Silver Resumes Leadership Position over Gold

After a seemingly interminable decline this summer, silver prices are once again showing strength. And of greater significance, they’ve finally resumed a relative strength position over gold.

As emphasized here, silver leadership is typically a prerequisite for a strengthening gold market. That said, silver’s latest rally is welcome news for our speculative long position in our favorite gold-tracking ETF.

In the industrial metals, aluminum is still strong while copper has lately been the subject of a massive short-covering event. Lithium, meanwhile, is also in a solid position while the uranium market has been resurgent—thanks in part to the Reddit crowd.

Feature Story: Metals Feeding Off Inflation Fears

Gold shot up late last week, hitting a six-week high at $1,815 an ounce before falling back after disquieting (from a gold investor’s perspective) remarks by the Federal Reserve chairman. Jerome Powell said he anticipates inflation pressures to “ease” next year while indicating the central bank is on course to begin winding down asset purchases.

While the anti-inflationary sentiment poured cold water on gold’s latest rally attempt, there’s no denying that inflation remains a very real threat despite the Fed’s insistence to the contrary. Indeed, the metals market’s prevailing view seems to be that the Fed is “behind the curve” where inflation is concerned (in the words of RJO Futures strategist Daniel Pavilonis) and isn’t doing enough to contain the problem.

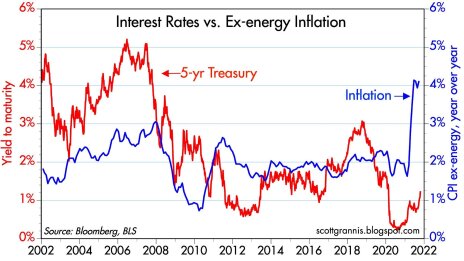

Further proof that inflation expectations in the U.S. are rising can be found in the bond market. The yields on longer-dated Treasury bonds are beginning to accelerate higher on a sustained basis as investors increasingly awaken to the inflation narrative.

Indeed, the 10-year Treasury Yield Index (TNX) is up to almost 1.7% while the five-year yield is currently around 1.2%. Of more significance, however, TNX has risen by an incredible 44% in just the last three months! And as the national inflation rate (minus energy) is above 4%, the implication is that yields have a lot of catching up to do.

Of course, the question that investors will sooner or later be confronted with is: At what point do higher yields serve as an impediment to higher stock prices? Wall Street doesn’t seem to be terribly concerned about the threat of higher yields yet since equity prices are still soaring, and hardly anyone seems to be asking that question.

Nevertheless, inflation is slowly creeping higher and can’t be ignored by the typical investor since it’s clearly evident by each week’s rise in the cost per gallon of gasoline. The national average for retail pump prices reached $3.37 last week, according to Gas Buddy (see chart below), the highest level in eight years. And while fuel prices haven’t yet reached levels that are acutely painful to consumers, they’re definitely trending in that direction.

The U.S., meanwhile, isn’t the only place experiencing inflation, however. Euro zone inflation expectations have reached their highest levels in years, “putting additional pressure on the European Central Bank and its insistence on maintaining crisis-era stimulus,” in the words of a Reuters report.

The increasingly global nature of inflation has already caused some investors to begin hedging their bets against further retail price increases. This can be seen in the renewed interest in defensively-oriented sectors of the stock market such as utilities and consumer staples, which are both up around 5% in just the last three weeks.

Gold prices, meanwhile, are also beginning to see something akin to a safety bid in the past three weeks as inflation has become increasingly discussed in the mainstream financial media. Measured from its latest intraweek high, the yellow metal is up nearly 6% in that same period of time.

And while it hasn’t happened yet, December gold is on the cusp of breaking out above its widely watched (and psychologically significant) 200-day trend line. It was attempted twice before in the last few months, but the breakout never stuck. Based on recent market action, however, there’s an excellent possibility that the third time will prove to be the charm.

What to Do Now

With our favorite gold-tracking ETF, the GraniteShares Gold Trust (BAR), showing signs of life, I recommended doing some nibbling in the event gold prices surge ahead in the coming weeks on mounting inflation fears. To that end, participants purchased a conservative position in BAR on October 13 using a level slightly under 17.35 as the initial stop-loss (intraday basis). Hold for now. HOLD

New Recommendations/Updates

Silver Finally Shows Some Leadership

Some observers are ascribing it to inflation fears, others to increased industrial demand, while still others suspect it’s a run on the market by the so-called “silver apes” (i.e. Reddit traders). But whatever the reason, gold’s sister metal has had one of its best monthly showings of the year so far, gaining 16% in October.

