The precious metals remain near their yearly lows, but a window of opportunity still beckons. Specifically, recent commercial hedging activity points to a possible bottom ahead for the metals.

Elsewhere, titanium remains one of today’s strongest metals. Other industrial metals, meanwhile, are coming off major lows but have rebound potential.

In the trading portfolio, I’m adding a potential short-covering trade for a palladium ETF. Details inside.

Cabot SX Gold & Metals Advisor Issue: July 26, 2022

More Good News for the Metals

“Smart Money” Covers Short Positions

Last week we looked at the copper/gold ratio, which reached a level suggesting a bottom may finally be imminent for copper (and even silver). This week we’ll look at some additional indicators that also suggest a meaningful low may soon be confirmed for several metals, including copper, silver, platinum, palladium and even gold.

A caveat is in order, however: should these metals fail to establish a bottom in the next couple of weeks, the positive implications of the technical and seasonal considerations we’ll discuss here will soon diminish. Put simply, we’re getting very close to “now-or-never time” for the precious metals market.

Let’s start with the best news: According to the latest Commitments of Traders (COT) published each week by the Commodity Futures Trading Commission (CFTC), commercial hedgers (the so-called “smart money”) have been significantly reducing their short positions in several major metals, particularly gold and silver.

The implication of this development is that the players in these markets who have the most capital at stake—and who presumably know more about prevailing market conditions than all other participants—no longer have a reason to expect lower prices in the foreseeable future. And while heavy short covering among commercials doesn’t always produce meaningful rallies in the metals, rallies do tend to follow more often than not.

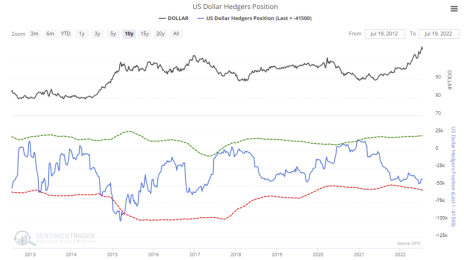

Also worth mentioning is that not only are commercial hedgers reducing short positions in several metals, they’re also beginning to cover big bets against the U.S. dollar. As you can see in the chart below, the rolling COT dollar hedger’s position has reached a level that normally occurs around peaks. It also supports a bullish outlook for the metals.

The dollar index is truly the key to the bullish metals market thesis in my view. For the better part of the first half of this year we saw metals prices and the dollar moving higher in virtual lockstep. That’s a fairly rare occurrence, but when it happens it invariably means that one of the two (metals or the greenback) are living on borrowed time. As it turned out, it was the metals that were in the unsustainable position, especially given that metals are priced in dollars.

I would further note that, according to SentimenTrader statistics, gold and silver are currently in the midst of their most favorable seasonal periods of the year. Historically, the strongest rallies in these metals have occurred from July through September, especially for gold. (For platinum and palladium, the fourth quarter typically affords the best buying opportunities.)

Conclusion: In view of the favorable seasonal profiles and short-covering developments underway, the metals have as good a backdrop as they’re likely to have for a while. But in order for them to have any chance of mounting a sustained reversal, the dollar must simply stop strengthening from here. A failure of the dollar index to soften in the coming weeks will almost certainly put more downward pressure on the metals, frustrating the hopes of the bulls.

What to Do Now

We were recently stopped out of our conservative trading position in the GraniteShares Gold Trust (BAR). No new trading positions are recommended in any gold-related stocks or ETFs until the market confirms a bottom has been made. WAIT

New Recommendations/Updates

Now or Never for Silver

Silver’s window of opportunity to rally based strictly on seasonal factors is in the process of closing. There’s still a chance the white metal can turn it around in the next several days, but once August is upon us the seasonal window will close.

That said, seasonal factors aren’t the main short-term consideration for silver (or the other metals for that matter). What matters most besides market sentiment is the U.S. dollar, whether it’s strengthening or weakening (see discussion above).

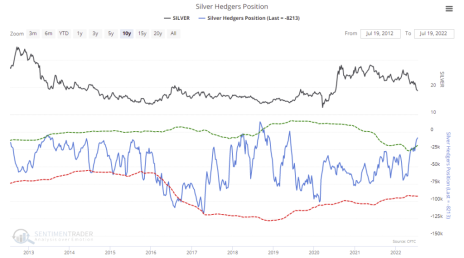

But there’s also another variable that bodes well for the near-term silver outlook, and it involves the biggest movers and shakers in the silver market. As it turns out, commercial hedgers now hold the lowest amount of net short open interest (less than 6%) of the last three years. This is according to CFTC Commitments of Traders (COT) data, and it provides yet another window of opportunity for the silver bulls.

Moreover, the COT data show that this is only the third time since 2013 that commercial hedgers have shown a similar level of disinterest in shorting silver. The previous two instances occurred in September 2018 (very close to a major silver market low) and July 2013 (again, near a pivotal low).

If the correlation between low commercial short interest and a strengthening silver price holds true this time, we should soon begin to see silver perking up and moving higher. However, if silver does begin to rally from here and the dollar remains strong, silver’s strength would have to be viewed with suspicion.

