Why Gold Will Benefit from De-Dollarization

Growing repudiation of greenback’s hegemony bodes well for gold

Somewhat surprisingly, the significant inflation the U.S. economy has experienced this year hasn’t exactly been a boon for gold investors. Year to date, bullion prices are down 5% despite an 8% domestic inflation rate. But as we’ll discuss here, there are legitimate reasons for gold’s underperformance despite inflation. Even more encouraging, an argument can be made that these factors are on the cusp of reversing in gold’s favor—mainly due to “de-dollarization.”

It’s no secret that inflation is historically gold’s biggest ally and demand catalyst. Indeed, the metal’s currency component always benefits from major increases in money supply, in turn boosting the metal’s price. The two biggest contributors to money supply explosions in recent decades have been recession (prompting central banks to respond by lowering rates and increasing money availability) and war (resulting in runaway deficit spending and credit creation).

Two instances of this occurring can be seen in the immediate wake of the 2008-2009 recession, when the Fed’s quantitative easing strategy served as a catalyst for a two-and-a-half-year bull market in which gold gained 130%.

Then there was the aftermath of the 2020 Covid crisis, which saw war-time levels of federal spending in the form of stimulus. Gold benefited from this form of inflation by rising 40% in a five-month period in 2020. While this pales in comparison to the 2009-2011 bull market, the fact that the post-Covid crash rally was compressed in such a short time makes it equally impressive from a comparative magnitude perspective.

The 2020 stimulus spending was a huge contributor to the inflation we’re seeing today in the U.S., not to mention the supply-chain disruptions. But while gold initially benefited from the runaway spending, when it became apparent that U.S. inflation would be mitigated by the Fed’s shift to a tighter money policy gold began to lose its appeal to investors as higher-yielding bonds suddenly became more attractive while the dollar began to strengthen.

Dollar strength was in fact the biggest contributor to gold’s weakness this past year, as the U.S. dollar index has embarked on its best showing in more than 20 years. (As an aside, gold speculators tend to be exceptionally leveraged and use the dollar index as a cue for either buying or selling gold futures contracts.) But the dollar’s strength has come at the expense of other nations’ currencies, in turn drastically increasing inflation rates abroad while mitigating the impact of higher consumer prices here at home. (It’s worth noting that in spite of the U.S. economy’s diminishing share of global output in the last two decades, the dollar still plays “an outsized role” in global markets, according to the IMF.)

However, signs have lately emerged that more than one major country is taking steps to reverse what many see as America “exporting” its inflation problem for others to contend with. Russia is one such country taking steps to reduce its reliance on the greenback, as Kremlin authorities recently initiated a policy of banning the use of dollars as collateral for transactions with Russia’s largest financial services marketplace, the Moscow Exchange. Financial commentators see the move as being a significant one in a growing global trend toward “de-dollarization.”

Central banks aren’t holding dollars as reserves in the same quantities as in prior years, as Cary Springfield of the International Banker pointed out in a recent commentary. She quoted an IMF paper which observed that the dollar’s share of global foreign-exchange reserves fell below 59% in last year’s Q4, extending a two-decade decline. A quarter of the shift out of the dollar has gone into the Chinese renminbi, with the rest going into the currencies of smaller countries, according to IMF data.

Springfield went on to note that “China’s rapidly growing global economic might may pose the biggest threat to the dollar’s status as the world’s reserve currency,” with its recent forays into Saudi Arabian oil possibly serving to tip the scales in favor of widespread adoption of the renminbi.

A big part of the dollar’s global dominance is owing to its use as the official currency used to price commodities, particularly crude oil. The de facto dollar standard has for years conveniently allowed the U.S. to push inflated dollars away from its own shores and into foreign countries, helping to keep domestic inflation contained. (It also explains why the U.S. didn’t experience inflation in the post-2008 years despite runaway debt spending.)

Meanwhile, relations between the U.S. and the oil-producing nations of the Middle East are rapidly deteriorating, which is calling the stability of the “petrodollar” (the requirement for global oil sales to be denominated in dollars) into question. The recent decision of OPEC+ to cut oil production by two million barrels a day beginning in November drew a sharp rebuke from Washington, while boosting oil prices (and by extension gold prices, albeit to a lesser extent).

