Weekly Commentary

The message remains consistent again this week in all five of our open positions: All there is to do at the moment is allow time decay to work its magic.

All five positions are shaping up nicely as we head closer to May 19, 2023 expiration. But with earnings season upon us, as I stated last week, I expect to see several short-term positions (30 to 60 days ‘til expiration) being added to the mix. I’ve been very conservative about adding new positions to the mix and I don’t necessarily think all is clear ahead, but I do think we have an opportunity during this earnings season to add a few selective positions to the portfolio.

*Since we started the Income Trader service back in early June 2022, we’ve brought in a total of 68.37% in income. My hope is that we can step up our gains even further by adding as we progress through 2023.

Current Positions

| Open Date | Ticker | Stock Price (open) | Stock Price (current) | Strategy | Trade | Open Price | Current Price | Delta |

| Income Wheel Portfolio - Open Trades | ||||||||

| 3/29/2023 | PFE | $40.15 | $41.19 | Covered Call | May 19, 2023 42.5 Call | $0.53 | $0.57 | 0.33 |

| 3/29/2023 | KO | $61.75 | $63.05 | Short Put | May 19, 2023 60 Put | $0.76 | $0.29 | 0.16 |

| 4/4/2023 | GDX | $34.20 | $35.09 | Short Put | May 19, 2023 32 Put | $0.78 | $0.44 | 0.19 |

| 4/4/2023 | WFC | $36.61 | $39.64 | Covered Call | May 19, 2023 40 Call | $0.55 | $1.07 | 0.47 |

| 3/23/2023 | BITO | $16.89 | $18.11 | Short Put | May 19, 2023 15 Put | $1.10 | $0.28 | 0.14 |

| Open Date | Close Date | Ticker | Strategy | Trade | Open Price | Closed Price | Profit | Return |

| Income Wheel Portfolio - Closed Trades | ||||||||

| 6/3/2022 | 7/8/2022 | PFE | Short Put | July 8, 2022 50 Put | $0.65 | $0.00 | $0.65 | 1.30% |

| 6/10/2022 | 7/15/2022 | GDX | Short Put | July 15, 2022 29 Put | $0.66 | Assigned at $29 | ($2.75) | -9.48% |

| 6/10/2022 | 7/15/2022 | BITO | Short Put | July 15, 2022 16 Put | $0.82 | Assigned at $16 | ($2.09) | -13.10% |

| 6/22/2022 | 7/21/2022 | WFC | Short Put | July 29, 2022 35 Put | $0.80 | $0.02 | $0.78 | 2.23% |

| 6/30/2022 | 8/10/2022 | KO | Short Put | August 19, 2022 57.5 Put | $0.70 | $0.03 | $0.67 | 1.20% |

| 7/21/2022 | 8/10/2022 | WFC | Short Put | August 19, 2022 39 Put | $0.46 | $0.04 | $0.42 | 1.08% |

| 7/18/2022 | 8/17/2022 | BITO | Covered Call | August 19, 2022 16 Call | $0.50 | $0.03 | $0.47 | 3.59% |

| 7/18/2022 | 8/17/2022 | GDX | Covered Call | August 19, 2022 28 Call | $0.63 | $0.05 | $0.57 | 2.22% |

| 7/11/2022 | 8/23/2022 | PFE | Short Put | August 19, 2022 50 Put | $1.00 | Assigned at $50 | $0.21 | 0.43% |

| 8/17/2022 | 9/7/2022 | BITO | Covered Call | September 23, 2022 16.5 Call | $0.55 | $0.03 | $0.52 | 4.00% |

| 8/17/2022 | 9/7/2022 | GDX | Covered Call | September 23, 2022 28 Call | $0.59 | $0.07 | $0.52 | 2.03% |

| 8/23/2022 | 9/23/2022 | PFE | Covered Call | October 21, 2022 50 Call | $1.50 | $0.09 | $1.41 | 2.82% |

| 8/10/2022 | 9/23/2022 | KO | Short Put | September 23, 2022 60 Put | $0.62 | Assigned at $60 | ($0.78) | -1.30% |

| 8/10/2022 | 9/23/2022 | WFC | Short Put | September 23, 2022 41 Put | $0.61 | Assigned at $41 | $0.02 | 0.05% |

| 9/7/2022 | 10/17/2022 | BITO | Covered Call | October 21, 2022 14 Call | $0.40 | $0.03 | $0.37 | 2.60% |