As with the other metals mentioned above, the dollar index remains key for the near-term silver outlook.

What to Do Now

From a short-term strategic perspective, no new silver ETF purchases are recommended. WAIT

Turning Point for Palladium?

Along with the other precious metals, palladium has taken a bruising in recent months as a weakening global economy, combined with continued coronavirus-related restrictions in China, have diminished the metal’s demand profile.

And while those factors haven’t improved much, there are reasons to believe that palladium prices could be at an important juncture.

Consider, for example, that palladium’s biggest supplier—Russia—is still engaged in its war with Ukraine. This has created a tight global supply situation for the metal due to delivery disruptions.

Then there’s Russian oligarch Vladimir Potanin, the country’s second-richest man who, according to Reuters, has been purchasing assets from firms exiting Russia over the war. Known as Russia’s “Nickel King,” Potanin was among the latest group of financiers to be sanctioned by Britain over the war. Potanin also happens to own a 36% stake in Nornickel, the world’s largest palladium producer.

On the futures front, CFTC data show that commercial hedgers (a.k.a. the “smart money”) have recently reached their least hedged position in palladium of the last 10 years. With the commercials heavily exiting short positions, the possibility for a worthwhile short-covering rally has increased.

Given how technically “oversold” the palladium market has become in recent weeks, I see long trade in the catalyst metal as being asymmetric at this time.

What to Do Now

The Sprott Physical Platinum & Palladium Trust (SPPP) is arguably the lowest-cost way to play a potential palladium market short-covering rally. As mentioned above, I view this as an asymmetric trading opportunity given the strong short-covering trend among commercial hedgers in the palladium market. However, because this ETF is coming off a major low and doesn’t enjoy the tailwind of forward momentum (as most of my recommendations do), it also represents an above-normal volatility risk. For that reason, I’m not recommending this trade for conservative traders. That said, participants who don’t mind the risk can purchase a small position in SPPP here using a level slightly under 12.60 as an initial stop-loss (closing basis). BUY A HALF

Copper Catches a Needed Break

Copper just tallied its first weekly gain in seven weeks, as the market’s risk tolerance has lately improved.

Expectations that the Federal Reserve would hold off on a more hawkish approach to raising interest rates in the face of a cooling economy helped stimulate interest in bottom fishing among copper traders. Although the red metal is still down 30% from its March peak, improved interest rate expectations and a weaker dollar provided traders reasons for optimism.

Last week we examined the copper/gold ratio and saw that copper tends to rally when that ratio falls under 0.19, which it did recently. A 14-year statistical survey shows that in every case without exception, copper posted a meaningful price gain (i.e. between 30% and 50%) in the six to 12 months following the signal.

The ratio is still under 0.19 as of July 25, so there’s no denying that copper is significantly “oversold” based solely on technical factors. That said, there’s also no denying that the technical factors I view as the most important one for determining copper’s short-term trend (namely the 25-day and 50-day lines) are still trending lower.

In order to confirm that a bottom has been made, copper should at least be able to close above the 25-day line (which is currently at the $3.57 per pound level in the daily chart shown here). Until this occurs, copper’s immediate position must be viewed with skepticism since the trend is still down.

Meanwhile, lower copper prices have impacted the earnings of the major copper producers. Freeport-McMoRan (FCX) reported last week an earnings miss, with second-quarter revenue coming in 6% below the year-ago level and per-share earnings missing estimates by eight cents.

While Freeport’s Q2 copper production rose 18%, the company’s average realized copper price fell 7% to $4.03 per pound. While management acknowledges the negative impact of lower prices, the firm stated that physical demand for its copper is as strong as it was when copper prices were $4.50 earlier this year.

Management added that as the world becomes progressively electrified, it expects copper demand to grow, especially as demand for alternative power and electric vehicles increases. Mine development, meanwhile, isn’t keeping up with that demand, Freeport said. Accordingly, Freeport believes the downturn in prices is a temporary phenomenon (a “correction” if you will) that will eventually be reversed.

What to Do Now

From a short-term strategic perspective, no new copper ETF purchases are recommended. WAIT

Voracious Auto Demand Should Boost Steel

After falling $900 per ton for the first time since 2020, U.S. hot-rolled coil prices rebounded to $923 last week.

The HRC U.S. Midwest price is down 40% since hitting a peak of $1,500 per ton in April, according to data from Argus Metal Price service. However, HRC steel has spent the last two weeks bottoming and is trying to rebound, though a bottom hasn’t yet been confirmed.

Indeed, aggregate steel prices as measured by the NYSE American Steel Index, came very close to confirming a low last week, closing decisively above the 25-day moving average (my favorite benchmark for signaling price lows). However, the steel index slipped back under the 25-day line on Friday and failed to finish the week above it. Steel prices have spent the better part of the last four months under this trend line, so we’ll need to see a solid weekly close above it to let us know the bottom is likely in for steel.

Of interest, Cleveland-Cliffs (CLF), North America’s largest flat-rolled steel and iron ore pellet maker, last week reported mostly upbeat second-quarter earnings. Revenue for the steelmaker in Q2 rose 26% from a year ago to $6.3 billion, while per-share earnings of $1.31 missed estimates by five cents.

