Weekly Commentary

As the February 17, 2023 expiration cycle nears we are in good shape to make some decent profits from our current positions. In fact, there is a good chance that we will have an opportunity to buy back a few of our positions this week and immediately sell more premium. Moreover, I intend on adding one to two new trades to the mix this week; of course, as always, Mr. Market will help to dictate our path.

Current Positions

| Open Date | Ticker | Stock Price (open) | Stock Price (current) | Strategy | Trade | Open Price | Current Price | Delta |

| Income Wheel Portfolio - Open Trades | ||||||||

| 1/5/2023 | WFC | $42.35 | $46.12 | Covered Call | February 17, 2023 45 Call | $0.84 | $1.60 | 0.7 |

| 1/9/2023 | GDX | $31.59 | $32.31 | Selling Puts | February 17, 2023 29 Put | $0.54 | $0.13 | 0.1 |

| 1/23/2023 | KO | $60.50 | $60.49 | Selling Puts | February 17, 2023 59 Put | $0.62 | $0.56 | 0.29 |

| 1/23/2023 | BITO | $14.54 | $14.65 | Selling Puts | February 17, 2023 13.5 Put | $0.52 | $0.35 | 0.3 |

| 1/20/2023 | PFE | $45.00 | $43.79 | Covered Call | March 3, 2023 46 Call | $1.00 | $0.65 | 0.29 |

| Open Date | Close Date | Ticker | Strategy | Trade | Open Price | Closed Price | Profit | Return |

| Income Wheel Portfolio - Closed Trades | ||||||||

| 6/3/2022 | 7/8/2022 | PFE | Short Put | July 8, 2022 50 Put | $0.65 | $0.00 | $0.65 | 1.30% |

| 6/10/2022 | 7/15/2022 | GDX | Short Put | July 15, 2022 29 Put | $0.66 | Assigned at $29 | ($2.75) | -9.48% |

| 6/10/2022 | 7/15/2022 | BITO | Short Put | July 15, 2022 16 Put | $0.82 | Assigned at $16 | ($2.09) | -13.10% |

| 6/22/2022 | 7/21/2022 | WFC | Short Put | July 29, 2022 35 Put | $0.80 | $0.02 | $0.78 | 2.23% |

| 6/30/2022 | 8/10/2022 | KO | Short Put | August 19, 2022 57.5 Put | $0.70 | $0.03 | $0.67 | 1.20% |

| 7/21/2022 | 8/10/2022 | WFC | Short Put | August 19, 2022 39 Put | $0.46 | $0.04 | $0.42 | 1.08% |

| 7/18/2022 | 8/17/2022 | BITO | Covered Call | August 19, 2022 16 Call | $0.50 | $0.03 | $0.47 | 3.59% |

| 7/18/2022 | 8/17/2022 | GDX | Covered Call | August 19, 2022 28 Call | $0.63 | $0.05 | $0.57 | 2.22% |

| 7/11/2022 | 8/23/2022 | PFE | Short Put | August 19, 2022 50 Put | $1.00 | Assigned at $50 | $0.21 | 0.43% |

| 8/17/2022 | 9/7/2022 | BITO | Covered Call | September 23, 2022 16.5 Call | $0.55 | $0.03 | $0.52 | 4.00% |

| 8/17/2022 | 9/7/2022 | GDX | Covered Call | September 23, 2022 28 Call | $0.59 | $0.07 | $0.52 | 2.03% |

| 8/23/2022 | 9/23/2022 | PFE | Covered Call | October 21, 2022 50 Call | $1.50 | $0.09 | $1.41 | 2.82% |

| 8/10/2022 | 9/23/2022 | KO | Short Put | September 23, 2022 60 Put | $0.62 | Assigned at $60 | ($0.78) | -1.30% |

| 8/10/2022 | 9/23/2022 | WFC | Short Put | September 23, 2022 41 Put | $0.61 | Assigned at $41 | $0.02 | 0.05% |

| 9/7/2022 | 10/17/2022 | BITO | Covered Call | October 21, 2022 14 Call | $0.40 | $0.03 | $0.37 | 2.60% |

| 9/7/2022 | 10/17/2022 | GDX | Covered Call | October 21, 2022 26 Call | $0.70 | $0.04 | $0.66 | 2.50% |

| 9/26/2022 | 10/21/2022 | WFC | Covered Call | October 21, 2022 41 Call | $1.30 | Called away at $41 | $1.89 | 4.67% |

| 9/26/2022 | 10/21/2022 | KO | Covered Call | October 21, 2022 60 Call | $0.70 | $0.00 | $0.70 | 1.20% |

| 9/23/2022 | 1028/2022 | PFE | Covered Call | October 28, 2022 47 Call | $0.56 | Called away at $47 | $3.49 | 7.43% |

| 10/17/2022 | 11/17/2022 | BITO | Covered Call | November 25, 2022 13.5 Call | $0.38 | $0.03 | $0.35 | 2.60% |

