Alternate Energy Metals Steal the Spotlight

The metals necessary for the worldwide clean energy agenda are significantly outperforming their industrial and precious metal counterparts. Specifically, lithium, nickel and cobalt are showing relative strength, while steel, iron ore and silver continue to lag. Meanwhile, continued strong demand in the magnet market is keeping prices for rare earths like neodymium and praseodymium buoyant. As a result of this strength, our rare earth stock holdings continue to perform well.

Feature Story: Why Gold Didn’t Participate in the “Everything Rally”

Inflation—or more specifically, rising costs—is a problem that consumers, producers and investors alike are coming to realize won’t disappear anytime soon. Indeed, what was at first assumed to be merely a “transitory” or cyclical phenomenon is now being accepted by economists and market participants as a secular event with the potential to become endemic.

So, with inflation on everyone’s mind right now, why hasn’t gold been able to break out of its malaise and soar to the vertiginous heights that many gold bulls have envisioned? After all, gold is widely regarded as the ultimate inflation hedge, so shouldn’t it be responding to it by persistently rallying?

If you’ve been with me for a while you probably already know my answer to those questions, viz. gold is more of a safe haven than a short-term inflation hedge. Accordingly, it tends to respond to informed investors’ fears, or what they believe will happen in the intermediate-term (6-12 months) future. In the short-term (3-6 months), gold is more responsive to currency and interest rate changes, as well as (to a lesser extent) investor sentiment.

But before we discuss gold’s response to the inflation threat, let’s take a look at how other markets are responding to it.

For equity investors, inflation has so far proven to be benign and has even contributed to corporate profit growth. This observation was made in a recent Wall Street Journal article which noted that, “Companies are paying higher wages, spending more for materials and absorbing record freight costs, pushing up economic inflation gauges. They are also reporting some of their best profitability in years.”

WSJ went on to note that corporate executives are “seizing a once in a generation opportunity to raise prices to match and in some cases outpace their own higher expenses, after decades of grinding down costs and prices.”

The noted Wall Street economist Ed Yardeni echoes this sentiment, pointing out that expectations for record-high corporate profit margins of 13.1% in 2021, 13.2% next year and 13.8% in 2023 underscore that pricing pressures aren’t squeezing margins.

Barron’s, moreover, recently opined that consumers’ inflation fears have actually helped to increase their spending levels, adding, “Consumers speeding up purchases in anticipation of higher prices is the very dynamic central bankers fear.”

Inflation has actually been a boon thus far to financial markets, contributing to the “everything rally” (from stocks and bonds, to commodities and cryptos). Yet one asset that was notably ignored by investors in 2021 was gold. Base metals by and large benefited from the inflation-driven everything rally, yet precious metals—led by gold—basically went nowhere and showed no signs of responding to the threat posed by inflation.

My explanation for gold’s seeming lack of response to inflation is that the yellow metal had already factored in the probability of future inflation back in 2020. Well before most observers were aware of the inflation threat, gold commenced a rally in March of last year almost immediately after the shutdown began. The Fed would begin a massive round of quantitative easing, with Washington following suit in the form of all-out fiscal stimulus to counteract the economic impacts of the lockdowns.

The U.S. dollar responded to these loose monetary policy measures by collapsing for almost a full year, while gold experienced a vigorous rally. The metal rose from a March 2020 low of $1,450 an ounce to a high of just under $2,100 by August—a 45% gain in just under five months!

But this proved to be the apex of gold’s rally; after a subsequent seven-month decline, gold bottomed out, but the metal has never since recovered last year’s high. In retrospect, it’s obvious that the gold market foresaw that this year’s reopening would relieve much of the stress being inflicted upon the nation’s money supply and production levels, thereby diminishing some of the inflation pressures. The fact that inflation isn’t raging right now can also be seen in the relative firmness of the dollar index (below), which has also created a headwind for gold this year.

Additionally, rising longer-dated Treasury yields (as reflected in the 10-year Treasury Yield Index, shown below) acted as a counterweight to several attempted gold rallies this year. Between the stronger dollar and higher bond yields, gold faced too much competition to effectively extend last year’s price gains.

More to the point, the rising dollar index suggests that the demand for dollars is high enough to counteract safe-haven demand for bullion. As investors around the globe flee foreign currencies and equity markets for the relative strength of U.S. markets, the dollar benefits. And right now, investors are still more focused on capital gains than on capital preservation, which means gold has been temporarily shunted in favor of equities, cryptocurrencies and select commodities.

