Weakening economic indicators in the U.S., along with Covid-related shutdowns in China and economic woes in Europe, have converged to push prices for industrial metals lower. Gold and silver, meanwhile, have been caught up in the equity market downdraft produced by the Fed’s tightening monetary policy.

There are windows of opportunities ahead for both precious metals, however, including a potential recession-related safety bid for gold and an upcoming seasonal factor for silver.

In the trading portfolio, no new positions (save for a U.S. dollar ETF) are recommended for now as the broad metals market is still unsettled.

Cabot SX Gold & Metals Advisor Issue: September 27, 2022

How Gold Behaves in a “Rush to the Exits”

Relative Strength is There, but Recession May Be Needed to Boost Demand

Investors are increasingly worried about the prospect of a global slowdown, as underscored by last week’s equity market slump. Not just stocks, but bonds, commodities and even cryptos came under heavy selling pressure as fears of a U.S. recession, along with economic woes overseas, combined to send participants running to the safety of cash in what might be called a “rush to the exits.”

One of the catalysts behind the recent weakness was last week’s release of the August Leading Economic Index (LEI) by the Conference Board. This index comprises 10 economic components and, tellingly, posted its first annual decline since the pandemic-led recession in 2020.

With recession fears abounding, it’s tempting to believe that gold would be the biggest beneficiary from a flight to safety like we’re seeing now, but that hasn’t actually been the case historically. Indeed, experience teaches that gold typically suffers a similar fate with equities as even the yellow metal is sold off in investors’ desperate bid to raise cash. Where the difference begins, however, is when the initial dash to raise liquidity ends.

There have been several examples of this phenomenon in the last several years, the most recent of which was in 2020. When the pandemic broke early that year, investors were panicked into dumping assets across the board, and gold sold off along with the stock market. The difference between stocks and gold is that while the former didn’t bottom until late March of 2020, gold bottomed a week earlier and proceeded to outperform stocks in the initial stages of the post-crash recovery.

Prior to this, stocks were also sold heavily in September through November of 2008—the worst part of the ’08 credit crisis. Gold also sold off during that time, although gold prices bottomed in November and turned higher into the first quarter of 2009, while the stock market continued to churn lower during that same period.

In fact, this same pattern of gold showing relative strength versus equities has repeated several times over the years, and in almost every case, gold has signaled its intention to commence a new bull market by posting a major low before the stock market does. To date, this hasn’t happened yet.

The catalyst for the recent financial market weakness was the Fed’s latest interest rate hike, which the central bank says is necessary to contain inflation pressures. The market was well aware that the Fed Funds rate would likely be increased by 75 basis points to 3.00-3.25%, but what it didn’t want to hear was the Fed’s guidance that more rate hikes would be coming before the end of the year.

Fed Chairman Jerome Powell said investors can expect another 100 to 125 basis points of tightening this year and indicated the Fed Funds rate would surely reach 4.6%, which is the Fed’s median estimate for next year and, presumably, the new “terminal rate.” However, as the well-known economic commentator Scott Grannis noted in a recent blog, “…money is already tight enough to impact the economy, and more could be destructive.”

Problematically for gold, the U.S. dollar is complicating matters for safety-oriented investors, as they’ve been gobbling up the currency as fast as they can, pushing it to 20-year highs in the process. As The Wall Street Journal recently pointed out, “That has made gold more expensive for overseas buyers, damping their demand.”

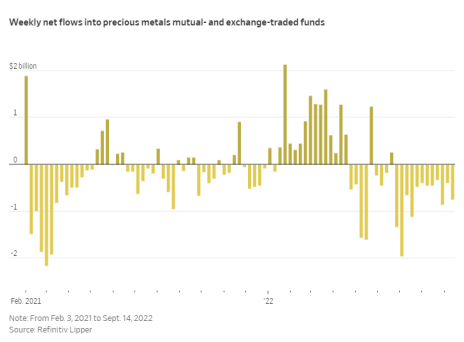

This diminished enthusiasm for gold vis-à-vis the dollar is reflected in the world’s largest gold-backed ETF, the SPDR Gold Shares (GLD). According to the latest data from Refinitiv Lipper, investors in GLD have removed money from the ETF for 12 consecutive weeks, which constitutes the longest unbroken streak of outflows since May 2021.

