Weekly Commentary

As I stated on our subscriber-only call last week, expect to see several trades this week. On the call I went over several trades, bullish, bearish and neutral, and I expect to add at least one of each over the next week or so.

We need to ramp up positions and now that July expiration has passed, we start selling premium going out roughly 30 to 60 days, but given the low-volatility environment that has taken over the market, I would expect to sell premium going out towards a longer duration trade. Just know that even though we place a trade going out further in duration, say 60 days, it doesn’t mean that we are going to be in a trade for that long. As we discussed on our call, our average hold time per trade duration is 20.5 days, regardless of the duration of the trade at the point of entry.

Also, as discussed on our call, expect to see a few conservative, blue-chip, underlying stocks enter the fray. This gives us the opportunity to sell options premium for slightly higher levels and maintain the types of returns we are accustomed to going forward.

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Current Portfolio

| Open Trades | |||||||

| Open Date | Ticker | Strategy | Trade | Open Price | Current Price | Current Probability | Delta |

| 6/30/2023 | SPY | Bear Call | August 18, 2023 462/466 | $0.52 | $0.96 | 74.07% | -0.09 |

| Open Date | Closed Date | Ticker | Strategy | Trade | Open Price | Closing Price | Return |

| 6/2/2022 | 6/13/2022 | SPY | Bear Call Spread | July 15, 2022 440/445 | $0.70 | $0.05 | 14.94% |

| 6/8/2022 | 6/17/2022 | XOP | Bear Call Spread | July 15, 2022 190/195 | $0.70 | $0.04 | 15.21% |

| 6/22/2022 | 7/13/2022 | SPY | Bear Call Spread | July 29, 2022 405/410 | $0.75 | $0.35 | 8.70% |

| 6/30/2022 | 7/25/2022 | IWM | Iron Condor | August 19, 2022 195/200 - 145/140 | $0.70 | $0.34 | 7.76% |

| 7/8/2022 | 7/28/2022 | GLD | Bull Put Spread | August 19, 2022 155/150 | $0.60 | $0.16 | 9.65% |

| 7/14/2022 | 8/11/2022 | SPY | Iron Condor | August 19, 2022 417/412 - 335/330 | $0.70 | $4.10 | -68.00% |

| 8/1/2022 | 8/29/2022 | SPY | Bear Call Spread | September 16, 2022 439/444 | $0.70 | $0.07 | 14.42% |

| 8/11/2022 | 8/29/2022 | DIA | Bear Call Spread | September 23, 2022 350/325 | $0.75 | $0.08 | 15.47% |

| 8/11/2022 | 9/8/2022 | IWM | Iron Condor | September 23, 2022 220/215 - 173/168 | $0.77 | $0.57 | 4.17% |

| 9/7/2022 | 9/9/2022 | QQQ | Bull Put Spread | October 21, 2022 260/255 | $0.62 | $0.30 | 6.84% |

| 9/9/2022 | 9/15/2022 | SPY | Bear Call Spread | October 21, 2022 430/435 | $0.75 | $0.25 | 11.11% |

| 9/13/2022 | 10/17/2022 | IWM | Iron Condor | October 21, 2022 208/203 - 163/158 | $0.77 | $0.30 | 10.40% |

| 10/3/2022 | 10/25/2022 | SPY | Bull Put Spread | November 18, 2022 325/320 | $0.54 | $0.09 | 9.89% |

| 10/4/2022 | 11/2/2022 | IWM | Iron Condor | November 18, 2022 198/203 - 143/138 | $0.64 | $0.32 | 6.84% |

| 10/6/2022 | 11/2/2022 | SPY | Bear Call Spread | November 18, 2022 412/416 | $0.43 | $0.28 | 3.90% |

| 11/16/2022 | 11/28/2022 | IWM | Iron Condor | December 16, 2022 205/200 - 162/157 | $0.75 | $0.24 | 11.36% |

| 11/10/2022 | 12/6/2022 | SPY | Bear Call Spread | December 16, 2022 420/425 | $0.65 | $0.14 | 11.36% |

| 12/1/2022 | 12/6/2022 | SPY | Bear Call Spread | January 20, 2023 435/440 | $0.67 | $0.18 | 10.86% |

| 12/13/2022 | 12/15/2022 | SPY | Bear Call Spread | January 20, 2023 430/435 | $0.54 | $0.17 | 7.99% |

| 12/7/2023 | 1/6/2023 | IWM | Iron Condor | January 20, 2023 202/198 - 160/156 | $0.70 | $0.06 | 19.00% |

| 1/4/2023 | 2/1/2023 | IWM | Iron Condor | February 17, 2023 200/195 - 154/149 | $0.65 | $2.00 | -27.00% |

| 1/6/2023 | 2/2/2023 | SPY | Bear Call Spread | February 17, 2023 415/420 | $0.60 | $2.50 | -38.00% |