Short covering undoubtedly has played a part in this rally, but another driving force behind silver’s latest strength is undoubtedly value-related. That silver has been significantly undervalued relative to gold was obvious, as we discussed in a recent report, and could be seen in a classic and widely followed market gauge.

I’m referring of course to the gold-silver ratio, which hit one of its highest readings of the past year in late September, just as silver was putting in an intermediate-term low. The gold-silver ratio shows how many ounces of silver can be bought with one ounce of gold. Historically, the higher the ratio level, the more attractive silver becomes for value investors.

As you can see here, the ratio has pulled back since last month’s high-water mark, yet it’s still at a fairly elevated level. This suggests that the silver rally could continue as its attraction vis-à-vis gold from a value perspective remains a factor.

I’ve also pointed out many times in past reports that ideally, the silver price should lead the gold price if there is to be a worthwhile rally for the yellow metal. That wasn’t the case in gold’s last significant rally in April and May, as gold began its rally without silver’s participation. And while the white metal did eventually join gold in moving higher, gold was always in the lead. Not surprisingly, the rally failed and gold gave back a substantial part of its gains while silver surrendered all of its gains and then some.

This time around is a different story, however, as silver has in fact led the latest gold rally—at least in terms of magnitude. Silver’s gains to date have far surpassed gold’s, and silver has clearly exceeded its 50-day line for the first time since entering its bear market in June. This can be considered as a key technical development given how widely followed this particular trend line is. The breakout above the 50-day line was clearly also a short-covering catalyst, as subsequent market action has suggested.

Silver’s next major test is likely to occur around the $25.50 level where the next major benchmark—the 200-day moving average—is visible in the daily chart. The most important takeaway from silver’s latest showing from our perspective, though, is the potential for spillover strength into gold due to silver’s leadership attributes.

What to Do Now

I’m not currently recommending any new position in the iShares Silver Trust (SLV), our preferred silver-tracking vehicle. Although silver did close decisively above the 50-day moving average (which was needed to confirm a reversal of the intermediate-term downward trend in SLV), I’m going to play it conservative for now and stand pat with our gold ETF trading position. Frankly, I’d like to see some additional firming up of the silver price before feeling comfortable enough to jump in again with both feet. WAIT

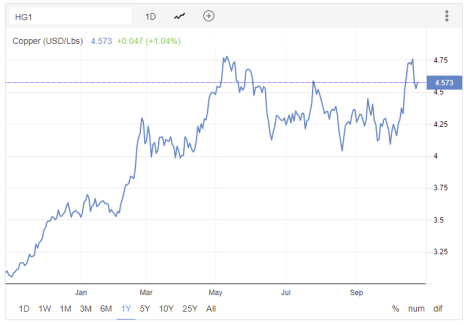

Copper Roiled by Short Squeeze

Copper was subject to a massive short squeeze recently, forcing the London Metal Exchange (LME) to apply restraints in an attempt to restore order. The exchange’s restraining measures included changing lending guidance rules, limiting backwardation and permitting deferred delivery of select positions.

High grade copper futures were up nearly 20% earlier last week from lows at the start of October. The premium for cash metal went “spiraling out of control,” according to one report, soaring to a record $1,103 per ton at one point on October 18 as LME warehouse stockpiles fell to their lowest level in over two decades.

By later in the week, however, the squeeze had subsided as market participants begin turning their attention back to the potential for slowing demand for the metal from China due to widespread power shortages and slowing growth.

There are also increased concerns that copper scrap supply is rising, as evidenced by an October 21 report from price provider Scrap Monster, which said that light copper prices tumbled by 18 cents per pound on Thursday from the previous day’s level.

Meanwhile, the LME stated that it is “monitoring the ongoing tightness in the copper market with Exchange inventories falling and nearby carries tightening.”

And while the bears contend that China’s economic concerns will dampen copper demand, it should be noted that key Shanghai copper stocks were sitting at a multi-year low of 43,500 tons at the end of September, which suggests that supply is still a problem and could keep prices elevated as construction and automotive demand remain high.

