Profits, profits, profits, that’s all most traders, particularly those new to trading, think about when placing a trade. But, when taking a statistical or quantitative approach to the market, the most important factor is risk management. And proper risk management starts with a proper position-sizing plan.

So rather than looking at ourselves as traders or investors, I would argue that. Because again, if we understand the Law of Large Numbers, we know that the probabilities we choose will define our success.

But in order for the Law of Large Numbers to work, we must have a large enough sample size or, in our case, number of trades.

For instance, if we take a position that has an 80% probability of success, we should expect to see a win ratio of roughly 80%. But the journey to get to that percentage should never be considered straight forward, especially in the beginning. Basically, just because you place 10 trades, eight of those trades are not guaranteed to be winning trades. In the world of statistics, we call this sequence risk, or sequencing risk.

Coin Toss Example

Think about a coin toss.

A coin has a 50% chance, or probability, of landing on heads or tails.

Therefore, according to the Law of Large Numbers, the number of heads in a large number of coin flips should be 50%, which is known as our expected value. Basically, as our number of trades increase over time our win ratio should fall increasingly closer to our expected value—again, 50%.

But we must understand that when we follow a quantitative approach there are several obstacles in our way.

When flipping a coin 10 times the variance of the coin landing on heads has an average range of three heads to seven heads. As we increase the number of observations, the range tightens until eventually the overall probability of success stands at approximately 50%.

Maximizing the Number of Trade Occurrences is Essential to Long-Term Success

- If you flip the coin 10 times, 7 heads and 3 tails may occur (70% heads / 30% tails)

- If you flip the coin 100 times, 60 heads and 40 tails may occur (60% heads / 30% tails)

- If you flip the coin 500 times, 275 heads and 225 tails may occur (55% heads / 45% tails)

- If you flip the coin 1,000 times, ~500 heads and ~500 tails may occur (~50% heads / ~50% tails)

As you can clearly see above, variance over shorter spans can lead to bouts of sequencing risk.

So, just because the expected value is 50%, it doesn’t mean that for every 10 flips we are going to fall right at 50%, or five heads and five tails. In the world of quantitative trading, we call this sequencing risk. Sequencing risk simply means that we could have numbers that vary from zero heads to 10 heads for every 10 flips. We call these statistical outliers, or tail risk, and while they are rare, they should be expected from time to time.

But again, the Law of Large Numbers always falls around the expected outcome as the number of observations (trades) increases.

It’s an incredibly easy concept to understand, yet most traders simply don’t allow the Law of Large Numbers to work in their favor. Lack of patience is typically the reason.

In short, knowing we have a probability of success greater than 80% on the trade, our win ratio, as our number of trades increases, should fall around 80%.

Of course, as I stated before, much of your success relies on how disciplined you are as a risk manager, achieved through consistent and strict position-size guidelines.

Position-Sizing Guidelines

Position sizing is simply the percentage of overall capital allocation dedicated to a trade.

For example, if an investor has an account size of $100,000 and decides to place a trade that requires $5,000 in capital, the position size is 5% of the portfolio’s overall capital.

Position sizing plays an ENORMOUS factor in constructing a portfolio, while simultaneously acting as a major source of managing risk.

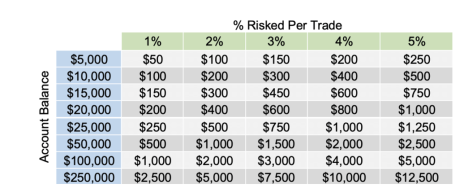

I typically risk between 0.5% to 6% per position. But everyone has a different level of risk tolerance, therefore position size will vary from one individual to the next. However, you MUST incorporate strict guidelines to position size if you wish to have any chance of being successful over the long term. Again, we must allow the Law of Large Numbers to work.

Regardless of the amount of capital you are trading, focus on the percentages. Oftentimes, those with smaller accounts focus more on the amount of money they can make on each trade, rather than the percentages. Focus on the percentages!

Sequencing Returns

As I mentioned earlier, sequencing risk is a major player in the world of statistically based, high-probability options strategies. Which is why position size is so important.

Position size allows us to calculate how many consecutive losses would need to occur to lose a specific amount of capital in our overall trading account. Sequence of returns is the inherent risk that a trader could experience several losses in a row. Knowing that the sequence of returns is a math-based reality, our chosen position size helps to lessen the impact of a string of potential losing trades.

