How We’ll Make You Money

In this service, you will learn how to use lazy-way and factor-based investment models based on published writings and academic papers that have stood the test of time. Knowing that each strategy takes a mechanical approach to the market allows us to use two highly effective, long-term options strategies known as poor man’s covered calls and poor man’s covered puts.

But before I get to how I approach the prominent two options strategies (and their variations) in this service, here are the five portfolios that we will model in the Cabot Options Institute’s Fundamental Options Trading Service, with the possibility of adding a few more in the future.

The five investment strategies below will have roughly 5-10 open positions per strategy. Each strategy has stood the test of time, which is why I’ve chosen the five below as the foundation for our poor man’s approach. Through the use of LEAPS we are able to reduce our capital outlay by 65% to 85%, which allows us the capability for greater diversification across a variety of investment strategies.

LEAPS, or long-term equity anticipation securities, are basically options contracts with an expiration date longer than one year. LEAPS are no different from short-term options, but the longer duration offered through a LEAPS contract gives an investor the opportunity for long-term exposure for significantly less cost.

I’ll get to an example of how we use LEAPS below, but before we get to the options strategy here are the five investment strategies on which we will focus our efforts.

Lazy Way Strategies - Passive

- Dogs (and Small Dogs) of the Dow

- Ray Dalio’s All-Weather Portfolio

- David Swensen’s Yale Endowment Strategy

Lazy way strategies require little time and effort. The three broad-based strategies we use are built for investors who seek a track record of steady gains, but don’t have the time to continually monitor the market. We manage a total of 20 positions (10 in the Dogs of the Dow) in our three “lazy way” portfolios.

We are simply taking this “tried and true” long-term approach and wrapping an options strategy around it…poor man’s covered calls. I will go over the step-by-step details of the strategy shortly.

Some choose to build entire portfolios, others use a chosen set of positions across all three portfolios to create their own portfolio. Ultimately, it’s up to you to decide how you want to manage your positions.

Factor-Based Strategies - Active

- James O’Shaughnessy’s Growth-Value Strategy

- Warren Buffett’s Patient Investor

Factor-Based Strategies are active strategies that require a little more time and effort as we rebalance our portfolios every month around options expiration (third Friday each month).

The two factor-based portfolios are built for investors who are looking for proven long-term strategies that also provide a steady stream of ideas, hence the rebalancing of some positions. We will carry anywhere from 5 to 10 positions in each portfolio applying a poor man’s covered call approach with each, rebalancing some holdings each month.

As with our Lazy Way strategies, some choose to build entire portfolios, others use a variety of positions across both portfolios to create their own portfolio with the intent of continually selling premium against each position. Ultimately, it’s up to you to decide how you want to manage your positions.

Lazy Way Strategies (Passive Management)

Dogs (and Small Dogs) of the Dow

Oftentimes, I find that investors overcomplicate their approach, searching for the latest and greatest strategies only to find frustration when the approach fails. Well, that’s simply not the case for the Dogs of the Dow. The strategy has a long-term track record of success. In fact, the strategy has consistently outperformed the Dow Industrials over the last 90 years with far less volatility.

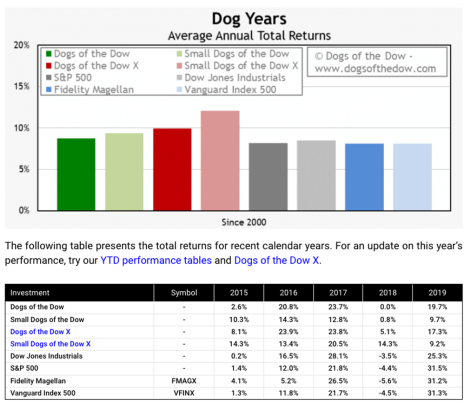

According to DogsoftheDow.com, “the data shows that, over the long-term, the performance of the Dogs of the Dow and the Small Dogs of the Dow has been impressive. For example, since the turn of the century, Dogs of the Dow has an average annual total return of 9.9% while Small Dogs of the Dow did even better with an average annual total return of 12.1%. Noticeably better than the Dow Jones Industrial Average…and notable considering that the time period involved included the dot-com bust, a historic financial crisis and a pandemic-induced economic shutdown.”

And that’s my goal within Cabot Options Institute’s Fundamental Trader--to provide simple, conservative investment strategies that have a long-term track record of success and wrap conservative options strategies around them.

Because there aren’t bonus points for complicated strategies, or taking aggressive, highly volatile approaches. It all comes down to returns but returns based on calculated risk. And that’s what the five approaches in the service provide….strategies with a long-term track record of success.

The process for the Dogs of the Dow is simple. Pick the 10 highest-yielding stocks out of the 30 Dow stocks. Most equally weight their positions, but this isn’t necessary, in my opinion, if you diversify across each position. In our case, we typically initiate a position with one LEAPS position in each stock.