Sustained gold ETF outflows often serve as a contrarian indicator, however, in that this phenomenon typically coincides with a major intermediate-term market low. Clearly, we’re not there yet, although there are signs that gold’s rate of decline is slowing.

As far as a catalyst for gold price strength, an actual recession would almost certainly provide one. As the U.S. Bureau of Labor Statistics (BLS) acknowledged in a 2013 report, gold’s tendency to outperform vis-à-vis other major assets is typically highest during a recession. BLS wrote:

“…gold prices can act as an indicator of the health of the economy. A rise in the price of gold may be a signal that the economy is struggling. As a result, in times of either a crisis or inflation, many investors turn to gold to protect their principal.”

Also worth mentioning is that if gold is again destined to fulfill its role as the “ultimate” safe haven asset, then we should see the metal begin to show relative strength versus the S&P 500 index—and other major assets—very soon.

You may recall the indicator that I view as the single most important one for determining gold’s intermediate-term performance is its relative performance versus the S&P 500. On that score, take a look at the following ratio chart which shows gold’s relative performance to stocks in the last few weeks.

The potentially good news here is that gold is finally starting to outperform the SPX on a relative basis for the first time since the April-to-June period (which incidentally was the last time gold was able to maintain a reasonable amount of value when compared with the stock market). A rising gold-to-stocks ratio by itself won’t guarantee that a new gold bull market is imminent, but it would suggest that institutional investors and hedge funds (the big market movers for gold) are starting to take a closer look at gold.

What to Do Now

We currently have no trading position in our favorite gold-tracking ETF, the GraniteShares Gold Trust (BAR). No new trading positions are recommended in this or any other gold-related stocks or ETFs until I see some additional improvement, particularly in the gold mining stocks. WAIT

As a temporary holding until the gold price outlook improves, investors may wish to buy a conservative position in the Invesco DB U.S. Dollar Index Bullish Fund (UUP). I suggest using a level slightly under 29 as the stop-loss for this position, which is about where the psychologically significant 50-day line comes into play in the daily chart. BUY A HALF

New Recommendations/Updates

Silver Has Bullish Potential Beginning in Late Q4

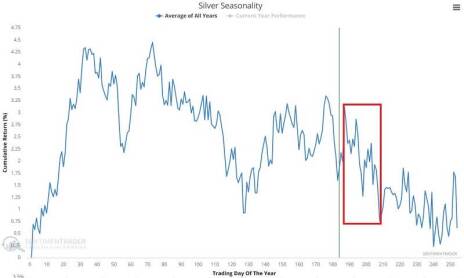

Market analyst Jay Kaeppel, editor of Kaeppel’s Corner, reminds us in his latest missive that silver is currently in the midst of one of its weakest periods of the year, from a seasonal perspective.

Silver’s most unfavorable season, according to Kaeppel, runs the one-month period from September 20 through October 19. A back test revealed that 62% of the time, the silver price declined during this period going back to the year 1974.

As Kaeppel points out, with seasonality there’s no guarantee that silver will repeat its typically bearish performance in the weeks ahead. Given its tendency to weaken during the beginning of the fourth quarter, however, I believe a continued cautious stance toward the white metal is in order—especially given currently volatile broad market conditions.

Where silver’s seasonal outlook typically brightens is later during the fourth quarter, especially in December. In fact, the December-to-February period is when silver typically posts some of its biggest gains for the year (which was the case in the last two years).

In view of the fact that silver is becoming exceptionally “oversold” as measured by several technical and sentiment indicators, we’ll definitely need to be on the lookout for a possible buying opportunity as Q4 progresses. For now, though, a defensive posture toward silver is still warranted.

