Another week of less-than-stellar earnings season opportunities as we are well entrenched in the earnings season doldrums and the opportunities are, at least for a few more weeks, non-existent.

That being said, I am intrigued by a potential trade in Oracle (ORCL) today. If I’m able to sell a three-strike-wide iron condor for roughly $0.55, I might take a small position. As always, I’ll send out a trade alert if I decide to make a trade. If not, some of you may still find the trade interesting. As a result, I discuss below a potential trade idea in ORCL that consists of a three-strike-wide iron condor. For those interested, check it out in the “Trade Ideas for Next Week” section at the bottom.

Cabot Options Institute – Earnings Trader Issue: September 12, 2022

It was another week of less-than-stellar earnings season opportunities as we are well entrenched in the earnings season doldrums and the opportunities are, at least for a few more weeks, non-existent.

That being said, I am intrigued by a potential trade in Oracle (ORCL) today. If I’m able to sell a three-strike-wide iron condor for roughly $0.55, I might take a small position. As always, I’ll send out a trade alert if I decide to make a trade. If not, some of you may still find the trade interesting. As a result, I discuss below a potential trade idea in ORCL that consists of a three-strike-wide iron condor. For those interested, check it out in the “Trade Ideas for Next Week” section at the bottom.

But as I state almost every week, while the offseason earnings trades often lack all the necessities for an actual trade, it’s still worth looking at potential trades as we patiently wait for another earnings season, if only for educational purposes.

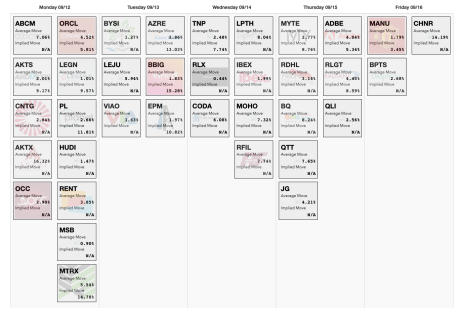

The Week Ahead

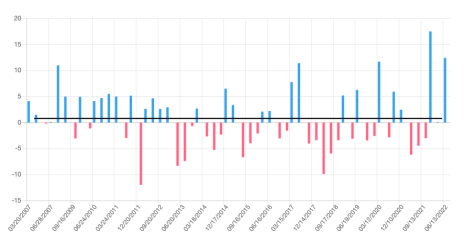

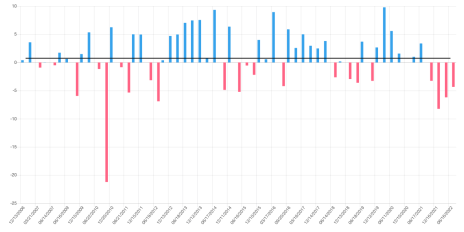

There are no real opportunities, at least in my book, next week. However, here are two stocks with incredibly high implied volatility that have suffered mightily over the past several earnings cycles. I’ll discuss, mostly for educational purposes, a potential bearish trade in GME in the “Trade Ideas for Next Week” section below.

- Oracle (ORCL)

- Adobe (ADBE)

- Manchester United (MANU)

Below are a few more ideas for those of you who tend to be a bit more aggressive.

Top Earnings Options Plays

Here are a few top earnings options plays for next week (9/12 to 9/16) if you are so inclined:

Trade Ideas for Next Week

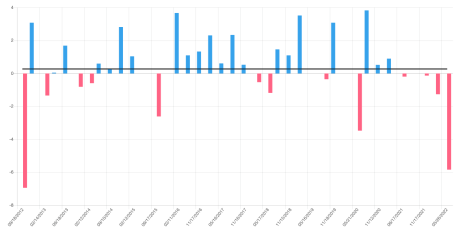

Oracle (ORCL)

ORCL is due to announce earnings today after the closing bell. The stock is currently trading for 75.91.

IV Rank: 49.7

Expected Move for the September 16, 2022, Expiration Cycle: 71.5 to 80.5

Knowing the expected range, let’s look at an iron condor outside of the expected range, or 71.5 to 80.5.

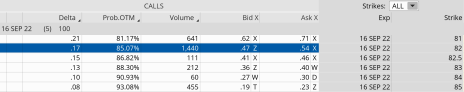

If we look at the call side of ORCL for the September 16, 2022, expiration, we can see that selling the 82 call strike offers an 85.07% probability of success. The 82 call strike sits just above the expected move, or 80.5. We can define our risk through buying the 85 call, thereby creating a three-strike-wide bear call spread at the 82/85 call strikes.

By choosing the 82 call strike we have an 8.0% cushion to the upside.

Now let’s take a look at the bull put portion of our ORCL iron condor.

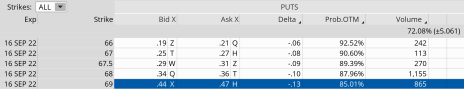

If we look at the put side of ORCL for the September 16, 2022, expiration, we can see that selling the 69 put strike offers an 85.01% probability of success. The 69 put strike sits just below the expected move, or 71.5. We can define our risk through buying the 66 put, thereby creating a three-strike-wide bull put spread at the 69/66 put strikes.

By choosing the 69 put strike we have a 9.1% cushion to the downside.

Here is the trade:

Simultaneously:

Sell to open ORCL September 16, 2022, 82 calls

Buy to open ORCL September 16, 2022, 85 calls

Sell to open ORCL September 16, 2022, 69 puts

Buy to open ORCL September 16, 2022, 66 puts for roughly $0.55, or $55 per iron condor.

Our margin requirement would be $245 per iron condor. The goal of selling the ORCL iron condor is to have the underlying stock stay between the 82 call strike and 69 put strike immediately after ORCL earnings are announced.

Here are the parameters for this trade:

- The probability of success: 85.07% (call side) – 85.01% (put side)

- The maximum return on the trade is the credit of $0.55, or $55 per iron condor

- Max return: 22.4%

- Break-even level: 82.55 – 68.45

The next Cabot Options Institute – Earnings Trader issue will be published on September 19, 2022.

About the Analyst

Andy Crowder

Andy Crowder is a professional options trader, researcher and Chief Analyst of Cabot Options Institute. Formerly with Oppenheimer & Co. in New York, Andy has leveraged his investment experience to develop his statistically based options trading strategy which applies probability theory to option valuations in order to execute risk-controlled trades. This proprietary strategy has been refined through two decades of research and real-world experience and has been featured in the Wall Street Journal, Seeking Alpha, and numerous other financial publications. Andy has helped thousands of option traders learn and implement his meticulous rules-driven options trading strategies through highly attended conferences, one-on-one coaching, webinars, and his work as a financial columnist. He currently resides in Bolton Valley, Vermont and when he’s not trading, teaching and writing about options, he enjoys spending time with his wife and two daughters, backcountry skiing, biking, running and enjoying all things outdoors.