| 2/2/2023 | 2/15/2023 | SPY | Bear Call Spread | March 17, 2023 440/445 | $0.63 | $0.15 | 10.62% |

| 2/10/2023 | 2/22/2023 | DIA | Bear Call Spread | March 31, 2023 355/360 | $0.70 | $0.17 | 11.86% |

| 2/2/2023 | 3/1/2023 | IWM | Iron Condor | March 17, 2023 175/180 - 215/220 | $0.72 | $0.51 | 4.38% |

| 3/6/2023 | 3/13/2023 | DIA | Bear Call Spread | April 21, 2023 350/355 | $0.85 | $0.17 | 15.74% |

| 2/23/2023 | 3/28/2023 | SPY | Iron Condor | April 21, 2023 435/430 - 350/345 | $0.80 | $0.15 | 14.94% |

| 3/23/2023 | 4/11/2023 | DIA | Bear Call Spread | April 21, 2023 338/443 | $0.62 | $2.05 | -28.60% |

| 3/23/2023 | 4/19/2023 | IWM | Iron Condor | May 19, 2023 196/191 - 147/142 | $0.83 | $0.23 | 13.64% |

| 4/12/2023 | 4/21/2023 | DIA | Bear Call Spread | May 19, 2023 350/355 | $0.82 | $0.44 | 8.23% |

| 4/21/2023 | 5/2/2023 | SPY | Iron Condor | June 16, 2023 440/435 - 365/360 | $0.95 | $0.63 | 6.84% |

| 4/24/2023 | 5/10/2023 | DIA | Bear Call Spread | June 16, 2023 354/359 | $0.72 | $0.22 | 11.11% |

| 5/5/2023 | 5/24/023 | SPY | Bear Call Spread | June 16, 2023 430/435 | $0.72 | $0.35 | 7.99% |

| 6/15/2023 | 6/22/2023 | SPY | Bear Call Spread | August 18, 2023 465/470 | $0.70 | $0.24 | 10.13% |

| 5/26/2023 | 6/23/2023 | IWM | Iron Condor | July 21, 2023 191/196 - 156/151 | $0.79 | $0.50 | 6.15% |

| 5/31/2023 | 7/12/2023 | QQQ | Bear Call Spread | July 21, 2023 375/380 | $0.60 | $1.80 | -31.60% |

Volatility Talk

The VIX continues to be mired in the 13 to 15 range as complacency has officially taken over the market. Market sentiment has officially pushed into bullish territory as economic reports keep surprising to the upside. Simultaneously, inflation continues to ease, financial conditions are improving, and market insiders are buying Financials and Consumer Staples, all of which typically bode well for the continuation of a bullish move…and hence the almost two-months-long doldrums in the VIX. Until we see some shake-up in the market, expect to see ongoing complacency and a market that continues to trend higher…until it doesn’t. Trade accordingly. Remember, while everyone thinks something is going to occur in the market, no one knows with any certainty what is really going to happen…NO ONE!

Weekly High-Probability Mean Reversion Indicator

Below is my watch list of ETFs and stocks with the most liquid options headed into the week of July 24, 2023.

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

| Very Overbought | greater than or equal to 80.1 |

| Overbought | 60.1 to 80.0 |

| Neutral | 40.1 to 60 |

| Oversold | 20.1 to 40.0 |

| Very Oversold | less than or equal to 20.0 |

Each week I also include the current implied volatility (IV) and IV Rank. I look for an IV rank above 40, preferably higher.

ETF Watch List – Trade Ideas

| Exchange Traded Fund | Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought |

