Titanium, an under-covered market on Wall Street, has the unlikely distinction of now being one of the top-performing metals.

This metal, along with lithium and steelmaking coal, grabbed the top spots in terms of overall performance and has provided us with a solid performance in an otherwise soft metals broad market.

Elsewhere, steel should strengthen while gold and silver both have a good chance to turn around in the coming weeks.

I continue to recommend that we maintain a mostly defensive stance.

Cabot SX Gold & Metals Advisor Issue: May 24, 2022

Gold’s Technical Backdrop Strengthens

Confirmed Low Could Be Imminent

Finally, there are signs that gold is on the brink of being unfettered, as two of its biggest “enemies” are starting to show signs of weakness. As I’ll explain, gold now has its best chance to rally in several weeks on the basis of improving currency and interest rate factors.

To reiterate the major points of our recent discussions, the biggest obstacles keeping gold from rallying have been the strong dollar and rising Treasury yields. I’ve emphasized that until we see some sustained dollar weakness—along with a sizable pullback in bond rates—gold will likely remain moribund.

But the last few days have offered a glimmer of hope that both the dollar and bond yields are on the point of reversing their respective uptrends.

The dollar index (USD) showed signs of being vulnerable to a decline last week when it suddenly dropped nearly 2%. The greenback’s failure to follow through with latest rally to multi-year highs caused many to speculate the dollar has outworn its welcome as a temporary safe haven. If that’s indeed the case, then we’ll need to see some downside follow-through in the next few days.

Specifically, the dollar should fall under 102 (see chart below) which would pave the way for the widely-followed 50-day line to be tested. Plus, a drop below 102 would almost certainly provide gold with a clear path to rally as its currency component strengthens.

As for the 10-year Treasury yield (TNX), it threatened to test its own 50-day line last week after dropping from a major peak earlier this month. While it’s not as critical for bond yields to decline in order for gold to rally, a falling 10-year yield would certainly improve gold’s allure as a haven investment among yield-conscious investors.

That said, we still don’t have a confirmed buy signal for gold based on the leading indicators. While the odds of a gold rally have definitely improved in the short term, we haven’t yet seen the requisite leadership in the platinum and palladium markets. (Both metals typically lead gold higher—or lower—whenever gold’s trend is reversing.)

Moreover, as we’ll discuss further in this report, silver hasn’t yet shown the necessary strength to confirm a trend reversal for gold. Ideally, the three white metals just mentioned should lead, or else confirm, strength in the yellow metal.

So for now, the waiting game for another opportunity to buy gold continues. But if the dollar continues to weaken, we should get that chance very soon.

What to Do Now

From a short-term strategic perspective, no new gold ETF purchases are recommended. WAIT

New Recommendations/ Updates

Silver Seasonality Will Shortly Improve

We’re not there yet, but an important seasonal period for buying silver is quickly approaching.

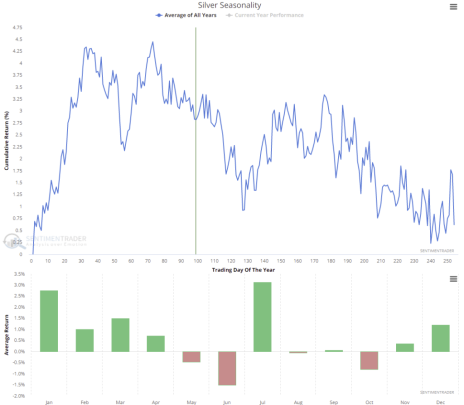

According to data compiled by Jason Goepfert of SentimenTrader, July is historically one of the best-performing months for silver. This is illustrated in the following chart.

What typically happens is that if silver enters July in a downtrend, there’s a good chance of a short-covering pop to higher levels. Granted, it’s not often the start of a new sustained uptrend, but it does tend to afford traders with an opportunity to make some quick profits. Moreover, the bullish seasonal period—even in down years for silver—tends to last into early September.

However, if silver enters the bullish summer seasonal period in a relative strength position, prices tend to appreciate much more in percentage terms (as happened in 2019). The only exception to this rule tends to occur when silver enters July overextended and “overbought” after already rallying for several months (as happened in 2016 and 2020).

Thankfully, silver is in an “oversold” technical condition after dropping 22% in the last 10 weeks, so we shouldn’t have to worry about the bullish July seasonal tendency being annulled this year.

On a short-term basis, meanwhile, we’re still waiting for silver to confirm that it has fully established a bottom. Silver has rallied 5% off its year-to-date low of 19, but it’s still under the key 25-day line. It also hasn’t yet established a simple stair-stepping pattern of higher highs and lows which is needed to form the basis of a trend reversal.

Silver is looking better from both a fundamental and technical perspective, however, so a confirmed bottom could be just a few days away.

What to Do Now

From a short-term strategic perspective, no new silver ETF purchases are recommended. WAIT

Shanghai Reopening is Key for Copper

After falling 16% from is early March peak, the copper price touched a low of $4.10 per ton on May 12 and has since bounced back 4%.

