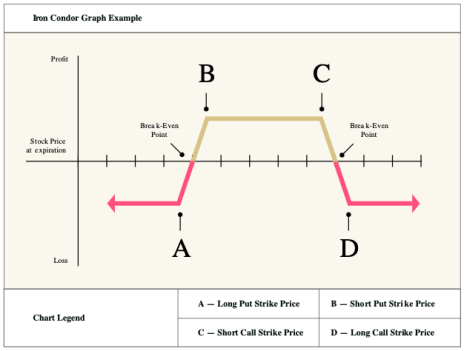

One of my favorite, defined risk, non-directional options strategies is known as the iron condor.

Yep, weird name, I know. But the name makes perfect sense when you look at the profit/loss chart for the strategy.

An iron condor is not only one of the most powerful options strategies, it’s also one of the best all-around investments strategies that we, as investors, have at our disposal.

The strategy consists of a short call vertical spread (bear call spread) and short put vertical spread (bull put spread).

[text_ad use_post='261460']

If all the aforementioned seems like a foreign language, no worries. This is a strategy I want all investors to learn, so I’m going to go through the strategy and my approach in a step-by-step process.

Step One – Liquidity

Liquidity is king. The first step when trading iron condors, or any options strategy for that matter, is to make sure you are choosing a highly liquid stock or ETF. Some of the best ways to find out if an underlying security is liquid is to take a look at the open interest, volume and bid-ask spread for the at-the-money options.

I have created a list of highly liquid stocks and ETFs that I like to trade and I rarely stray from that list. Why would I want to trade an underlying security that requires me to make back 5% to 15% on average just to get back to breakeven? It doesn’t make sense. Remember, we want to use efficient products that allow us to get in and out of the trade with ease. Don’t overlook the importance of using highly-liquid securities.

Step Two – Expected Move

Let’s say we decide to place a trade in the highly-liquid SPDR S&P 500 (SPY) going out roughly 30 days until expiration.

As you can see below, the expected move, also known as the expected range, is from 413 to 434.

In most cases, my goal is to place my iron condor outside of the expected move. Moreover, I prefer to have my probability OTM or probability of success around 75%, if not higher, on both the call and put side.

Step Three – Choosing Expiration Cycle and Strike Prices

Since I know the expected range, as seen above, for the S&P 500 (SPY) for the July 23, 2021 expiration cycle is from 413 to 434, I can then begin the process of choosing my strike prices.

Call Side of the Iron Condor:

The high side of the range is, again, 434 for the July 23, 2021 expiration cycle, so I want to sell the short call strike just above the 434 strike, possibly higher.

As you can see above, the 435 strike with an 86.10% probability of success fits the bill. Once I’ve chosen my short call strike, I then begin the process of choosing my long call strike. Remember, buying the long strike defines my risk on the upside of my iron condor. For this example, I am going with a 5-strike wide iron condor, so I’m going to buy the 440 strike.

As a result, I am going to sell the 435/440 bear call spread for roughly $0.52. But, before I place the trade I want to choose the bull put portion of my iron condor.

Put Side of the Iron Condor:

The low side of the range is, again, 413 for the July 23, 2021 expiration cycle, so I want to sell my short put strike just below the 413 strike, possibly lower.

As you can see above, the 409 strike with a 75.29% probability of success fits the bill. Once I’ve chosen my short put strike, I then begin the process of choosing my long put strike. Remember, buying the long put strike defines my risk on the downside. For this example, I am going with a 5-strike wide iron condor, so I’m going to buy the 404 strike.

Again, it’s all about the probabilities when using options selling strategies. The higher the probability of success, the less premium you should expect to bring in. But as long as I can bring in a reasonable amount of premium, I always side with the higher probability of success, as opposed to taking on more risk for a greater return.

So, with a range of $26 (413-435) and SPY trading for roughly 423.50, the underlying ETF can move higher 2.7% or lower 3.4% over the next 30 days before the trade is in jeopardy of taking a loss.

Here is the theoretical trade:

Simultaneously…

- Sell to open SPY July 23, 2021 435 calls

- Buy to open SPY July 23, 2021 440 calls

- Sell to open SPY July 23, 2021 409 puts

- Buy to open SPY July 23, 2021 404 puts

We can sell this iron condor for roughly $1.05. This means our max potential profit sits at approximately 26.6%.

Again, I wanted to choose an iron condor that was outside of the expected move and has a high probability of success. This is why I sold the 435 calls and the 409 puts.

Remember, when approaching the market from a purely quantitative approach, it’s all about the probabilities. The higher the probability of success on the trade, the less premium I’m able to bring in, but again, the tradeoff is a higher win rate. And when I couple a consistent and disciplined high probability approach on each and every trade I place, I allow the law of large numbers to take over. Ultimately, that is the true path to success.

Step Four – Managing the Trade

I typically close out my trade for a profit when I can lock in 50% to 75% of the original premium sold. So, if I sold an iron condor for $1.00, I would look to buy it back when the iron condor reaches $.50 to $0.25. This way I’m pocketing $0.50 to $0.75 on the trade.

If the underlying moves against my position I typically adjust the untested side. Most roll the tested side, but all research states that rolling the untested side higher/lower allows me to bring in more premium and thereby decreasing my overall risk on the trade. Moreover, I look to get out of the trade when it reaches 1 to 2 times my original premium. So, in our case when the iron condor hits $2.00 to $3.00.

Ultimately, position size is the best way to truly manage an iron condor. We know prior to placing a trade what we stand to make and lose on the trade, therefore we can adjust our position size to fit our own personal guidelines. Iron condors are risk-defined, so it’s important to take advantage of their risk-defined nature by staying consistent with your position size for each and every trade you place. Remember, it’s all about the law of large numbers.