Elsewhere in the world, China has drastically reduced its holdings of U.S. Treasury debt (which recently fell under $1 trillion for the first time since 2010), while also embarking on an effort to unload dollars in order to stabilize its own currency. Even Egypt’s government has been issuing debt denominated in China’s currency as an alternative to the higher borrowing costs associated with the U.S. dollar.

And while the dollar reserves of many countries are shrinking, gold reserves are increasing as a nascent shift seems to be underway from using the dollar as a preferred safe haven to that of gold. A World Gold Council (WGC) report found that 80% of the 57 central banks it surveyed plan to increase their holdings of the metal in the coming year. Moreover, some 42% of those surveyed anticipated the greenback would diminish as a portion of total reserves in the next five years due to loss of confidence in the dollar as a reserve currency.

Longer term, as the de-dollarization trend accelerates, gold should begin to come into its own as the U.S. finds its ability to export inflation more limited. In the immediate term, however, the gold price is still being hampered by residual strength in the dollar index and by rising interest rates.

Moreover, as Jay Kaeppel of SentimenTrader has pointed out, gold is about to enter a period of seasonal weakness. (The period begins on October 20 and ends around November 3, as shown in the following chart.)

But as Kaeppel also points out, there’s good news for gold: The metal’s price has declined in each of the past six months, which has only happened a few times since 1975. And whenever this has occurred, higher gold prices typically followed, with a 15% average return in the following six months and an 18% average return in the following 9-month and 12-month periods.

Moreover, as we’ve discussed in recent months, the copper/gold ratio dropped below 0.19 back in July—the first time this has occurred since the Covid-driven crash of early 2020. Kaeppel pointed out that this signal has an undefeated winning streak of predicting higher gold prices in the coming year, with gold prices higher 100% of the time a year following the signal (based on a data set going back to 1990).

So while the month of October has a seasonal tendency to be a weak month for gold, there are several factors that suggest gold’s prospects will improve in the coming months.

What to Do Now

As a temporary holding until the gold price outlook improves, investors may wish to buy a conservative position in the Invesco DB U.S. Dollar Index Bullish Fund (UUP). I previously suggested using a level slightly under 29 as the stop-loss for this position; I now recommend raising the stop to slightly under 29.50. BUY A HALF

Kinross Gold (KGC) is a senior mining firm that acquires, explores and develops gold properties in the U.S., Canada, Brazil, Chile, and Mauritania. Kinross was one of the few actively traded gold miners that posted higher revenue from a year ago in Q2, with total sales of $822 million increasing 16% from the comparable 2021 quarter. The company also reported cash and equivalents of $719 million, and total liquidity of approximately $2 billion, as of the quarter’s end, plenty of capital to take on new projects and fund existing operations. Management also provided upbeat guidance, with plans to “significantly” increase production in the second half of the year, primarily driven by stronger production at its Paracatu, Tasiast and La Coipa gold projects. Kinross expects all-in sustaining costs per gold equivalent ounce sold to be approximately $1,240—about $430 per ounce above the current gold price. On the development front, the company is proceeding with development of its 70%-owned Manh Choh project in Alaska, which is expected to increase the firm’s production profile by approximately 640,000 attributable ounces over the life of mine at lower costs. Kinross’s world-class Great Bear project in Ontario, meanwhile, continues to make excellent progress, with drilling results from the first half of the year continuing to confirm Kinross’ vision of developing a large, long-life mining complex. Most recently, Kinross announced approval from the Toronto Stock Exchange to increase its normal course issuer bid as part of the firm’s $300 million stock buyback program. The amendment increases the maximum number of common shares that may be repurchased (up to 65 million shares), representing 10% of the company’s public float. Purchases under the bid began August 3 and will end no later than next August 3. The stock is showing observable relative strength versus most actively traded gold shares, suggesting accumulation by informed interests is taking place. Participants can accordingly purchase a conservative position in KGC using a level slightly under 3.30 as the initial stop-loss on a closing basis. BUY A HALF

New Recommendations/Updates

Commercial Hedging Data Constructive for Silver

The recent pullback in longer-dated Treasury bond yields didn’t go unnoticed by silver investors, who collectively piled into the metal and sparked a 9% rally to a six-week high in early October in what many analysts characterized as a flight to safety.

