Industrial metals, led by aluminum, are on the rise once again. Copper looks to extend a three-year winning streak. The battery metal and rare earth miners are still in good shape. And even laggards like gold and silver could finally “pop” in the New Year. These are just some of the topics we’ll discuss in the latest report.

In the portfolio, we recently took profits in our aluminum play and are adding a new position in a top copper producer.

Feature Story: Metals Heat Up on Inflation Outlook

Looking back on the past year, it’s easy to see where the best performance was to be found. Base/industrial metals were clearly the winners in 2021, while gold, silver and other precious metals were notable laggards. Although the precious metals group still doesn’t have a lot going for it heading into 2022, there has been a definite shift in the market’s backdrop, fundamentally, technically and psychologically.

In this issue we’ll look at how the gold outlook has improved and why the coming year may finally be the yellow metal’s time to shine. We’ll also discuss the short-term improvement for the leading industrial metals and uncover some nice-looking setups in the leading metal stocks and ETFs.

The main price drivers for gold can be distilled into two major factors: the currency factor and the fear factor. The first one summarizes gold’s historically inverse relationship with the dollar, while the latter one deals with market sentiment.

The refrain I’ve sounded in the last few reports is that gold’s fear factor has been missing in recent months; that is, participants haven’t been very concerned about the economic, political or financial market outlook. This lack of palpable fear has served as a major headwind for gold and has kept the price locked in a lateral trading range for the last six months.

Indeed, a soaring stock market and bullish cryptocurrency sentiment eroded interest in gold among traders up until November. It was then that both markets encountered some turbulence, with crypto especially hard hit with selling pressure. This is when gold’s psychological backdrop began to improve.

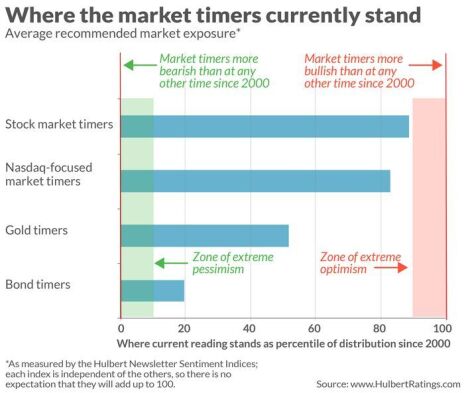

For most of the past half year, while the average investor had little interest in buying gold, gold “bugs” (i.e. perma-bulls), small speculators and gold newsletter writers were mostly bullish on the metal. This further undermined gold’s outlook since there was a lack of short interest to fuel gold rallies. With trader sentiment uniformly bullish for several months running, gold’s upside was limited.

In recent weeks, however, most sentiment surveys have shown that traders have been backing off their unrelenting enthusiasm for owning the metal. According to Mark Hulbert of The Hulbert Financial Digest, bullish sentiment on gold has fallen since November and is now near the midpoint of its historical range (i.e. neither excessively bullish or bearish). While this doesn’t exactly qualify as a buy signal from a contrarian standpoint, it does mark a major improvement for gold’s psychological backdrop. (It’s also well below the July 2020 peak in sentiment that preceded the metal’s ongoing market correction).

It’s not only among gold traders and analysts where sentiment is souring, but among mainstream investors there has also been a notable increase in bearish sentiment. Concern over the omicron strain of the coronavirus is dominating news headlines, along with fresh inflation fears after the latest record spike in the U.S. producer price index (PPI) and large increase in the consumer price index (CPI).

Consequently, investors are showing increased interest in inflation hedges, including the stocks of industrial metal producers (discussed later in this report). Even gold and silver have seen some minor buying interest in the last two weeks as the traditional safe havens are being re-examined.

With that in mind, let’s examine another area where there are also some encouraging signs for the precious metals. I’m referring, of course, to gold’s currency factor, which has also been a major obstacle for the gold bulls in recent months. Although the U.S. Dollar Index (USD) remains in an intermediate-term rising trend, it’s showing signs of losing forward momentum.

Specifically, in the last couple of weeks USD has stalled out and is having trouble staying above the 25-day line (below). And while this doesn’t necessarily mean the dollar’s bull run is over, it suggests a serious struggle over control for the greenback’s interim trend—the first such struggle since October.

Although the dollar bulls ultimately prevailed in the previous battle back in October, recent breakouts in several inflation-sensitive areas of the stock and commodity markets suggest that this time around, the dollar bears enjoy an advantage.

