Weekly Commentary

We currently have two positions due to expire in December. My hope is to add at least one more December expiring position this week as our deltas are leaning far too negative for my liking, at least at the moment.

Expect to see a new trade or two as we progress throughout the week. And if the market continues to rally we will need to adjust a position or two, which I discuss in further detail in the open positions section below.

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Current Portfolio

| Open Date | Ticker | Strategy | Trade | Open Price | Current Price | Current Probability | Delta |

| 10/31/2023 | SPY | Iron Condor | December 15, 2023 450/445 - 380/375 | $0.77 | $2.21 | 58.36% - 97.00% | -0.11 |

| 11/6/2023 | SPY | Bear Call | December 15, 2023 456/461 | $0.58 | $0.77 | 82.35% | -0.08 |

| Open Date | Closed Date | Ticker | Strategy | Trade | Open Price | Closing Price | Return |

| 6/2/2022 | 6/13/2022 | SPY | Bear Call Spread | July 15, 2022 440/445 | $0.70 | $0.05 | 14.94% |

| 6/8/2022 | 6/17/2022 | XOP | Bear Call Spread | July 15, 2022 190/195 | $0.70 | $0.04 | 15.21% |

| 6/22/2022 | 7/13/2022 | SPY | Bear Call Spread | July 29, 2022 405/410 | $0.75 | $0.35 | 8.70% |

| 6/30/2022 | 7/25/2022 | IWM | Iron Condor | August 19, 2022 195/200 - 145/140 | $0.70 | $0.34 | 7.76% |

| 7/8/2022 | 7/28/2022 | GLD | Bull Put Spread | August 19, 2022 155/150 | $0.60 | $0.16 | 9.65% |

| 7/14/2022 | 8/11/2022 | SPY | Iron Condor | August 19, 2022 417/412 - 335/330 | $0.70 | $4.10 | -68.00% |

| 8/1/2022 | 8/29/2022 | SPY | Bear Call Spread | September 16, 2022 439/444 | $0.70 | $0.07 | 14.42% |

| 8/11/2022 | 8/29/2022 | DIA | Bear Call Spread | September 23, 2022 350/325 | $0.75 | $0.08 | 15.47% |

| 8/11/2022 | 9/8/2022 | IWM | Iron Condor | September 23, 2022 220/215 - 173/168 | $0.77 | $0.57 | 4.17% |

| 9/7/2022 | 9/9/2022 | QQQ | Bull Put Spread | October 21, 2022 260/255 | $0.62 | $0.30 | 6.84% |

| 9/9/2022 | 9/15/2022 | SPY | Bear Call Spread | October 21, 2022 430/435 | $0.75 | $0.25 | 11.11% |

| 9/13/2022 | 10/17/2022 | IWM | Iron Condor | October 21, 2022 208/203 - 163/158 | $0.77 | $0.30 | 10.40% |

| 10/3/2022 | 10/25/2022 | SPY | Bull Put Spread | November 18, 2022 325/320 | $0.54 | $0.09 | 9.89% |

| 10/4/2022 | 11/2/2022 | IWM | Iron Condor | November 18, 2022 198/203 - 143/138 | $0.64 | $0.32 | 6.84% |

| 10/6/2022 | 11/2/2022 | SPY | Bear Call Spread | November 18, 2022 412/416 | $0.43 | $0.28 | 3.90% |

| 11/16/2022 | 11/28/2022 | IWM | Iron Condor | December 16, 2022 205/200 - 162/157 | $0.75 | $0.24 | 11.36% |

| 11/10/2022 | 12/6/2022 | SPY | Bear Call Spread | December 16, 2022 420/425 | $0.65 | $0.14 | 11.36% |

| 12/1/2022 | 12/6/2022 | SPY | Bear Call Spread | January 20, 2023 435/440 | $0.67 | $0.18 | 10.86% |

| 12/13/2022 | 12/15/2022 | SPY | Bear Call Spread | January 20, 2023 430/435 | $0.54 | $0.17 | 7.99% |

| 12/7/2023 | 1/6/2023 | IWM | Iron Condor | January 20, 2023 202/198 - 160/156 | $0.70 | $0.06 | 19.00% |

