This week offers a few potential trades in Micron (MU) and Nike (NKE). The following week offers us next to nothing in the way of trades, but no worries, because on October 14 earnings season begins in earnest with the big banks (JPM, C, WFC, MS, etc.) due to report.

I will be introducing short strangles when we enter earnings season and will be covering the strategy during our first webinar of this upcoming earnings report. Regardless, if you wish to use the strategy it will be a wonderful introduction to an approach that many professionals use as their bread and butter strategy. I recently received an email from an old subscriber who has been using the strategy since he learned my approach. My goal was to wait one more earnings season to introduce short strangles, but I have reconsidered after his email and will be utilizing the strategy, in addition to our already established iron condors approach, during this upcoming earnings season.

Here is the email:

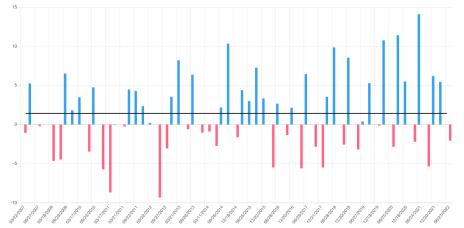

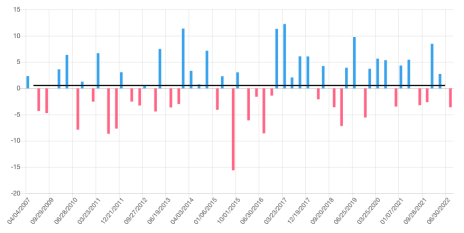

A little over two years ago in a service of yours, you introduced the short strangle as a technique to use on earnings report dates

In 2021 I closed 148/149 trades profitable.

In 2022 so far I have closed 108/110 trades profitable.

I spoke with the gentleman shortly after the email and was thoroughly impressed by his results and his disciplined approach. Again, I will be going over my step-by-step approach to short strangles in our upcoming subscriber-exclusive webinar. To learn more about the webinar, click here.

The Week Ahead

There are no real opportunities, at least in my book, next week. However, here are two stocks with incredibly high implied volatility that have suffered mightily over the past several earnings cycles. I’ll discuss, mostly for educational purposes, a potential bearish trade in GME in the “Trade Ideas for Next Week” section below.

- Nike (NKE)

- Micron (MU)

Below are a few more ideas for those of you who tend to be a bit more aggressive.

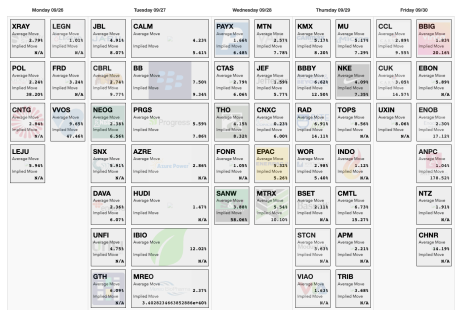

Top Earnings Options Plays

Here are a few top earnings options plays for this week (9/26 to 9/30) if you are so inclined:

Trade Ideas for Next Week

Nike (NKE)Nike is due to announce earnings Thursday after the closing bell. The stock is currently trading for 97.02.

IV Rank: 84.6

Expected Move for the October 7, 2022, Expiration Cycle: 89 to 105

Knowing the expected range, let’s look at an iron condor outside of the expected range, or 89 to 105.

If we look at the call side of NKE for the October 7, 2022, expiration, we can see that selling the 108 call strike offers an 85.92% probability of success. The 108 call strike sits just above the expected move, or 105. We can define our risk through buying the 113 call, thereby creating a five-strike-wide bear call spread at the 108/113 call strikes.

By choosing the 108 call strike we have an 11.3% cushion to the upside.

Now let’s take a look at the bull put portion of our NKE iron condor.

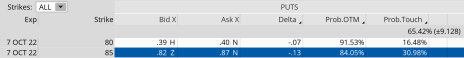

If we look at the put side of NKE for the October 7, 2022, expiration, we can see that selling the 85 put strike offers an 84.05% probability of success. The 85 put strike sits just below the expected move, or 89. We can define our risk through buying the 80 put, thereby creating a five-strike-wide bull put spread at the 85/80 put strikes.

By choosing the 85 put strike we have a 12.4% cushion to the downside.

Here is the trade:

Simultaneously:

Sell to open NKE October 7, 2022, 108 calls

Buy to open NKE October 7, 2022, 113 calls

Sell to open NKE October 7, 2022, 85 puts

Buy to open NKE October 7, 2022, 80 puts for roughly $0.90, or $90 per iron condor.

Our margin requirement would be $410 per iron condor. The goal of selling the NKE iron condor is to have the underlying stock stay between the 108 call strike and 85 put strike immediately after NKE earnings are announced.

Here are the parameters for this trade:

- The probability of success: 85.92% (call side) – 84.05% (put side)

- The maximum return on the trade is the credit of $0.90, or $90 per iron condor

- Max return: 22.0%

- Break-even level: 108.90 – 84.10

The next Cabot Options Institute – Earnings Trader issue will be published on October 3, 2022.