As for inflation, The Wall Street Journal recently noted that global inflation pressures are expected to endure, with the Organization for Economic Cooperation and Development forecasting U.S. consumer price inflation to average 4.4% in 2022, up from 3.1% in its last forecast just a few months ago.

On that score, two of the Canadian mining industry’s biggest luminaries—David Garofalo and Rob McEwen—recently told Bloomberg that investors will soon come to realize that global inflationary pressures are much greater than most economists envision. They collectively predict that gold prices could soar to $3,000 an ounce (from current levels around $1,800).

But I must respectfully disagree with this sanguine outlook. It’s my view that a revival of gold’s fortunes likely won’t hinge on the threat of inflation (which gold has evidently already discounted). Rather, gold’s next short-to-intermediate-term bull run will likely be catalyzed by the reappearance of fear—in its most persistent form.

Whether that fear is the result of a major equity market rout or a geopolitical event is open to speculation. But it’s clear that the “fear factor” has been conspicuously missing from the equation, and what’s more, gold needs it to get any meaningful traction. Without it, we can likely expect the yellow metal’s multi-month trading range to remain in force.

What to Do Now

We were quickly stopped out of our speculative purchase of Harmony Gold Mining (HMY) last week when the 3.75 mark (the 50-day line) was violated on a closing basis. For now, we have no active commitments in either our favorite gold-tracking ETF or any gold mining stocks as we await the next confirmed breakout signal in the yellow metal price. SOLD

New Recommendations & Current Portfolio

Despite Physical Demand, Silver Stuck in Neutral

According to the Silver Institute, global silver demand will rise to just over a billion ounces this year, up 15% from 2020 and above one billion ounces for the first time since 2015.

“The coronavirus sharply reduced use of silver by manufacturers and jewelers but increased demand from investors who wanted a safe asset to ride out economic turbulence,” the Institute said. “This year, with most economies out of lockdowns, demand has risen across the board—from manufacturers of goods including solar panels and electronics to jewelers, makers of silverware and investors in silver bars and coins.”

The Silver Institute further predicted the silver market would see its first deficit in six years, albeit modestly, and would be undersupplied by seven million ounces this year.

However, this figure doesn’t take into account silver ETFs that store physical silver for investors. Instead, the Silver Institute anticipates that silver ETF managers will stockpile less of the metal in 2022.

Additionally, and serving to somewhat counter the increased demand, mined silver production is expected to rise by 6% from a year ago for full-year 2021. The recovery is attributed to most mines now able to be fully operative after last year’s enforced closings. Major silver mining countries where output was most heavily impacted, including Peru, Mexico and Bolivia, are expected to see the biggest increases.

What’s holding silver back in the near term, however, is the persistent strength of the U.S. dollar index. As previously discussed, until the currency-related headwind abates, silver is likely to remain stuck in neutral.

Additionally, silver faces pressure from short-term bond yields. The yield for the U.S. 2-year Treasury, which reveals investors’ expectations for longer-term yields, is currently 0.66% (below) and near its highest level for this year. This is a key reason for the recent weakness in both gold and silver due to the competition both metals face from yield-oriented investments.

Thus, the strong dollar and strong short-term yield trends are likely to keep silver prices contained in the near term. Consequently, I continue to recommend that we remain content with our exposure to some of the other major metals covered in this report without taking on extra risk by purchasing a stake in a trendless silver market. I’m going to stand pat with that advice for now (though admittedly the silver market outlook could quickly shift in the bulls’ favor if the dollar suddenly weakens).

What to Do Now

I’m not currently recommending any new position in the iShares Silver Trust (SLV), our preferred silver-tracking vehicle. As previously noted, I’d like to see some additional firming up of the silver price before feeling comfortable enough to jump in again with both feet. WAIT

Copper Hangs Tough Despite Headwinds

Like silver, copper prices have been range-bound in the last few weeks. Unlike silver, however, copper has shown signs of latent strength and has done a better job of fighting against economic and currency-related headwinds.

Copper futures are currently around $4.30 per pound and certainly within reach of the $4.80 peak last seen in October. The latest news regarding China’s plans to introduce economic stimulus is largely viewed as a potential boon to the manufacturing-sensitive metal.

