We currently have two positions open, both of which have a probability of success higher than 84%.

With December expiration quickly approaching (45 days) I plan on adding several new positions this week. We want to have, at the minimum, one bullish, bearish and neutral trade for each expiration cycle and December is no different.

My hope is that we have the ability to take our open trades off the table this month for a profit. Both trades are due to expire at the November expiration cycle in 18 days. Time decay is accelerating as each day passes and a move lower would make it easier to take the trades off the table over the next few days for some nice profits.

Current Portfolio

| Open Trades | |||||||

| Open Date | Ticker | Strategy | Trade | Open Price | Current Price | Current Probability | Delta |

| 10/4/2022 | IWM | Iron Condor | November 18, 2022 198/203 – 143/138 | $0.64 | $0.55 | 86.39% – 98.74% | -6 |

| 10/6/2022 | SPY | Bear Call | November 18, 2022 412/416 | $0.43 | $0.64 | 84.38% | -4 |

| Closed Trades | |||||||

| Open Date | Closed Date | Ticker | Strategy | Trade | Open Price | Closing Price | Return |

| 6/2/2022 | 6/13/2022 | SPY | Bear Call Spread | July 15, 2022 440/445 | $0.70 | $0.05 | 14.94% |

| 6/8/2022 | 6/17/2022 | XOP | Bear Call Spread | July 15, 2022 190/195 | $0.70 | $0.04 | 15.21% |

| 6/22/2022 | 7/13/2022 | SPY | Bear Call Spread | July 29, 2022 405/410 | $0.75 | $0.35 | 8.70% |

| 6/30/2022 | 7/25/2022 | IWM | Iron Condor | August 19, 2022 195/200 – 145/140 | $0.70 | $0.34 | 7.76% |

| 7/8/2022 | 7/28/2022 | GLD | Bull Put Spread | August 19, 2022 155/150 | $0.60 | $0.16 | 9.65% |

| 7/14/2022 | 8/11/2022 | SPY | Iron Condor | August 19, 2022 417/412 – 335/330 | $0.70 | $4.10 | -68.00% |

| 8/1/2022 | 8/29/2022 | SPY | Bear Call Spread | September 16, 2022 439/444 | $0.70 | $0.07 | 14.42% |

| 8/11/2022 | 8/29/2022 | DIA | Bear Call Spread | September 23, 2022 350/325 | $0.75 | $0.08 | 15.47% |

| 8/11/2022 | 9/8/2022 | IWM | Iron Condor | September 23, 2022 220/215 – 173/168 | $0.77 | $0.57 | 4.17% |

| 9/7/2022 | 9/9/2022 | QQQ | Bull Put Spread | October 21, 2022 260/255 | $0.62 | $0.30 | 6.84% |

| 9/9/2022 | 9/15/2022 | SPY | Bear Call Spread | October 21, 2022 430/435 | $0.75 | $0.25 | 11.11% |

| 9/13/2022 | 10/17/2022 | IWM | Iron Condor | October 21, 2022 208/203 – 163/158 | $0.77 | $0.30 | 10.40% |

| 10/3/2022 | 10/25/2022 | SPY | Bull Put Spread | November 18, 2022 325/320 | $0.54 | $0.09 | 9.89% |

Volatility Talk

The VIX broke below the near-term range of 28 to 35 to close out last week at 25.75. The question is, how much lower will the fear gauge go? Is the market becoming more at ease with ongoing inflationary and geopolitical concerns?

The VIX is very oversold at the moment, so it wouldn’t surprise me to see a near-term bounce off oversold levels. If a bounce occurs, we will intently watch how the index responds to the 28 level. Will it act as support or resistance?

Weekly High-Probability Mean Reversion Indicator

Below is my watch list of ETFs and stocks with the most liquid options headed into the week of October 31, 2022.

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

| Very Overbought | greater than or equal to 80.1 |

| Overbought | 60.1 to 80.0 |

| Neutral | 40.1 to 60 |

| Oversold | 20.1 to 40.0 |

| Very Oversold | less than or equal to 20.0 |

Each week I also include the current implied volatility (IV) and IV Rank. I look for an IV rank above 40, preferably higher.

