After a volatile March, the market has found its footing. Month to date, the S&P 500 is up 2.8%, and is back to an all-time high.

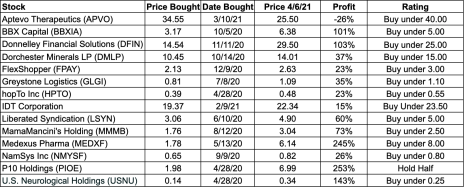

Our open recommendations are up 80% on average from when they were initially profiled. In total (including closed recommendations), our picks are up 70% since being initially profiled.

While there are definitely pockets of froth in the market, I continue to find many attractive opportunities, and I’m looking forward to profiling my latest idea next week.

This week, we have material updates for Liberated Syndication (LSYN), P10 Holdings (PIOE), and Aptevo Therapeutics (APVO).

Liberated Syndication announced that it will acquire AdvertiseCast, an independent podcast advertising company. The combination of Libsyn’s 75,000 podcasts with AdvertiseCast’s advertising capabilities should result in accelerating revenue growth going forward. Last year, AdvertiseCast grew revenue 45% to $12MM and has scaled profitably since being launched in 2016 with no outside investment.

Under the terms of the transaction, Libsyn will pay $30MM ($18MM in cash, $10MM in newly issued Libsyn shares, and $2MM in earnouts). Libsyn will issue $25MM of stock to pay for the deal in a PIPE transaction which will be led by Camac Partners. The transaction is expected to close in Q2 2020. The acquisition looks like a steal. Libsyn is paying 2.5x revenue for a podcast advertising business that is growing 45% per year and profitable. With the acquisition, podcast revenue growth will increase from 11.1% to 26.2%. Total company growth increases from 5.0% to 17.5%.

I will be reviewing my price target in the coming weeks, but given this attractive deal, I’m increasing my limit to 5.00. Original Write-up. Buy under 5.00.

P10 Holdings filed its 10K and issued its annual letter to shareholders. It is always a great read and quick (only three pages).

In the letter, Co-CEOs Robert Alpert and Clark Webb lay out high-level guidance for P10 Holdings’ financial outlook. The business currently has $12.7 billion in assets under management and charges ~1.00% on average for its management fee. The business should generate 55% to 60% EBITDA margins. Taxes and interest payments currently amount to $18.4MM per year. After doing the basic algebra (assuming a 55% EBITDA margin), I determined that the business is currently on track to generate ~$70MM of EBITDA and $51MM of free cash flow.

As such, it’s trading at 12.9x EBITDA and 12.1x free cash flow. This isn’t dirt cheap, but it is very reasonable for such a well-positioned company with organic growth and additional acquisition opportunities. Its closest (albeit larger) peer is Hamilton Lane (HLNE) which trades at 31.9x EBIDTDA and 21.3x free cash flow.

My official rating is Hold Half, but I may eventually switch my rating back to Buy given how well the business is positioned. Original Write-up. Hold Half.

Aptevo Therapeutics (APVO) continues to be very weak.

Aptevo reported Q4 2020 quarterly results and announced that it has agreed to sell its Ruxience Royalty stream for $35MM up front and milestone payments of up to an additional $32.5MM in 2021, 2022, and 2023. Aptevo did not announce any details on the sale of its IXINITY royalty stream, however, I estimate it is worth $19MM. Aptevo’s enterprise value is $99MM.

Counting $67.5MM in payments for Ruxience and $19MM for IXINITY, Aptevo’s pipeline is being valued by the market at $16.5MM which seems low considering APVO436 has generated 1 complete response and another partial response in very difficult to treat AML patients.

With regards to Tang’s unsolicited offer, management noted that it couldn’t agree to a non-disclosure agreement and so talks broke down.

I still believe Aptevo looks like a great asymmetric bet and believe Tang will follow through with his proxy fight to get Aptevo sold to the highest bidder. Original Write-up. Buy under 40.

The next issue of Cabot Micro-Cap Insider will be published on Wednesday, April 14, 2021. As always, if you have any questions, don’t hesitate to email me at rich@cabotwealth.com.

Changes This Week

Increasing LSYN limit to Buy under 5.00

Updates

Aptevo Therapeutics (APVO) was covered above.

BBX Capital (BBXIA) had no news this week. It reported its fourth quarter results recently. The story remains on track. The most important positive relates to the company’s real estate business. Management wrote in its press release: “Although BBX Capital Real Estate (“BBXRE”) was initially adversely impacted by the COVID-19 pandemic during 2020, it has largely recovered and has to some extent benefited from the recent migration of residents into Florida. We believe that there has been an increase in the demand for single-family and multifamily apartment housing in many of the markets in which BBXRE operates.” This news is a major positive as the company has over $100MM of fair value invested in real estate primarily in Florida. The company’s Renin subsidiary (subsidiary and distributor of building products, including barn doors, closet doors, and stair parts) appears to be performing well and should benefit from a strong economic recovery in 2021.The one negative in the quarter was that the company didn’t buy back any shares despite its $10MM share repurchase authorization. A share buyback would make perfect sense given the stock is trading well below and reasonable estimate of fair value. The investment thesis remains on track and the stock is too cheap trading at 39% of book value. Original Write-up. Buy under 5.00.

Donnelley Financial Solutions (DFIN) has performed well but had no news this week. Recently, Donnelley reported a solid quarter. Revenue increased 10.5%, beating consensus expectations considerably. The revenue upside was driven by strong capital markets activity (IPOs and SPAC issuance) as well as continued growth of software and tech enabled solutions. Software solutions revenue increased 8% y/y to $54.2MM and now represent 25.8% of total sales. The company also announced the launch of a new software solution for SEC filing and announced a $50MM share repurchase authorization that will replace its current $25MM authorization. All in all, an excellent quarter. Currently, the stock trades at 7.4x free cash flow and 6.7x forward EBITDA. Original Write-up. Buy under 25.00.