| 10/25/2022 | 11/17/2022 | WFC | Short Put | November 25, 2022 43 Put | $0.96 | $0.07 | $0.89 | 2.00% |

| 10/17/2022 | 11/25/2022 | GDX | Covered Call | November 25, 2022 26 Call | $0.58 | Called away at $26 | $1.09 | 3.87% |

| 10/25/2022 | 11/25/2022 | KO | Covered Call | November 25, 2022 60 Call | $0.80 | Called away at $60 | $2.20 | 3.75% |

| 11/3/2022 | 12/8/2022 | PFE | Short Put | December 16, 2022 45 Put | $1.08 | $0.02 | $1.06 | 2.36% |

| 11/17/2022 | 12/19/2022 | BITO | Covered Call | December 30, 2022 12 Call | $0.45 | $0.04 | $0.41 | 3.42% |

| 11/17/2022 | 12/30/2022 | WFC | Short Put | December 30, 2022 44 Put | $1.02 | Assigned at $44 | ($1.37) | -3.11% |

| 11/29/2023 | 1/9/2023 | GDX | Short Put | January 20, 2023 26 Put | $0.87 | $0.02 | $0.85 | 3.27% |

| 12/8/2022 | 1/13/2023 | PFE | Short Put | January 13, 2023 49 Put | $0.62 | Assigned at $49 | ($0.53) | -1.08% |

| 12/19/2022 | 1/20/2023 | BITO | Covered Call | January 20, 2023 11.5 Call | $0.30 | Called away at $11.5 | $1.49 | 14.70% |

| 11/29/2022 | 1/20/2023 | KO | Short Put | January 20, 2023 60 Put | $0.84 | $0.00 | $0.84 | 1.40% |

| Income Trades Portfolio - Closed Trades | ||||||||

| 7/26/2022 | 8/17/2022 | JPM | Short Put | September 16, 2022 100 Put | $1.22 | $0.16 | $1.06 | 1.10% |

| 48.65% | ||||||||

Weekly High-Probability Mean Reversion Indicator

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

| Very Overbought | greater than or equal to 80.1 |

| Overbought | 60.1 to 80.0 |

| Neutral | 40.1 to 60 |

| Oversold | 20.1 to 40.0 |

| Very Oversold | less than or equal to 20.0 |

Each week I also include the current implied volatility (IV) and IV Rank. I look for an IV rank above 40, preferably higher.

ETF Watchlist – Weekly Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| ARK Innovation ETF | ARKK | 48.2 | 5.1 | 79.3 |

| Proshares Bitcoin ETF | BITO | 61.8 | 8.2 | 83.5 |

| iShares MSCI Emerging Markets | EEM | 17.8 | 5.9 | 76 |

| iShares MSCI EAFE | EFA | 18.0 | 5.6 | 77.5 |

| iShares MSCI Mexico ETF | EWW | 21.6 | 12.6 | 75 |

| iShares MSCI Brazil | EWZ | 37.6 | 25 | 55.9 |

| iShares China Large-Cap | FXI | 28.0 | 4.1 | 75.2 |

| Vaneck Gold Miners | GDX | 35.4 | 3.7 | 54 |

| SPDR Gold | GLD | 15.1 | 3.1 | 60.3 |

| iShares High-Yield | HYG | 9.6 | 4 | 55.5 |

| SPDR Regional Bank | KRE | 22.8 | 4.9 | 63.1 |

| iShares Silver Trust | SLV | 29.6 | 6.7 | 45 |

| iShares 20+ Treasury Bond | TLT | 19.5 | 8 | 52 |

| United States Oil Fund | USO | 36.3 | 2 | 47.8 |

| Proshares Ultra VIX Short | UVXY | 102.8 | 21.2 | 16.6 |

| Barclays S&P 500 VIX ETN | VXX | 70.9 | 13.4 | 18.2 |

| SPDR Biotech | XLB | 19.8 | 12.6 | 63.1 |

| SPDR Energy Select | XLE | 27.8 | 5.1 | 59.2 |

| SPDR Financials | XLF | 18.4 | 3 | 68.8 |

| SPDR Utilities | XLU | 18.6 | 19.3 | 35.6 |

| SPDR Retail | XRT | 28.6 | 5 | 74.8 |

Stock Watchlist – Weekly Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| Bank of America | BAC | 24.6 | 2.6 | 70.5 |