| 9/7/2022 | 10/17/2022 | GDX | Covered Call | October 21, 2022 26 Call | $0.70 | $0.04 | $0.66 | 2.50% |

| 9/26/2022 | 10/21/2022 | WFC | Covered Call | October 21, 2022 41 Call | $1.30 | Called away at $41 | $1.89 | 4.67% |

| 9/26/2022 | 10/21/2022 | KO | Covered Call | October 21, 2022 60 Call | $0.70 | $0.00 | $0.70 | 1.20% |

| 9/23/2022 | 1028/2022 | PFE | Covered Call | October 28, 2022 47 Call | $0.56 | Called away at $47 | $3.49 | 7.43% |

| 10/17/2022 | 11/17/2022 | BITO | Covered Call | November 25, 2022 13.5 Call | $0.38 | $0.03 | $0.35 | 2.60% |

| 10/25/2022 | 11/17/2022 | WFC | Short Put | November 25, 2022 43 Put | $0.96 | $0.07 | $0.89 | 2.00% |

| 10/17/2022 | 11/25/2022 | GDX | Covered Call | November 25, 2022 26 Call | $0.58 | Called away at $26 | $1.09 | 3.87% |

| 10/25/2022 | 11/25/2022 | KO | Covered Call | November 25, 2022 60 Call | $0.80 | Called away at $60 | $2.20 | 3.75% |

| 11/3/2022 | 12/8/2022 | PFE | Short Put | December 16, 2022 45 Put | $1.08 | $0.02 | $1.06 | 2.36% |

| 11/17/2022 | 12/19/2022 | BITO | Covered Call | December 30, 2022 12 Call | $0.45 | $0.04 | $0.41 | 3.42% |

| 11/17/2022 | 12/30/2022 | WFC | Short Put | December 30, 2022 44 Put | $1.02 | Assigned at $44 | ($1.37) | -3.11% |

| 11/29/2023 | 1/9/2023 | GDX | Short Put | January 20, 2023 26 Put | $0.87 | $0.02 | $0.85 | 3.27% |

| 12/8/2022 | 1/13/2023 | PFE | Short Put | January 13, 2023 49 Put | $0.62 | Assigned at $49 | ($0.53) | -1.08% |

| 12/19/2022 | 1/20/2023 | BITO | Covered Call | January 20, 2023 11.5 Call | $0.30 | Called away at $11.5 | $1.49 | 14.70% |

| 11/29/2022 | 1/20/2023 | KO | Short Put | January 20, 2023 60 Put | $0.84 | $0.00 | $0.84 | 1.40% |

| 1/5/2023 | 2/17/2023 | WFC | Covered Call | February 17, 2023 45 Call | $0.84 | Called away at $45 | $4.23 | 10.17% |

| 1/9/2023 | 2/17/2023 | GDX | Short Put | February 17, 2023 29 Put | $0.54 | Assigned at $29 | ($0.05) | -0.10% |

| 1/23/2023 | 2/17/2023 | KO | Short Put | February 17, 2023 59 Put | $0.62 | $0.00 | $0.62 | 1.05% |

| 1/23/2023 | 2/17/2023 | BITO | Short Put | February 17, 2023 13.5 Put | $0.52 | $0.00 | $0.52 | 3.85% |

| 1/20/2023 | 3/1/2023 | PFE | Covered Call | March 3, 2023 46 Call | $1.00 | $0.02 | $0.98 | 2.18% |

| 2/22/2023 | 3/23/2023 | BITO | Short Put | March 31, 2023 31 Put | $0.50 | $0.05 | $0.45 | 3.46% |

| 2/22/2023 | 3/29/2023 | KO | Short Put | March 31, 2023 59 Put | $0.86 | $0.02 | $0.84 | 1.42% |

| 3/1/2023 | 3/29/2023 | PFE | Covered Call | April 6, 2023 42 Call | $0.65 | $0.05 | $0.60 | 1.43% |

| 2/21/2023 | 3/31/2023 | GDX | Covered Call | March 31, 2023 29.5 Call | $0.75 | Called away at $29.5 | $1.84 | 6.48% |

| 2/23/2023 | 3/31/2023 | WFC | Short Put | March 31, 2023 43 Put | $0.53 | Assigned at $43 | ($4.87) | -11.32% |

| Income Trader Portfolio | ||||||||

| 7/26/2022 | 8/17/2022 | JPM | Short Put | September 16, 2022 100 Put | $1.22 | $0.16 | $1.06 | 1.10% |

