SPDR Utilities ETF (XLU)

There is little to no value left in our XLU January 19, 2024, 61 puts. As a result, I’m going to buy them back, lock in some nice profits and immediately sell more premium. I’ll be doing the same in a few other positions as we move throughout the rest of the week.

Moreover, I wanted to let everyone know that I will be holding my first subscriber-only webinar of the year next Wednesday at 12 ET. I’ll be discussing our performance from last year, what’s to come in 2024 and the state of our current positions. As always, come with lots of questions. Click here to attend.

XLU is currently trading for 62.92.

Here is the trade:

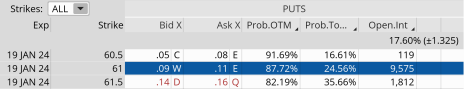

Buy to close XLU January 19, 2024, 61 put for $0.11. (As always, prices will vary, please adjust accordingly.)

Once that occurs (or if you are new to the position):

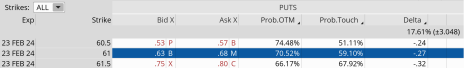

Sell to Open XLU February 23, 2024, 61 put for $0.65. (As always, prices will vary, please adjust accordingly.)

Delta of short call: 0.27

Probability of Closing Out-of-the-Money: 70.52%

Probability of Touch: 59.10%

Total net credit: $0.65

Max return (cash-secured): 1.1% over the next 43 days (or less)

Risk Management

We will use XLU as part of our Income Wheel Portfolio, so if XLU closes below our put strike at expiration, we will be assigned shares of XLU (per the guidelines of the strategy). Until that point, we will repeatedly sell puts on XLU. Of course, any necessary trade alerts/updates will follow.

Coca-Cola (KO)

Like our XLU position above, there is little to no value left in our KO January 19, 2024, 57.5 puts. As a result, I’m going to buy them back, lock in some nice profits and immediately sell more premium.

KO is currently trading for 59.73.

Here is the trade:

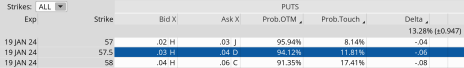

Buy to Close KO January 19, 2024 57.5 puts for $0.04.

Once that occurs (or if you are new to the position):

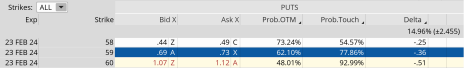

Sell to Open KO February 23, 2024, 59 puts for $0.70.

Delta of short put: 0.36

Probability Closing Out-of-the-Money: 62.10%

Probability of Touch: 77.86%

Total net credit: $0.70

Max return (cash-secured): 1.2%

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com