Before I get started, I wanted to thank everyone that wrote in this week. I appreciate all of the kind words during and after our first subscriber-exclusive webinar. If you didn’t get a chance and want to check it out, click here or go to your subscriber page at your leisure. As I stated in the webinar, if you have any feedback, comments or questions please do not hesitate to email me at andy@cabotwealth.com. I’m more than happy to help in any way I can.

Monday saw a historic amount of selling pressure. In fact, fewer than five stocks in the S&P 500 were able to eke out a gain on the day.

And it only got worse.

Cabot Options Institute – Quant Trader Issue: June 17, 2022

Before I get started, I wanted to thank everyone that wrote in this week. I appreciate all of the kind words during and after our first subscriber-exclusive webinar. If you didn’t get a chance and want to check it out, click here or go to your subscriber page at your leisure. As I stated in the webinar, if you have any feedback, comments or questions please do not hesitate to email me at andy@cabotwealth.com. I’m more than happy to help in any way I can.

Monday saw a historic amount of selling pressure. In fact, fewer than five stocks in the S&P 500 were able to eke out a gain on the day.

And it only got worse.

The stretch from last Friday to Tuesday was one of the worst three-day selloffs in market history. The move officially pushed the market into bear market territory. Now the question is, how will market participants respond? So far, not great.

On Wednesday, the Fed raised interest rates by 75 basis points and what was left of the “buy the dip” crowd managed to push the market fractionally higher on the session. The bullishness was short-lived as the bears took over at the opening bell on Thursday and never let up. The S&P 500 closed down 3.31% on the trading session.

Thankfully we were positioned to take advantage of the bearishness and decided to take off our SPY position early in the week. We sold the SPY bear call spread for $0.70 and bought the spread back for $0.05 on Monday for a solid 14.94% return.

Our XOP bear call spread is also currently worth $0.05, and like our SPY bear call spread, we sold the XOP 190/195 bear call spread for $0.70. So, by the time you are reading this, I’ve most likely taken the trade off the table for another 14.94% profit.

My intent was to open two to three more trades this week, but the market just wasn’t cooperative. We never want to force a trade purely for action. It doesn’t make sense. Allow the trades to come to you. Wait for the setups. Be patient!

As I stated last week, my goal is to eventually ramp up to five to eight ongoing positions, keeping the deltas of the overall portfolio neutral to slightly bearish. Once we get to that level (which will hopefully be in the next few weeks) we’ll start to discuss the Greeks of the overall portfolio a bit more, especially the overall delta and theta.

Current Portfolio

| Open Trades | ||||||||

| Open Date | Ticker | Strategy | Trade | Open Price | Current Price | Current Return | Current Probability | Delta |

| 6/8/2022 | XOP | Bear Call Spread | July 15, 2022, 190/195 | $0.70 | $0.05 | 14.94% | 98.36% | -1 |

| Closed Trades | |||||||

| Open Date | Closed Date | Ticker | Strategy | Trade | Open Price | Closing Price | Return |

| 6/2/2022 | 6/13/2022 | SPY | Bear Call Spread | July 15, 2022, 440/445 Calls | $0.70 | $0.05 | 14.94% |

Volatility Talk

Volatility, as seen through the VIX, popped 26.3% this week. Now the investor’s fear gauge is back to what has been strong overhead resistance.

You can see in the chart below that we’ve seen upwards of seven pushes to the 35 area, only to see a pullback in the volatility gauge each and every time. The VIX is one of the few underlying measures that experiences strong mean-reversion. Could we see another reversion to the mean this time around? While no one knows for certain (crystal balls don’t exist), if the VIX does revert to the mean we could see a decent short-term rally over the next week or so and probably another good opportunity to sell some more bear call spreads.

Weekly High Probability Mean Reversion Indicator

Below is my watch list of ETFs and stocks with the most liquid options headed into the week of June 20, 2022.

