Weekly Commentary

We have two positions on at the moment, both due to expire at the June 16 expiration date. Fortunately, both are hovering around the same price we sold them for, so all is well at the moment. And given we are leaning slightly bearish in both positions, a move lower should certainly help both positions and possibly lead to some early profit taking.

My hope this week is to add one more trade to the June 16 expiration cycle, preferably a bullish leaning trade to balance out the deltas in the portfolio. Otherwise, we will simply sit on our hands and allow time decay to work in our favor.

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Current Portfolio

Open Trades | |||||||

| Open Date | Ticker | Strategy | Trade | Open Price | Current Price | Current Probability | Delta |

| 4/24/2023 | DIA | Bear Call | June 16, 2023 354/359 | $0.72 | $0.92 | 80.15% | -0.1 |

| 4/21/2023 | SPY | Iron Condor | June 16, 2023 440/435 - 365/360 | $0.95 | $0.93 | 83.65% - 92.57% | -0.05 |

| Open Date | Closed Date | Ticker | Strategy | Trade | Open Price | Closing Price | Return |

| 6/2/2022 | 6/13/2022 | SPY | Bear Call Spread | July 15, 2022 440/445 | $0.70 | $0.05 | 14.94% |

| 6/8/2022 | 6/17/2022 | XOP | Bear Call Spread | July 15, 2022 190/195 | $0.70 | $0.04 | 15.21% |

| 6/22/2022 | 7/13/2022 | SPY | Bear Call Spread | July 29, 2022 405/410 | $0.75 | $0.35 | 8.70% |

| 6/30/2022 | 7/25/2022 | IWM | Iron Condor | August 19, 2022 195/200 - 145/140 | $0.70 | $0.34 | 7.76% |

| 7/8/2022 | 7/28/2022 | GLD | Bull Put Spread | August 19, 2022 155/150 | $0.60 | $0.16 | 9.65% |

| 7/14/2022 | 8/11/2022 | SPY | Iron Condor | August 19, 2022 417/412 - 335/330 | $0.70 | $4.10 | -68.00% |

| 8/1/2022 | 8/29/2022 | SPY | Bear Call Spread | September 16, 2022 439/444 | $0.70 | $0.07 | 14.42% |

| 8/11/2022 | 8/29/2022 | DIA | Bear Call Spread | September 23, 2022 350/325 | $0.75 | $0.08 | 15.47% |

| 8/11/2022 | 9/8/2022 | IWM | Iron Condor | September 23, 2022 220/215 - 173/168 | $0.77 | $0.57 | 4.17% |

| 9/7/2022 | 9/9/2022 | QQQ | Bull Put Spread | October 21, 2022 260/255 | $0.62 | $0.30 | 6.84% |

| 9/9/2022 | 9/15/2022 | SPY | Bear Call Spread | October 21, 2022 430/435 | $0.75 | $0.25 | 11.11% |

| 9/13/2022 | 10/17/2022 | IWM | Iron Condor | October 21, 2022 208/203 - 163/158 | $0.77 | $0.30 | 10.40% |

| 10/3/2022 | 10/25/2022 | SPY | Bull Put Spread | November 18, 2022 325/320 | $0.54 | $0.09 | 9.89% |

| 10/4/2022 | 11/2/2022 | IWM | Iron Condor | November 18, 2022 198/203 - 143/138 | $0.64 | $0.32 | 6.84% |

| 10/6/2022 | 11/2/2022 | SPY | Bear Call Spread | November 18, 2022 412/416 | $0.43 | $0.28 | 3.90% |

| 11/16/2022 | 11/28/2022 | IWM | Iron Condor | December 16, 2022 205/200 - 162/157 | $0.75 | $0.24 | 11.36% |

| 11/10/2022 | 12/6/2022 | SPY | Bear Call Spread | December 16, 2022 420/425 | $0.65 | $0.14 | 11.36% |

| 12/1/2022 | 12/6/2022 | SPY | Bear Call Spread | January 20, 2023 435/440 | $0.67 | $0.18 | 10.86% |

| 12/13/2022 | 12/15/2022 | SPY | Bear Call Spread | January 20, 2023 430/435 | $0.54 | $0.17 | 7.99% |

| 12/7/2023 | 1/6/2023 | IWM | Iron Condor | January 20, 2023 202/198 - 160/156 | $0.70 | $0.06 | 19.00% |

| 1/4/2023 | 2/1/2023 | IWM | Iron Condor | February 17, 2023 200/195 - 154/149 | $0.65 | $2.00 | -27.00% |

| 1/6/2023 | 2/2/2023 | SPY | Bear Call Spread | February 17, 2023 415/420 | $0.60 | $2.50 | -38.00% |