| 1/4/2023 | 2/1/2023 | IWM | Iron Condor | February 17, 2023 200/195 - 154/149 | $0.65 | $2.00 | -27.00% |

| 1/6/2023 | 2/2/2023 | SPY | Bear Call Spread | February 17, 2023 415/420 | $0.60 | $2.50 | -38.00% |

| 2/2/2023 | 2/15/2023 | SPY | Bear Call Spread | March 17, 2023 440/445 | $0.63 | $0.15 | 10.62% |

| 2/10/2023 | 2/22/2023 | DIA | Bear Call Spread | March 31, 2023 355/360 | $0.70 | $0.17 | 11.86% |

| 2/2/2023 | 3/1/2023 | IWM | Iron Condor | March 17, 2023 175/180 - 215/220 | $0.72 | $0.51 | 4.38% |

| 3/6/2023 | 3/13/2023 | DIA | Bear Call Spread | April 21, 2023 350/355 | $0.85 | $0.17 | 15.74% |

| 2/23/2023 | 3/28/2023 | SPY | Iron Condor | April 21, 2023 435/430 - 350/345 | $0.80 | $0.15 | 14.94% |

| 3/23/2023 | 4/11/2023 | DIA | Bear Call Spread | April 21, 2023 338/443 | $0.62 | $2.05 | -28.60% |

| 3/23/2023 | 4/19/2023 | IWM | Iron Condor | May 19, 2023 196/191 - 147/142 | $0.83 | $0.23 | 13.64% |

| 4/12/2023 | 4/21/2023 | DIA | Bear Call Spread | May 19, 2023 350/355 | $0.82 | $0.44 | 8.23% |

| 4/21/2023 | 5/2/2023 | SPY | Iron Condor | June 16, 2023 440/435 - 365/360 | $0.95 | $0.63 | 6.84% |

| 4/24/2023 | 5/10/2023 | DIA | Bear Call Spread | June 16, 2023 354/359 | $0.72 | $0.22 | 11.11% |

| 5/5/2023 | 5/24/023 | SPY | Bear Call Spread | June 16, 2023 430/435 | $0.72 | $0.35 | 7.99% |

| 6/15/2023 | 6/22/2023 | SPY | Bear Call Spread | August 18, 2023 465/470 | $0.70 | $0.24 | 10.13% |

| 5/26/2023 | 6/23/2023 | IWM | Iron Condor | July 21, 2023 191/196 - 156/151 | $0.79 | $0.50 | 6.15% |

| 5/31/2023 | 7/12/2023 | QQQ | Bear Call Spread | July 21, 2023 375/380 | $0.60 | $1.80 | -31.60% |

| 6/30/2023 | 8/7/2023 | SPY | Bear Call Spread | August 18, 2023 462/466 | $0.52 | $0.23 | 7.82% |

| 8/4/2023 | 8/11/2023 | SPY | Bear Call Spread | September 15, 2023 470/475 | $0.65 | $0.20 | 9.90% |

| 8/17/2023 | 9/13/2023 | SPY | Iron Condor | October 20, 2023 475/470 - 390/385 | $0.72 | $0.25 | 10.38% |

| 9/6/2023 | 10/11/2023 | IWM | Iron Condor | October 20, 2023 204/199 - 169/164 | $0.62 | $0.19 | 9.41% |

| * 9/29/2023 | 10/27/2023 | SPY | Bear Call Spread | November 17, 2023 452/457 | $0.74 | $0.03 | |

| *10/6/2023 | 11/3/2023 | SPY | Bull Put Spread | November 17, 2023 408/403 | $0.58 | ||

| * 10/27/2023 | 11/3/2023 | SPY | Bear Call Spread | November 17, 2023 430/435 | $0.58 | $3.50 | -33.20% |

Volatility Talk

The investor’s fear gauge, otherwise known as the VIX, pushed further into short-term oversold territory this past week. My sentiment remains the same as last week: I wouldn’t be surprised to see the VIX test the lows established in October before a reversion to the mean event occurs. And given all the geopolitical turmoil, etc., I wouldn’t think sitting at current levels (or lower) will last.

