Weekly Commentary

Wishing you all the best from the past holiday season and as we embark on the final trading week of the year. May the new year bring renewed energy and success in all your endeavors. Here’s to a bright and prosperous 2024!

Not much has changed since last week. So, as we enter one of the slowest trading weeks of the year, we currently have one open position, a SPY bear call spread due to expire in the January 19, 2024, expiration cycle.

As I stated last week, my hope is to add one, if not two more trades for the January 31, 2024, expiration cycle, although with volatility on the low side, we might have to go out a bit further in duration. The challenge when volatility is low is finding a highly liquid ETF or stock with a decent IV rank, and therefore, at least in most cases, some decent options premium. So again, if premium just isn’t there, we might have to extend the duration on the trade, possibly going out to the February 16, 2024, expiration cycle. Either way, I intend on adding an iron condor, and hopefully a bull put spread to the mix. Of course, a slight pullback would make things easier.

On another note, I’m looking at a few different volatility plays. With the VIX hitting four-year lows last week, I wouldn’t mind having a bit of volatility exposure just in case volatility popped over the next three to six months. I’ll send out an alert, if and when, I decide to take a position.

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Current Portfolio

Open Trades | |||||||

| Open Date | Ticker | Strategy | Trade | Open Price | Current Price | Current Probability | Delta |

| 12/1/2023 | SPY | Bear Call | January 19, 2024 475/480 | $0.75 | $2.37 | 48.90% | -0.14 |

| Open Date | Closed Date | Ticker | Strategy | Trade | Open Price | Closing Price | Return |

| 6/2/2022 | 6/13/2022 | SPY | Bear Call Spread | July 15, 2022 440/445 | $0.70 | $0.05 | 14.94% |

| 6/8/2022 | 6/17/2022 | XOP | Bear Call Spread | July 15, 2022 190/195 | $0.70 | $0.04 | 15.21% |

| 6/22/2022 | 7/13/2022 | SPY | Bear Call Spread | July 29, 2022 405/410 | $0.75 | $0.35 | 8.70% |

| 6/30/2022 | 7/25/2022 | IWM | Iron Condor | August 19, 2022 195/200 - 145/140 | $0.70 | $0.34 | 7.76% |

| 7/8/2022 | 7/28/2022 | GLD | Bull Put Spread | August 19, 2022 155/150 | $0.60 | $0.16 | 9.65% |

| 7/14/2022 | 8/11/2022 | SPY | Iron Condor | August 19, 2022 417/412 - 335/330 | $0.70 | $4.10 | -68.00% |

| 8/1/2022 | 8/29/2022 | SPY | Bear Call Spread | September 16, 2022 439/444 | $0.70 | $0.07 | 14.42% |

| 8/11/2022 | 8/29/2022 | DIA | Bear Call Spread | September 23, 2022 350/325 | $0.75 | $0.08 | 15.47% |

| 8/11/2022 | 9/8/2022 | IWM | Iron Condor | September 23, 2022 220/215 - 173/168 | $0.77 | $0.57 | 4.17% |

| 9/7/2022 | 9/9/2022 | QQQ | Bull Put Spread | October 21, 2022 260/255 | $0.62 | $0.30 | 6.84% |

| 9/9/2022 | 9/15/2022 | SPY | Bear Call Spread | October 21, 2022 430/435 | $0.75 | $0.25 | 11.11% |

| 9/13/2022 | 10/17/2022 | IWM | Iron Condor | October 21, 2022 208/203 - 163/158 | $0.77 | $0.30 | 10.40% |

| 10/3/2022 | 10/25/2022 | SPY | Bull Put Spread | November 18, 2022 325/320 | $0.54 | $0.09 | 9.89% |

| 10/4/2022 | 11/2/2022 | IWM | Iron Condor | November 18, 2022 198/203 - 143/138 | $0.64 | $0.32 | 6.84% |

| 10/6/2022 | 11/2/2022 | SPY | Bear Call Spread | November 18, 2022 412/416 | $0.43 | $0.28 | 3.90% |

| 11/16/2022 | 11/28/2022 | IWM | Iron Condor | December 16, 2022 205/200 - 162/157 | $0.75 | $0.24 | 11.36% |

