It’s a good news/bad news situation for most metals, as shutdowns across Europe, Asia and South America due to power shortages and other factors are contributing to lower supplies for several industrial metals. However, signs that inflation may be in the process of reversing bodes ill for the intermediate-term outlook.

Uranium, meanwhile, is now in the driver’s seat as the global energy crisis supports the renewal of nuclear power initiatives.

In the trading portfolio, no new positions are recommended for now as the broad metals market is still unsettled.

Cabot SX Gold & Metals Advisor Issue: September 13, 2022

Good News/Bad News for the Metals

Good: Factory Shutdowns; Bad: Producer Prices Plunge

Investors in precious and base metals have been seeking some good news for what seems like forever. But as I’ll explain here, they now have something to look forward to in the near term. Beyond the intermediate-term outlook (six to 12 months), however, the news is less encouraging.

For precious metals like gold and silver, the outlook has been subdued—if not outright depressing—since April, when it became clear the metal was no longer in high demand among safe-haven investors. For industrial metals like copper and tin, April also proved to be a bearish turning point as prices went into decline in the months that followed.

A softer global economic outlook, coupled with the hard lockdowns in the world’s second-largest economy China in the spring, were among the factors that took the wind out of the metal market’s sails. But the market has since assimilated the slowing economy due to inflation, and most major metals have established what looks like solid price bottoms.

More importantly, many industrial metal prices now have a good fundamental reason to begin rising again. The catalyst? Supply restrictions.

Supply-related metals strength comes as no surprise to most investors, given how the industry’s last major bull market in 2021 to early 2022 was partly driven by supply-chain backups. This time around, however, the problem quickly building across the industry involves shutdowns of smelting operations for metals including copper, iron, nickel, aluminum, steel and zinc.

The smelting and fabrication operations of several major producers have been halted in recent months in what has become an industry-wide trend. Among the most recent shutdowns include Slovenian aluminum smelter Talum (cutting 20% of its smelter capacity), which joined other European firms “forced to reduce output by sky-high energy costs,” in the words of Reuters.

Swedish miner Boliden (BDNNY) declared force majeure on zinc deliveries to Europe in late August due to a strike among Norwegian electrochemical industry workers.

Elsewhere, Swedish aluminum giant Norsk Hydro (NHYDY) plans to shutter an energy-intensive aluminum smelter in Slovakia later this month. The planned closure is being attributed to soaring power costs in Europe. The region has already lost about half of its zinc and aluminum smelting capacity during the past year, mainly as producers dialed back output, according to Bloomberg.

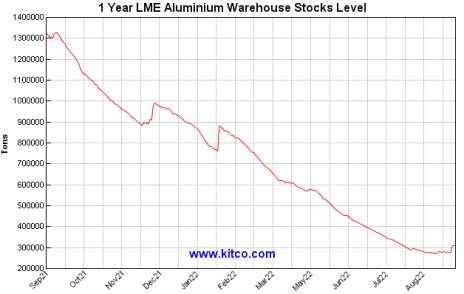

Moreover, Norsk Hydro just announced it would exclude Russian aluminum from deals to several industries it serves (including auto and construction) for 2023. Russia is the world’s third-largest provider of the metal, and the growing number of firms excluding Russian aluminum will almost certainly exacerbate an already tight supply situation (see chart below).

On the copper, cobalt and zinc front, Swiss multinational miner Glencore (GLNCY) cut 2022 production guidance for all three metals recently. Copper guidance was reduced 3%, cobalt was reduced 6% and zinc production was cut by 9%.

Additionally, a September 9 S&P Global report highlighted the threat to Europe’s steel industry from spiking electricity prices. “High energy prices are putting the viability of steelmaking in Europe at risk, and have forced numerous mills to halt installations,” according to the report. S&P Global also quoted the European Steel Association Eurofer as saying, “The EU needs to take immediate emergency measures to overcome the region’s current life-threatening energy crisis.”

S&P further noted that producers including ArcelorMittal, Salzgitter, Arvedi, Acciaierie d’Italia, Acerinox, HBIS Serbia, US Steel Kosice and Metinvest have halted steelmaking or rolling capacities in Europe over recent weeks or have announced upcoming stoppages, mainly due to rising power prices.

Given the major challenges facing the production of these important industrial metals, supply restrictions should eventually come to the rescue by lifting prices in the coming months.

For gold and silver, the potentially good news in the near term is mainly due to the recent weakness of the U.S. dollar index (USD). It’s no secret that the dollar’s relentless strength in the last several months has put tremendous pressure on both metals. Lately, though, the currency has shown signs of topping, although the dollar index remains above its nearest trend line of significance (the 50-day moving average). A close below this key line, however, would tilt the advantage toward the gold bulls by allowing the metal to rally on the back of its strengthening currency component.

