New Watchlist Recommendation

ProShares Short Bitcoin ETF (BITI)

The ProShares Short Bitcoin ETF (BITI) launched on Tuesday, June 21. This is the first ETF of its kind launched in U.S. markets, catering to investors (and bears) who are looking to hedge their cryptocurrency holdings. As active investors here at Cabot, we believe the launch of this product to be a compelling way for our readers to profit from short-term declines in cryptocurrency markets and offers a new way to hedge our long portfolio.

BITI tracks the inverse performance of the S&P CME Daily Bitcoin Futures Index. This means that on days when the index rises as a result of positive underlying moves in crypto, BITI will fall; but on days when crypto markets are diving – BITI will rise.

This offers investors some relief during down days and the chance lock in guaranteed profits even when crypto markets are down.

How to Buy BITI

The ProShares Short Bitcoin ETF can be purchased in a traditional brokerage account.

Search the ticker symbol BITI; the ETF should populate your brokerage online page. Fidelity and other major brokers will ask for your consent and approval to trade this product if you have not already traded other ETF or derivative products previously. Simply check the box and submit the online form if you are interested.

Risks

Bitcoin (BTC) is volatile. Significant movements upwards in price will benefit our long portfolio, from which we have non-leveraged exposure through BITO.

BTC is extremely likely to undergo significant movements upwards in price over a longer period, with many of these moves happening over the course of single days and single weeks. These events are likely to put pressure on BITI margin agreements and could lead to significant outflows from their fund when Bitcoin goes on a significant run to the upside.

We do expect ProShares to account for these factors and their fund is likely to gain further adoption as institutions look to profit from short-term declines in volatile crypto markets.

As such, we are currently adding BITI to our watch list as we closely examine the prospectus documents and monitor the correlation between spot price and NAV (net asset value) of BITI before allocating any portion of our portfolio to this fund.

BITI can be a useful tool for short-term trading to hedge our long exposure to Bitcoin.

Purchasing BITI, for example, would be much cheaper than shorting BITO outright, as the cost to short this fund is near 13.9%, according to data from S3 Partners and Bloomberg.

Market Update

The key feature of public blockchain technology is transparency. We are able to see every transaction on the network through the verifiable public record.

Therefore, we can examine patterns in the transaction data.

Over the past five years, there have only been six other similar stretches of key indicators of Bitcoin bottoming. Bitcoin’s relative strength index is near its lowest point ever, pointing to how oversold the market is.

Typically during bear markets, cryptocurrencies are taken out of cold storage and deposited back on to exchanges with the intent to sell. We are not seeing this phenomenon as strongly today. Furthermore, large and small wallets are continuing to accumulate Bitcoin and Ethereum despite overall trading volume being lower. This indicates demand at these discounted price levels from both large and small investors.

A core component of the long-term thesis for BTC is the ability to borrow against it. Large holders of Bitcoin are accumulating for the long-term – ignoring even 70% price declines, because when the asset has moved to the upside it has been by magnitudes of hundreds of percent.

Bitcoin can neither be debased through inflation nor can its transactions be prevented by central authority. This makes Bitcoin highly desirable digital property that has defined securities and tax treatment by the U.S. government.

Bitcoin remains highly correlated to the Nasdaq in today’s environment at 0.80. Meanwhile, the dollar has excelled with the DXY index hovering around highs of 105.78.

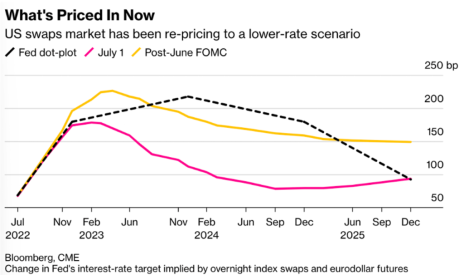

The dollar has benefitted from rate hikes, as traders are pricing in another hike of 0.75 in July but anticipate that the Fed will not raise rates beyond 3.3%. Foreign exchange rates will stabilize as rate increases subside with time. This process will lead to mean reversion for the dollar as traders look to put money to work elsewhere back into oversold stocks and crypto. This process will take time and requires improvement in the overall macro environment, which is why we are staying patient.

The S&P 500 Index has endured the worst start to the year since 1970. With that in mind, it makes sense to start adding exposure to risk assets in the back half of this year.

Remember, the Fed must raise rates to have a shot at using its only weapon during a recession – a rate cut. This unspoken reason is why the Fed must always raise rates at some point to avoid a persistent low rate and low-growth environment as other countries like Japan have experienced.

Crypto Portfolio

| Ticker | Original Weight | Price | Price at Rec | Performance | Rating |

| ETH | 15.0% | 1,123.47 | 3,444.22 | -67.38% | BUY A QUARTER |

| ENS | 2.50% | 9.51 | 10.22 | -6.95% | BUY A HALF |

| MATIC | 1.25% | 0.48 | 0.678 | -29.69% | BUY A QUARTER |

| APE | — | 4.73 | — | — | WATCH |

| SOL | — | 34.87 | — | — | WATCH |

| HNT | — | 9.35 | — | — | WATCH |

| STEPN | — | 0.83222 | — | — | WATCH |

Equity Portfolio

| Ticker | Original Weight | Price | Price at Rec | Performance | Rating |

| Proshares Strategy Bitcoin ETF (BITO) | 2.50% | 11.96 | 25.93 | -53.88% | BUY A QUARTER |

| Arista Networks (ANET) | 2.50% | 93.41 | 105.00 | -11.04% | BUY A QUARTER |

| Nvidia (NVDA) | 2.50% | 145.23 | 188.20 | -22.83% | BUY A QUARTER |

| Okta Inc. (OKTA) | 2.50% | 95.98 | 95 | 1.03% | BUY A QUARTER |

| Proshares Short Bitcoin ETF (BITI) | — | 42.58 | — | — | WATCH |

| Concord Acquisition (CND) | — | 9.95 | — | — | WATCH |

| CrowdStrike (CRWD) | — | 179.25 | — | — | WATCH |

| Galaxy Digital (GLXY.TO) | — | 4.98(CAD) | — | — | WATCH |

| Unity (U) | — | 37.54 | — | — | WATCH |