Silver is about to enter its most bullish seasonal period of the year. As we’ll discuss here, July has the potential to bring about a strong performance for the metal—especially given its oversold technical condition.

Elsewhere, titanium remains strong, while lithium is currently the top-performing metal for the month of June. Industrial metals, meanwhile, were shaken by recession risks.

I continue to recommend that we remain defensive until the selling pressure dies down.

Cabot SX Gold & Metals Advisor Issue: June 28, 2022

Metals Softer on Recession Risk

But Gold Could Still Outperform

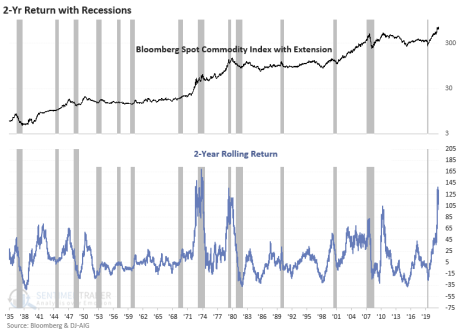

The momentum behind the historic bull market in commodities that began in early 2020 has been exceptionally strong, pushing the Bloomberg Spot Commodity Index to a record high earlier this spring. What’s more, the index posted its best two-year performance in the last two decades.

In fact, prior to the recent pullback, commodities as measured by this index achieved their second-best two-year performance ever on a rolling returns basis. This is a testament to how quickly inflationary pressure manifested in the economy following the pandemic.

With the risk of recession increasing, however, commodity investors should be concerned about the near-term outlook for metals and other commodities. Metals are on track for their worst quarterly performance since the 2008 financial crisis. Historically, the hard asset sector tends to underperform during a recession for obvious reasons (i.e. diminished demand).

The good news for investors is that when commodities sharply reverse a strong upward trend, stocks tend to outperform in the 12 months or so that follow. This was borne out in a recent study conducted by Dean Christians of ModelEdge Report. The reason for this inverse relationship is easy to guess: with higher commodity prices no longer pressuring corporate profit margins, earnings tend to improve when commodities weaken.

One of the biggest losers going into a recession tends to be copper (of which I’ll have more to say later in this report). Suffice it to say for now that the recent reversal in copper’s price (down 25% since the March peak!) is a prime barometer for recession risk.

To wit, weaker copper prices suggest a slowing global manufacturing outlook and diminishing inflation pressures. And according to the research conducted by Christians, copper losses of the magnitude we’ve just seen normally mean continued weakness in the months that follow.

Unfortunately for metal investors, what’s bad for copper is typically bad for the other major industrial metals, at least in the near term. Steel prices tend to follow copper’s lead closely, as has been the case in the last two years (copper’s peaks and bottoms have preceded key turning points for steel since 2020).

Other metals like aluminum, zinc, nickel and tin are showing even greater weakness than copper and steel as demand for building materials dwindles in the face of a weakening real estate market. (For perspective, the iPath Bloomberg Tin ETN is down 50% over the last three months, while the iPath nickel ETN is down 60%).

That said, there have been some instances in recent decades where commodity prices weakened during a recession but still remained in a secular bull market. Examples of this phenomenon include 1973-75 and 2007-08.

In the wake of the 2007-08 credit crisis, metals like gold, silver and even copper rebounded strongly and continued rallying for more than two years after the crisis before peaking. Considering just how much long-term momentum the broad metals sector has going for it, a powerful rebound wouldn’t be surprising once recession risk has been fully priced into the market.

As for gold, the yellow metal also tends to post solid gains in the immediate wake of a recession (as was the case in the two most recent recessions in 2008 and 2020). Even if the U.S. economy manages to dodge recession this time around, I still expect gold to outperform in the year ahead based on the anticipated increase in safety-related demand that normally follows a period of high financial market volatility.

All things considered, while softer prices for industrial metals may persist in the near term, there are good reasons for expecting the long-term metals bull market to remain intact.

What to Do Now

After the recent technical improvement in gold, participants recently purchased a conservative position in the GraniteShares Gold Trust (BAR). BAR is my gold tracker of choice when gold prices are on the rise (due to its attractive per-share price), and I’m expecting increasing recession worries among investors to bolster gold’s demand profile. I suggest using a level slightly under 17.94 (the May 13 bottom) as the initial stop-loss on a closing basis. While the 17.94 level was violated by two cents last week, it didn’t quite qualify as a sell signal, and so I recommend that we stick with this position. BUY A HALF

New Recommendations/Updates

Silver Nears a Key Seasonal Juncture

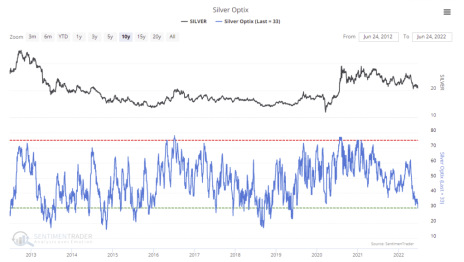

As we’ve talked about in recent newsletters, silver is fast approaching a key seasonal juncture that typically bodes well for the metal’s short-term performance.