| 2/2/2023 | 2/15/2023 | SPY | Bear Call Spread | March 17, 2023 440/445 | $0.63 | $0.15 | 10.62% |

| 2/10/2023 | 2/22/2023 | DIA | Bear Call Spread | March 31, 2023 355/360 | $0.70 | $0.17 | 11.86% |

| 2/2/2023 | 3/1/2023 | IWM | Iron Condor | March 17, 2023 175/180 - 215/220 | $0.72 | $0.51 | 4.38% |

| 3/6/2023 | 3/13/2023 | DIA | Bear Call Spread | April 21, 2023 350/355 | $0.85 | $0.17 | 15.74% |

| 2/23/2023 | 3/28/2023 | SPY | Iron Condor | April 21, 2023 435/430 - 350/345 | $0.80 | $0.15 | 14.94% |

| 3/23/2023 | 4/11/2023 | DIA | Bear Call Spread | April 21, 2023 338/443 | $0.62 | $2.05 | -28.60% |

| 3/23/2023 | 4/19/2023 | IWM | Iron Condor | May 19, 2023 196/191 - 147/142 | $0.83 | $0.23 | 13.64% |

| 4/12/2023 | 4/21/2023 | DIA | Bear Call Spread | May 19, 2023 350/355 | $0.82 | $0.44 | 8.23% |

| 117.68% | |||||||

Volatility Talk

Well, the short-term overbought state led to a short-term pullback early last week. However, the sharp decline didn’t last long as the bulls stepped back in Thursday and Friday to help push the VIX back down to new lows.

For a moment, the VIX bounced to 19 from 16.50. But again, the move wasn’t sustainable. So, the question now is whether the VIX continues to slide lower or if we see another mean-reversion pop like we did early last week. With IV ranks low across the board and many of the underlying stocks and ETFs we follow back in a short-term overbought state my guess is we see the bears attempt to rally the VIX again.

Weekly High-Probability Mean Reversion Indicator

Below is my watch list of ETFs and stocks with the most liquid options headed into the week of May 1, 2023.

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

| Very Overbought | greater than or equal to 80.1 |

| Overbought | 60.1 to 80.0 |

| Neutral | 40.1 to 60 |

| Oversold | 20.1 to 40.0 |

| Very Oversold | less than or equal to 20.0 |

Each week I also include the current implied volatility (IV) and IV Rank. I look for an IV rank above 40, preferably higher.

ETF Watch List – Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| ARK Innovation ETF | ARKK | 41.2 | 3.3 | 33.6 |

| Proshares Bitcoin ETF | BITO | 53.4 | 3.2 | 56.2 |

| SPDR Dow Jones | DIA | 14.3 | 3.1 | 64.7 |

| iShares MSCI Emerging Markets | EEM | 15.8 | 1.8 | 51.9 |

| iShares MSCI EAFE | EFA | 16.2 | 1.3 | 62.8 |

| iShares MSCI Mexico ETF | EWW | 20.7 | 2.5 | 65 |

| iShares MSCI Brazil | EWZ | 30.9 | 0.5 | 55.9 |

| iShares China Large-Cap | FXI | 27.4 | 0.1 | 47.6 |

| Vaneck Gold Miners | GDX | 33.9 | 0.8 | 45.3 |

| SPDR Gold | GLD | 16.1 | 22.6 | 46.2 |

| iShares High-Yield | HYG | 9.5 | 2.1 | 62.5 |

| iShares Russell 2000 | IWM | 21.3 | 5.2 | 48.6 |

| SPDR Regional Bank | KRE | 40.6 | 27.8 | 50.8 |

| Vaneck Oil Services | OIH | 38.9 | 7 | 43 |

| Invesco Nasdaq 100 | QQQ | 20.6 | 4.7 | 66.8 |

| iShares Silver Trust | SLV | 28.4 | 6.3 | 54.2 |

| Vaneck Semiconductor | SMH | 27.6 | 4.7 | 49 |

| SPDR S&P 500 | SPY | 16.1 | 3.4 | 64.7 |

| iShares 20+ Treasury Bond | TLT | 17.0 | 1.9 | 57 |

| United States Oil Fund | USO | 35.6 | 12.1 | 46.4 |

| Proshares Ultra VIX Short | UVXY | 106.8 | 20 | 30.7 |

| CBOE Market Volatility Index | VIX | 84.3 | 26.8 | 31.8 |

| Barclays S&P 500 VIX ETN | VXX | 69.1 | 17.4 | 31.7 |

| SPDR Biotech | XLB | 18.0 | 0.5 | 52.9 |

| SPDR Energy Select | XLE | 25.7 | 3.2 | 51.3 |

| SPDR Financials | XLF | 19.7 | 3.9 | 60.2 |

| SPDR Utilities | XLU | 17.2 | 7.2 | 48.4 |

| SPDR S&P Oil & Gas Explorer | XOP | 34.7 | 1.5 | 47.8 |

| SPDR Retail | XRT | 26.6 | 8.5 | 44.3 |

Stock Watch List – Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| Apple | AAPL | 28.1 | 8.9 | 71.5 |