Also worth mentioning is that major miners and smelters like Freeport-McMoRan (FCX) are producing less copper than the market has anticipated, which have only served to increase tight market conditions.

Additionally, global supply chain woes (a likely catalyst for the short squeeze) should continue to buoy copper prices going forward, in turn elevating copper mining stocks (about which I’ll have more to say below).

What to Do Now

We recently added Taseko Mines (TGB) after last week’s breakout above the 2 level (per instructions in our previous update). Canada-based Taseko is known mainly for being a mid-tier copper miner that operates the Gibraltar Mine, Canada’s second largest open-pit copper mine. Taseko produces more than just copper, though, and the Gibraltar mine boasts proven reserves of 53 million pounds of molybdenum. Located in south-central British Columbia, Gibraltar has an estimated 18-year mine life and is located in a mining-friendly, low-risk jurisdiction. Total molybdenum production for the company in the second quarter of 2021 was 402 thousand pounds. Taseko reported that molybdenum prices strengthened in Q2 and averaged $14.32 per pound (27% higher sequentially). Copper production for Q2 was 20% higher from a year ago, while cash flow from operations was $72.5 million (nearly double from a year ago). Things are expected to strengthen for the firm moving forward. Management said the current copper price and expected production growth is supportive of improved financial performance at the Gibraltar mine over the remainder of 2021. All told, we think Taseko has turnaround potential and has established a nice-looking base in recent months from a chart perspective. After the 12% rally in TGB, I recommend taking some profit in TGB and raising the stop-loss to slightly under 2 (the original entry point) on an intraday basis. Earnings are due out October 28. HOLD

Teck Resources (TECK) is one of the world’s largest copper producers and is also the second-largest seaborne exporter of coking coal, with four operations in Western Canada and significant high-quality steelmaking coal reserves. Going forward, Teck plans to double its copper production in the next two years, seeing demand for the metal dramatically increasing from the white-hot electric vehicle industry. A major Wall Street institution agrees, estimating Teck’s copper production will more than double from its “transformational” QB2 project (one of the world’s largest underdeveloped copper resources) in top producer Chile. Providing additional support for Teck’s copper strength is news that copper stocks in top consumer China hit their lowest levels since 2009, with London Metal Exchange inventories falling 27% last week. Analysts see the firm’s revenue jumping 68% in both Q3 and Q4, with earnings growth accelerating. Investors did some nibbling in TECK last week using a suggested initial stop-loss slightly under 24. I now suggest raising the stop to slightly under 26 on a closing basis after the recent rally. Earnings are due out October 27. BUY A HALF

I also placed the ADR for Glencore PLC (GLNCY) on a buy after its recent show of strength. Glencore is the well-known multinational commodity trading and producing firm, with exposure to oil and gas, minerals like coal, ag commodities and metals like copper (with 50% of the global market share for internationally tradable copper), zinc (60% of the market) and nickel. In other words, it’s an across-the-board natural resource play and, as such, allows investors to capitalize on broad commodity market strength. Recent strength in the energy sector is responsible for much of Glencore’s outperformance vis-à-vis more metal-focused stocks, but its industrial metals business is also doing well. (Glencore’s CEO recently told the Qatar Economic Forum that world copper supplies need to double by 2050 in order to meet the growing demand for renewable energy, and the firm is well positioned to benefit from this demand explosion.) Analysts anticipate 47% revenue growth for the full year. Participants bought a conservative position in GLNCY last week using a level slightly under 8.75 as the initial stop-loss. I suggest raising the stop-loss to slightly under 9.70 (closing basis) after the strong rally in the last few days. BUY A HALF

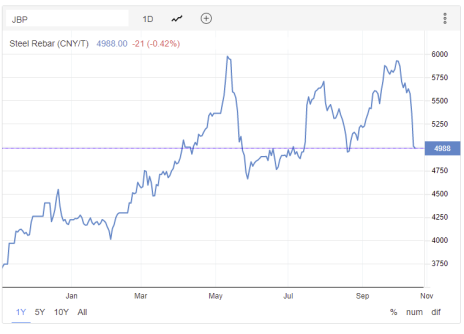

Steel Plunges on Demand Worries

North America’s largest integrated steel maker Cleveland-Cliffs (CLF) released earnings results last week that were better than expected.