Concerning inflation, a final point is worth considering. Lawrie Williams, chief analyst for the bullion brokerage firm Sharps Pixley, has observed that despite the imminent threat of a higher Fed funds rate in 2022, real interest rates are still negative. Expanding on this theme, he wrote:

“Unless the Fed eventually goes for much bigger rate increases than expected, the general public will be stuck in a negative real rate position where inflation increases are higher than those of interest rates being received. In theory that tends to be positive for gold.”

All told, I recommend that we maintain most of our focus on the industrial metals (including battery metals) where the majority of the strength lies right now. And though I’m not recommending any new speculative commitments for gold yet, I’m closely monitoring the improving sentiment backdrop while watching the dollar for signs of further deterioration (which would provide us with another trading opportunity in our favorite gold-tracking ETF).

What to Do Now

We are still waiting for the next confirmed breakout signal in the yellow metal price as the metal’s fundamental picture slowly improves. Accordingly, I’m not yet recommending any new positions in our favored gold tracker, the GraniteShares Gold Trust (BAR). WAIT

New Recommendations & Current Portfolio

Silver Boosted by Omicron Fears

Silver was held back for much of 2021 by a strengthening dollar and Fed tapering/rising rate fears. Both of those variables are showing signs of reversing as we exit 2021, and while it’s too early to declare a paradigm shift, it looks like the rising threat of inflation has forced the Federal Reserve to tone down its previously hawkish message—developments which have given precious metal traders a higher degree of confidence heading into the New Year.

On the Fed policy front, Fed Chairman Jerome Powell indicated at the most recent Fed meeting that asset purchase tapering would likely be sped up, as the market expected. And while the market is also expecting higher interest rates in 2022, Powell indicated that any future rate increases would depend on economic data, including the “maximum” employment level being achieved.

Silver traders interpreted this to mean that the Fed has left itself plenty of room to maneuver should the economic situation deteriorate in the coming months, which would allow the Fed to hold off on rate hikes and possibly slow down the pace of tapering. And with omicron variant concerns on the rise, there seems to be a consensus among the silver crowd that the interest rate factor likely won’t be a headwind for the metal—at least not in the early part of 2022.

Another factor which has buoyed sentiment on the part of silver traders of late has been the prevailing view that equity prices are “too high.” Any disruption in the stock market’s rising trend in the first part of the new year would likely further boost haven demand for silver, as indeed proved to be the case after the stock market’s most recent volatility increase.

From a technical standpoint, the silver price has been trying to bottom and may have posted a final low on an intermediate-term basis. In its most recent decline, silver refused to budge below its late-September low at 21.50 an ounce and bounced off that level last week.

Silver still has a lot of ground to cover before it exits its bear market of the past year, however, and we need to see some additional technical improvement—as well as a weaker U.S. dollar—before we initiate a new long position in our favorite silver-tracking ETF.

What to Do Now

I’m not currently recommending any new position in the iShares Silver Trust (SLV), our preferred silver-tracking vehicle. As previously noted, I’d like to see some additional firming up of the silver price before feeling comfortable enough to jump in again with both feet. WAIT

Another Strong Year Likely Ahead for Copper

Unlike gold and silver, copper is on track for a third consecutive year of gains. The driving forces behind this strength are easy to discern: higher global growth expectations, a strong real estate market (where copper is widely utilized) and inflation.

Each of these factors are expected to persist in 2022, notwithstanding the short-term threat to the economy posed by the omicron variant. Moreover, according to analyst John Mothersole of IHS Markit, copper has entered a fundamental deficit due to increased Chinese consumption growth, in addition to recent copper mine disruptions.

This outlook was confirmed when the International Copper Study Group said the market for copper was in a 161,000-ton deficit during the January-September period (versus a 239,000 ton deficit in the comparable 9-month period in 2020).

Additional factors which should contribute to a strong year ahead for the red metal include the lingering effects of the past year’s supply-chain disruptions. And while analysts expect overall copper consumption growth to moderate in 2022, refined production growth is anticipated to increase by more than 5% (from under 4% this year), based on projections by consultancy IHS Markit.

Then there’s the long-term “super-cycle” for commodities that many analysts believe to be still in the early innings. Goldman Sachs’ top commodity analyst, Jeff Currie, says this cycle—combined with tight global supplies—will likely keep prices elevated for many years ahead. (Goldman, incidentally, is also predicting an intermediate-term copper deficit.)

Specifically, Currie sees industrial metals prices booming as governments around the world spend more on “green” infrastructure goals. His year-ahead price target for copper is $12,000 per ton, which implies a 25% gain from current prices.

Short-term, LME copper inventories dropped 66% in December (to 80,000 tons) from the August high of almost 240,000 tons. Another factor supporting prices is the latest production halt at Peru’s Las Bambas mine, the world’s ninth-largest copper mine.

