YALE ENDOWMENT PORTFOLIO

Like in our last alert for the All-Weather portfolio, we need to keep our deltas at reasonable levels, and with the recent pullback, we are a bit longer than we would like to be at the moment. Much of the premium has been taken out of our October expiration positions, so now is a good time to start selling premium for the November expiration cycle.

SPDR S&P 500 ETF (SPY)

We currently own the SPY January 19, 2024, 290 call LEAPS contract at $117. You must own LEAPS in order to use this strategy.

If you wish to enter the position and are uncertain about which LEAPS to purchase, please refer to the reports section of your subscriber page or our latest subscriber-exclusive webinar in which I go through the process, step by step, of entering a new position of an already established position. Based on our approach, the LEAPS contract that works best is the one with a current delta of 0.80: the January 19, 2024, 275 calls. We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

Here is the trade:

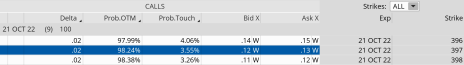

Buy to close SPY October 21, 2022, 397 call for roughly $0.13 (adjust accordingly, prices may vary from time of alert)

Once that occurs (or if you are new to the position and already own LEAPS):

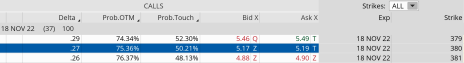

Sell to open SPY November 18, 2022, 380 call for roughly $5.17 (adjust accordingly, prices may vary from time of alert)

Premium received: 4.4%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $117 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in SPY.

Vanguard Real Estate ETF (VNQ)

We currently own the VNQ January 19, 2024, 70 call LEAPS contract at $23.25. You must own LEAPS in order to use this strategy.

If you wish to enter the position and are uncertain about which LEAPS to purchase, please refer to the reports section of your subscriber page or our latest subscriber-exclusive webinar in which I go through the process, step by step, of entering a new position of an already established position. Based on our approach, the LEAPS contract that works best is the one with a current delta of 0.80: the January 19, 2024, 55 calls. We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

Here is the trade:

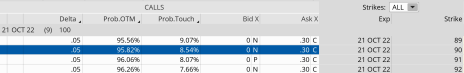

Buy to close VNQ October 21, 2022, 90 call for roughly $0.10 (adjust accordingly, prices may vary from time of alert)

Once that occurs (or if you are new to the position and already own LEAPS):

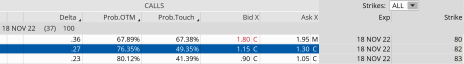

Sell to open VNQ November 18, 2022, 82 call for roughly $1.20 (adjust accordingly, prices may vary from time of alert)

Premium received: 5.2%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $23.25 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in VNQ.