Hope you had a great fourth of July!

I spent the holiday north of Boston with my in-laws.

Despite the rainy weather, we managed to have a blast.

It was great to enjoy good food and drink with the other adults, and the kids had fun too as they were able to play all day with their cousins.

Before we get into this week’s update, I want to share a few thoughts on my favorite free investing resource: Twitter.

From 2006 to 2018, I worked at Eaton Vance and then at Citi, and didn’t really see the use for Twitter.

It just seemed like a bunch of people arguing with one another.

I also could not access Twitter from my work computer, so that didn’t help.

Once I started working full time for myself, I started spending more time on Twitter.

And I quickly realized it’s a gold mine.

The primary way that I use Twitter is to find new investment ideas.

In fact, two of my best-performing recommendations for Cabot Micro-cap Insider (P10 Holdings and BBX Capital) were sourced from Twitter.

The other reason Twitter is useful is for news. News breaks on Twitter faster than on Bloomberg or CNBC. If you want to know why a stock is moving (up or down), just log on to Twitter and search “$” and then its ticker.

Just last week, one of my favorite follows on twitter, Connor Haley, disclosed a new, high conviction idea: IDT Corporation (IDT).

That’s the reason IDT jumped into the mid-40s last week.

Here’s a link to IDT presentation.

His base case price target is $88, double our $44 price target.

After reviewing his detailed work, especially his analysis of IDT’s point of sale segment, NRS, I believe our price target is far too conservative.

NRS has the ability to increase penetration considerably while also increasing average revenue per user. This should result in continued explosive revenue growth over time.

As such, we are increasing our buy limit for IDT to 45. Original Write-up. Buy under 45.00.

Before I get into the other updates, I wanted to give a quick plug for our upcoming annual conference.

9th Annual Smarter Investing, Greater Profits Online Conference

It will take place from August 17-19 and you will hear from all our experts (including me!) about opportunities in the market.

The next issue of Cabot Micro-Cap Insider will be published on Wednesday, July 14, 2021. As always, if you have any questions, please email me at rich@cabotwealth.com.

Changes This Week

Increasing limit on IDT to Buy under 45.00

Updates

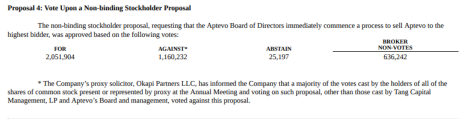

Aptevo (APVO) filed an 8-K disclosing that Proposal 4 (Company Sale) passed.

However, as you can see in the screenshot below, the company made a special point in the footnote that the majority of non-Tang shareholders voted against the immediate sale.

As such, it looks like management might believe it can proceed without an immediate sale process. I’m not a fiduciary expert, but I would think the Board of Directors would open themselves up to all sorts of lawsuits if they ignore this shareholder vote (even though it’s non-binding) unless they are extremely confident they can ultimately sell at a higher price later.

Where does it leave us?

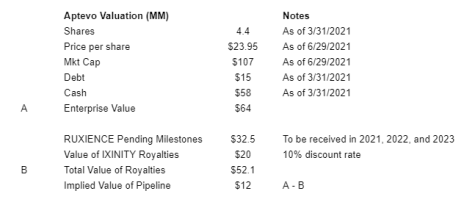

As of July 6, 2021, Aptevo had a market cap of $93MM and an EV of $50MM (see math below). It will receive another $32.5MM in milestone payments from its RUXIENCE sale. Further, I believe its IXINITY royalty payments could be sold for ~$20MM (assuming 10% discount rate).

As shown above, at Aptevo’s closing price on 6/28/2021, its pipeline is being valued by the market at $12MM. This seems too low given the promising results that APVO436 has shown in difficult to treat AML patients. Besides APVO436, Aptevo has a pipeline of other interesting assets.

I don’t know how it will play out, but I continue to believe APVO represents a good risk/reward opportunity with potential asymmetric upside. Original Write-up. Buy under 40

Atento S.A. (ATTO), had no news this week. The company reported a solid quarter in May. It sold off after earnings but has started to perk up lately. One thing should benefit Atento this year is the strength of the Brazilian Real (Brazil represents 40% of revenue). I expect a strong end to 2021 and believe the investment case is on track. I see over 100% upside in the stock over the next couple of years. Original Write-up. Buy under 25.00.