With the VIX at 14.17 we’ve now hit the high side of the range of established lows set back during the late-June to September period. It will be interesting to see if volatility trades around this area into the new year or simply mean reverts over the next few trading sessions. As it stands, our current positions would love for the latter to occur sooner than later.

Weekly High-Probability Mean Reversion Indicator

Below is my watch list of ETFs and stocks with the most liquid options headed into the week of November 13, 2023.

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

| Very Overbought | a reading greater than or equal to 80.0 |

| Overbought | greater than or equal to 60.0 |

| Neutral | between 40 to 60 |

| Oversold | less than or equal to 40.0 |

| Very Oversold | less than or equal to 20.0. |

Each week I also include the current implied volatility (IV) and IV Rank. I look for an IV rank above 40, preferably higher.

ETF Watch List – Trade Ideas

| Exchange Traded Fund | Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought |

| ARK Innovation ETF | ARKK | 38.1 | 20.1 | 60.1 |

| Proshares Bitcoin ETF | BITO | 65.7 | 32.1 | 82.3 |

| SPDR Dow Jones | DIA | 11.8 | 11.9 | 70 |

| iShares MSCI Emerging Markets | EEM | 16.1 | 15.3 | 60.9 |

| iShares MSCI EAFE | EFA | 14.7 | 17.5 | 64.3 |

| iShares MSCI Mexico ETF | EWW | 23.0 | 28.8 | 65.8 |

| iShares MSCI Brazil | EWZ | 28.0 | 4.6 | 72.1 |

| iShares China Large-Cap | FXI | 27.7 | 6.2 | 41.5 |

| Vaneck Gold Miners | GDX | 30.9 | 24.8 | 30.9 |

| SPDR Gold | GLD | 13.7 | 27.2 | 32.2 |

| iShares High-Yield | HYG | 8.3 | 22.4 | 64.8 |

| iShares Russell 2000 | IWM | 20.2 | 23.4 | 50.5 |

| SPDR Regional Bank | KRE | 31.3 | 12 | 50.7 |

| Vaneck Oil Services | OIH | 31.1 | 18.3 | 37.5 |

| Invesco Nasdaq 100 | QQQ | 18.3 | 7.3 | 75.7 |

| iShares Silver Trust | SLV | 27.0 | 27.1 | 30.9 |

| Vaneck Semiconductor | SMH | 27.2 | 19 | 84.4 |

| SPDR S&P 500 | SPY | 14.4 | 14.9 | 72 |

| iShares 20+ Treasury Bond | TLT | 19.6 | 45.9 | 58.4 |

| United States Oil Fund | USO | 39.0 | 51.5 | 36 |

| Proshares Ultra VIX Short | UVXY | 98.2 | 15.5 | 29 |

| CBOE Market Volatility Index | VIX | 85.3 | 31.5 | 29.1 |

| Barclays S&P 500 VIX ETN | VXX | 66.1 | 14.9 | 29.2 |

| SPDR Biotech | XLB | 16.3 | 21 | 54.7 |

| SPDR Energy Select | XLE | 22.3 | 13.9 | 35.5 |

| SPDR Financials | XLF | 15.8 | 6.6 | 70.8 |

| SPDR Utilities | XLU | 17.8 | 30.8 | 49.7 |

| SPDR S&P Oil & Gas Explorer | XOP | 28.5 | 15.7 | 29.8 |

| SPDR Retail | XRT | 23.7 | 43.6 | 48.6 |

Stock Watch List – Trade Ideas

| Stock - Quant Trader | Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought |