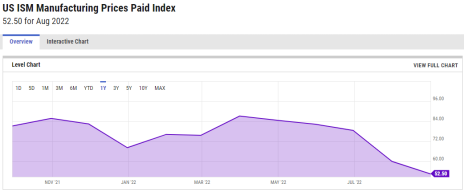

And now for the bad news. A major measure of inflation is collapsing at a historic rate, which doesn’t bode well for the intermediate-term outlook for commodities in general (including metals).

Specifically, the Institute for Supply Management released the latest manufacturing report last week which showed that the prices paid index has plummeted to levels not seen since the 2020 pandemic. Moreover, the index has fallen 34% in the last five months—the fifth-biggest drop in its 73-year history.

According to market statistician Dean Christians, commodities tend to suffer in the intermediate term after a significant contraction in the ISM prices paid index, with only the years 1995 and 2006 being exceptions to the rule.

Putting it all together, a short-term rally in the metals is a strong possibility as supply restrictions across Europe—and possibly a weaker dollar—come to the market’s rescue. But with a growing number of inflation measures showing weakness, including the ISM prices paid survey and the M2 money supply growth rate, lower commodity prices could be ahead within the next six to 12 months. As always, we’ll stay prepared to take advantage of any opportunities we see while maintaining a focus on preserving capital should bearish market conditions prevail.

What to Do Now

We currently have no trading position in our favorite gold-tracking ETF, the GraniteShares Gold Trust (BAR). No new trading positions are recommended in this or any other gold-related stocks or ETFs until I see some additional improvement, particularly in the gold mining stocks. WAIT

New Recommendations/Updates

Sentiment Factors Favor Silver (but Seasonals Don’t)

From the perspective of retail trader sentiment, things haven’t looked this good for silver in a long time.

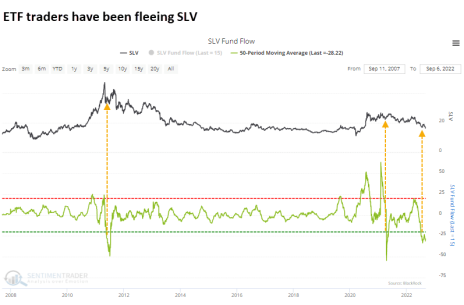

Small-time investors and traders are fleeing the white metal in droves, which is what normally happens around the time of a major price low. Historically, whenever such indications that traders are heavily betting against silver are seen, the metal has shown a tendency to rally—even if only modestly.

The problem, though, is that silver needs a catalyst to kickstart a meaningful rally, and no catalyst has been forthcoming this summer. Additionally, silver’s best timeframe to rally from a seasonal standpoint was in July-August, and as we all know, the rally didn’t materialize.

This doesn’t mean that silver can’t kickstart a new upside move this fall, however. With that in mind, let’s examine some of the signs that support a more favorable market environment for the so-called “poor man’s gold.”

Jason Goepfert of SentimenTrader points out that silver hasn’t hit a new 252-day high for over two years—its longest such streak in half a century! According to Goepfert, whenever this has happened historically, “silver had a modest tendency to keep falling over the next 1-2 months before rebounding.”

However, he further noted that the sentiment data supports a serious bottoming effort and eventual turnaround for silver. For instance, large traders tracked by CBOE data hold more than 8,200 contracts net short, or more than 5% of open interest. Goepfert noted that whenever the speculators held 5% or more of silver contracts short, the metal rallied more than 70% across multiple time frames (1-month, 3-month, 6-month, etc.).

Moreover, retail trader sentiment on silver has been as low as measured by some optimism/pessimism polls as it has been in 20 years. Typically, this is also a sign of a completely sold-out market that is vulnerable to short-covering rallies.

A final consideration is that in the last two months, the extremely popular iShares Silver Trust ETF (SLV) has seen outflows of nearly $30 million a day—the third-worst outflow in SLV’s history. The two prior instances of this mass exodus led to silver rallies, albeit of a limited duration (as shown in the following chart).

While a short-term technical rally is certainly possible—even likely—for silver in the coming weeks, a more durable rally will likely require the removal of the main obstacle standing in silver’s way. I’m referring of course to the strong dollar, which has been a major headwind for much of the year.

A weaker dollar would do more than any single factor to force a “run on the shorts” and push prices significantly higher. But until that time arrives, a defensive posture is still recommended.