Weekly High-Probability Mean Reversion Indicator

Here are the various levels I use to determine if an ETF is in an oversold or overbought state.

| Very Overbought | greater than or equal to 80.1 |

| Overbought | 60.1 to 80.0 |

| Neutral | 40.1 to 60 |

| Oversold | 20.1 to 40.0 |

| Very Oversold | less than or equal to 20.0 |

Each week I also include the current implied volatility (IV) and IV Rank. I look for an IV rank above 40, preferably higher.

ETF Watchlist – Weekly Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| ARK Innovation ETF | ARKK | 46.5 | 1.7 | 51.6 |

| Proshares Bitcoin ETF | BITO | 49.5 | 3.7 | 66.9 |

| iShares MSCI Emerging Markets | EEM | 16.8 | 1.0 | 61.2 |

| iShares MSCI EAFE | EFA | 15.9 | 0.5 | 75.3 |

| iShares MSCI Mexico ETF | EWW | 21.9 | 1.9 | 81.1 |

| iShares MSCI Brazil | EWZ | 33.4 | 1.6 | 61.4 |

| iShares China Large-Cap | FXI | 28.7 | 1.3 | 44.8 |

| Vaneck Gold Miners | GDX | 38.2 | 12.4 | 68.4 |

| SPDR Gold | GLD | 17.3 | 35.3 | 53.1 |

| iShares High-Yield | HYG | 10.4 | 0.8 | 63.8 |

| SPDR Regional Bank | KRE | 42.6 | 28.4 | 37.2 |

| iShares Silver Trust | SLV | 31.1 | 24.2 | 70.8 |

| iShares 20+ Treasury Bond | TLT | 17.4 | 4.9 | 36.9 |

| United States Oil Fund | USO | 31.7 | 3.3 | 76.5 |

| Proshares Ultra VIX Short | UVXY | 105.3 | 17.8 | 22.2 |

| Barclays S&P 500 VIX ETN | VXX | 69.7 | 18.3 | 22.1 |

| SPDR Biotech | XLB | 20.8 | 9.6 | 61.9 |

| SPDR Energy Select | XLE | 26.1 | 0.9 | 70.8 |

| SPDR Financials | XLF | 22.0 | 14.1 | 72.1 |

| SPDR Utilities | XLU | 19.1 | 0.2 | 56.6 |

| SPDR Retail | XRT | 28.9 | 16.6 | 49.4 |

Stock Watchlist – Weekly Trade Ideas

| Ticker Symbol | IV | IV Rank | HPMR Oversold - Overbought | |

| Bank of America | BAC | 44.0 | 37.6 | 33.4 |

| Bristol-Myers | BMY | 21.4 | 21.1 | 1 |

| Citigroup | C | 38.3 | 27.9 | 6.4 |

| Costco | COST | 23.4 | 21.6 | 0.2 |

| Cisco Systems | CSCO | 21.2 | 23.5 | 9.8 |

| CVS Health | CVS | 29.6 | 30.5 | 44.7 |

| Dow Inc. | DOW | 31.0 | 29.8 | 7.8 |

| Duke Energy | DUK | 23.5 | 24.8 | 19.3 |

| Ford | F | 48.5 | 46.1 | 20.1 |

| Gilead Sciences | GILD | 32.4 | 30 | 32.7 |

| General Motors | GM | 45.9 | 43.7 | 31.7 |

| Intel | INTC | 46.7 | 44.3 | 39.4 |

| Johnson & Johnson | JNJ | 19.1 | 18.3 | 2.7 |

| Coca-Cola | KO | 16.5 | 16.6 | 0.6 |

| Altria Group | MO | 22.2 | 21.5 | 10.7 |

| Merck | MRK | 24.8 | 24.3 | 29.7 |

| Marvell Tech. | MRVL | 51.4 | 47.9 | 3.5 |

| Morgan Stanley | MS | 36.8 | 31.5 | 27.8 |

| Micron | MU | 41.1 | 38.4 | 1 |

| Oracle | ORCL | 23.2 | 21.1 | 2.2 |

| Pfizer | PFE | 26.1 | 26.7 | 9.4 |

| Paypal | PYPL | 44.5 | 46.1 | 15.4 |

| Starbucks | SBUX | 33.3 | 31.5 | 28 |

| AT&T | T | 28.2 | 27.7 | 20.1 |

| Verizon | VZ | 25 | 23.7 | 18.5 |

| Walgreens Boots Alliance | WBA | 26.3 | 26.6 | 4.3 |

| Wells Fargo | WFC | 41.3 | 30.4 | 14.4 |

| Walmart | WMT | 18.3 | 19.3 | 4.4 |

| Exxon-Mobil | XOM | 29.4 | 27 | 3.5 |

Weekly Trade Discussion: Open Positions

Income Wheel Portfolio: Open Positions

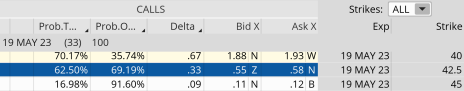

Covered Calls: PFE May 19, 2023, 42.5 Calls