News reports reveal that the Bank of China has cut the reserve requirement ratio for banks by 50 basis points in a bid to support economic growth. Moreover, China’s top policy making bureau has affirmed plans to support the nation’s beleaguered real estate sector (a major copper end-user).

However, recent concerns over the spread of the Omicron variant of the coronavirus have apparently kept copper futures from rallying, as health officials around the world have warned the variant could become the dominant strain by Christmas. Thus, there has been a near-perfect balance between buying and selling pressures.

Looking ahead, the shift to cleaner energy among some of the world’s biggest nations is expected to increase copper consumption in the coming years. Due to its wide use in alternative energy technologies like wind, solar, hydro and nuclear (as well as battery technologies), copper is expected to get a demand boost.

On a short-term basis, Reuters reports that after lagging for much of the year, China’s copper imports have increased for a third straight month as of November and have hit their highest level since March. Rising domestic industrial demand, coupled with easing power curbs, were attributed as reasons for the increased copper consumption.

Reuters also reports that there are signs of tight supply in the physical market, as shown by low visible stocks and cash-to-three-month spreads. Total copper stocks at LME warehouses stood at 74,225 tons, a 9-month low, while Shanghai stockpiles are at 36,110 tons, down 84% from May.

All told, the fundamental picture is brightening and suggests copper prices—barring a significant worsening of the Omicron situation—should remain supported with the potential to move higher in the coming weeks.

What to Do Now

Traders recently purchased a conservative position in the United States Copper Index Fund (CPER) using a level slightly under 25.60 (the nearest pivotal low) as the initial stop-loss on an intraday basis. Let’s maintain this stop for now. BUY A HALF

Steel Hindered by Weak Iron Ore Demand

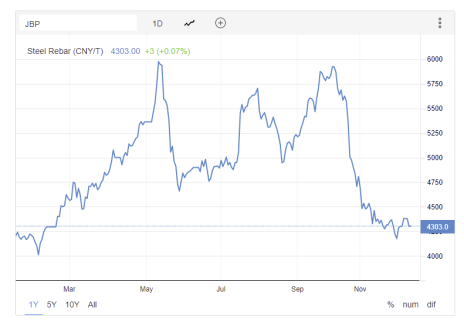

After rising as much as 50% earlier this year, steel rebar prices have gained just 4% for the year to date.

Accounting for much of the steel price weakness since reaching its peak for the year in May is continued weakness in iron ore, a key raw material for steel making. Iron ore prices, which peaked in May at the same time steel rebar prices topped, are down 55% since then as of December 13.

A major reason for both iron ore and steel price weakness is the instability of China’s property sector in recent months. Led by concerns over China’s second-largest property developer by sales, Evergrande, which just slid into default.

According to CNN Business, “Evergrande has defaulted on its debt [and] now Beijing is intervening to prevent a disorderly collapse of the indebted real estate group that could wreak havoc on the world’s second biggest economy.” Ongoing worries over China’s real estate outlook will likely keep a lid on steel prices for the rest of the year, although there are preliminary signs that the metal could perk up in 2022.

However, Trading Economics reports that Chinese firms are set to increase output after a slew of strict production curbs imposed by the government stunted production.

Assuming the government’s attempt at stabilizing the domestic property market succeed, both steel and iron ore prices should likewise stabilize and could see a much-anticipated rally from a technically “oversold” position in the coming months.

Moreover, Tata Steel’s CEO, T.V. Narendran, told CNBC that he anticipates steel prices will trend “much higher” than the 10-year average. He predicted hot-rolled coil steel will likely average around $600 per metric ton in the coming years, compared to $400 or $450 per ton in past years.

Narendran based his bullish long-term steel price prediction on a World Steel Association report that concluded steel demand growth in the coming years will come from countries other than China, adding that high steelmaking coal prices will also likely contribute to higher steel prices.

“With the Western world investing [in] infrastructure, that’s positive for demand as well,” he said.

Short term, the market remains in a state of limbo with U.S. dollar strength serving as a headwind to a sustained steel price rally. Accordingly, I recommend that we hold off on making any new commitments in our favorite steel-tracking ETF for now.

Nickel Mining Stocks Look Tempting

While nickel prices have remained fairly buoyant in recent months and near 8-year highs, the metal has been under some pressure in the last few weeks.

Nickel futures fell from a 2-week high on December 8 on the potential for rising supply out of China (due to the easing power crisis) as smelters have been given the go-ahead to increase output. Subsequently, a major Chinese producer, Tsingshan Group, has reportedly commenced nickel production at its plant in Indonesia.