BBX Capital (BBXIA) recently increased its tender offer to buy back shares up to 8.00 per share, up from 6.75.

Currently, the stock is trading at 7.96 and it makes sense to buy shares up to 8.00 as you can immediately sell the shares back to the company at a profit.

My sense is this offer won’t get raised again.

Because BBX is buying back shares at a higher price, it won’t be able to purchase as many shares (3.5MM instead of 4MM). Nonetheless, this is a huge positive as it will increase book value per share significantly.

By my math, book value per share will increase from $16.40 to $18.32. The bear case on BBX capital is that corporate governance will be bad, but this massive share repurchase directly refutes the bear case.

I will not be tendering any of my shares at 8.00.

Ultimately, I believe BBX Capital is probably worth 60% of pro forma (after the buyback) book value per share (18.32). This equates to a new price target of 11.00. Original Write-up. Buy under 8.00.

Donnelley Financial Solutions (DFIN) had no news this week. It reported a great quarter in May with 11% revenue growth, significantly ahead of consensus expectations. Non-GAAP EPS of $1.15 beat consensus as well, and the stock performed well. The stock pulled back after an analyst downgraded it to Hold, but the stock has rebounded sharply. Donnelley is executing well and is still too cheap trading at 9.0x free cash flow and 7.6x forward EBITDA. Original Write-up. Buy under 25.00.

Dorchester Minerals LP (DMLP) recently paid a $0.30 quarterly dividend. At an annualized rate, the annual dividend yield is 7.2%. In 2020, the company generated $39.4MM of free cash flow. Given the pandemic, we can view this free cash flow generation as a trough. As such, DMLP is trading at 15.0x trough free cash flow. This is an extraordinarily cheap multiple for such a high-quality royalty business. Given oil prices are back to pre-pandemic levels but the stock remains depressed, I think the stock looks compelling. Original Write-up. Buy under 17.50.

Drive Shack (DS) has performed well on really no news. However, I believe Drive Shack’s traditional and entertainment golf businesses are set to boom in 2021. Given substantial recent cost cuts, operating leverage should drive earnings growth in 2021 and beyond. Longer term, growth will be driven by new Puttery Venues which have high potential. At its current valuation, Drive Shack’s share price gives minimal value to the strong upside potential from new Puttery Venues. Finally, alignment is high as management and directors own 16.3% of shares outstanding and have recently bought in the open market. I recently spoke to investor relations at the company and the conversation increased my conviction levels. While the stock has rallied sharply, I still see good upside. My price target is 6, but I think the stock could hit 9 looking out a few years. Original Write-up. Buy under 4.00.

FlexShopper (FPAY) disclosed recently that more insiders (Chairman and a director) bought in the open market. This gives me strong confidence that strong results should continue. Recently, the company reported another excellent quarter. Revenue increased by 32.0%, beating consensus slightly. Adjusted EBITDA increased by 20% to $2.4MM. New originations increased 21.7%, which implies that revenue and earnings growth for 2021 should be very strong. I continue to like FlexShopper. It is a rapidly growing company in the virtual lease-to-own market. Despite rapid growth and margin expansion, it is only trading at 7.7x 2021 earnings. My 12-month price target for FlexShopper is 4.70. Original Write-up. Buy under 3.00.

Greystone Logistics (GLGI) is primed to continue to perform well. In April, I had a chance to speak to the CEO and learned a bunch of new stuff. Why did I want to speak to the CEO? Greystone had recently reported a quarter that looked awful at first blush. Revenue declined in the quarter by 26% while EPS declined by 65% to $0.02. However, the 10-Q revealed that the decline in revenue was primarily due to a timing issue. In March (one month after quarter end), Greystone received an order for $7.8MM. If that order had been received in February, revenue would have grown by 13% and earnings would have grown significantly as well. I wanted to get clarity on what was going on. I called the company and within 30 minutes, I was on the phone with CEO Warren Kruger. For the next 20 minutes, I asked Kruger a ton of questions about the industry and his business (he owns over 40% of shares outstanding). He was very candid and direct. I think it was the most informative 20-minute conversation that I’ve ever had! I had two big takeaways from the call: 1) The customer that previously decided to diversify away from Greystone for its pallet orders reversed its decision. This is a major positive. 2) The long-term outlook for the company remains bright and Kruger remains highly engaged. The stock is trading at 8.7x current fiscal year EPS estimate of $0.15 (fiscal year ends in May) which is too cheap given strong growth. I expect strong EPS growth in 2021 (fiscal 2022). Greystone Original Write-up. Buy under 1.30.