What to Do Now

Freeport-McMoRan Copper & Gold (FCX) is back on our radar after the stock’s latest show of relative strength. Not only is FCX manifesting strength versus the copper price, it has even begun to strengthen relative to the broad market S&P 500 Index. Based on the fundamental outlook for copper mentioned above, FCX could prove to be a top performer among the most actively traded copper producers. In its latest financial quarter, Freeport topped earnings estimates but missed revenue estimates, as copper prices rose while weaker gold prices weighed on sales. Net income soared to $1.4 million from $329 million in last year’s Q3, while revenue increased 58% to just over $6 billion. Consolidated copper sales were up 22% in the quarter, while gold sales jumped 72%. Average realized prices for copper were higher, while realized gold prices were lower from the year-ago quarter. Looking ahead, management said “the outlook for the copper market is extraordinarily positive,” and expects higher full-year sales for the metal. Traders can purchase a half position in FCX using a level slightly under 37 (closing basis) as the initial stop-loss. BUY A HALF

Steel Rebounds on European Outlook

Record gas and electricity prices in Europe are causing metal smelters across the euro zone to reduce production. Metals ranging from aluminum to zinc to steel are all impacted by rising energy costs which in turn are contributing to a shortfall in supplies. Additionally, a recovery in China’s industrial output is putting upward pressure on prices.

According to Trading Economics, Shanghai steel futures are now trading at levels not seen since early November, due partly to expectations of lower steel supplies. Analysts also expect several stainless-steel plants to reduce output for routine maintenance and cost management this month and in January.

Previously, news headlines revealed that China’s steel production dropped 22% in November, compared to a year ago, as China’s government increased pollution restrictions ahead of the Winter Olympic Games. China’s real estate sector, meanwhile, remains subdued after recent debt-related problems—most notably with property developer Evergrande.

Iron ore prices, meanwhile, have risen by a remarkable 45% from their November lows as China’s iron ore imports hit a 16-month high last month while its manufacturing sector growth increased ahead of expectations.

Chinese steel firms are also expected to raise output for the next few weeks after being faced with production curbs imposed by Beijing in the last few months. Steel rebar prices have subsequently rebounded nearly 14% from their late-November lows.

China’s Bauxite Hunt Bolsters Aluminum

Aluminum prices have risen 9% in the past two weeks as the global supply situation continues to tighten.

Top producer China’s output fell in November by around 5% from a year ago to its lowest level in 18 months as production curbs remain in place throughout the country. Supply disruptions are also a factor as the major Chinese manufacturing province of Zhejiang is dealing with a Covid outbreak.

Meanwhile, Goldman Sachs’ commodity chief, Jeff Currie, is predicting that aluminum prices will average $3,250 per ton in 2022. That’s around 15% above current prices. Like a growing number of industry analysts, Currie believes aluminum’s tight supply situation will bolster prices in the coming year.

Aluminum’s fundamentals are further improving thanks in part to soaring energy prices which has forced Aluminum Dunkerque, Europe’s largest aluminum smelter, to shutter around 4% of its production in December. The company didn’t comment on whether soaring power prices in Europe could lead to further shutdowns.

China has also become increasingly dependent on foreign supplies of bauxite ore used to make aluminum, as stricter environmental regulations have curtailed China’s mining operations for the sediment.

Consequently, Chinese aluminum producers are “renovating production lines to take more foreign bauxite and investing in major mining economies like Guinea and Indonesia to secure supply,” according to Bloomberg.

In other industry news, the European Union will place additional tariffs on aluminum foil from China after the European Commission found that producers there “benefited from excessive and unfair subsidies,” according to the EU’s official journal.

What to Do Now

Among the most actively U.S.-traded aluminum stocks, Alcoa (AA) has not only outperformed the industry lately but is also in a relative strength position versus the broad equity market as reflected in the benchmark S&P 500 Index (as discussed in last week’s trade alert). From an earnings standpoint, Alcoa set a record for quarterly net income in Q3, prompting management to initiate a quarterly cash dividend (10 cents per common share). Revenue was up by a solid 32% from a year ago and well ahead of Wall Street’s estimates, driven by higher aluminum prices and higher premiums for value-added products. Liquidity isn’t an issue, either, as Alcoa had a cash balance of nearly $1.5 billion at quarter’s end, with no substantial debt maturities until 2027. Moreover, the company just launched a half-billion-dollar stock buyback plan. All these factors prompted a major institution to give Alcoa a “conviction buy” rating, the upgrade was also due to Alcoa’s efforts at decarbonizing its portfolio while supporting the “green transition.” Accordingly, I recommended on December 16 that participants purchase a conservative position in AA, using a level slightly under 45 as an initial protective stop. On December 22, I recommended taking half profits in AA after the latest 17% rally. I further suggest raising the stop-loss on the remaining position to slightly under 49.75 where the 50-day line is currently found. HOLD A HALF

Nickel Inventories Support Higher Prices

Nickel prices are still hovering near an 8-year high as the key battery metal has been under some supply-related pressure in the last few weeks.