| 11/10/2022 | 12/6/2022 | SPY | Bear Call Spread | December 16, 2022 420/425 | $0.65 | $0.14 | 11.36% |

| 12/1/2022 | 12/6/2022 | SPY | Bear Call Spread | January 20, 2023 435/440 | $0.67 | $0.18 | 10.86% |

| 12/13/2022 | 12/15/2022 | SPY | Bear Call Spread | January 20, 2023 430/435 | $0.54 | $0.17 | 7.99% |

| 12/7/2023 | 1/6/2023 | IWM | Iron Condor | January 20, 2023 202/198 - 160/156 | $0.70 | $0.06 | 19.00% |

| 1/4/2023 | 2/1/2023 | IWM | Iron Condor | February 17, 2023 200/195 - 154/149 | $0.65 | $2.00 | -27.00% |

| 1/6/2023 | 2/2/2023 | SPY | Bear Call Spread | February 17, 2023 415/420 | $0.60 | $2.50 | -38.00% |

| 2/2/2023 | 2/15/2023 | SPY | Bear Call Spread | March 17, 2023 440/445 | $0.63 | $0.15 | 10.62% |

| 2/10/2023 | 2/22/2023 | DIA | Bear Call Spread | March 31, 2023 355/360 | $0.70 | $0.17 | 11.86% |

| 2/2/2023 | 3/1/2023 | IWM | Iron Condor | March 17, 2023 175/180 - 215/220 | $0.72 | $0.51 | 4.38% |

| 3/6/2023 | 3/13/2023 | DIA | Bear Call Spread | April 21, 2023 350/355 | $0.85 | $0.17 | 15.74% |

| 2/23/2023 | 3/28/2023 | SPY | Iron Condor | April 21, 2023 435/430 - 350/345 | $0.80 | $0.15 | 14.94% |

| 3/23/2023 | 4/11/2023 | DIA | Bear Call Spread | April 21, 2023 338/443 | $0.62 | $2.05 | -28.60% |

| 3/23/2023 | 4/19/2023 | IWM | Iron Condor | May 19, 2023 196/191 - 147/142 | $0.83 | $0.23 | 13.64% |

| 4/12/2023 | 4/21/2023 | DIA | Bear Call Spread | May 19, 2023 350/355 | $0.82 | $0.44 | 8.23% |

| 4/21/2023 | 5/2/2023 | SPY | Iron Condor | June 16, 2023 440/435 - 365/360 | $0.95 | $0.63 | 6.84% |

| 4/24/2023 | 5/10/2023 | DIA | Bear Call Spread | June 16, 2023 354/359 | $0.72 | $0.22 | 11.11% |

| 5/5/2023 | 5/24/023 | SPY | Bear Call Spread | June 16, 2023 430/435 | $0.72 | $0.35 | 7.99% |

| 6/15/2023 | 6/22/2023 | SPY | Bear Call Spread | August 18, 2023 465/470 | $0.70 | $0.24 | 10.13% |

| 5/26/2023 | 6/23/2023 | IWM | Iron Condor | July 21, 2023 191/196 - 156/151 | $0.79 | $0.50 | 6.15% |

| 5/31/2023 | 7/12/2023 | QQQ | Bear Call Spread | July 21, 2023 375/380 | $0.60 | $1.80 | -31.60% |

| 6/30/2023 | 8/7/2023 | SPY | Bear Call Spread | August 18, 2023 462/466 | $0.52 | $0.23 | 7.82% |

| 8/4/2023 | 8/11/2023 | SPY | Bear Call Spread | September 15, 2023 470/475 | $0.65 | $0.20 | 9.90% |

| 8/17/2023 | 9/13/2023 | SPY | Iron Condor | October 20, 2023 475/470 - 390/385 | $0.72 | $0.25 | 10.38% |

| 9/6/2023 | 10/11/2023 | IWM | Iron Condor | October 20, 2023 204/199 - 169/164 | $0.62 | $0.19 | 9.41% |

| * 9/29/2023 | 10/27/2023 | SPY | Bear Call Spread | November 17, 2023 452/457 | $0.74 | $0.03 | 16.60% |