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

| Very Overbought | greater than or equal to 80.1 |

| Overbought | 60.1 to 80.0 |

| Neutral | 40.1 to 60 |

| Oversold | 20.1 to 40.0 |

| Very Oversold | less than or equal to 20.0 |

Each week I also include the current implied volatility (IV) and IV Rank. I look for an IV rank above 40, preferably higher.

ETF Watch List

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| ARK Innovation ETF | ARKK | 82.1 | 79.1 | 35.7 |

| Proshares Bitcoin ETF | BITO | 139.1 | 84.6 | 14.2 |

| SPDR Dow Jones | DIA | 28.9 | 80.5 | 21.6 |

| iShares MSCI Emerging Markets | EEM | 29 | 54 | 32 |

| iShares MSCI EAFE | EFA | 26.5 | 54.5 | 23.3 |

| iShares MSCI Mexico ETF | EWW | 34.4 | 50.9 | 20.9 |

| iShares MSCI Brazil | EWZ | 46.7 | 79.8 | 19.5 |

| iShares China Large-Cap | FXI | 45.6 | 56.9 | 45.8 |

| Vaneck Gold Miners | GDX | 48.2 | 74.5 | 43.6 |

| SPDR Gold | GLD | 20.5 | 34.4 | 53.9 |

| iShares High-Yield | HYG | 23.1 | 86.3 | 31.6 |

| iShares Russell 2000 | IWM | 39.7 | 85.2 | 23 |

| SPDR Regional Bank | KRE | 40 | 59.2 | 23.5 |

| Vaneck Oil Services | OIH | 63.4 | 83.7 | 17.6 |

| Invesco Nasdaq 100 | QQQ | 39.9 | 90.1 | 27.3 |

| iShares Silver Trust | SLV | 34.1 | 38.1 | 54.8 |

| Vaneck Semiconductor | SMH | 48.7 | 82.7 | 23.9 |

| SPDR S&P 500 | SPY | 30.2 | 84.7 | 23 |

| iShares 20+ Treasury Bond | TLT | 29.8 | 80.6 | 40.4 |

| United States Oil Fund | USO | 45.8 | 28.4 | 48.5 |

| Proshares Ultra VIX Short | UVXY | 152.2 | 32.1 | 62.9 |

| CBOE Market Volatility Index | VIX | 116.6 | 28.3 | 65.2 |

| Barclays S&P 500 VIX ETN | VXX | 92.5 | 17 | 63.6 |

| SPDR Biotech | XLB | 33.2 | 94.4 | 16 |

| SPDR Energy Select | XLE | 50.3 | 106.8 | 19.1 |

| SPDR Financials | XLF | 35.5 | 65.7 | 20.8 |

| SPDR Utilities | XLU | 27.5 | 77.8 | 15.3 |

| SPDR S&P Oil & Gas Explorer | XOP | 58.3 | 55.6 | 22.9 |

| SPDR Retail | XRT | 49.4 | 67.9 | 28.9 |

Stock Watch List- Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| Apple | AAPL | 44.2 | 85.6 | 27.6 |