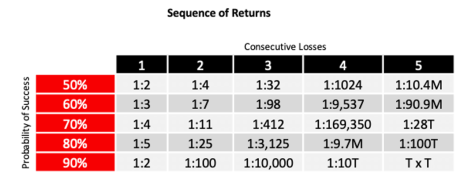

The following table demonstrates the statistics of experiencing consecutive losses based on your chosen probability of success at the time of entering trade. As you will quickly notice, as the probability of success increases, the likelihood of consecutive losses diminishes exponentially.

So, for example, if I were to consistently use a risk-defined options strategy like an iron condor with a delta of 0.20 or a probability of success of 80%, there is a 4% chance of losing two trades in a row and 0.03% chance of losing five trades in a row. So, knowing this info, we have the ability to plan accordingly by choosing a realistic position size based on the probability of success of our trade.

I can’t emphasize enough just how important position size is when trading, especially when using a high-probability approach. We ALL should think of ourselves as risk managers first and traders second. If you are able to follow this mindset, you will have a much better chance of being successful over the long term.

Remember, statistically based trading is simply a game of math. We are trading high-probability strategies here, so we know we have an advantage over the long term, but we must have a sound understanding of how to manage sequence risk accordingly. Position size is probably the most important factor, so don’t ignore it.

Proper Position Size in Options Trading

It doesn’t matter if you are just starting or have an advanced grasp of all things options, if you don’t think of yourself as a risk manager first, you will fail, it’s just a matter of time.

Proper risk management is what separates those that succeed from those that continually struggle or simply just give up.

What people continue to struggle with is trying to find the latest and greatest strategy, constantly hopping from one strategy to the next. Strategy is far less important, than proper risk management.

Placing trades, well, it’s the easiest part of the trading process. Anyone can place a trade. It’s how you handle the trade that allows you to be profitable over the long term.

Which is why you MUST think of yourself as a risk manager first, especially if you are taking a truly quant-based approach. The Law of Large Numbers is your foundation but managing sequence risk is the obstacle that most traders just can’t overcome.

As stated above earlier, sequence risk is the inherent risk that a trader could suffer multiple losses in a row. The best way to combat sequence risk is through proper position sizing. Position sizing mitigates the impact of consecutive losses. The lower the capital risked per trade, the lower the probability that a sequence of losing trades will cause a significant drawdown.

The table in the section above shows how sequence risk can impact your overall account and why it is imperative that you use proper position size when investing/trading.

Again, we know losing trades are going to occur. It’s a hard fact that we must accept. So, trades must be managed appropriately….

And the first step is proper position size.

The most important decision you will make as a successful options trader is how much to allocate per trade. From a risk-management standpoint, maintaining a consistent position size among your trades is of the utmost importance. We want to limit the havoc that one trade could have on our portfolio.

For simplicity’s sake, let’s say our trading account stands at $10,000 in this example.

In one case, we have allocated 50% per trade. In the other, we have allocated 5% per trade.

$10,000 Account (50% allocated per trade):

One position, equally weighted at $5,000. So, with each trade, a 10% drop will cause a 5% drop in our overall portfolio. A 20% drop will cause a 10% drop, 30% would be 15% . . . you get the picture.

Just knowing this gives every options trader the insight necessary to shape a position size and stop-loss strategy for maximum effectiveness.

Let’s say with each trade we set our stop-loss order at 50% of our allocated amount. For example, with 50% allocated to each trade, our stop-loss would be set at $2,500.

Two trades would only allow us to diversify among two positions with 50% of our overall portfolio value at risk.

$10,000 Account (5% allocated per trade):

One position, equally weighted at $500. So, with each trade, a 10% drop will cause a 0.5% drop in our overall portfolio. A 20% drop will cause a 1% drop, 30% would be 1.5% . . . again, you get the picture.

Our stop-loss with 5% allocated per trade is $250.

For example, if we had four iron condor trades open simultaneously, we would have $2,000 in play with only $1,000 or 10% of our overall portfolio at risk.

Worst-Case Scenario

If we assume our position size of $500 per trade and had four trades going at one time, our maximum loss is 10% or $1,000 of our overall portfolio.

A 10% loss in the portfolio would need a 11.11% overall gain to make up for the loss.

Summary

I realize the prior exercise is fairly simplistic. Again, it only begins the important discussion of risk management. Without some form of risk management, emotions take over.

And emotions are the enemy. Hindsight never exists in the present. We must realize that we will be wrong on occasion.

Being privy to this allows us to prepare accordingly. We know over the long term that having a defined stop-loss will only serve to benefit the performance of our respective portfolios. More importantly, we always know when to sell. Of course, all of the above assumes that we prefer the straight percentage stop-loss.

If you want to be a successful trader/investor over the long term, then taking the time to figure out an appropriate position-sizing plan is imperative. Please, please, please do not overlook this important concept.

You will not regret it.