| *10/6/2023 | 11/3/2023 | SPY | Bull Put Spread | November 17, 2023 408/403 | $0.58 | $0.03 | 12.36% |

| * 10/27/2023 | 11/3/2023 | SPY | Bear Call Spread | November 17, 2023 430/435 | $0.58 | $3.50 | -33.20% |

| 10/31/2023 | 11/14/2023 | SPY | Iron Condor | December 15, 2023 450/445 - 380/375 | $0.77 | $3.00 | -44.60% |

| 11/6/2023 | 12/8/2023 | SPY | Bear Call Spread | December 15, 2023 456/461 | $0.58 | $3.08 | -50.00% |

Volatility Talk

Volatility, as seen through the VIX, hit its lowest point since 2019 two weeks ago. Since then, the volatility index has crept higher to back above 13, even testing 14.5 midday Thursday before eventually closing out the week at 13.03.

I want to reiterate what I stated last week, we are starting to see lots of mixed signals. While sentiment has shifted to the bull side, quite quickly, the “bandwagon” effect is rearing its head. And while it will be an interesting battle between the bulls and bear going forward, there is no doubt complacency is currently dominating the psyche of market participants and this is clearly seen through the “performance” of the volatility gauge. So, for those who use options selling strategies, opportunities become more challenging. Remember, volatility is a major component of the options pricing model, so when volatility is low, so are options prices (premium).

Weekly High-Probability Mean Reversion Indicator

Below is my watch list of ETFs and stocks with the most liquid options headed into the week of December 26, 2023.

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

| Very Overbought | a reading greater than or equal to 80.0 |

| Overbought | greater than or equal to 60.0 |

| Neutral | between 40 to 60 |

| Oversold | less than or equal to 40.0 |

| Very Oversold | less than or equal to 20.0. |

Each week I also include the current implied volatility (IV) and IV Rank. I look for an IV rank above 40, preferably higher.

ETF Watch List – Trade Ideas

| Exchange Traded Fund | Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought |

| ARK Innovation ETF | ARKK | 40.5 | 27.2 | 68.1 |

| Proshares Bitcoin ETF | BITO | 72.9 | 56.9 | 61.9 |

| SPDR Dow Jones | DIA | 12.4 | 15.7 | 68.9 |

| iShares MSCI Emerging Markets | EEM | 17.3 | 23.6 | 47 |

| iShares MSCI EAFE | EFA | 12.5 | 9.6 | 60.2 |

| iShares MSCI Mexico ETF | EWW | 19.7 | 18.6 | 64.7 |

| iShares MSCI Brazil | EWZ | 24.9 | 0 | 53.5 |

| iShares China Large-Cap | FXI | 29.0 | 18.1 | 35.1 |

| Vaneck Gold Miners | GDX | 31.5 | 35.3 | 61.6 |

| SPDR Gold | GLD | 15.1 | 38.9 | 64 |

| iShares High-Yield | HYG | 7.3 | 17.6 | 79.3 |

| iShares Russell 2000 | IWM | 23.1 | 39.7 | 73 |

| SPDR Regional Bank | KRE | 31.9 | 20 | 65.2 |

| Vaneck Oil Services | OIH | 28.8 | 11.7 | 59.7 |

| Invesco Nasdaq 100 | QQQ | 17.2 | 10.3 | 70.3 |

| iShares Silver Trust | SLV | 26.0 | 24 | 55.5 |

| Vaneck Semiconductor | SMH | 24.0 | 17.9 | 65.7 |

| SPDR S&P 500 | SPY | 13.4 | 10.3 | 67 |

| iShares 20+ Treasury Bond | TLT | 16.9 | 24.4 | 63.8 |

| United States Oil Fund | USO | 35.8 | 33.9 | 55.3 |

| Proshares Ultra VIX Short | UVXY | 93.5 | 9.5 | 46 |

| CBOE Market Volatility Index | VIX | 92.0 | 43.8 | 52.2 |

| Barclays S&P 500 VIX ETN | VXX | 64.7 | 11.3 | 46.8 |

| SPDR Biotech | XLB | 13.7 | 7.5 | 67.7 |

| SPDR Energy Select | XLE | 21.7 | 9.5 | 60.8 |

| SPDR Financials | XLF | 16.1 | 8.5 | 64 |

| SPDR Utilities | XLU | 18.5 | 33.7 | 41.7 |

| SPDR S&P Oil & Gas Explorer | XOP | 27.2 | 11.7 | 61.7 |

| SPDR Retail | XRT | 25.0 | 39.5 | 68.9 |

Stock Watch List – Trade Ideas

| Stock - Quant Trader | Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought |

