Cabot Options Institute Income Trader – Alert (KO, BITO)

Coca-Cola (KO)

We allowed our February 17, 2023, 59 puts to expire worthless. As a result, per our Income Wheel guidelines, we will remain mechanical and sell more puts in KO today.

We added KO to the Income Wheel Portfolio back on June 30, 2022. At the time it was trading for roughly 63, now it trades for 60, or down -4.8%. However, by taking the income wheel approach we’ve managed to bring in 7.3%, outperforming the individual stock by 12.1%.

KO is currently trading for 60.

Here is the trade:

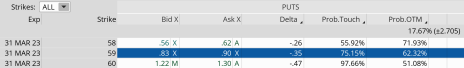

Sell to Open KO March 31, 2023, 59 puts for $0.86. (As always, prices will vary, please adjust accordingly.)

Delta of short call: 0.35

Probability of Profit: 62.32%

Probability of Touch: 75.15%

Total net credit: $0.86

Max return (cash-secured): 1.5%

Risk Management

We use KO as part of our Income Wheel Portfolio, so if KO closes below our put strike at expiration, we will be assigned shares of KO (per the guidelines of the strategy). Until that point, we will repeatedly sell puts on KO. Of course, any necessary trade alerts/updates will follow.

ProShares Bitcoin ETF (BITO)

Like KO, we allowed our BITO February 17, 2023, 13.5 puts to expire worthless, thereby locking in some decent profits. As a result, per our Income Wheel guidelines, we will remain mechanical and sell more puts in BITO today.

Not many can say they’ve made money in BITO since the beginning of June 2022. At the time we added our first BITO trade it was trading for approximately 18; now it stands at 14.75. Thankfully, due to our income wheel approach we’ve managed to lock in 21.3% over the same time frame.

BITO is currently trading for 14.75.

Here is the trade:

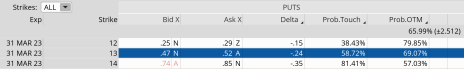

Sell to Open BITO March 31, 2023, 13 puts for $0.50. (As always, prices will vary, please adjust accordingly.)

Delta of short call: 0.24

Probability of Profit: 69.07%

Probability of Touch: 58.72%

Total net credit: $0.50

Max return (cash-secured): 3.8%

Risk Management

We use BITO as part of our Income Wheel Portfolio, so if BITO closes below our put strike at expiration, we will be assigned shares of BITO (per the guidelines of the strategy). Until that point, we will repeatedly sell puts on BITO. Of course, any necessary trade alerts/updates will follow.