| Bank of America | BAC | 44.3 | 63.5 | 23 |

| Bristol-Myers Squibb | BMY | 26.7 | 41.7 | 22.6 |

| Citigroup | C | 47.6 | 73.6 | 33.6 |

| Caterpillar | CAT | 43.3 | 85.4 | 20 |

| Comcast | CMCSA | 40.4 | 62.5 | 14.6 |

| Costco | COST | 39.8 | 59.2 | 38.4 |

| Cisco Systems | CSCO | 34.9 | 42.8 | 36.6 |

| Chevron | CVX | 45.9 | 93.1 | 16.2 |

| Disney | DIS | 43.6 | 45.5 | 23.3 |

| Duke Energy | DUK | 29 | 93.5 | 11.6 |

| FB | 44.9 | 43.5 | 32.3 | |

| Fedex | FDX | 56.7 | 86.3 | 57.2 |

| Gilead Sciences | GILD | 38.1 | 41.4 | 19.1 |

| General Motors | GM | 59.2 | 85.2 | 26.8 |

| Intel | INTC | 43.7 | 67.4 | 23.1 |

| Johnson & Johnson | JNJ | 26 | 68.4 | 30.9 |

| JP Morgan | JPM | 43.1 | 74 | 21.7 |

| Coca-Cola | KO | 32.6 | 86.5 | 31 |

| Altria Group | MO | 36.1 | 82 | 12.2 |

| Merck | MRK | 28.3 | 51.3 | 20.5 |

| Morgan Stanley | MS | 48.4 | 82.8 | 21.8 |

| Microsoft | MSFT | 41 | 66.5 | 32.3 |

| Nextera Energy | NEE | 37.9 | 88.2 | 32.9 |

| Nvidia | NVDA | 67 | 59.2 | 31.6 |

| Pfizer | PFE | 37.8 | 66.8 | 22.5 |

| Paypal | PYPL | 67.9 | 70 | 28.9 |

| Starbucks | SBUX | 45.8 | 87.8 | 31.3 |

| AT&T | T | 37.1 | 85.9 | 11.9 |

| Verizon | VZ | 33.3 | 77.4 | 22.7 |

| Walgreens Boots Alliance | WBA | 42.8 | 91.1 | 23.8 |

| Wells Fargo | WFC | 51.1 | 70.2 | 20.7 |

| Walmart | WMT | 30.6 | 63.6 | 35.7 |

| Exxon Mobil | XOM | 45.4 | 80.7 | 27.7 |

Weekly Trade Discussion: Open Positions

Bear Call Spread: XOP July 15, 2022 190/195 calls

Original trade published on 6-8-2022 (click to see original alert)

Background: XOP reached an extreme overbought state. Typically, when we see this level of extreme in a highly liquid ETF or stock, a short-term reprieve is right around the corner. So, due to the short-term overbought extremes in XOP we decided to try and take advantage of the situation by placing a high-probability bear call spread in XOP.

At the time of the trade XOP was trading for 168.62. We sold the July 15, 2022, 190/195 bear call spread for $0.70 with an 83.69% probability of success. At the time the high side of the expected move was 189.

Current Thoughts: As I stated above there is a good chance that by the time you are reading this, I’ve already taken the trade off the table.

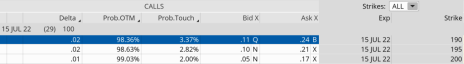

XOP is now trading for 139.68. As you can see in the image below, our probability of success now stands at 98.36% and our probability of touch is 3.37%. The spread is currently trading for roughly $0.05.

It’s time to take this one off and lock in a decent return.

Call Side

Next Live Analyst Briefing with Q&A

Our next live analyst briefing with Q&A is scheduled for next Wednesday, July 13, 2022 at 12 p.m. ET. As always, I will be discussing the options market, giving a detailed look at open positions, strategies used, look at a few potential trades on the trading platform and follow up with live questions and answers. I hope to see you all there! Register here.

The next Cabot Options Institute – Quant Trader issue will be published on June 24, 2022.

About the Analyst

Andy Crowder

Andy Crowder is a professional options trader, researcher and Chief Analyst of Cabot Options Institute. Formerly with Oppenheimer & Co. in New York, Andy has leveraged his investment experience to develop his statistically based options trading strategy which applies probability theory to option valuations in order to execute risk-controlled trades. This proprietary strategy has been refined through two decades of research and real-world experience and has been featured in the Wall Street Journal, Seeking Alpha, and numerous other financial publications. Andy has helped thousands of option traders learn and implement his meticulous rules-driven options trading strategies through highly attended conferences, one-on-one coaching, webinars, and his work as a financial columnist. He currently resides in Bolton Valley, Vermont and when he’s not trading, teaching and writing about options, he enjoys spending time with his wife and two daughters, backcountry skiing, biking, running and enjoying all things outdoors.