The company earnings $2.33 per share from $6 billion in sales, which exceeded Wall Street’s predictions by 3% and 7%, respectively. Yet it wasn’t the earnings and revenue beats that had investors excited as much as the year-ahead steel outlook by CEO Lourenco Goncalves.

In its earnings release, Goncalves said: “The Cleveland-Cliffs business model is based on a significant amount of contract. Differently from other steel companies more exposed to spot prices, we believe that our average sales price next year should be higher than in 2021.”

Cliffs’ selling price averaged $1,334 a ton in the third quarter, up from $1,000 a ton in the third quarter in 2020, according to Barron’s. The firm’s selling prices have also averaged $1,122 a ton (up 11% from a year ago).

Consequently, Cliff’s share price shot up 13% on the day of the release last Friday. Steel futures prices, by contrast, weren’t so bullish. Shanghai futures prices dropped CNY 5,000 a ton last week—the lowest amount in two months and 15% lower than the previous record high set in May.

According to Trading Economics: “Chinese consumption for the construction material stood at 2.9 million tons in the week ending October 22nd, a level not seen since February 2020, when the pandemic brought economic activity to a halt.” Additionally, manufacturing demand was said to be lower in the face of China’s energy crisis (due to output curbs for energy-intensive industries throughout the mainland).

Nonetheless, metallurgical coal prices remain elevated as North American demand for the metal is still strong. For that reason, I continue to recommend that we keep our focus fixed on our steelmaking coal-related trade while continuing to avoid a direct play on steel until prices substantially firm up.

What to Do Now

Alliance Resource Partners (ARLP) is a metallurgical coal mining complex operator with approximately 1.7 billion tons of coal reserves in Illinois, Indiana, Kentucky, Maryland, Pennsylvania and West Virginia, making it the second-largest coal producer in the eastern U.S. Alliance produces a diverse range of metallurgical coal with varying sulfur and heat contents, enabling the company to satisfy the broad range of specifications required by steelmaking and thermal customers. The company also generates royalty income from mineral interests in premier oil and gas producing regions in the U.S., primarily the Anadarko, Permian, Williston and Appalachian basins. Analysts project revenue growth in the high teens for the next two quarters. A 3.4% dividend yield is an added bonus. Participants last week bought a conservative position in ARLP; I recommend using a level slightly under 10.50 (closing basis) as the initial stop-loss for this position. Earnings are due out Monday (October 25), after time of publication. BUY A HALF

Aluminum Remains Industrial Metal Leader

Aluminum prices have persistently shown strength in recent months and are within reach of a 13-year high of around $3,000 per ton last seen in September.

Aluminum futures were around $2,930 last week as persistently high demand and tight supplies continue to buoy the market. As previously noted, production in top producer/consumer China has been dwindling as the nation continues to restrict aluminum smelting in an effort to meet environmental standards.

The cost of aluminum, moreover, was up over 11% in the first half of October, as aluminum has been one of the industrial metals most heavily impacted by China’s power curbs (due in part to significantly higher coal and gas prices).

According to industry reports, China’s aluminum production last month fell for a fifth straight month to its lowest level in 15 months. September’s aluminum imports in China, meanwhile, increased over 2% from the previous month. The data suggests that aluminum’s supply/demand profile is considerably stronger than that of steel’s.

As noted in the above section, then, aluminum’s near-term outlook will likely continue to be driven by metallurgical coal market strength.

What to Do Now

Alcoa (AA) is one of the world’s largest aluminum producers, and as such stands to benefit from the persistent strength in the global aluminum market. Its operations include bauxite mining (aluminum ore), alumina refining (for smelting) and the primary aluminum manufacturing. On September 7, I recommended using pullbacks to buy a half position in AA, using an initial stop-loss placed slightly under the 40 level. Last week I suggested booking partial profit in AA after the stellar 22% gain, while raising the stop-loss on the remaining position to slightly under 50. This stop was triggered on October 22, which means we’re now completely out of AA. SOLD

Tin Hangs Tough Below Record Level

As discussed in the last newsletter, we have a new buy signal for a mining company that will provide us with some exposure to tin after our stop-loss in the tin ETN was recently triggered. While the tin price itself has been subject to some volatility lately, demand for the metal remains strong in the face of tightening supplies.

The London Metal Exchange tin price is up 84% since January, according to a benchmark tracker for this commodity, and is currently just 2% below an all-time record high.