Original trade published on 3-29-2023 (click here to see original alert)

Current Comments: Several weeks ago we sold the May 19, 2023, 42.5 calls for $0.53. At the time of the alert, PFE was trading for 40.15.

Now, with PFE trading for 41.19, the probability of success stands at 69.19%, and the price of the 42.5 calls sits at $0.57. With 33 days left until expiration, all there is to do now is allow time decay to work its magic. Once we dip below 30 days, time decay begins to truly accelerate. If we have an opportunity to buy back our 42.5 calls for roughly $0.10 or less prior to two weeks before expiration we will do so and immediately sell more call premium.

Since we introduced PFE to the income wheel strategy our position has made 16.87%, while the underlying stock has fallen 22.6%.

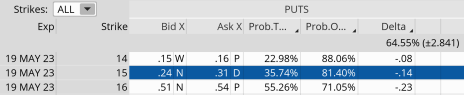

Selling Puts: BITO May 19, 2023, 15 Puts

Original trade published on 3-23-2023 (click here to see original alert)

Current Comments: We sold the May 19, 2023, 15 puts for $1.10. At the time of the alert, BITO was trading for 16.89.

Now, with BITO trading for 18.11, the probability of success stands at 81.40%, and the price of the 15 puts sits at $0.28. With 33 days left until expiration, there isn’t much to do at the moment other than to allow time decay to work its magic.

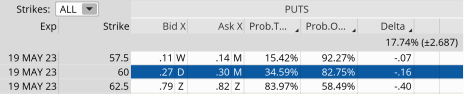

Selling Puts: KO May 19, 2023, 60 Puts

Original trade published on 3-29-2023 (click here to see original alert)

Current Comments: We recently sold the May 19, 2023, 60 puts for $0.76. At the time of the alert, KO was trading for 61.75.

Now, with KO trading for 63.05, the probability of success stands at 82.75%, and the price of the 60 puts sits at $0.29. With 33 days left until expiration, there isn’t much to do other than to allow time decay to settle in.

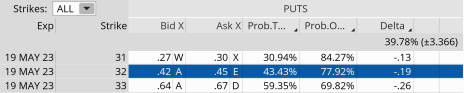

Selling Puts: GDX May 19, 2023, 32 Puts

Original trade published on 4-4-2023 (click here to see original alert)

Current Comments: On April 4, 2023, we sold the May 19, 2023, 32 puts for $0.78. At the time of the alert, GDX was trading for 34.20.

Now, with GDX trading for 35.09, the probability of success stands at 77.92%, and the price of the 32 puts sits at $0.44. With 33 days left until expiration, there isn’t much to do other than to allow time decay to settle in.

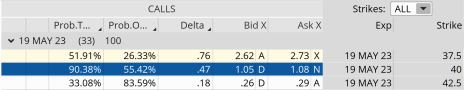

Covered Calls: WFC May 19, 2023, 40 Calls

Original trade published on 4-4-2023 (click here to see original alert)

Current Comments: Last week we sold the May 19, 2023, 40 calls for $0.55. At the time of the alert, WFC was trading for 36.61.

Now, with WFC trading for 39.64, the probability of success stands at 55.92%, and the price of the 40 calls sits at $1.07. Like all of our other positions, with 33 days left until expiration, all there is to do at the moment is allow time decay to work its magic.

As always, if you have any questions please do not hesitate to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Income Trader issue will be published on April 24, 2023.