Cabot Options Institute Income Trader - Alert (BITO, DKNG)

ProShares Bitcoin ETF (BITO)

Our BITO June 30, 2023 puts are essentially worthless, so we can lock in some decent profits and immediately sell more puts.

Not many can say they’ve made money in BITO since the beginning of June 2022. At the time we added our first BITO trade it was trading for approximately 18; now it stands at 15.65. Thankfully, due to our income wheel approach, we’ve managed to lock in over 32% in BITO over the same time frame.

BITO is currently trading for 16.77.

Here is the trade:

Buy to Close BITO June 30, 2023, 14 puts for $0.01. (As always, prices will vary, please adjust accordingly.)

Once that occurs (or if you are new to the position):

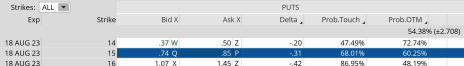

Sell to Open BITO August 18, 2023 15 put for $0.78 (As always, prices will vary, please adjust accordingly)

Delta of short call: 0.20

Probability of Profit: 60.36%

Probability of Touch: 67.82%

Total net credit: $0.78

Max return (cash-secured): 5.2%

Risk Management

We use BITO as part of our Income Wheel Portfolio, so if BITO closes below our put strike at expiration, we will be assigned shares of BITO (per the guidelines of the strategy). Until that point, we will repeatedly sell puts on BITO. Of course, any necessary trade alerts/updates will follow.

DraftKings (DKNG)

It’s time to add a new stock to the mix and I wanted to add something with a bit more implied volatility (IV) to the portfolio. So, as a result, I’m going to place a trade in DraftKings (DKNG) today. IV is currently over 60% for the August expiration cycle. I intend on adding another stock next week and my goal is to go with something a little more conservative by using a stock that has an IV around 30% to 35%.

DKNG is currently trading for 26.57.

Here is the trade:

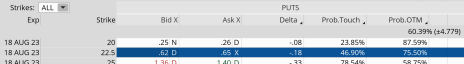

Sell to Open DKNG August 18, 2023 22.5 put for $0.63 (As always, prices will vary, please adjust accordingly)

Delta of short call: 0.18

Probability of Profit: 75.50%

Probability of Touch: 46.90%

Total net credit: $0.63

Max return (cash-secured): 2.8%

Risk Management

We will use DKNG as part of our Income Wheel Portfolio, so if DKNG closes below our put strike at expiration, we will be assigned shares of DKNG (per the guidelines of the strategy). Until that point, we will repeatedly sell puts on DKNG. Of course, any necessary trade alerts/updates will follow.