What to Do Now

We were stopped out of a conservative trading position in our favorite silver-tracking fund, the iShares Silver ETF (SLV), on August 19 when the 18 level was violated on a closing basis. No further action is warranted in the silver ETF until the near-term technical picture improves. SOLD

Good News/Bad News for Copper

As alluded to in this week’s feature article, there is both good news and bad news for copper.

On the plus side of the ledger, the copper/gold ratio has flashed yet another positive signal that has tended to precede periods of outperformance for the red metal. As previously discussed, the ratio recently closed under 0.19 for the first time in a year, and while the ratio is now above this key level, a survey of past instances of this signal shows a nearly perfect win rate for copper across all time frames, short and intermediate, up to a year.

In other words, based strictly on market statistics, copper should begin to appreciate in price. And indeed, the metal’s price has been gradually edging higher since the copper/gold ratio fell under 0.19 two months ago.

Further supporting the short-to-intermediate-term outlook is the potentially bullish copper supply situation discussed above. With smelting and refining operations across Europe being shuttered, copper’s fundamental backdrop is as strong as it has been in a while, which bodes well for future price appreciation.

Also worth mentioning is that workers at Chile’s Escondida mine, the world’s largest copper mine, agreed to temporarily suspend a work stoppage planned for next week to meet with local regulators, according to Reuters. However, the possibility of a strike in the near future at Escondida looms large, which would further restrict copper’s availability and put upward pressure on prices.

The bad news for copper is the metal’s seasonal tendency, which is about to enter its weakest timeframe of the year. To be exact, the fourth quarter of the year is when copper prices have tended to weaken.

Of the factors mentioned here, I consider the copper/gold ratio to be the most important—trumping seasonal factors. That said, until the dollar stops appreciating, any further gains in copper are likely to be limited by currency headwinds. For that reason, I recommend using a fairly tight stop-loss on open copper ETF (and copper stock) positions.

What to Do Now

Our recent examination of the copper/gold ratio revealed that copper tends to rally when the ratio falls under 0.19, which it did recently. A 14-year statistical survey further shows that in every case without exception, copper posted a meaningful price gain (i.e. between 30% and 50%) in the six to 12 months following the signal. With that in mind, participants who don’t mind the short-term volatility risk recently purchased a conservative position in the Global X Copper Miners ETF (COPX) using a level slightly under 28 as the initial stop-loss on a closing basis. BUY A HALF

Steel Has Likely Bottomed

A couple of weeks ago, I noted that the CEO of Canada’s Stelco Holdings (STZHF) who correctly called the “falling knife”-style carnage for the market at the beginning of this year more recently predicted the bottom for steel was likely in. It’s looking more and more like his prediction will once again prove prescient.

The order books for major North American steel producers have been filling up lately despite the downturn in the domestic construction industry. Additionally, steel’s longer-term outlook looks sanguine based on industry-wide predictions that South America’s steel consumption will double within the next 10 years based on “gigantic opportunities” in real estate construction, renewable energy, ports and oil and gas projects.

Further contributing to the increasingly positive steel market backdrop is recent electricity rationing in China (leading to steel mill shutdowns), plus the growing power crisis across Europe (as mentioned earlier in this report).

Other major steel-producing countries are experiencing similar supply-related setbacks. POSCO, the largest steel company in South Korea, unexpectedly shut down a major steel mill last week after a fire-related accident happened to several mills affiliated with the company. According to SMM data, POSCO has an annual stainless-steel capacity of 2.1 million metric tons, accounting for about 70% of the country’s stainless-steel market and about 9% of the global market.

On a related note, China’s leading metals news provider, SMM News, observed that “recently, steel mills around the world have initiated production reduction or shutdown due to various reasons,” and suggested that this could have a significant impact on supply chains for the metal.

What to Do Now

Alliance Resource Partners (ARLP) is a producer of metallurgical coal (for the steelmaking industry) and thermal coal (for electrical utilities), with approximately two billion tons of coal reserves in several U.S. midwestern and southern states. Alliance is currently the second-largest coal producer in the eastern U.S. with additional mineral and royalty interests in the highly productive Permian, Anadarko and Williston Basins. (The company markets its mineral interests for lease to operators in those regions and generates royalty income from the leasing and development of those mineral interests.) Management indicated that coal operations have delivered “significant” year-over-year per ton margin expansion, adding that it sees ARLP well positioned to see further margin growth in 2023 and 2024. While metallurgical coal demand is weakening due to softer global economic conditions, thermal coal demand is expected to remain supported going forward by lower exports from major suppliers like Australia (more than 50% of met coal supply) and Russia as more countries turn to coal to meet an energy crisis brought on by natural gas shortages. On a technical note, I suggest raising the stop-loss on the remaining position (after our recent profit-taking move) to slightly under 22.40 on a closing basis, where the 50-day line currently resides. HOLD A HALF