| Bank of America | BAC | 29.7 | 12.8 | 51.7 |

| Bristol-Myers Squibb | BMY | 20.4 | 7 | 20.6 |

| Citigroup | C | 27.9 | 7.9 | 37.2 |

| Caterpillar | CAT | 27.6 | 0..8 | 47 |

| Comcast | CMCSA | 21.4 | 8 | 79.8 |

| Costco | COST | 22.9 | 7.9 | 55.3 |

| Cisco Systems | CSCO | 27.2 | 21.3 | 37.1 |

| Chevron | CVX | 23.6 | 5.5 | 50.3 |

| Disney | DIS | 33.6 | 10.6 | 65.5 |

| Duke Energy | DUK | 23.2 | 13.6 | 53.3 |

| Fedex | FDX | 23.7 | 0.3 | 50.8 |

| Gilead Sciences | GILD | 25.3 | 23.2 | 34.3 |

| General Motors | GM | 36.4 | 7.4 | 40 |

| Intel | INTC | 33.8 | 3.8 | 57.1 |

| Johnson & Johnson | JNJ | 16.5 | 4.7 | 54.5 |

| JP Morgan | JPM | 21.2 | 4.5 | 57.5 |

| Coca-Cola | KO | 13.1 | 1.5 | 73.1 |

| Altria Group | MO | 16.5 | 1.8 | 77.3 |

| Merck | MRK | 19.5 | 10.4 | 59.5 |

| Morgan Stanley | MS | 25.3 | 6.5 | 59.4 |

| Microsoft | MSFT | 23.0 | 7.3 | 74.4 |

| Nextera Energy | NEE | 24.2 | 4.2 | 44.6 |

| Nvidia | NVDA | 47.3 | 9.6 | 62.2 |

| Pfizer | PFE | 24.9 | 2.8 | 26.8 |

| Paypal | PYPL | 42.5 | 9.7 | 60.8 |

| Starbucks | SBUX | 30.7 | 24.2 | 91.3 |

| AT&T | T | 20.3 | 1.7 | 35.1 |

| Verizon | VZ | 18.8 | 4.6 | 60.1 |

| Walgreens Boots Alliance | WBA | 27 | 5.1 | 51.1 |

| Wells Fargo | WFC | 29.7 | 13.5 | 43.5 |

| Walmart | WMT | 22.1 | 18.3 | 56.1 |

| Exxon Mobil | XOM | 25.2 | 5.2 | 64.7 |

Weekly Trade Discussion: Open Positions

*Portfolio updated every Monday

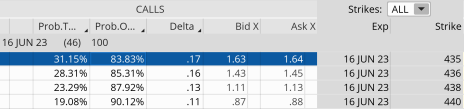

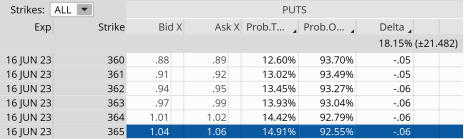

Iron Condor: SPY June 16, 2023, 440/435 calls – 365/360 puts

Original trade published on 4-21-2023 (click to see original alert)

Background: At the time of the trade, SPY was trading for 412.50. We sold the June 16, 2023, SPY 440/435 – 365/360 iron condor for $0.95. The expected range or move was 393 to 432.

Current Thoughts: So far, so good. Our iron condor is currently trading for $0.92, slightly below where we sold the iron condor. Since our position is a tad bearish leaning, a move lower would help to decrease the amount of premium in the trade which is good for the position. My goal is to take off the position prior to 21 days left until expiration. Of course, Mr. Market will dictate whether or not that is possible.

Call Side:

Put Side:

Bear Call: DIA June 16, 2023, 354/359 calls

Original trade published on 4-24-2023 (click to see original alert)

Background: At the time of the trade, DIA was trading for 338.15. We sold the June 16, 2023, DIA 354/359 bear call spread for $0.72. The expected range or move was 321 to 353.

Current Thoughts: Since we are early in the trade there really isn’t much to discuss at the moment.

Call Side:

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Quant Trader issue will be published on

May 8, 2023.