This year’s astounding price increases have been primarily driven by high demand coupled with supply still not being able to catch up to it. This is in part due to a shortage from a major smelter in Malaysia, which was unable to fulfil contracts due to Covid-related lockdowns.

With tin remaining in a position of strength, I recently placed Alphamin Resources (AFMJF) on a buy.

What to Do Now

Mauritius-based Alphamin explores and develops mineral properties and is a low-cost producer of tin concentrate from its high-grade deposit, Mpama North, part of the Bisie Tin Project in the Democratic Republic of Congo. (Mpama North is the world’s highest-grade tin resource—about four times higher than most other operating tin mines in the world—allowing Alphamin to produce 3% of tin produced globally.) Alphamin also mines and sells tin from its North Kivu mine, producing nearly 10,000 tons of tin annually. While Alphamin is recognized as a promising tin producer, it flies largely under the radar among mining stock analysts right now. Total revenues for 2021 are projected to be around $310 million, up 66% from a year ago. Participants purchased a conservative position in AFMJF on October 7 using a level slightly under 58 cents as the initial stop-loss. I suggested taking a bit of profit last week after the stock’s 12% rally and raising the stop to slightly under 65 cents. I now suggest further raising the stop to slightly under 70 cents (around the 25-day line). HOLD

EV Battery Demand Driving Lithium Price Boom

Worldwide electric vehicle (EV) sales rose 114% in August (the latest date for which stats are available), reaching an 8% share of all autos sold. In top consumer China, EV sales were up 186%, reaching 19% share, while sales in Europe rose 60%, reaching a 22% share.

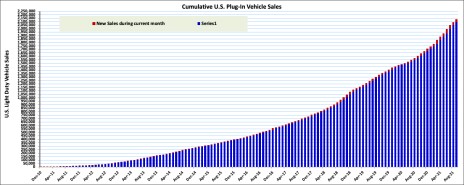

In the U.S. alone, some 60,850 HEVs (18,877 cars and 41,973 light trucks) were sold in September—up 41% from a year ago—according to U.S. Energy Department statistics. The following chart illustrates the eye-catching rise in demand for plug-in EVs over the last decade. The trend shows no sign of slowing and is expected by industry experts to continue accelerating, in turn boosting demand for the lithium-based EV batteries.

Source: U.S. Energy Dept.

Year-to-date, lithium prices are up 325% as EV battery demand has persistently increased while supply worries linger. The governments of several major countries, led by the U.S., are making huge bets on the future of the lithium battery industry, helping to maintain the current lofty market environment.

What to Do Now

Livent Corp. (LTHM) is the largest U.S. lithium-only miner, providing a range of lithium-based products and serving the EV, chemical, aerospace and pharmaceutical industries. Revenue and earnings projections for Livent are strongly optimistic for the next several years, with analysts expecting top-line growth of 34% this year and around 20% next year, while earnings are projected to grow at an even faster pace. Participants on October 13 bought a conservative position in LTHM using a level slightly under 22.25 as the initial stop-loss. Earnings are due out November 4. BUY A HALF

Reddit Crowd Strikes Again in Uranium

As governments around the world push ahead with decarbonization plans, and as power shortages worsen, uranium-based nuclear power is becoming increasingly embraced as a key fuel source.

On that score, the White House is attempting to create a government-funded uranium reserve for the purpose of achieving its clean energy goals. (Upwards of $75 million was allocated for this purpose in last December’s Covid relief bill.)

To be fair, though, much of uranium’s recent strength comes not so much from “clean” energy demand as from an old-fashioned greed play. To be exact, traders on the social media platform, Reddit, were credited (or blamed) for recently galvanizing a huge short squeeze in the uranium stock market.

Kazatomprom, the world’s largest uranium miner, last week made a strategic $50 million investment into Anu Energy OEIC, a fund that allows investors the opportunity to trade publicly-listed uranium shares. In the words of a Fortune article, “That set off a chain-reaction rally of uranium-linked stocks around the world.”

The previous major rally in uranium stocks occurred in September and was triggered by purchases of actual product from the Sprott Physical Uranium Trust, a Toronto-listed ETF that owns nearly 28 million pounds of uranium worth nearly $2 billion.

Last but not least, according to Fortune, “Investors on Twitter have taken up the call, too, pumping the radioactive stuff premarket.”