Reliance Steel & Aluminum (RS) is the largest metals service center operator in North America, providing metals processing, inventory management and delivery services for several industries, including construction, energy, electronics, automotive and aerospace. Reliance expects its average selling price per ton sold for the third quarter of 2022 to be down 5%, due to recent weakness in aluminum and steel prices. Despite this, however, the company sees improving demand and pricing for higher-value products sold into the aerospace, energy and semiconductor end markets. Wall Street expects Q3 sales to increase 8% with full-year sales expected to jump 20%, both of which could prove too conservative if the dollar weakens and the industrial metals market reignites. In view of the strong relative performance of this dual steel/aluminum company in recent weeks, traders recently purchased a conservative long position in RS using a level slightly under 175 as the initial stop-loss. I suggest raising the stop to slightly under 184.70 (closing basis) where the 50-day line currently resides. HOLD

Uranium Has New Demand Drivers

The global energy crisis has catapulted uranium back into the headlines, with factors including energy security concerns and government-sponsored green energy initiatives.

Additional demand drivers include a major nuclear policy reversal from Japan’s government, plus India’s plan to build a massive nuclear reactor as both countries move away from coal and natural gas imports.

One of uranium’s most important bullish catalysts was Japan’s recent order to develop new nuclear reactors. The nation’s government recently approved 17 existing reactors to be reactivated, which serves as a key turning point in the wake of the 2010 Fukushima power plant meltdown.

Major nuclear producer France has also indicated that its nuclear power generating industry will be operating at full capacity by the winter. This follows corrosion issues and drying rivers necessary for cooling reactors, which led to output cuts at several French power plants earlier this summer.

Among the leading uranium miners, Cameco (CCJ) made a stir last month after announcing the restart of operations at its McArthur River mine (the world’s largest high-grade uranium deposit), which closed in 2018. Cameco’s management said it plans to operate the mine at a “lower-than-full-capacity rate,” adding that the company is “still in supply discipline mode,” which should provide the market with more of the coveted energy source while allowing prices to remain firm.

Dennison Mines (DNN), meanwhile, created a headline of its own last week when it reported encouraging assays from drilling completed at its McClean Lake property. The results showed a “significant expansion of the high-grade uranium mineralization” discovered last year, which the market greeted with optimism.

All told, uranium appears to have plenty of new demand drivers heading into what should be a constructive fall/winter season for the energy metal.

What to Do Now

Multiple factors—including energy security concerns, government-sponsored green energy initiatives and rising uranium prices (prompting miners to seek more capital)—have combined to make the actively traded uranium stocks more attractive than they’ve been in some time. Given the relatively attractive risk/reward scenario for the miners, I recently recommended that we get some exposure to our favorite uranium-tracking ETF. Consequently, participants purchased a conservative position in the Global X Uranium ETF (URA) using a level slightly under 19.50 as the initial stop-loss on a closing basis. After the recent 13% rally, I now suggest taking 50% profit and raising the protective stop to slightly under 22 on a closing basis on the remaining position. SELL A HALF

Current Portfolio

Stock | Price Bought | Date Bought | Price on Sep. 12 | Profit | Rating |

Alliance Resource Partners (ARLP) | 18.75 | 7/5/22 | 25.5 | 36% | Hold a Half |

Global X Copper Miners ETF (COPX) | 30.5 | 8/2/22 | 31.5 | 3% | Buy a Half |

Global X Uranium ETF (URA) | 21.2 | 8/24/22 | 24 | 13% | Sell a Half |

Reliance Aluminum & Steel (RS) | 190 | 8/2/22 | 197.2 | 4% | Hold |

Buy means purchase a position at or around current prices.

Buy a Quarter/Half means allocate less of your portfolio to a position than you normally would (due to risk factors).

Hold means maintain existing position; don’t add to it by buying more, but don’t sell.

Sell means to liquidate the entire (or remaining) position.

Sell a Quarter/Half means take partial profits, either 25% or 50%.

The next Cabot SX Gold & Metals Advisor issue will be published on September 27, 2022.

Analyst Bio

Clif Droke

Clif Droke is Chief Analyst of Cabot SX Gold & Metals. For over 20 years, he has worked as a writer, analyst and editor of several market-oriented advisory services and has written several books on technical trading in the stock market, including “Channel Buster: How to Trade the Most Profitable Chart Pattern” and “The Stock Market Cycles.”