| Apple | AAPL | 19.1 | 6.3 | 43.6 |

| Bank of America | BAC | 30.2 | 24.5 | 70.9 |

| Bristol-Myers Squibb | BMY | 27.0 | 83.1 | 63.9 |

| Citigroup | C | 30.2 | 21.0 | 70.4 |

| Caterpillar | CAT | 24.7 | 19.3 | 84.7 |

| Comcast | CMCSA | 25.4 | 33.7 | 58.1 |

| Costco | COST | 19.4 | 29.0 | 70.7 |

| Cisco Systems | CSCO | 16.4 | 9.5 | 63.7 |

| Chevron | CVX | 22.3 | 21.8 | 69.4 |

| Disney | DIS | 24.9 | 18.5 | 40.1 |

| Duke Energy | DUK | 17.3 | 17.5 | 62.3 |

| Fedex | FDX | 23.0 | 7.9 | 24.6 |

| Gilead Sciences | GILD | 26.4 | 20.5 | 52.9 |

| General Motors | GM | 29.8 | 11.1 | 70.4 |

| Intel | INTC | 36.1 | 29.9 | 74.4 |

| Johnson & Johnson | JNJ | 18.1 | 39.1 | 52.5 |

| JP Morgan | JPM | 21.4 | 16.5 | 77.7 |

| Coca-Cola | KO | 14.7 | 22.5 | 46.2 |

| Altria Group | MO | 16.4 | 18.2 | 31.2 |

| Merck | MRK | 17.8 | 13.0 | 67.2 |

| Morgan Stanley | MS | 27.2 | 24.3 | 79.4 |

| Microsoft | MSFT | 22.9 | 16.7 | 56.4 |

| Nextera Energy | NEE | 29.0 | 46.3 | 44.8 |

| Nvidia | NVDA | 35.6 | 6.6 | 55.1 |

| Pfizer | PFE | 28.2 | 58.6 | 55.2 |

| Paypal | PYPL | 35.9 | 24.6 | 60.4 |

| Starbucks | SBUX | 20.7 | 23.9 | 34.2 |

| AT&T | T | 24.2 | 31.1 | 50.9 |

| Verizon | VZ | 22.8 | 34.7 | 48.2 |

| Walgreens Boots Alliance | WBA | 54.4 | 96.8 | 77.9 |

| Wells Fargo | WFC | 28.6 | 17.9 | 64.8 |

| Walmart | WMT | 16.7 | 23.8 | 62.4 |

| Exxon Mobil | XOM | 23.7 | 17.7 | 54.7 |

Weekly Trade Discussion: Open Positions

*Portfolio updated every Monday

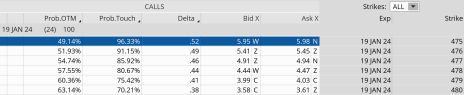

Bear Call Spread: SPY January 19, 2024, 475/480

Original trade published on 12-1-2023 (click to see original alert)

Background: At the time of the trade, SPY was trading for roughly 458.50. We sold the January 19, 2024, SPY 475/480 bear call spread for $0.75. The expected range or move was 442 to 472. The probability of success at the time of the trade was 82.51% on the call side.

Current Thoughts: SPY is roughly $15 higher since we added our bear call spread. As a result, our probability of success on the trade stands at 49.14%. The price of the bear call spread is currently $2.37. We need to see a short-term pullback to get this trade back on the dancefloor. Otherwise, we will simply exit the trade and move on to the next opportunity.

Call Side:

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Quant Trader issue will be

published on January 2, 2024.