After the initial set-up, all you will need to do is adjust the holdings and LEAPS positions at the beginning of each year. An incredibly easy process and one that we will walk through in a step-by-step process when the time comes. In addition, much like a covered call strategy, we are simply selling calls against our LEAPS position (rather than stock) every 30-60 days. Of course, I will send detailed alerts when we place any trades.

Historically, the Dogs of the Dow strategy have outperformed the larger Dow by approximately 3% a year. Doesn’t sound like much, but when you triple, quadruple or even quintuple that percentage on an annual basis the returns add up over time.

And by using poor man’s covered calls we have that ability.

Also known as long call diagonal spreads, a poor man’s covered call is similar to a traditional covered call strategy, with one exception in the mechanics. Rather than buying 100 or more shares of stock, an investor simply buys an in-the-money LEAPS call and sells a near-term out-of-the-money call against it.

LEAPS, or long-term equity anticipation securities, are basically options contracts with an expiration date longer than one year. LEAPS are no different from short-term options, but the longer duration offered through a LEAPS contract gives an investor the opportunity for long-term exposure.

The positions in the portfolio are delta positive. This simply means that each position is inherently bullish, and my goal is to make sure each position remains delta positive at all times. And even though the positions are delta positive, we still have the opportunity to make money if the market remains flat or even drops slightly, but the portfolio does best when the stocks that reside in the portfolio trend higher.

When initiating a position, I buy LEAPS with a delta of .80 and selling a call against my LEAPS contract with a delta of roughly .20 to .30. So, my overall delta is typically between .50 to .60 when a position is initiated. Of course, the delta continually fluctuates with the price of the underlying stocks, but I have the ability to manage each position so that the delta remains in a positive state.

How to Initiate Your First Trade (Applicable to All of Our Strategies)

There are numerous ways to approach poor man’s covered calls. My preference is to use LEAPS that have at least two years left until expiration.

For example, let’s take a look at one of the Dogs of the Dow stocks and one that will likely be a candidate for 2022, Chevron (CVX). It’s a fairly expensive stock and that can be a huge deterrent for many investors; not with a poor man’s covered call.

As you can see in the chart below the stock is currently trading for 118.30.

Now, if we followed the route of the traditional covered call we would need to buy at least 100 shares of the stock. At the current share price, 100 shares would cost $11,830. Certainly not a crazy amount of money. But just think if you wanted to use a covered call strategy on, say, a higher-priced stock like Apple (AAPL), Microsoft (MSFT) or even an index ETF like SPDR S&P 500 ETF (SPY). For some investors, the cost of 100 shares can be prohibitive, especially if diversification amongst a basket of stocks is a priority. Therefore, a covered call strategy just isn’t in the cards…and that’s unfortunate.

But with a poor man’s covered call strategy you can typically save 55% to 85% of the cost of a covered call strategy.

So again, rather than purchase 100 shares or more of stock, we only have to buy one LEAPS call contract for every 100 shares we wish to control.

As I said before, my preference is to buy a LEAPS contract with an expiration date around two years. Some options professionals prefer to only go out 12-16 months, but I prefer the flexibility the two-year LEAPS offers.

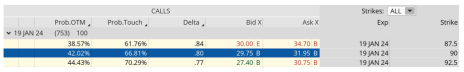

The image below shows every expiration cycle available for CVX. Again, I want to go out roughly two years in time. The January 19, 2024 expiration cycle with 753 days left until expiration is the longest dated expiration cycle and would be my choice.

So, when my LEAPS reach 10-12 months left until expiration I then begin the process of selling my LEAPS and reestablishing a position with approximately two years left until expiration.

Once I have chosen my expiration cycle, I then look for an in-the-money call strike with a delta of around 0.80.

When looking at CVX’s option chain I quickly noticed that the 90 call strike has a delta of 0.80. The 90 strike price is currently trading for approximately $30.75. Remember, always use a limit order. Never buy an option at the ask price, which in this case is $31.95.

So, rather than spend $11,830 for 100 shares of CVX, we only needed to spend $3,075. As a result, we saved $8,755, or 74.0%. Now we have the ability to use the capital saved to diversify our premium amongst other securities, if we so choose.

After we purchase our LEAPS call option at the 90 strike, we then begin the process of selling calls against our LEAPS.

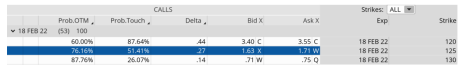

My preference is to look for an expiration cycle with around 30-60 days left until expiration and then aim for selling a strike with a delta ranging from 0.20 to 0.40, or a probability of success between 60% and 85%.

As you can see in the options chain below, the 125 call strike with a delta of 0.27 falls within my preferred range. This would give our position a total delta of 0.53 (0.80 – 0.27) or $53 per poor man’s covered call.