Silver investors ignored the Fed’s reiteration of its plans to keep pursuing a tight money policy to fight inflation, which would be potentially bearish for silver. Instead, they focused on the recent weak U.S. manufacturing data, which provided them with some hope that the Fed may be forced to “pivot” at some point in the near future, which in turn would be bullish for the white metal.

A Fed pivot would occur if the economy weakens to a point where the central bank no longer views higher interest rates as feasible. Instead, either a diminution in the extent of the rate increases would ensue, or result in a complete end to the hikes. Either would presumably benefit silver by reducing the opportunity cost of holding non-yielding bullion vis-à-vis Treasury bonds.

Near term, a more sustained decline in U.S. Treasury bond yields would go a long way toward making the bullish case for silver. We’re obviously not there yet, but there are signs—both technically and in terms of investor sentiment—that the silver market has become so unloved and oversold in recent months that any further downside is likely to be very limited.

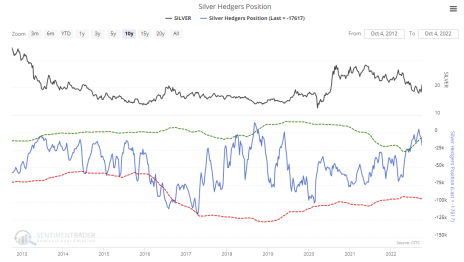

To that end, CFTC data indicate that commercial hedgers (the so-called “smart money”) are net long silver right now, and in fact are the most bullish on the metal they’ve been since 2019. History shows that when this group is actively reducing their silver hedges like they have been lately, prices typically rise in the months that follow.

The constructive trend in commercial silver hedging begs the question: Are silver hedgers anticipating a more dovish Fed pivot…or is there a supply-related reason for their positioning?

Moreover, the number of ounces held by the popular iShares Silver Trust (SLV) exchange-traded fund has declined 18% in the last five months, to 473 million, and is down 30% since February 2021. While this reflects neither an excessive amount of optimism or pessimism, the outflow of silver in SLV is getting closer to what has historically constituted a contrarian buy signal for the silver-backed ETF.

What to Do Now

I’m on the lookout for a new entry in our favorite silver-tracking ETF, the iShares Silver ETF (SLV). The technical picture for silver and SLV have improved in recent weeks, especially after last week’s breakout above the 50-day moving average. The chart is looking more constructive by the week, but I want to see if SLV can hold above the upside gap created in the daily chart by the recent rally. Assuming it doesn’t fall under 17.75 in the next few days, I’ll likely move SLV back to a buy. WATCH

As previously discussed, white metals—particularly palladium—are holding their own relative to other metals. And while I’m not yet ready to pull the trigger on our favorite platinum/palladium ETF, I’m keeping a close watch on one of the biggest stocks in this segment, Platinum Group Metals (PLG). The South African-based company is focused on platinum and palladium production and operates the Waterberg large-scale platinum group metal (PGM) resource, which has an attractive risk profile given its shallow nature. The project also has the potential to be one of the lowest-cost operations in the PGM sector. An even bigger attraction for the company right now, however, is its partnership with Anglo American Platinum (ANGPY). The two companies have created Lion Battery Technologies to support the use of palladium and platinum in lithium battery applications. Lion has entered into an agreement with Florida International University to further advance a research program that uses platinum and palladium to unlock the potential of Lithium Oxygen and Lithium Sulfur battery chemistry, which can perform better, by orders of magnitude, than the best-in-class Lithium-ion batteries currently on the market. This new generation of lightweight, powerful batteries has the potential to grow to scale on the back of the attractiveness of electric vehicles (EVs) and the use of lithium batteries in other applications beyond mobility. Given that alternative energy is one of the market’s strongest performing sectors right now, this could position PLG to significantly outperform in the coming quarters. Accordingly, I’m recommending that we purchase a conservative position in PLG if the stock closes above 1.80 (the stock most recently closed at 1.63). BUY A HALF ABOVE 1.80.