HopTo Inc (HPTO) has been relatively weak on no news. The company reported earnings recently. Disclosure was limited but revenue grew slightly in the first quarter. The company also disclosed that it sold some patents for $269.8K. The company didn’t disclose how many patents were sold, but it’s good to see that the company was able to monetize at least a portion of its patent portfolio. All in all, the investment case remains on track. Insiders own a significant stake in the company and have an incentive to growth revenue and earnings to increase value. I believe HPTO is worth ~0.80 per share. Original Write-up. Buy under 0.55.

IDT Corporation (IDT) was covered above.

Liberated Syndication (LSYN) recently announced that it closed its AdvertiseCast acquisition. This is a major positive, and I look forward to when the company can disclose more about it. Currently, disclosure is limited given Libsyn is in the process of restating its financials as it previously mis-accounted for state sales taxes (I view this restatement to be immaterial). I continue to have conviction in the stock. Original Write-up. Buy under 5.00.

MamaMancini’s Holding (MMMB) recently reported another good quarter. Revenue declined by 5%, but this was due to a difficult comparison versus the quarter from Q2 2020 when consumers were stockpiling frozen foods in preparation for the pandemic (sales in the quarter are up 45% over a two-year period). Revenue growth will reaccelerate in the second half of 2021, driven by increased distribution into Walmart and Sam’s Club. The company is also exploring a NASDAQ uplisting and bolt-on acquisitions. My 12-month price target is 3.80, which is driven by an estimated price to earnings multiple of 20x on expected fiscal 2021 earnings of $0.19. Original Write-up. Buy under 2.50.

Medexus Pharma (MEDXF) remains our highest conviction idea. Last week, we had two positive pieces of news. First, we saw insider buying by the management team. Second, it received approval to start selling Treosulfan in Canada (this bodes well for ultimate approval in the U.S.). Also, it recently uplisted to the Toronto Stock Exchange which is a positive. The big news for Medexus is its biggest pipeline drug, Treosulfan, will likely be approved by the FDA in August. This will drive the next leg of growth for the company. Longer term, I think revenue and the stock can triple as the company continues to execute. Original Write-up. Buy under 8.00.

NamSys Inc. (NMYSF) recently filed Q2 ’21 results. Revenue grew 4.5% which is solid, but a definite deceleration from last year’s growth. The Canadian dollar was strong relative to the USD and, as a result, was a headwind for the company in the first quarter. Nonetheless, I’m going to dig deeper into the financials and speak to the company to understand when we can expect revenue to reaccelerate. The stock continues to look attractive, trading at only ~15.0x free cash flow. It has a pristine balance sheet with significant cash and no debt, and insiders own more than 40% of the company, ensuring strong alignment. Original Write-up. Buy under 0.80.

P10 Holdings (PIOE) recently released its Q1 ’21 letter and everything looks great. A couple highlights. Assets under management are expected to increase by 30% this year. This will drive revenue, earnings and cash flow higher in 2021. The company has a full pipeline of M&A opportunities. Insiders own 73% of shares outstanding. If we assume the company can achieve $16.0BN in assets under management by the end of the year (its goal), it is trading at 9.6x free cash flow and 12.9x EBITDA. Very reasonable considering its closest (albeit larger) peer is Hamilton Lane (HLNE) which trades at 31.9x EBITDA and 21.3x free cash flow. My official rating is Hold Half, but I may eventually switch my rating back to Buy given how well the business is positioned. Original Write-up. Hold Half.

Stabilis Solutions (SLNG) had performed well on no news. It is my latest recommendation. It specializes in delivering liquid natural gas (LNG) and hydrogen to its customers who are away from pipelines and off the energy grid. Customers use Stabilis Solutions as it provides them with cheap, reliable energy that is cleaner than other fossil fuels. The company has grown revenue at a 27% CAGR and has a bright outlook. Insiders own over 50% of the company but have been relentlessly buying more stock in the open market. The stock has performed well since the pandemic but looks like a double over the next 12 months. Original Write-up. Buy under 9.00

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, GLGI, HPTO, LSYN, MMMB, MEDXF, PIOE, FPAY, IDT, APVO, DS, and SLNG. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members.