (COPX) | 30.5 | 8/2/22 | 32 | 5% | Buy a Half |

| Global X Lithium & Battery ETF (LIT) | 80.85 | 8/15/22 | 77 | -5% | Buy a Half |

| Global X Uranium ETF (URA) | 21.2 | 8/24/22 | 22 | 4% | Buy a Half |

| Reliance Aluminum & Steel (RS) | 190 | 8/2/22 | 194.6 | 2% | Buy a Half |

Buy means purchase a position at or around current prices.

Buy a Quarter/Half means allocate less of your portfolio to a position than you normally would (due to risk factors).

Hold means maintain existing position; don’t add to it by buying more, but don’t sell.

Sell means to liquidate the entire (or remaining) position.

Sell a Quarter/Half means take partial profits, either 25% or 50%.