Specifically, the month of July has historically been silver’s best-performing month of the year. This especially holds true if silver enters the summer season in a state of weakness after a downward trend (which is emphatically the case right now).

Silver tends to do well in the July-August time frame, with cumulative returns of 3% on balance. Options and hedging data compiled by Jason Goepfert of SentimenTrader also suggest silver is exceptionally “oversold” from a technical perspective (see chart below). This implies a higher probability of a short-covering rally in the weeks ahead for silver.

Additional data show that silver hedging activity has been abnormally high recently, with the so-called “smart money” (i.e. institutional and commercial traders) in the silver market doing less hedging, which tends to benefit silver prices.

Small speculators, by contrast, have collectively reached one of their most hedged (i.e. bearish) levels in months, according to CFTC Commitments of Traders data. When this happens it frequently produces a contrarian buy signal for silver.

From a strategic standpoint, while we don’t yet have a confirmed buy signal in the iShares Silver Trust (SLV), our favorite silver-tracking ETF, a 6-week bottoming process is underway. And if the aforementioned seasonal factor holds true, we should have another trading opportunity in SLV very soon.

What to Do Now

From a short-term strategic perspective, no new silver ETF purchases are recommended. WAIT

Copper Loses Luster (But Oversold)

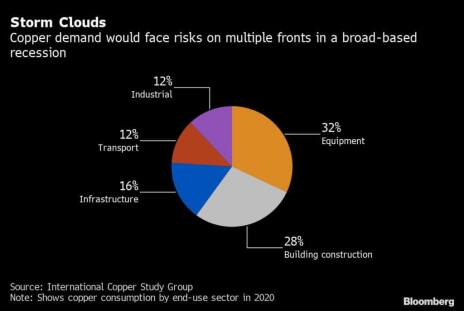

The outlook for copper in the face of rising recession risk is, to put it bluntly, unfavorable.

A recent Bloomberg article noted that in a broad-based recession, demand for copper would likely contract across multiple industries, with the building construction and equipment industries facing the biggest losses.

Based on a historical performance survey of the Thomson Reuters Core Commodity Index (CRB), whenever the broad commodities market as measured by the index reversed from a 2-year high to a 3-month low, additional weakness tends to follow in the 3-to-6 month period ahead.

In the 1-year period that follows a copper reversal, however, the red metal tends to show strong percentage gains (averaging 10% over the last 60 years). So while the intermediate-term outlook for copper appears to be weak, the longer-term outlook is still bullish.

It’s also worth mentioning that copper is becoming quite “oversold” from a technical standpoint on a short-term basis. After plunging 20% in June, copper is due a short-covering rally considering how overextended retail options and futures traders have become with bearish positions lately.

We don’t have a confirmed bottom in the copper ETFs yet, however, so for now I’m maintaining a defensive rating on copper while we wait for the next confirmed buy signal.

What to Do Now

From a short-term strategic perspective, no new copper ETF purchases are recommended. WAIT

Steel Demand Takes a China-Related Hit

Iron-ore prices fell to their lowest level in almost seven months last week over concerns of excess Chinese steel inventories.

“Worries remain about renewed restrictions dampening overall domestic demand, as China continues to detect new coronavirus cases day after day,” according to Mining.com. The following graph reveals the extent of the iron-ore price plunge, which in turn tends to set the stage for average steel prices.

Additional culprits behind the building of China’s steel inventories include continued weakness in the country’s property market and the shutdown-related slowdown in economic activity. Analysts also point to China’s apparent over-optimism in the last year, which led to steel factories ramping up production even as its domestic real estate sector faltered. (Real estate accounts for approximately 40% of China’s steel consumption.)

Steel industry sources added that disruptions to Chinese construction activity caused by heavy rains in key industrial regions have also contributed to the buildup of steel inventory. This in turn has prompted many of the nation’s steel mills to shutter blast furnaces until prices recover.

And with profit margins for many of China’s leading steel manufacturers currently in negative territory, it’s not likely that production will perk up significantly anytime soon.

In the steel segment of our portfolio, we remain in a cash position for now.

What to Do Now

From a short-term strategic perspective, no new steel ETF purchases are recommended. WAIT

Lithium Holds the Line

Prices for lithium carbonate in China have lately risen above the three-month lows that were seen in May. The rebound toward all-time highs is due to the lifting of Covid restrictions in Shanghai, which in turn have boosted industry forecasts for greater lithium demand in the coming months.

Specifically, investors are betting that electric vehicle (EV) sales will surge once again in China based on pent-up demand after the extended lockdowns. More than 13% of all cars in China are electric, and the government’s mandate to domestic automakers that at least 40% of all sales must be electric by 2030 is expected to provide a persistent demand floor for lithium.

Additionally, lithium prices are up almost 70% so far this year, thanks to a major push among the world’s leading nations to reduce carbon emissions and increase electrification.