If previous meme/short-squeeze plays are any indication, the latest upside move in uranium stocks and ETFs should have plenty of longevity and enough fuel to make periodic momentum-based trades in uranium stocks worthwhile.

What to Do Now

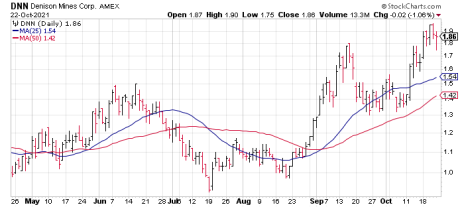

One uranium player showing promise from an intermediate-term standpoint is Denison Mines (DNN), a Canada-based uranium exploration, development and production company. Denison’s flagship project at Wheeler River, which has two high-grade uranium deposits, Phoenix and Gryphon. Phoenix is believed to possess the lowest production costs of any undeveloped uranium deposit, with all-in sustaining costs of $8.90 per pound (compared with current prices of around $32).and operating costs of just $3.33 per pound. All-in sustaining costs for Gryphon, meanwhile, are also a below-market $22.82 per pound, with a combined 109 pounds of probable reserves and a 14-year mine life. Additionally, Denison recently agreed to acquire a 50% stake in the JCU Exploration Company from UEX Corp. JCU holds a portfolio of 12 uranium project joint venture interests in Canada, and the acquisition is expected to allow Denison to not only increase its indirect ownership of its flagship Wheeler River project, but also to expand its asset base to include additional important Canadian uranium development projects such as Millennium and Kiggavik. Denison is admittedly speculative, but with physical uranium supplies getting tighter thanks to the recent decision of the world’s largest uranium producer, Kazatomprom, to limit production in 2022 and 2023—and with the Sprott Physical Uranium Trust gobbling up uranium on the spot market—the stock looks to be in a good position to continue a turnaround that began last year. Investors purchased a conservative position in DNN last week a level around 1.40 as the initial stop-loss on a closing basis. After last week’s 15% rally, let’s take some profit and raise the stop on the remaining position to slightly under 1.50. Earnings are due out November 4. HOLD

Current Portfolio

| Stock | Price Bought | Date Bought | Price 10/25/21 | Profit | Rating |

| Alcoa (AA) | - | - | - | - | Sold |

| Alliance Resource Partners (ARLP) | 12 | 10/13/21 | 12 | 4% | Buy a Half |

| Alphamin Resources (AFMJF) | 0.73 | 10/8/21 | 0.77 | 5% | Hold |

| Dennison Mines (DNN) | 1.65 | 10/19/21 | 1.89 | 15% | Hold |

| Glencore PLC ADR (GLNCY) | 9.64 | 10/8/21 | 10 | 6% | Buy a Half |

| GraniteShares Gold Trust (BAR) | 18 | 10/13/21 | 18 | 1% | Hold |

| Livent Corp. (LTHM) | 26 | 10/13/21 | 26 | -1% | Buy a Half |

| Taseko Mines (TGB) | 2.05 | 10/12/21 | 2.34 | 14% | Hold |

| Teck Resources (TECK) | 28 | 10/12/21 | 28.53 | 4% | Buy a Half |

Buy means purchase a position at or around current prices.

Buy a Quarter/Half means allocate less of your portfolio to a position than you normally would (due to risk factors).

Hold means maintain existing position; don’t add to it by buying more, but don’t sell.

Sell means to liquidate the entire (or remaining) position.

Sell a Quarter/Half means take partial profits, either 25% or 50%.

The next Sector Xpress Gold & Metals Advisor issue will be published on November 9, 2021.

Cabot Wealth Network

Publishing independent investment advice since 1970.

President & CEO: Ed Coburn

Chief Investment Strategist: Timothy Lutts

Cabot Heritage Corporation, doing business as Cabot Wealth Network

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2021. All rights reserved. Copying or electronic transmission of this information without permission is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. Disclosures: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to our publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Employees of Cabot Wealth Network may own some of the stocks recommended by our advisory services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: are made in regular issues, updates, or alerts by email and on the private subscriber website. Performance: Subscribers should apply loss limits based on their own personal purchase prices.

Subscribers agree to adhere to all terms and conditions which can be found on CabotWealth.com and are subject to change. Violations will result in termination of all subscriptions without refund in addition to any civil and criminal penalties available under the law.