What to Do Now

We were stopped out of a conservative trading position in our favorite silver-tracking fund, the iShares Silver ETF (SLV), on August 19 when the 18 level was violated on a closing basis. No further action is warranted in the silver ETF until the near-term technical picture improves. WAIT

Copper Hit by Recession Worries

Copper prices took a hit last week as recession worries continue to mount. The red metal fell to its lowest level in almost two months while the strengthening dollar further undermined the outlook for industrial metals.

Despite tight global supplies for copper and improving demand from top consumer China, copper wasn’t insulated from last week’s financial market shock after the Federal Reserve raised its benchmark interest rate and guided for even more rate increases in the coming months. Investors are worried that the Fed’s continued focus on tightening monetary policy to bring inflation under control will dampen enthusiasm for industrial metals.

Additional factors weighing on the near-term copper outlook include China’s 2023 economic growth forecast being downgraded by Goldman Sachs. The investment bank said it expects China’s strict “zero-Covid” policy will extend “well into next year,” potentially dampening demand for electronics manufacturing and construction uses of the metal.

Goldman further predicted that China wouldn’t begin reopening until the second quarter of next year. “We continue to expect a sizable drag from the property sector to GDP growth this year and beyond,” Goldman said, which would presumably diminish domestic copper demand.

Major producer Freeport-McMoRan (FCX) has warned that current prices are too weak to support new investments, noting that there’s a “a serious disconnect” between the physical copper price and the copper market. FCX management added, however, that it views current low copper prices as being “unsustainable” based on relatively unchanged levels of physical demand for the metal.

What’s more, there are indications that copper demand from the power grid and alternative energy sectors will provide support and keep the metal from taking a major tumble. According to a Reuters report, copper traders globally are seeing a rush of new orders for copper products from both sectors.

Meanwhile, analysts continue to warn of major supply shortfalls facing the metal in the years ahead, especially as more nations embrace alternative energy technologies that are heavily copper-dependent. A recent Bloomberg report also pointed to a recent trend toward under-investment in the copper mining industry that could further tighten global supplies, while potentially keeping a floor under prices.

What to Do Now

We were stopped out of our conservative position in the Global X Copper Miners ETF (COPX) last week when the 28 level was violated on a closing basis. SOLD

Producers Turn Bearish on Steel, Aluminum

In the last two weeks, at least three major global steel and aluminum producers sounded bearish outlooks for steel demand, citing economic headwinds.

Among the steelmakers who have lately turned bearish on the outlook for the industrial metal are U.S. Steel (X), Alcoa (AA), and Nucor (NUE), which said factors ranging from higher costs to difficulties sourcing raw materials to supply-chain backups have converged to undermine demand for the metals used most heavily in several key industries, including building construction, electronics and automotive.

The pessimistic tone lately sounded by the big-name metal producers represents an about-face from the more sanguine predictions many of them made back in August, when some of them believed a bottom for steel and aluminum prices was imminent.

“Accelerating market headwinds in the third quarter negatively impacted demand across most end-markets, which is expected to result in lower shipment volumes,” U.S. Steel said last week. “Supply chain issues in automotive and appliance end-markets continue, while containers and packaging has softened, and service center buyers remain on the sidelines,” the firm added.

The company reduced its adjusted EBITDA forecast for Q3 to about $825 million, more than 10% lower than consensus estimates on Wall Street.

Nucor, the largest U.S. steelmaker, also raised concerns on Wall Street recently when it said steel shipments will likely be reduced during Q3. Aluminum maker Alcoa, meanwhile, warned investors that earnings results will likely prove disappointing, pointing to “stubbornly high” raw materials prices, even as metal prices are in decline (aluminum prices just fell to their lowest level since March 2021).

As a result, a Credit Suisse analyst slashed his share price target on Alcoa from 63 to 50, “to reflect lower commodity prices and more significant operational and energy cost pressures.”

In the wake of the bearish sentiment surrounding both metals, the stocks of steel and aluminum producers across the board have been down in the last several days. Until the market’s technical backdrop improves, accordingly, a defensive stance in this segment of the metals group is recommended.