China’s copper imports fell 4% in April from a year ago, as manufacturing activity and domestic consumption were seriously impacted by the recent lockdowns.

The latest rally, however, was based on expectations that China will soon roll back its Covid restrictions, which should increase copper demand as manufacturing activity picks up around the nation’s key industrial centers.

Another factor weighing on copper of late was the runaway strength of the U.S. dollar (mentioned earlier in this report). But last week’s pullback in the dollar index helped trigger buying interest in copper, with short covering in evidence in the futures market.

Ongoing concerns that inflation pressures will keep increasing are also boosting sentiment on copper. The key factor for the red metal, however, is China. Assuming the government sticks to its stated intention to reopen by June the top industrial city of Shanghai, copper should be able to extend its latest rally and go on to establish a new uptrend.

For now, though, playing defense is still in order since copper still hasn’t technically confirmed the May 12 price low as the final bottom of the April-May decline.

What to Do Now

In view of the above-mentioned factors, our copper-focused portfolio remains in an all-cash position. We’ll wait for a confirmed bottom in the copper price before initiating a new trading position in our favorite copper ETF. WAIT

China Stimulus Should Boost Steel Demand

Steel rebar prices fell to their lowest level in over two months in the face of worries over Chinese demand.

Growing fears over China’s slowing economy and the potential for further demand erosion from the world’s biggest steel consumer. But as Shanghai moves closer to a targeted June 1 reopening date, the market should begin to strengthen. (This expectation is based on the observation that the recent steel price decline was likely a panic response to the drop in China’s retail sales and industrial production).

And as Trading Economics has pointed out, recurring pledges from China’s government should put a floor under prices as more stimulus is introduced to support the economy. President Xi Jinping said the stimulus would be particularly aimed at pandemic-hit industries, with a focus on increased infrastructure and construction spending, as well as supporting policies to restore the real estate market.

Another bullish factor for steel prices going forward is China’s latest move to reduce borrowing rates and shrinking stockpiles of iron ore, which boosted steel market sentiment last week and pushed prices higher for the steelmaking input (Singapore-listed iron ore prices rose 6% on May 20). Iron ore stockpiles also fell for an eighth straight week, further supporting a steel rebound.

Meanwhile, demand for steelmaking coal remains high as reflected by recent record coal futures prices. Aside from higher demand related to power generation, mushrooming natural gas prices are also boosting coal’s demand profile as a cheaper alternative industrial fuel. This trend continues to bode well for our exposure to metallurgical coal via our lone steel-related stock position.

What to Do Now

Natural Resource Partners (NRP) is a master limited partnership engaged in owning and managing a diversified portfolio of mineral reserve properties, including steelmaking coal and other natural resources (mainly gas and timber). Approximately 65% of the firm’s coal royalty revenues and around 45% of coal royalty sales volumes were derived from metallurgical coal in the latest quarter, making the stock a good proxy for steel demand. NRP posted Q1 revenue of $90 million (up 142% from a year ago) and per-share earnings of $3.11 that handily beat estimates, led by rising demand for steel, electricity and renewable energy. NRP also said it generated $52 million of free cash flow in the quarter and $152 million over the last year (up 120% and 85%, respectively). This allowed the company to return additional cash to shareholders through a dividend increase (to 75 cents per share from 45 cents). Management is sanguine about the year-ahead outlook, with plans to generate even more “robust” free cash flow in the coming months while paying down debt and solidifying its capital structure. Participants recently purchased a conservative position in NRP, and after a 10% rally, I recommended selling a half and raising the stop on the remaining position to slightly under 34.50. I now suggest raising the stop a bit higher to slightly under 45 (closing basis) where the 50-day line comes into play. HOLD A HALF

SFL Corp. (SFL) is one of the world’s largest ship owning companies, with investments in the tanker, dry bulk, container and offshore segments and boasting a significant charter backlog. Its cargoes include iron ore and metallurgical coal, and the outlook for this segment is bullish as increased trade volumes and potential effects from continued port congestion are expected to absorb fleet capacity, while few newbuild deliveries are scheduled in the second half of 2022. In Q1, operating revenue of $152 million was slightly above the year-ago level and beat estimates by 10%. Per-share earnings of 37 cents, meanwhile, beat estimates by 13 cents. The company has a strong cash position and expects to continue building its business platform through new asset acquisitions and investments in order to enhance cash flows and maintain its generous dividend payouts (8% yield). Traders can purchase a conservative position in SFL using a level slightly under 9.70 as the initial stop-loss on a closing basis. BUY A HALF

Battery Demand Still Support Lithium

Although lithium carbonate prices in China fell to their lowest level since February in late May, the metal is only slightly below its record high as supply projections continue to support prices.

However, carbonate supplies are expected to gradually increase in the coming months after Beijing called for a boost to output from smelters and miners in order to relieve the rally in the metal’s price since last December.