| Apple | AAPL | 20.7 | 3.8 | 81.3 |

| Bank of America | BAC | 28.7 | 20.1 | 57.9 |

| Bristol-Myers Squibb | BMY | 22.7 | 41.1 | 28.6 |

| Citigroup | C | 25.8 | 8.6 | 67.2 |

| Caterpillar | CAT | 23.8 | 13.3 | 49.1 |

| Comcast | CMCSA | 21.0 | 9.9 | 49.5 |

| Costco | COST | 18.4 | 17.3 | 69.8 |

| Cisco Systems | CSCO | 26.2 | 49.9 | 48.5 |

| Chevron | CVX | 22.4 | 21.0 | 29.6 |

| Disney | DIS | 24.3 | 2.5 | 67.2 |

| Duke Energy | DUK | 20.9 | 33.6 | 44 |

| Fedex | FDX | 23.9 | 9.1 | 56.8 |

| Gilead Sciences | GILD | 23.7 | 21.1 | 34.4 |

| General Motors | GM | 37.7 | 48.3 | 32.4 |

| Intel | INTC | 30.7 | 3.7 | 69 |

| Johnson & Johnson | JNJ | 19.3 | 51.6 | 30.7 |

| JP Morgan | JPM | 19.0 | 5.4 | 71.8 |

| Coca-Cola | KO | 17.0 | 36.0 | 58 |

| Altria Group | MO | 18.9 | 33.4 | 34.7 |

| Merck | MRK | 20.1 | 21.5 | 32.9 |

| Morgan Stanley | MS | 23.3 | 11.4 | 56.6 |

| Microsoft | MSFT | 21.9 | 9.3 | 82.6 |

| Nextera Energy | NEE | 31.2 | 54.2 | 37.1 |

| Nvidia | NVDA | 52.9 | 49.5 | 81.6 |

| Pfizer | PFE | 29.0 | 62.7 | 26.1 |

| Paypal | PYPL | 32.0 | 11.7 | 54.8 |

| Starbucks | SBUX | 17.9 | -5.3 | 72.7 |

| AT&T | T | 21 | 5 | 56.7 |

| Verizon | VZ | 18.4 | 6.6 | 65.3 |

| Walgreens Boots Alliance | WBA | 38.9 | 55.6 | 40 |

| Wells Fargo | WFC | 26.2 | 7.2 | 55.9 |

| Walmart | WMT | 21.3 | 39.7 | 66.6 |

| Exxon Mobil | XOM | 24.3 | 19.3 | 35 |

Weekly Trade Discussion: Open Positions

*Portfolio updated every Monday

Iron Condor: SPY December 15, 2023, 450/445 – 380/375

Original trade published on 10-31-2023 (click to see original alert)

Background: At the time of the trade, SPY was trading for roughly 418. We sold the December 15, 2023, SPY 450/445 – 380/375 iron condor for $0.77. The expected range or move was 398 to 438. The probability of success at the time of the trade was 89.45% on the call side and 88.67% on the put side.

Current Thoughts: At the time of the trade SPY was trading for 418 and now it sits at 440.61, a 5.4% move in just two weeks. We have 33 days left in the trade and the short call strike of our iron condor is uncomfortably close as it sits with a 58.37% probability of success. If we continue to see even the slightest of moves higher, I will most likely adjust the position to give us a little more room for error. And if we pull back, there is a good chance that I still adjust the position to give us a higher probability of success on the trade going forward. Our iron condor is currently worth $2.21.

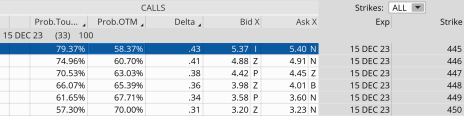

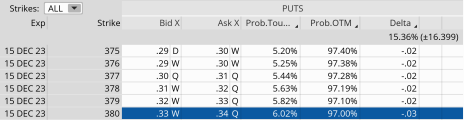

Call Side:

Put Side:

Bear Call Spread: SPY December 15, 2023, 456/461

Original trade published on 11-6-2023 (click to see original alert)

Background: At the time of the trade, SPY was trading for roughly 435.36. We sold the December 15, 2023, SPY 456/461 bear call spread for $0.58. The expected range or move was 419 to 451. The probability of success at the time of the trade was 86.49% on the call side.

Current Thoughts: At the time of the trade SPY was trading for 435.36 and now it sits at 440.61. Admittedly, we are early in the trade, but our probability sits at a mostly comfortable 82.36%. Of course, as we all know that can change quickly, especially if SPY continues to trend higher.

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Quant Trader issue will be

published on November 20, 2023.