Weekly Earnings Commentary

Our next webinar is this Friday, May 12. If you wish to attend the event or simply wish to receive a notification of the recording’s availability please click here.

Our focus this week will be on PayPal (PYPL) and Disney (DIS).

We got back on track this past week with a small winning trade. In total, we’ve placed five trades this earnings season, with a 60% win ratio and a cumulative loss of -16.1%. With a few weeks left on the earnings calendar, we have several more opportunities to bring our returns back to breakeven for this cycle or possibly into positive territory.

Our overall return is 28.9% - certainly nothing to write home about, but also no complaints as we thankfully sit in positive territory during what has been an incredibly challenging market for all participants over the past year.

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Weekly Watchlist

- PayPal (PYPL)

- Disney (DIS)

Top Earnings Options Plays

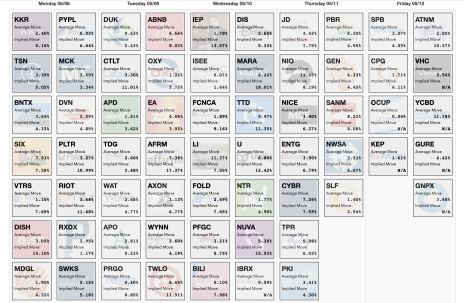

Here are a few top earnings options plays for this week (5/8-5/12) if you are so inclined:

Images Courtesy of Slope of Hope

Trade Ideas for Next Week

As a reminder, you will quickly begin to notice I tend to stick with stocks that have high liquidity as it’s far easier to get in and out of a trade. Medium liquidity offers tradable options, but sometimes the bid-ask spread is wider, which means a greater potential for more price adjustments, making entering and exiting a trade difficult from time to time. Remember, there are roughly 3,200 tradable stocks with options and 11% have medium liquidity while only 3% have what’s considered high liquidity.

Potential Trade Ideas for This Week

Disney (DIS)

Disney (DIS) is due to announce earnings Thursday after the closing bell.

The stock is currently trading for 100.52.

- IV Rank: 20.5

- IV: 50.4%

Expected Move for the May 19, 2023, Expiration Cycle: 94 to 107

Knowing the expected range, I want to place the short call strike and short put strike of my iron condor outside of the expected range, in this case outside of 94 to 107.

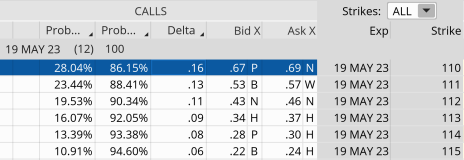

- If we look at the call side of DIS for the May 19, 2023, expiration, we can see that selling the 110 call strike offers an 86.15% probability of success. The 110 call strike sits just above the expected move, or 107.

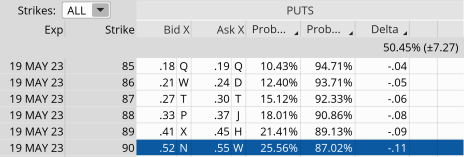

Now let us move to the put side. Same process as the call side. But now we want to find a suitable strike below the low side of our expected move, or 94. The 90 put, with an 87.02% probability of success, works.

We can create a trade with a nice probability of success if DIS stays within the 20-point range, or between the 110 call strike and the 90 put strike. Our probability of success on the trade is 86.15% on the upside and 87.02% on the downside.

Moreover, we have a 9.4% cushion to the upside and a 10.5% margin of error to the downside.

If one wanted to make a trade, below are the potential strikes that make the most sense or are at least a starting point for a trade. At the time of the trade, my hope is that I can increase my “cushion,” or probabilities of success on the trade, as I would be far more comfortable. However, the premium must still make sense.

Here is the potential trade (as always, if I decide to place a trade in DIS, I will send a trade alert with updated data):

Simultaneously:

Sell to open DIS May 19, 2023, 110 calls

Buy to open DIS May 19, 2023, 115 calls

Sell to open DIS May 19, 2023, 90 puts

Buy to open DIS May 19, 2023, 85 puts for roughly $0.80 or $80 per iron condor.

Our margin requirement would be roughly $420 per iron condor. Again, the goal of selling the DIS iron condor is to have the underlying stock stay below the 110 call strike and above the 90 put strike immediately after DIS earnings are announced.

Here are the parameters for this trade:

- The probability of success – 86.15% (call side) and 87.02% (put side)

- The maximum return on the trade is the credit of $0.80, or $80 per iron condor

- Max return: 19.0% (based on $420 margin per iron condor)

- Break-even level: 110.80 – 89.20.

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

The next Cabot Options Institute – Earnings Trader issue will be published on May 15, 2023.