ETF Watch List – Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| ARK Innovation ETF | ARKK | 62.9 | 46.4 | 65.9 |

| Proshares Bitcoin ETF | BITO | 65.4 | 9.4 | 71.5 |

| SPDR Dow Jones | DIA | 23.6 | 52.5 | 86.1 |

| iShares MSCI Emerging Markets | EEM | 26.8 | 47.9 | 41.7 |

| iShares MSCI EAFE | EFA | 25.8 | 41.9 | 68.4 |

| iShares MSCI Mexico ETF | EWW | 29.4 | 43.5 | 83.9 |

| iShares MSCI Brazil | EWZ | 55.9 | 86.4 | 46.5 |

| iShares China Large-Cap | FXI | 53.1 | 60.6 | 27.5 |

| Vaneck Gold Miners | GDX | 45.7 | 55.8 | 58.4 |

| SPDR Gold | GLD | 17.5 | 20.2 | 41.7 |

| iShares High-Yield | HYG | 17.0 | 55.1 | 76.3 |

| iShares Russell 2000 | IWM | 30.2 | 48.6 | 75.5 |

| SPDR Regional Bank | KRE | 34.5 | 27.4 | 67.6 |

| Vaneck Oil Services | OIH | 50.7 | 41 | 78.5 |

| Invesco Nasdaq 100 | QQQ | 31.3 | 63.2 | 59.5 |

| iShares Silver Trust | SLV | 35.2 | 43.9 | 51.25 |

| Vaneck Semiconductor | SMH | 41.2 | 58.5 | 65.1 |

| SPDR S&P 500 | SPY | 25.4 | 56.5 | 69.9 |

| iShares 20+ Treasury Bond | TLT | 26.2 | 60.3 | 48 |

| United States Oil Fund | USO | 46.8 | 38.8 | 61.6 |

| Proshares Ultra VIX Short | UVXY | 87.8 | 2.1 | 18.4 |

| CBOE Market Volatility Index | VIX | 66.3 | 7.8 | 18.2 |

| Barclays S&P 500 VIX ETN | VXX | 60.2 | 6.6 | 17.7 |

| SPDR Biotech | XLB | 28.7 | 49.9 | 70.6 |

| SPDR Energy Select | XLE | 37.8 | 40.8 | 81.5 |

| SPDR Financials | XLF | 27.0 | 31.2 | 77.4 |

| SPDR Utilities | XLU | 26.8 | 58.4 | 69 |

| SPDR S&P Oil & Gas Explorer | XOP | 47.2 | 22.3 | 63.9 |

| SPDR Retail | XRT | 42.4 | 47.6 | 72.6 |

Stock Watch List – Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| Apple | AAPL | 40.8 | 40.8 | 67.6 |