On the supply side, the outlook is more supportive of higher prices, however. LME warehouse inventories of the metal fell 58% from April to 110,358 tons—their lowest level in the last two years. Shanghai warehouse inventories are also near an all-time low registered in August, at 4,455 tons.

I would hasten to add that the publicly traded stocks of some major global nickel producers are starting to look attractive from a fundamental perspective. Low P/E ratios, higher dividend yields and an improved earnings outlook (in part due to increased EV battery demand) are reasons for taking a closer look at the nickel stocks. One of my favorite ones is highlighted below.

What to Do Now

Vale S.A. (VALE) is one of the world’s largest iron ore and nickel miners, as well as a diversified producer of other industrial and precious metals. Earlier this year, the company garnered attention when management announced an ambitious plan to reach 400 million tons of iron ore production by 2022, which, if realized, would be a 33% increase from 2020’s total production. More recently, though, Vale has shifted its focus on so-called “green” metals in an effort to diversify and generate higher shareholder returns. Vale recently guided for copper production to increase to a midpoint of around 345,000 tons per year, led by the firm’s Salobo 3 expansion copper project, while nickel production is expected to reach around 185,000 tons per year. Additionally, Vale’s outlook received a boost from the recently passed $1 trillion infrastructure spending bill, which would dramatically expand fiscal spending for roads, water pipes, EV charging stations and other infrastructure, in turn necessitating higher industrial metal production volumes. Analysts, meanwhile, expect Vale’s revenue for full-year 2021 to increase 34% while per-share earnings improve 85%. From a technical standpoint, VALE is coming off a 1-year low near 12 but appears to be bottoming out. Any improvement in the iron ore, copper and nickel prices from here should provide a boost to the stock. Traders who don’t mind the China-related volatility risk can do some nibbling around current levels, using a level slightly under 12 as the initial stop-loss on a closing basis. BUY A HALF

Lithium Boosted by Clean Energy Outlook

Lithium carbonate prices have increased by a stunning 366% in 2021 to date, led by battery-related demand for electric vehicles (EVs).

Also boosting lithium’s demand profile is the recently passed U.S. infrastructure bill, which earmarked almost $8 billion for a nationwide network of EV charging stations—a move that many experts expect will accelerate the adoption of EVs. Industry experts, meanwhile, predict lithium production will reach a million metric tons by 2025 and two million metric tons by 2030.

Lithium supplies remain tight, further boosting prices as lithium carbonate prices in China recently hit record levels on supply tightness and increasing automotive and EV battery demand.

To that end, Cameron Perks, senior analyst at Benchmark Mineral Intelligence, observed that the “trend of increasing EV penetration is key for [lithium] demand going forward,” adding that there is “little chance of a balanced supply market” in the coming years.

Elsewhere, the International Energy Agency (IEA) has said that the total share of mineral demand from the energy sector will likely increase in the coming two decades, to almost 90% for lithium.

An additional consideration is that lithium supply is in need of significant bolstering after years of underinvestment. But as governments around the world move toward zero carbon emission goals, metals like lithium are expected to see a conspicuous rise in demand.

Barron’s, meanwhile, maintains that the battery metals rush is just starting, which will lead to a new “supercycle.” Several leading lithium producers, including Albemarle Corp. (ALB), are anticipating “astronomical growth” in the lithium mining industry, according to a recent Barron’s report on the battery metal industry.

What to Do Now

Sigma Lithium Resources (SGML) is a Canada-based, exploration-stage lithium developer with access to the largest hard rock lithium deposits in the Americas, located in its wholly owned Grota do Cirilo Project in Brazil. The company has been producing low carbon high purity lithium concentrate at an on-site demonstration pilot plant since 2018, with plans to reach near-term commercial stage production (initially in 2022) and eventually producing 220,000 tons annually of battery grade lithium concentrate. It’s admittedly a speculative play with sovereign and mining-related risks in Brazil. But with its substantial, high grade and low impurity resource, coupled with booming lithium carbonate and hydroxide prices, the risk appears justified. Accordingly, speculators who don’t mind the risk can do some nibbling here, using a level slightly under 8.50 (intraday) as the initial stop loss. BUY A HALF