| ARK Innovation ETF | ARKK | 39.2 | 8.6 | 52.7 |

| ProShares Bitcoin ETF | BITO | 49.1 | 7.4 | 43.1 |

| SPDR Dow Jones | DIA | 12.6 | 3.4 | 81.1 |

| iShares MSCI Emerging Markets | EEM | 18.2 | 19.5 | 48.6 |

| iShares MSCI EAFE | EFA | 14.3 | 15.4 | 63.5 |

| iShares MSCI Mexico ETF | EWW | 20.0 | 11.9 | 41.9 |

| iShares MSCI Brazil | EWZ | 28.5 | 3.5 | 67.6 |

| iShares China Large-Cap | FXI | 30.4 | 12.2 | 47.8 |

| VanEck Gold Miners | GDX | 30.6 | 8 | 52.3 |

| SPDR Gold | GLD | 12.1 | 0.6 | 58.5 |

| iShares High-Yield | HYG | 7.5 | 4.5 | 59 |

| iShares Russell 2000 | IWM | 19.5 | 2.2 | 62.9 |

| SPDR Regional Bank | KRE | 35.4 | 17.1 | 71 |

| VanEck Oil Services | OIH | 33.6 | 7.7 | 76.6 |

| Invesco Nasdaq 100 | QQQ | 20.0 | 6.5 | 49.7 |

| iShares Silver Trust | SLV | 25.8 | 5 | 59.7 |

| VanEck Semiconductor | SMH | 28.3 | 11.4 | 46.3 |

| SPDR S&P 500 | SPY | 13.4 | 3.3 | 67.8 |

| iShares 20+ Treasury Bond | TLT | 13.5 | 3.2 | 51.9 |

| United States Oil Fund | USO | 29.2 | 4.1 | 69 |

| ProShares Ultra VIX Short | UVXY | 101.5 | 17.6 | 30.8 |

| CBOE Market Volatility Index | VIX | 93.3 | 41.4 | 44.6 |

| Barclays S&P 500 VIX ETN | VXX | 69.8 | 17.8 | 32.5 |

| SPDR Biotech | XLB | 15.5 | 4.9 | 64.4 |

| SPDR Energy Select | XLE | 22.8 | 1 | 69.1 |

| SPDR Financials | XLF | 15.7 | 0.3 | 77.6 |

| SPDR Utilities | XLU | 16.2 | 6.5 | 71.8 |

| SPDR S&P Oil & Gas Explorer | XOP | 29.6 | 0.8 | 71 |

| SPDR Retail | XRT | 23.4 | 15.4 | 55.3 |

Stock Watch List – Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| Apple | AAPL | 25.7 | 19.5 | 52.3 |

| Bank of America | BAC | 23.7 | 1.6 | 83.4 |

| Bristol-Myers Squibb | BMY | 21.2 | 24 | 73.5 |

| Citigroup | C | 23.9 | 2.9 | 53.2 |

| Caterpillar | CAT | 29.5 | 20.7 | 58.9 |

| Comcast | CMCSA | 32.1 | 18.7 | 66.1 |

| Costco | COST | 16.7 | 6.5 | 82.1 |

| Cisco Systems | CSCO | 25.9 | 34 | 65.6 |

| Chevron | CVX | 24.5 | 7.4 | 64.5 |

| Disney | DIS | 36.8 | 39.2 | 44.3 |

| Duke Energy | DUK | 22.4 | 18.6 | 70.8 |

| FedEx | FDX | 23.5 | 4 | 59.3 |

| Gilead Sciences | GILD | 26.1 | 27.7 | 81.8 |

| General Motors | GM | 34.6 | 11.8 | 38.4 |

| Intel | INTC | 45.4 | 43.1 | 54.8 |

| Johnson & Johnson | JNJ | 19.2 | 36.5 | 82.4 |

| JPMorgan | JPM | 18.5 | 3 | 77.8 |

| Coca-Cola | KO | 15.4 | 13 | 75.6 |

| Altria Group | MO | 19.0 | 16.7 | 56.8 |

| Merck | MRK | 23.6 | 34.9 | 60.7 |

| Morgan Stanley | MS | 21.8 | 3.3 | 86.7 |

| Microsoft | MSFT | 34.8 | 55.5 | 49.1 |

| NextEra Energy | NEE | 26.6 | 23.7 | 71.4 |

| Nvidia | NVDA | 51.1 | 28.6 | 46.9 |

| Pfizer | PFE | 26.8 | 33.1 | 70.3 |

| Paypal | PYPL | 46.9 | 26.4 | 64.9 |

| Starbucks | SBUX | 33.0 | 43 | 68.2 |

| AT&T | T | 34.9 | 63.5 | 48.7 |

| Verizon | VZ | 28.7 | 46 | 45.1 |

| Walgreens Boots Alliance | WBA | 29.1 | 12 | 62.3 |

| Wells Fargo | WFC | 26.6 | 3 | 66.9 |

| Walmart | WMT | 20.6 | 28.4 | 72.5 |

| Exxon Mobil | XOM | 26.4 | 5.8 | 53 |

Weekly Trade Discussion: Open Positions

*Portfolio updated every Monday

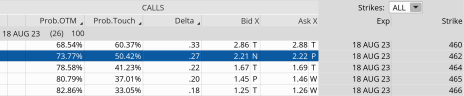

Bear Call: SPY August 18, 2023, 462/466 calls

Original trade published on 6-30-2023 (click to see original alert)

Background: At the time of the trade, SPY was trading for 442.50. We sold the August 18, 2023, SPY 462/466 bear call spread for $0.52. The expected range or move was 428 to 457. We placed our bear call spread 5 points higher than the expected move.

Current Thoughts: Not too much has changed since last week. SPY is now trading for 452.18, roughly $10 higher than when we placed the trade. The probability of success on our bear call sits at 73.77% and the delta of our short call sits at a fairly comfortable 0.27. With 26 days left until expiration our SPY bear call spread looks in good shape. Time decay has kicked in and is accelerating as each day passes, and if SPY stays around this area, or better yet, moves lower, we should be able to lock in a decent profit.

Call Side:

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Quant Trader issue will be published on

July 24, 2023.