We could sell the 125 call option for roughly $1.65.

Our total outlay for the entire position now stands at $29.10 ($30.75-$1.65). The premium collected is 5.4% over 53 days.

If we were to use a traditional covered call our potential return on capital would be less than half, or 1.4%.

And remember, the 5.4% is just the premium return; it does not include any increases in the LEAPS contract if the stock pushes higher. Moreover, we can continue to sell calls against our LEAPS position for another 8 – 12 months, thereby generating additional income or lowering our cost basis even further.

An alternative way to approach a poor man’s covered call, if you are a bit more bullish on the stock, is to buy two LEAPS for every call sold. This way you can benefit from the additional upside past your chosen short strike, yet still participate in the benefits of selling premium.

Regardless of your approach, you can continue to sell calls against your Dogs of the Dow LEAPS as long as you wish. Whether you hold a position for one expiration cycle or 12, poor man’s covered calls give you all the benefits of a covered call for significantly less capital.

Ray Dalio’s All-Weather Portfolio

The All-Weather Portfolio is considered a “lazy portfolio” due to the long-term, passive or laid-back approach. The portfolio was created by famed hedge-fund manager and billionaire investor, Ray Dalio. As the title of the portfolio suggests, the All-Weather Portfolio, is designed to perform well during all seasons, bullish, bearish or neutral.

Whether it’s an economic boom or bust, the All-Weather Portfolio is built to perform well over the long-term, regardless of market conditions.

Over the last 30 years the All-Weather Portfolio has made an annual average return of 7.9%, with the max drawdown during that time frame of only -12.18%.

Holdings

- iShares 20+ Year Treasury Bond ETF (TLT)

- iShares 7-10 Year Treasury Bond ETF (IEF)

- Invesco DB Commodity Index Tracking Fund (DBC)

- SPDR Gold Trust (GLD)

- Vanguard Total Stock Market ETF (VTI)

Quick Summary

Basically, we create a LEAPS position in each of the aforementioned ETFs and immediately sell calls against them. We continue to sell calls against our LEAPS to lower the cost basis of the position, or for a steady stream of income…your choice. Once our LEAPS have roughly one year left until expiration, we buy back our LEAPS and buy more as far out as we can and start the process over.

Of course, there is some nuance, like what we do if the underlying ETF moves through our short call or what if the ETF pushes towards our LEAPS strike, etc. We will handle those situations and more, step-by-step, as they come our way because we will, at some point, have positions that are tested, both ways.

David Swensen’s Yale Endowment Strategy

The David Swensen Portfolio is another “lazy portfolio” that has seen consistent long-term success. Swensen was the CIO at Yale University from 1985 until his death in May 2021.

Holdings

- SPDR S&P 500 ETF (SPY)

- iShares MSCI Emerging Market ETF (EEM)

- Vanguard Real Estate (VNQ)

- iShares Trust TIPS ETF (TIP)

- iShares trust MSCI EAFE ETF (EFA)

Basically, we create a LEAPS position in each of the aforementioned ETFs and immediately sell calls against them. We continue to sell calls against our LEAPS to lower the cost basis of the position, or for a steady stream of income…your choice. Once our LEAPS have roughly one year left until expiration, we buy back our LEAPS and buy more as far out as we can and start the process over.

Factor-Based Strategies (Active Management)

James O’Shaughnessy’s Growth-Value Strategy

O’Shaughnessy’s Growth/Value strategy is based on his book, What Works on Wall Street. The screening process is a bit more involved with O’Shaughnessy’s strategy as the choices are far more extensive than Buffett’s approach. As a result, the stocks chosen can offer a mix of low-beta and high-beta stocks, which tend to offer a nice diversified mix of premium.

The two-strategy approach combines large-cap value and growth focusing on persistent earnings growth and strong relative strength. Positions in the portfolio will be rebalanced around options expiration (third Friday of the month) every month based on O’Shaughnessy’s screening criteria for his “Growth/Value” approach. Some positions will be held for one month, others for potentially longer. We will average roughly five positions at a time.

Warren Buffett’s Patient Investor

Buffett’s Patient Investor strategy is based in his book, Buffettology. Basically, we are seeking, through a screen-based process, high-quality, mostly boring stocks as a source to sell consistent premium using our poor man’s covered call approach.

It’s an investment strategy that continually screens for companies with long-term, predictable profitability and low debt that trade at reasonable valuations. Positions in the portfolio will be rebalanced around options expiration (third Friday of the month) every month based on Buffett’s screening criteria for the “Patient” approach. Some positions will be held for one month, others for potentially longer. We will average roughly five positions at a time.

As always, if you have any questions, please do not hesitate to email at andy@cabotwealth.com. I am more than happy to help!