Rare Earths Outlook Bullish

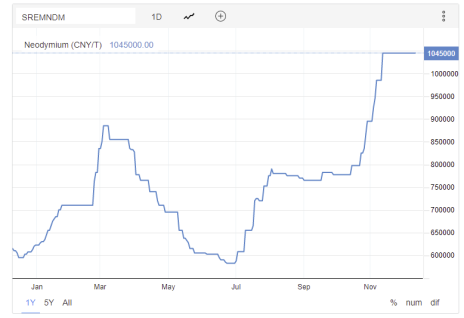

Neodymium prices are up 68% for the year to date and up 150% from a year ago, driven by strong demand in the magnet and laser markets. Praseodymium prices, meanwhile, are up 185% from a year ago driven by demand from the magnet and colorant markets.

According to a recent industry report, the global rare earth metals market is expected to grow from $5.22 billion in 2020 to $5.72 billion in 2021 at a compound annual growth rate of nearly 10%.

The growth is primarily attributed to mining and production companies resuming operations post-Covid after last year’s restrictions, including shuttering or partially closing commercial operations.

The rare earths market is benefiting from a number of trends, including the expanding growth of miniaturization in the electronics industry (particularly the development of ultrathin 2D magnets). For this reason, neodymium-based magnets are highly utilized as permanent magnets owing to the metal’s strong magnetic properties (in fact the strongest permanent magnet available today with maximum energy products).

Rare earth metals are also widely used in the manufacturing cellular telephones, computer hard drives, flat-screen monitors and televisions. In addition, cloud computing and data center growth are expected to drive higher rare earths usage going forward.

What to Do Now

Earlier this month I suggested selling half our stake in Lynas Corp. (LYSCF), a rare earth mining company based in Australia and boasting one of the highest-grade rare earth mines in the world (including neodymium and praseodymium (NdPr), lanthanum, cerium and other mixed heavy rare earths). Participants previously bought a conservative position in LYSCF using a level slightly under 5.25 as the initial stop-loss on a closing basis. But after rallying 15% from our initial entry point, it was time to take some profit based on the rules of our technical trading discipline. I also suggest raising the stop-loss on the remaining position in this stock to slightly under 6.00 (near the 25-day line). HOLD A HALF

MP Materials (MP) operates the largest rare earth mineral mines in the Western Hemisphere, currently accounting for around 15% of total global supply, with a focus on Neodymium-Praseodymium (NdPr)—a crucial input used for making rare-earth magnets used in many of those devices. MP opened Wall Street’s eyes to the oft-overlooked industry in Q3, boasting estimate-beating revenue that soared 143% from a year ago and 36% sequentially, while net earnings nearly tripled, prompting at least two major institutions to recommend the company. Management also reported generating a “significant” amount of cash from operations, which will be used to advance its Stage II and Stage III plans to restore the full rare earth supply chain to the U.S. (Most of the rare earth concentrates MP produces are sold to China through an intermediary, but its plans will allow it to bypass the middleman and fully process and sell NdPr straight to end users.) Most recently, MP got a boost when it was revealed that automaker General Motors (GM) has contracted with the firm to supply magnets for building motors for more than a dozen GM models. Traders recently purchased a conservative position in MP using a level slightly under 37.15 (50-day line) as the initial stop-loss on a closing basis. Let’s maintain this stop for now. Traders should also book some profit after the recent 14% rally. SELL A HALF

Current Portfolio

| Stock | Price Bought | Date Bought | Price 12/13/21 | Profit | Rating |

| Harmony Gold Mining (HMY) | - | - | - | - | Sold |

| Lynas Corp. (LYSCF) | 5.85 | 11/16/21 | 6.36 | 9% | Hold a Half |

| MP Materials (MP) | 42 | 12/7/21 | 43 | 5% | Sell a Half |

| Sigma Lithium Resources (SGML) | New Buy | - | - | - | Buy a Half |

| United States Copper Fund (CPER) | 27 | 11/23/21 | 26 | -2% | Buy a Half |

| Vale S.A. (VALE) | New Buy | - | - | - | Buy a Half |

Buy means purchase a position at or around current prices.

Buy a Quarter/Half means allocate less of your portfolio to a position than you normally would (due to risk factors).

Hold means maintain existing position; don’t add to it by buying more, but don’t sell.

Sell means to liquidate the entire (or remaining) position.

Sell a Quarter/Half means take partial profits, either 25% or 50%.

The next Sector Xpress Gold & Metals Advisor issue will be published on December 28, 2021.