Nickel inventories at LME warehouses fell 58% from an April high of just over 110,000 tons to their lowest since December 2019 in December. Inventories in Shanghai warehouses, meanwhile, were at 5,500 tons in the latest week, hovering near a record low of 4,450 tons last seen in August.

I would also reiterate that the publicly traded stocks of some major global nickel producers are starting to look attractive from a fundamental perspective. Low P/E ratios, higher dividend yields and an improved earnings outlook (in part due to increased EV battery demand) are reasons for taking a closer look at the nickel stocks. One of my favorite ones is highlighted below.

What to Do Now

Vale S.A. (VALE) is one of the world’s largest iron ore and nickel miners, as well as a diversified producer of other industrial and precious metals. Earlier this year, the company garnered attention when management announced an ambitious plan to reach 400 million tons of iron ore production by 2022, which, if realized, would be a 33% increase from 2020’s total production. More recently, though, Vale has shifted its focus on so-called “green” metals in an effort to diversify and generate higher shareholder returns. Vale recently guided for copper production to increase to a midpoint of around 345,000 tons per year, led by the firm’s Salobo 3 expansion copper project, while nickel production is expected to reach around 185,000 tons per year. Additionally, Vale’s outlook received a boost from the recently passed $1 trillion infrastructure spending bill, which would dramatically expand fiscal spending for roads, water pipes, EV charging stations and other infrastructure, in turn necessitating higher industrial metal production volumes. Analysts, meanwhile, expect Vale’s revenue for full-year 2021 to increase 34% while per-share earnings improve 85%. From a technical standpoint, VALE is coming off a 1-year low near 12 but appears to be bottoming out. Any improvement in the iron ore, copper and nickel prices from here should provide a boost to the stock. Traders who don’t mind the China-related volatility risk did some recent nibbling around current levels, using a level slightly under 12 as the initial stop-loss on a closing basis. BUY A HALF

Lithium Boosted by Energy Storage Demand

Lithium carbonate prices continue to rise in the face of global supply shortfalls and huge clean-tech demand for the metal.

Electric vehicle (EV) deliveries in China are projected at three million units for 2021, which is more than double the 2020 level. Analysts are also predicting that China’s sales of EVs could be as high as five million in 2022.

But it’s not just EV demand that’s boosting the lithium outlook; other energy storage applications are also at play here. Norwegian lithium-ion battery start-up FREYR Battery announced an agreement on December 16 to provide at least 31 gigawatt hours of battery cells. The undisclosed customer produces energy-storage systems.

As Barron’s observed, the agreement illustrates that “lithium-ion batteries will end up in more applications than just electric vehicles.” FREYR’s management added, “Battery-based energy storage solutions are key to accelerating the decarbonization of worldwide power systems, and the rapidly growing global ESS market represents a multi-billion-dollar commercial opportunity.”

On the supply front, lithium scarcity remains an issue going forward as EV makers desperately bid to secure long-term supply contracts while environmental groups continue to stand in the way of new mine openings. As one example of this, Rio Tinto PLC (RIO) pledged over $2 billion to develop lithium mines in Serbia, but environmental protesters have stymied those plans for now.

What to Do Now

Sigma Lithium Resources (SGML) is a Canada-based, exploration-stage lithium developer with access to the largest hard rock lithium deposits in the Americas, located in its wholly owned Grota do Cirilo Project in Brazil. The company has been producing low carbon high purity lithium concentrate at an on-site demonstration pilot plant since 2018, with plans to reach near-term commercial stage production (initially in 2022) and eventually producing 220,000 tons annually of battery grade lithium concentrate. It’s admittedly a speculative play with sovereign and mining-related risks in Brazil. But with its substantial, high grade and low impurity resource, coupled with booming lithium carbonate and hydroxide prices, the risk appears justified. Accordingly, speculators who don’t mind the risk can do some nibbling here. I recommend using a level slightly under 8.75 (intraday) as the initial stop-loss. BUY A HALF

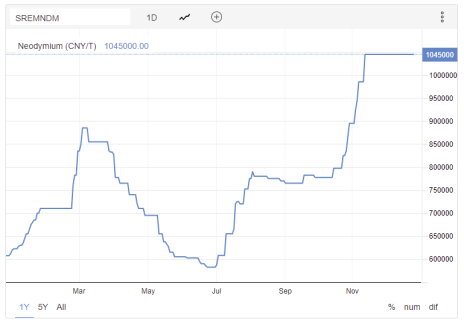

Neodymium Demand Remains Strong

Neodymium prices are up 68% for the year to date and up 150% from a year ago, driven by strong demand in the magnet and laser markets. Praseodymium prices, meanwhile, are up 185% from a year ago driven by demand from the magnet and colorant markets.