What to Do Now

We were stopped out of the remaining half of our long position in Alliance Resource Partners (ARLP) after the 23 level was violated on a closing basis. SOLD

Nickel Pressured, but Stays Above Lows

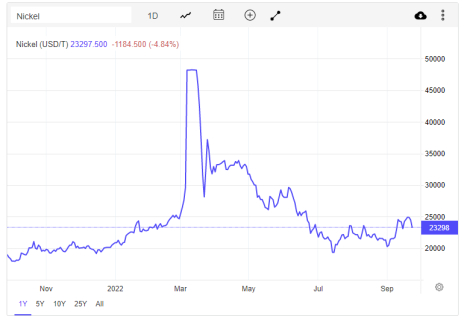

Nickel futures were last seen around the $24,000 per-ton level, under pressure from the recent broad market weakness, but still more than 25% above the major price low from July.

Increasing production levels and worries of a global recession are weighing on the market, however. Along those lines, it’s widely feared that global primary nickel production could increase 19% this year, to just over three million metric tons (mt).

By the same token, the top brass at Russia’s Nornickel predict that last year’s nickel deficit will likely return to a “mild” surplus of around 40,000 mt this year. Moreover, fears that the U.S. Federal Reserve’s policy tightness could lead to a recession are another reason why many analysts believe industrial demand for nickel will decline in the coming months.

One of the reasons why nickel has been able to resist the major selling pressure that other industrial metals are seeing right now is because of the recent announcement from a major nickel industry player. Vale SA (VALE) just announced plans to unlock value at its nickel and copper division, which prompted a major Wall Street bank to estimate the company’s plans could unlock as much as $13 billion in value.

Vale sees future nickel use being driven mainly by increasing electric vehicle (EV) batteries demand.

What to Do Now

Nickel prices recently jumped 12% after Vale SA (VALE) announced plans to unlock value at its nickel and copper division. The industry is getting an additional sentiment boost from the commencement of peak construction season in China. Since bottoming on July 15, nickel futures have risen over 20% as Vale increased its nickel output guidance, prompting a major Wall Street bank to estimate the company’s plans could unlock as much as $13 billion. Vale sees a 44% increase in global nickel demand by 2030, driven mainly by batteries that power electric vehicles. Accordingly, I’m putting my favorite nickel-tracking vehicle, the iPath Series B Bloomberg Nickel Subindex Total Return ETN (JJN), back on a buy. Participants can purchase a conservative position in JJN using a level slightly under 30 as the initial stop-loss on a closing basis. BUY A HALF

Current Portfolio

Stock | Price Bought | Date Bought | Price on Sep. 26 | Profit | Rating |

Alliance Resource Partners (ARLP) | 18.75 | 7/5/22 | 21.5 | 15% | Sold |

Global X Copper Miners ETF (COPX) | 30.5 | 8/2/22 | 27.5 | -10% | Sold |

Invesco U.S. Dollar Bullish ETF (UUP) | 30.3 | 9/26/22 | 30.3 | 0% | Buy a Half |

iPath Bloomberg Nickel ETN (JJN) | 32.5 | 9/20/22 | 31 | -5% | Buy a Half |

Buy means purchase a position at or around current prices.

Buy a Quarter/Half means allocate less of your portfolio to a position than you normally would (due to risk factors).

Hold means maintain existing position; don’t add to it by buying more, but don’t sell.

Sell means to liquidate the entire (or remaining) position.

Sell a Quarter/Half means take partial profits, either 25% or 50%.

The next Cabot SX Gold & Metals Advisor issue will be published on October 11, 2022.

Analyst Bio

Clif Droke

Clif Droke is Chief Analyst of Cabot SX Gold & Metals. For over 20 years, he has worked as a writer, analyst and editor of several market-oriented advisory services and has written several books on technical trading in the stock market, including “Channel Buster: How to Trade the Most Profitable Chart Pattern” and “The Stock Market Cycles.”