And despite China’s government asking lithium smelters and miners to suppress lithium prices in its effort to relieve the burden of higher gasoline prices on consumers, all signs point to strong lithium battery demand across several industries. This in turn is likely to keep lithium prices elevated in the foreseeable future.

What to Do Now

The Global X Lithium & Battery Tech ETF (LIT), my favorite lithium tracker, is perking up and showing relative strength for the first time this year. LIT invests in companies throughout the lithium cycle, including mining, refinement and battery production, cutting across traditional sector and geographic definitions. Traders can purchase a conservative position in LIT here using a level slightly under 69.70 as the initial stop-loss on a closing basis. BUY A HALF

Sociedad Química y Minera de Chile (SQM) is a Chilean supplier of fertilizers, iodine, lithium and industrial chemicals. It’s also the world’s fourth-largest lithium producer by market cap and holds a 19% share of the global market for lithium and lithium derivatives. After booking a half profit in our trading position in this stock in May, we were stopped out of the remaining position last week when the 87.15 level (at the 50-day line) was violated on a closing basis. SOLD

Titanium Hits the Big Time

The long-overlooked titanium market is attracting a growing number of Wall Street analysts and other interested observers to begin tracking this key industrial metal.

One sign the metal is becoming “major league” is the recent inclusion of a price graph and commentary section for titanium in some major financial market data platforms, including Trading Economics. (I can’t complain since it makes my job of finding lithium price graphs—previously a difficult task—a lot easier!)

Of course this begs the question, from a contrarian’s perspective, of just how much the increasingly mainstream coverage titanium is getting is pushing the metal toward an “overbought” condition.

For now, at least, the metal appears to be in fine shape and in no danger of becoming overheated in the near term. In fact, the recent 30% pullback in titanium’s price cooled what was an overheated market condition and put the metal back in a more stable condition, technically speaking.

Meanwhile in industry news, the world’s largest commercial airplane maker Airbus made headlines last week when it made a plea for Western countries to avoid putting sanctions on Russian titanium.

“We think sanctioning titanium from Russia would be sanctioning ourselves,” Airbus CEO Guillaume Faury told The Wall Street Journal. He added that Russian titanium sales are “one of the few areas of business where it is in the interest of no party to disrupt the current situation.”

Rival aerospace company Boeing has already halted titanium imports from Russia, which is used to make critical components for aircraft. Around 65% of Airbus’s titanium supply comes from Russia, according to consulting firm AlixPartners.

For now, titanium remains off the sanctions list of the U.S. and the EU.

What to Do Now

Kronos Worldwide (KRO) is a leader in the production of titanium dioxide pigments, the world’s primary pigment for providing whiteness, brightness and opacity (used in two-thirds of all pigments). In Q1, the company reported another solid, consensus-beating quarter. Revenue of $563 million was 21% higher from a year ago, while per-share earnings of 50 cents beat estimates by 23 cents, driven by higher titanium dioxide prices. Titanium dioxide segment profit was a whopping 129% higher, due to higher selling prices and higher sales volumes. Going forward, analysts see sales rising 9% and earnings soaring 23% for 2022, which will likely prove conservative. Kronos also declared a 16-cent dividend (4% yield), in line with the previous one. Meanwhile, Deutsche Bank just raised its price target on the stock from 18 to 20. On May 19, I advised traders to take 50% profit in KRO after its 18% rally from our initial entry point. I also recommend raising the stop-loss on the remaining position to slightly under 17.10 (closing basis) where the 50-day line comes into play. HOLD A HALF

Current Portfolio

| Stock | Price Bought | Date Bought | Price on 6/27/22 | Profit | Rating |

| Global X Lithium & Battery ETF (LIT) | 75.8 | 6/28/22 | 75.8 | 0% | Buy a Half |

| GraniteShares Gold Trust (BAR) | 18.35 | 6/7/22 | 18.1 | -1% | Buy a Half |

| Kronos Worldwide (KRO) | 15.25 | 4/12/22 | 19 | 25% | Hold a Half |

| Sociedad Química y Minera (SQM) | 83.5 | 5/17/22 | 89.3 | 7% | Sold |

Buy means purchase a position at or around current prices.

Buy a Quarter/Half means allocate less of your portfolio to a position than you normally would (due to risk factors).

Hold means maintain existing position; don’t add to it by buying more, but don’t sell.

Sell means to liquidate the entire (or remaining) position.

Sell a Quarter/Half means take partial profits, either 25% or 50%.

The next Cabot SX Gold & Metals Advisor issue will be published on July 12, 2022.

Analyst Bio

Clif Droke

Clif Droke is Chief Analyst of Cabot SX Gold & Metals. For over 20 years, he has worked as a writer, analyst and editor of several market-oriented advisory services and has written several books on technical trading in the stock market, including “Channel Buster: How to Trade the Most Profitable Chart Pattern” and “The Stock Market Cycles.”