| Bank of America | BAC | 34.6 | 34.6 | 77.8 |

| Bristol-Myers Squibb | BMY | 23.7 | 19.9 | 82.9 |

| Citigroup | C | 34.3 | 30.3 | 73.8 |

| Caterpillar | CAT | 34.3 | 34.6 | 90.4 |

| Comcast | CMCSA | 38.9 | 39.5 | 71.5 |

| Costco | COST | 30.0 | 29.6 | 75 |

| Cisco Systems | CSCO | 36.8 | 51.6 | 85.8 |

| Chevron | CVX | 33.6 | 46.6 | 85.9 |

| Disney | DIS | 43.8 | 46.2 | 75.2 |

| Duke Energy | DUK | 28.3 | 39.5 | 67.8 |

| Fedex | FDX | 36.1 | 38.6 | 65.8 |

| Gilead Sciences | GILD | 31.8 | 39.9 | 91.5 |

| General Motors | GM | 45.4 | 39.4 | 82.2 |

| Intel | INTC | 42.3 | 50.9 | 71.4 |

| Johnson & Johnson | JNJ | 20.8 | 20.9 | 83.2 |

| JP Morgan | JPM | 30.3 | 28.4 | 80.7 |

| Coca-Cola | KO | 25.1 | 35.3 | 80.9 |

| Altria Group | MO | 27.1 | 30.5 | 65.2 |

| Merck | MRK | 23.7 | 13.4 | 87.4 |

| Morgan Stanley | MS | 33.7 | 34.7 | 65 |

| Microsoft | MSFT | 33.8 | 43.7 | 48.5 |

| Nextera Energy | NEE | 34.0 | 49.6 | 67.6 |

| Nvidia | NVDA | 65.9 | 49.5 | 74.4 |

| Pfizer | PFE | 31.1 | 29.8 | 78.8 |

| Paypal | PYPL | 68.0 | 66.7 | 49.6 |

| Starbucks | SBUX | 42.7 | 72.1 | 52.2 |

| AT&T | T | 28.4 | 35.3 | 85.9 |

| Verizon | VZ | 27.7 | 43.5 | 61.4 |

| Walgreens Boots Alliance | WBA | 31 | 27.2 | 82.1 |

| Wells Fargo | WFC | 33.9 | 31 | 77.4 |

| Walmart | WMT | 30.1 | 33.9 | 80.5 |

| Exxon Mobil | XOM | 34.3 | 30.1 | 83.3 |

Weekly Trade Discussion: Open Positions

*Portfolio updated every Monday

Iron Condor: IWM November 18, 2022, 198/203 calls – 143/138 putsOriginal trade published on 10-4-2022 (click to see original alert)

Background: At the time of the trade, IWM was trading for 174.86. We sold the November 18, 2022, IWM 198/203 – 143/138 iron condor for $0.64 with a 90.48% (upside) and 90.49% (downside) probability of success. The expected range was 160 to 190.

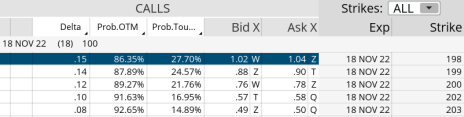

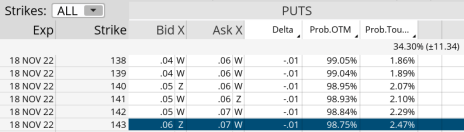

Current Thoughts:vIWM is currently trading for 183.16, and our iron condor is worth $0.55. Our probability of success stands at 86.35% on the call side and 98.75% on the put side.

With 18 days left until expiration, our November IWM iron condor is in great shape at the moment. Our probabilities of success, on both sides, remain incredibly high and if IWM manages to stay around this area over the next week or so we should have the opportunity to take off our trade early for a nice profit.

The only concern we have is if IWM continues to trend sharply higher over the next few trading days. If that occurs we should have the ability to adjust our trade by most likely rolling out and up several strikes for the following expiration cycle. But again, this would take a sharp move. Time decay is working in our favor and we still have an 8.2% cushion to the upside in an ETF that sits in a short-term “very overbought” state.

Call Side:

Put Side:

Bear Call: SPY November 18, 2022, 412/416 calls

Original trade published on 10-6-2022 (click to see original alert)

Background: At the time of the trade, SPY was trading for 374.50. We sold the November 18, 2022, SPY 412/416 bear call for $0.43 with an 89.44% probability of success. The expected range was 348 to 401.

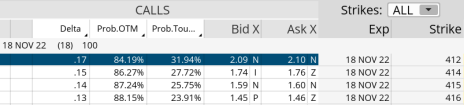

Current ThoughtS: SPY is currently trading for 389.02 and our bear call is worth $0.64. Our probability of success stands at 84.19% and the probability of touch is 31.94%.

With 18 days left, our SPY bear call spread remains in good shape. But like our IWM position, the one concern we have is if SPY continues to trend sharply higher over the next few trading days. If that occurs, again just like our IWM trade, we should have the ability to adjust our trade by most likely rolling out and up several strikes for the following expiration cycle. But again, this would take a sharp move. Time decay is working in our favor and we still have a 5.9% cushion to the upside in another ETF that also sits in a short-term “very overbought” state.

The next Cabot Options Institute – Quant Trader issue will be published on November 7, 2022.