Copper Industry Urges Chilean Production Increase

Copper prices are down nearly 30% in the last six months as persistent fears of a global growth slowdown, weaker demand and a stronger dollar continue to weigh on the red metal.

Prices for copper and other industrial metals, including aluminum, are expected to remain under pressure in the near term, in part due to an anticipated production increase in China.

However, not all the news is bad for copper. Top producer Codelco has cut its 2022 production outlook based on lower recovery levels at some of its mines, as well as lower ore grades at the Chuquicamata mining site in Chile. The Chilean state-owned miner said it now expects output to reach around 1.5 million tons, down 7% from a year ago.

Chile’s domestic mining industry, meanwhile, faces serious legal challenges due to proposed changes to mining royalties and the country’s reformed mining code. With copper production in Chile tied up due to royalty- and security-related issues, copper experts around the world will convene at the Copper 2022 conference in Santiago next month to discuss these issues and recommend ways that Chile can increase production to supply a growing global demand for the metal.

In a recent interview with BNAmericas, Sergio Demetrio, president of the Chilean institute of mining engineers, explained that the surging electric vehicle (EV) industry uses three to five times more copper than gas-powered vehicles, while electricity generation requires millions of copper wires.

It’s further expected that EVs and power generation will account for a substantial portion of copper demand in the coming years, which in turn should put a floor on the metal’s price around this year’s low of $3.25 per pound.

What to Do Now

We were stopped out of our conservative position in the Global X Copper Miners ETF (COPX) last week when the 28 level was violated on a closing basis. SOLD

Auto Industry Demand Halts Steel Slump

Steel prices are recovering from a China-induced slump, as Covid-related lockdowns and the Evergrande real estate crisis crimped demand for the industrial metal.

There are, however, signs that the steel bear market has likely bottomed, and the metal may soon experience a rebound on the back of higher demand from the auto industry. Indeed, the latest quarterly production data from General Motors (GM) and Ford (F) last week supports this thesis.

GM said its Q3 vehicle sales jumped 24% from a year ago, to over half a million. This represents a major rebound from the abysmal sales figures from Q2, and was above consensus expectations of a 22% increase. Ford, meanwhile, saw a 16% sales increase in Q3.

Analysts and investors alike are interpreting the auto sales data as pointing to a production increase for the domestic steel industry, including big players like Cleveland-Cliffs (CLF) and U.S. Steel (X). The latter company reportedly idled its second blast furnace in less than a month, based on a Seeking Alpha report which said it removed a combined raw steel production capacity of 7,945 short tons per day from the market.

Meanwhile, total U.S. raw steel production fell to 1.68 million net tons, while the capability utilization rate slipped to 76%—its lowest rate in 20 months, according to the American Iron and Steel Institute (AISI). Also according to AISI, net U.S. steel imports were down 6% from a year ago in the latest reporting month of August.

Elsewhere, BHP Group (BHP) raised its long-term demand forecast for steel consumption by 2% to 42 million metric tons by 2030. The forecast was based on “the rising need for the product in the global shift towards the decarbonization of power generation.”

What to Do Now

We were recently stopped out of the remaining half of our long position in Alliance Resource Partners (ARLP) after the 23 level was violated on a closing basis. This was our last remaining steel-related position. For now, I recommend standing pat until the leading steel stocks and ETFs show greater resilience in the midst of the broad financial market weakness. WAIT

Current Portfolio

Stock | Price Bought | Date Bought | Price on Oct. 10 | Profit | Rating |

Invesco U.S. Dollar Bullish ETF (UUP) | 30.3 | 9/26/22 | 30.3 | 0% | Buy a Half |

Kinross Gold (KGC) | 3.75 | 10/4/22 | 3.75 | 0% | Buy a Half |

Buy means purchase a position at or around current prices.

Buy a Quarter/Half means allocate less of your portfolio to a position than you normally would (due to risk factors).

Hold means maintain existing position; don’t add to it by buying more, but don’t sell.

Sell means to liquidate the entire (or remaining) position.

Sell a Quarter/Half means take partial profits, either 25% or 50%.

The next Cabot SX Gold & Metals Advisor issue will be published on October 25, 2022.