The latest data also revealed that lithium production in China increased 2% month over month in April and rose 30% from a year ago. Supply, meanwhile, is expected to further rise in May as China’s Covid lockdowns are expected to subside.

Capacity is also expected to rebound for electric vehicle (EV) manufacturers, however, which will continue to boost lithium’s demand profile. On that score, after rising 157% to 3.2 million units in 2021, China’s EV sales are forecast to exceed five million this year—a record—further boosting battery-related demand for the metal.

What to Do Now

Sociedad Química y Minera de Chile (SQM) is a Chilean supplier of fertilizers, iodine, lithium and industrial chemicals. It’s also the world’s fourth-largest lithium producer by market cap and holds a 19% share of the global market for lithium and lithium derivatives. Lithium supply was unable to keep pace with demand in 2021, a trend that SQM’s management expects to continue this year. Additionally, the company is in the midst of a capacity expansion (up to 180,000 tons, and with plans to spend $900,000 this year) which SQM believes will allow it to increase its market share in 2022. SQM posted a stellar 12-times increase in net income for Q1 on the back of strong revenue thanks to higher lithium prices. The results pushed SQM to a new high last week, prompting us to book some profit in our recently initiated trading position in this stock. I now recommend that traders raise the stop-loss to slightly under 83.50 (closing basis). HOLD A HALF

New U.S. Titanium Resource Found

At a time when titanium is in tight supply and high demand globally, the second-largest indicated rare earth resource in the U.S. has now been identified, which includes titanium.

The finding by NioCorp Developments (NB:TSX) Elk Creek project in southeastern Nebraska follows an updated feasibility study of rare earth resources, second only to MP Materials’ (MP) Mountain Pass rare earth deposit.

“According to the 2022 feasibility study, the Elk Creek project contains an estimated 632.9 kilotonnes of contained total rare earth oxides in the indicated mineral resource category,” said NioCorp in a statement. Based on U.S. Geological Survey data, this places the Elk Creek mineral resource ahead of all other current rare earth projects (MP Materials excepted) in terms of contained total rare earth oxides.

NioCorp said the feasibility study also showed that, in addition to rare earth elements, the mineral resource contains relatively high grades of titanium. The titanium oxide resource was also substantial at an estimated four million tons.

Meanwhile, according to The Wall Street Journal, U.S. chemical companies like Chemours (CC) are having a hard time sourcing supplies of titanium dioxide due to supply constraints surrounding ore from South Africa and Ukraine. The tight supply situation should keep titanium prices buoyant in the foreseeable future.

What to Do Now

Kronos Worldwide (KRO) is a leader in the production of titanium dioxide pigments, the world’s primary pigment for providing whiteness, brightness and opacity (used in two-thirds of all pigments). In Q1, the company reported another solid, consensus-beating quarter. Revenue of $563 million was 21% higher from a year ago, while per-share earnings of 50 cents beat estimates by 23 cents, driven by higher titanium dioxide prices. Titanium dioxide segment profit was a whopping 129% higher, due to higher selling prices and higher sales volumes. Going forward, analysts see sales rising 9% and earnings soaring 23% for 2022, which will likely prove conservative. Kronos also declared a 16-cent dividend (4% yield), in line with the previous one. Meanwhile, Deutsche Bank just raised its price target on the stock from 18 to 20. On May 19, I advised traders to take 50% profit in KRO after its 18% rally from our initial entry point. I also recommend raising the stop-loss on the remaining position to slightly under 15.90 (closing basis). HOLD A HALF

Current Portfolio

| Stock | Price Bought | Date Bought | Price on 5/23/22 | Profit | Rating |

| Kronos Worldwide (KRO) | 15.25 | 4/12/22 | 17.5 | 15% | Hold a Half |

| Natural Resource Partners (NRP) | 34.75 | 1/16/22 | 47.5 | 37% | Hold a Half |

| SFL Corporation (SFL) | 11.5 | 5/17/22 | 11.1 | -3% | Buy a Half |

| Sociedad Química y Minera (SQM) | 83.5 | 5/17/22 | 95.5 | 14% | Hold a Half |

Buy means purchase a position at or around current prices.

Buy a Quarter/Half means allocate less of your portfolio to a position than you normally would (due to risk factors).

Hold means maintain existing position; don’t add to it by buying more, but don’t sell.

Sell means to liquidate the entire (or remaining) position.

Sell a Quarter/Half means take partial profits, either 25% or 50%.

The next Cabot SX Gold & Metals Advisor issue will be published on June 14, 2022.

Analyst Bio

Clif Droke

Clif Droke is Chief Analyst of Cabot SX Gold & Metals. For over 20 years, he has worked as a writer, analyst and editor of several market-oriented advisory services and has written several books on technical trading in the stock market, including “Channel Buster: How to Trade the Most Profitable Chart Pattern” and “The Stock Market Cycles.”