Other highlights included free cash flow that more than doubled from the prior quarter, plus the firm’s largest quarterly debt reduction since it began its transformation two years ago.

The company, which enjoys a leadership position in providing steel for the U.S. automotive industry, expects the enormous backlog for vehicles will result in higher steel demand in the coming quarters, which could help push prices higher.

U.S. Steel (X), meanwhile, recently issued bullish Q2 guidance and predicted EBITDA of $1.6 billion, which would be an all-time Q2 record if realized. Management further predicted record performance across several metrics, with each of its business segments “meaningfully” contributing to profitability.

Wall Street analysts weren’t impressed, however, and the company was the subject of a couple of high-profile downgrades. This could prove to be premature on the Street’s part, though, and if U.S. Steel’s earnings beat the consensus, we could see a nice pop in the stock, as well as a sympathy move higher across the industry group. The earnings report is due out this Thursday, July 28, after the close of trading.

What to Do Now

Alliance Resource Partners (ARLP) is a producer of metallurgical coal (for the steelmaking industry) and thermal coal (for electrical utilities), with approximately two billion tons of coal reserves in several U.S. midwestern and southern states. Alliance is currently the second-largest coal producer in the eastern U.S. with additional mineral and royalty interests in the highly productive Permian, Anadarko and Williston basins. (The company markets its mineral interests for lease to operators in those regions and generates royalty income from the leasing and development of those mineral interests.) ARLP has been one of the few standouts in an otherwise weak market as coal prices surge around the world (forming what one analyst called a “space needle pattern”) in response to the recent natural gas crisis in Europe. Consequently, many industry experts foresee shortages and sky-high energy prices persisting until at least 2024. I also suggest raising the stop-loss on the remaining position to slightly under 19.30 (closing basis) where the 50-day line currently resides. HOLD A HALF

Titanium Bull Market Rolls On

It’s a slow-moving market that rarely makes headlines, to be sure, but there’s no denying that titanium is among today’s best-performing metals.

Indeed, the metal widely used in the aerospace industry is up 85% year to date. And with the war between Ukraine and Russia dragging on, the heavy demand for titanium on the part of aircraft makers and defense contractors is likely to persist in the foreseeable future.

But titanium’s story is more than just a military-related metal. Demand for titanium dioxide pigments is especially high right now in the automotive industry. The global market for these pigments is forecast to increase 42% in the next six years, largely due to auto industry demand.

In the meantime, benchmark titanium prices have remained flat since May and aren’t likely to show any meaningful volatility anytime soon. Nonetheless, prices are much closer to their all-time highs (currently 35% below) than their 2020 low. And if the war in Ukraine persists, there’s good reason to believe wartime material demand for the metal will push prices higher eventually.

What to Do Now

Valhi (VHI) is a leader in the titanium industry. The company has operations through majority-owned subsidiaries or less than majority-owned affiliates operating in several industries, including component products (security products, furniture components and performance marine components) and titanium metals products. But its biggest segment by sales is titanium dioxide pigments, which are used in the automotive and construction industries, as well as in plastic and printing inks. Its main titanium oxide subsidiary is Kronos (KRO)—whose stock was recently a (profitable) part of our trading portfolio. On the financial front, Valhi posted revenue of $629 million in Q1, up 24% from a year ago, led by higher titanium oxide selling prices and volumes in its chemical segment. Per-share earnings of $1.59, meanwhile, beat estimates by 34 cents. When the company reports Q2 earnings on August 11, analysts expect EPS to grow 170% from a year ago and more than 25% sequentially. In view of VHI’s strong relative performance in the last few weeks, traders purchased a conservative position in this stock using an initial stop-loss slightly under 41.60 (closing basis). BUY A HALF

Current Portfolio

| Stock | Price Bought | Date Bought | Price on July 25 | Profit | Rating |

| Alliance Resource Partners (ARLP) | 18.75 | 7/5/22 | 20 | 7% | Hold a Half |

| Sprott Physical Palladium Trust (SPPP) | 13.5 | 7/26/22 | 13.5 | 0% | Buy a Half |

| Valhi Inc. (VHI) | 48 | 7/20/22 | 49 | 2% | Buy a Half |

Buy means purchase a position at or around current prices.

Buy a Quarter/Half means allocate less of your portfolio to a position than you normally would (due to risk factors).

Hold means maintain existing position; don’t add to it by buying more, but don’t sell.

Sell means to liquidate the entire (or remaining) position.

Sell a Quarter/Half means take partial profits, either 25% or 50%.

The next Cabot SX Gold & Metals Advisor issue will be published on August 9, 2022.

Analyst Bio

Clif Droke

Clif Droke is Chief Analyst of Cabot SX Gold & Metals. For over 20 years, he has worked as a writer, analyst and editor of several market-oriented advisory services and has written several books on technical trading in the stock market, including “Channel Buster: How to Trade the Most Profitable Chart Pattern” and “The Stock Market Cycles.”