| Bristol-Myers | BMY | 21.3 | 21.1 | 45.3 |

| Citigroup | C | 25.2 | 1.4 | 71.7 |

| Costco | COST | 24.2 | 4.7 | 73.6 |

| Cisco Systems | CSCO | 29.1 | 26 | 62.1 |

| CVS Health | CVS | 26.7 | 35.5 | 43.7 |

| Dow Inc. | DOW | 26.5 | 4.1 | 75.3 |

| Duke Energy | DUK | 22.6 | 17.3 | 36.5 |

| Ford | F | 43.6 | 15.1 | 69.9 |

| Gilead Sciences | GILD | 28.7 | 37.6 | 40.8 |

| General Motors | GM | 39.2 | 18.3 | 69.9 |

| Intel | INTC | 35.8 | 12.7 | 37.8 |

| Johnson & Johnson | JNJ | 17.2 | 8.7 | 25 |

| Coca-Cola | KO | 20.0 | 19.3 | 39.3 |

| Altria Group | MO | 24.6 | 10.4 | 31.4 |

| Merck | MRK | 22.8 | 27.8 | 20.1 |

| Marvell Tech. | MRVL | 50.2 | 9.8 | 74.7 |

| Morgan Stanley | MS | 23.9 | 2.1 | 69 |

| Micron | MU | 37.8 | 2.6 | 84.9 |

| Oracle | ORCL | 23.5 | 9.2 | 60.9 |

| Pfizer | PFE | 28.1 | 28.7 | 17.9 |

| Paypal | PYPL | 54.4 | 30.3 | 73.4 |

| Starbucks | SBUX | 31.7 | 27.8 | 75 |

| AT&T | T | 22.4 | 4.9 | 62.6 |

| Verizon | VZ | 22.4 | 17.9 | 54.9 |

| Walgreens Boots Alliance | WBA | 25 | 6.2 | 60 |

| Wells Fargo | WFC | 25.8 | 2.5 | 75.7 |

| Walmart | WMT | 26.3 | 42.2 | 53.2 |

| Exxon-Mobil | XOM | 28.8 | 5.4 | 62 |

Weekly Trade Discussion: Open Positions

Income Wheel Portfolio: Open Positions

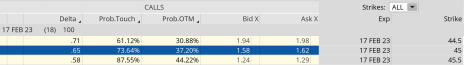

Covered Call: WFC February 17, 2023, 45 Calls

Original trade published on 1-5-2023 (click here to see original alert)

Current Comments: On January 5 we sold the February 17, 2023, 45 calls for $0.84.

Now, with WFC trading for 43.92, the probability of success stands at 65.98%, and the price of the 45 calls sits at $0.64. We have 25 days left in the expiration cycle, so there isn’t much to do at the moment other than to allow the wheel strategy to work its magic.

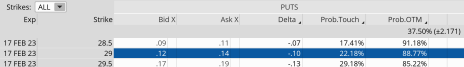

Selling Puts: GDX February 17, 2023, 29 Puts

Original trade published on 1-9-2023 (click here to see original alert)

Current Comments: Two weeks ago, we sold the February 17, 2023, 29 puts for $0.54. At the time of the alert, GDX was trading for 31.59.

Now, with GDX trading for 32.42, the probability of success stands at 84.39%, and the price of the 29 puts sits at $0.22. If GDX continues to push higher and our premium manages to hit the $0.10 to $0.15 range, I will buy back our puts and immediately sell more puts in GDX.

Covered Calls: PFE March 3, 2023, 46 Calls

Original trade published on 1-20-2023 (click here to see original alert)

Current Comments: Last week we sold the February 17, 2023, 46 calls for $0.84. At the time of the alert, PFE was trading for 45.

Now, with PFE trading for 45.11, the probability of success stands at 60.82%, and the price of the 46 calls sits at $1.09. We are early in the expiration cycle, so there isn’t much to do at the moment, other than to allow the wheel strategy to work its magic.

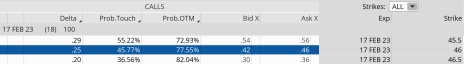

Selling Puts: KO February 17, 2023, 59 Puts

Original trade published on 1-23-2023 (click here to see original alert)

Current Comments: Last week, we sold the February 17, 2023, 59 puts for $0.62. At the time of the alert, KO was trading for 60.50.

Now, with KO trading for 60.49, the probability of success stands at 68.81%, and the price of the 59 puts sits at $0.56. If KO pushes higher and our premium manages to hit the $0.10 to $0.15 range, I will buy back our puts and immediately sell more puts in KO.

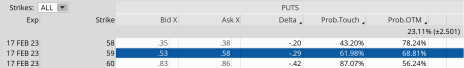

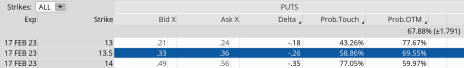

Selling Puts: BITO February 17, 2023, 13.5 Puts

Original trade published on 1-23-2023 (click here to see original alert)

Current Comments: Last week, we sold the February 17, 2023, 13.5 puts for $0.52. At the time of the alert, BITO was trading for 14.54.

Now, with BITO trading for 14.65, the probability of success stands at 69.55%, and the price of the 13.5 puts sits at $0.35. If BITO pushes higher and our premium manages to hit the $0.05 to $0.10 range, I will buy back our puts and immediately sell more puts in BITO.

The next Cabot Options Institute – Income Trader issue will be published on

February 6, 2023.