As discussed previously, the global rare earth metals market is expected to grow from $5.22 billion in 2020 to $5.72 billion in 2021 at a compound annual growth rate of nearly 10%. The growth is mainly attributable to mining and production companies resuming operations after Covid-related shutdowns and restrictions, including shuttering or partially closing commercial operations.

The rare earths market is benefiting from a number of trends, including the expanding growth of miniaturization in the electronics industry (particularly the development of ultrathin 2D magnets). For this reason, neodymium-based magnets are highly utilized as permanent magnets owing to the metal’s strong magnetic properties (in fact, the strongest permanent magnet available today with maximum energy products).

Rare earth metals are also widely used in the manufacturing cellular telephones, computer hard drives, flat-screen monitors and televisions. In addition, cloud computing and data center growth are expected to drive higher rare earths usage going forward.

What to Do Now

Earlier this month I suggested selling half our stake in Lynas Corp. (LYSCF), a rare earth mining company based in Australia and boasting one of the highest-grade rare earth mines in the world (including neodymium and praseodymium (NdPr), lanthanum, cerium and other mixed heavy rare earths). Participants previously bought a conservative position in LYSCF using a level slightly under 5.25 as the initial stop-loss on a closing basis. But after rallying 15% from our initial entry point, it was time to take some profit based on the rules of our technical trading discipline. I also suggest raising the stop-loss on the remaining position in this stock to slightly under 6.25 (mid-way between the 25-day and 50-day lines). HOLD A HALF

MP Materials (MP) operates the largest rare earth mineral mines in the Western Hemisphere, currently accounting for around 15% of total global supply, with a focus on Neodymium-Praseodymium (NdPr)—a crucial input used for making rare-earth magnets used in many of those devices. MP opened Wall Street’s eyes to the oft-overlooked industry in Q3, boasting estimate-beating revenue that soared 143% from a year ago and 36% sequentially, while net earnings nearly tripled, prompting at least two major institutions to recommend the company. Management also reported generating a “significant” amount of cash from operations, which will be used to advance its Stage II and Stage III plans to restore the full rare earth supply chain to the U.S. (Most of the rare earth concentrates MP produces are sold to China through an intermediary, but its plans will allow it to bypass the middleman and fully process and sell NdPr straight to end users.) MP also got a boost when it was revealed that automaker General Motors (GM) has contracted with the firm to supply magnets for building motors for more than a dozen GM models. Most recently, J.P. Morgan analyst Michael Glick raised his December 2022 price target for MP from $45 to $52 (up 16%) based on higher rare earth prices. MP Materials’ move into rare-earth magnets “could drive multiple expansion for the company,” he said in a December 10 research report. Traders recently purchased a conservative position in MP and also booked some profit after the recent 14% rally (per the rules of our trading discipline). I recommend raising the protective stop on the remainder of the trading position to slightly under the 40 level (closing basis). HOLD A HALF

Current Portfolio

| Stock | Price Bought | Date Bought | Price 12/28/21 | Profit | Rating |

| Alcoa (AA) | 52.25 | 12/16/21 | 58.90 | 13% | Hold a Half |

| Freeport Copper & Gold (FCX) | New Buy | – | – | – | Buy a Half |

| Lynas Corp. (LYSCF) | 5.85 | 11/16/21 | 7.14 | 22% | Hold a Half |

| MP Materials (MP) | 42 | 12/7/21 | 46 | 11% | Hold a Half |

| Sigma Lithium Resources (SGML) | 10.15 | 12/14/21 | 10 | -1% | Buy a Half |

| Vale S.A. (VALE) | 13.50 | 12/14/21 | 14 | 2% | Buy a Half |

Buy means purchase a position at or around current prices.

Buy a Quarter/Half means allocate less of your portfolio to a position than you normally would (due to risk factors).

Hold means maintain existing position; don’t add to it by buying more, but don’t sell.

Sell means to liquidate the entire (or remaining) position.

Sell a Quarter/Half means take partial profits, either 25% or 50%.

The next Sector Xpress Gold & Metals Advisor issue will be published on January 11, 2022.