Dorchester Minerals LP (DMLP) continues to look attractive. While oil has pulled back recently it’s still above $55/bbl and the company will generate substantial dividends at this price level. In 2020, the company generated $39.4MM of free cash flow. Given the pandemic, we can view this free cash flow generation as a trough. As such, DMLP is trading at 12.4x trough free cash flow. This is an extraordinarily cheap multiple for such a high-quality royalty business. Original Write-up. Buy under 15.00.

FlexShopper (FPAY) recently reported an excellent quarter but has pulled back. In the quarter, revenue increased by 25.3%, beating the consensus by 4%. Adjusted EBITDA increased by 136% to $2.6MM. And better yet, new originations increased 26.5%, which implies that revenue and earnings growth for 2021 should be very strong. I continue to like FlexShopper. It is a rapidly growing company in the virtual lease-to-own market. Despite rapid growth and margin expansion, it is only trading at 7.2x 2021 earnings. Importantly, the Chairman of FlexShopper owns over 20% of the company and has recently been buying in the open market. My 12-month price target for FlexShopper is 4.70. Original Write-up. Buy under 3.00.

Greystone Logistics (GLGI) had been strong despite no news. The company reported a relative disappointing quarter in January. Nevertheless, I still have long-term conviction in it. Revenue declined by 20% in the quarter. The biggest challenge that Greystone currently has is meeting demand from its customer base. As a result, one of the company’s customers (a major beer company) gave notice that it will be diversifying purchases of case pallets between Greystone and another vendor. Greystone will continue to be the sole provider for the keg pallets. Greystone believes that it will not have a material impact on its financials. On the one hand, a 20% decline in revenue is worse than I had anticipated. But on the positive side, net income increased by 187%. How is that possible? The big driver was a strong improvement in the company’s gross margin. It increased from 11.0% last year to 19.9% in the most recent. Greystone has been investing in improving its manufacturing efficiency and clearly that has paid off. The gross margin expansion is even more impressive given that revenue declined. Usually, gross margins shrink as revenue shrinks given diseconomies of scale. The key question in my mind is: Will revenue ever start growing again? I have high conviction that it will. From 2016 to 2020, revenue grew at a compound annual growth rate of 30.4%. Once vaccines are broadly distributed and Greystone has its workforce back up to full capacity, the company should start growing quickly again. In the most recent quarter, the company generated $0.03 of EPS or $0.12 on an annualized basis. Thus, the stock is trading at a P/E of 9.1x. This represents a good value for a company with such a strong long-term growth outlook. Original Write-up. Buy under 1.10.

HopTo Inc (HPTO) recently filed its 10-k to disclose Q4 earnings. Revenue increased 6% y/y to $0.8MM. For the full year, revenue grew 3%. While not a blow out quarter, it is a positive nonetheless. Insiders own a significant stake in the company and have an incentive to growth revenue and earnings to increase value. I believe HPTO is worth ~0.80 per share. The stock is currently trading at an EV/EBIT multiple of 7.0x. This is way too cheap. To put it in perspective, the software and Internet industry trades at an average EV/EBIT multiple of over 50x. Original Write-up. Buy under 0.55.

IDT Corporation (IDT) has performed well since reporting strong earnings recently. Consolidated revenue increased by 5%. National Retail Solutions (NRS), BOSS Revolution Money Transfer, and net2phone-UCaaS subscription revenues increased by 151%, 73% and 36%, respectively. In particular, NRS’ growth of 151% was incredibly impressive. NRS deployed 1,300 billable POS terminals during the quarter, increasing its network to 13,700 terminals, and had 3,800 active payment processing merchant accounts at January 31, 2021. IDT believes that the market for NRS’ point of sale terminals is 100,000. On a sum-of-the-parts basis (which I think is the right way to view this name given IDT’s propensity to sell and spinoff its assets), the stock is worth 34. Original Write-up. Buy under 23.50.

Liberated Syndication (LSYN) was covered above.

MamaMancini’s Holding (MMMB) is performing very well. We originally recommended the stock last summer and for a long time, it didn’t really do anything. The stock moved slightly up but didn’t make any large moves. It wasn’t as exciting as some of our other fast moving micro-cap recommendations. But we stuck with the stock because it had solid fundamentals (good revenue and earnings growth), a strong balance sheet, and reasonable valuation. And our patience is starting to pay off. After treading water for a while, the stock looks like it’s breaking out. Not a ton has changed from a fundamental perspective. Recently, the company announced that it appointed Managing Partner from Alta Fox Capital, Connor Haley, as a member of the board. This is a major positive as it suggests that Alta Fox Capital (the firm has excellent performance) will remain a shareholder for the long term. MamaMancini’s is in the process of uplisting to the NASDAQ, but that isn’t really new news. The company did recently announce that it is looking to make bolt-on acquisitions of companies with $12MM to $20MM of sales and positive EBITDA. Any acquisition will be complementary to the company’s current portfolio of products and will be immediately accretive. Given strong performance and a cheap valuation, I recently increased my buy limit to 2.50. My 12-month price target is 3.80, which is driven by an estimated price to earnings multiple of 20x on expected fiscal 2021 earnings of $0.19. Original Write-up. Buy under 2.50.

Medexus Pharma (MEDXF) recently disclosed that two insiders (including the CEO) bought shares in the open market. While the size of the insider buy was small, it is nonetheless bullish. I expect Medexus to announce that it will be uplisted to the NASDAQ very soon and this could be a nice catalyst to see the stock continue its upward march. Medexus remains my highest conviction idea and largest person holding. Management believes its current drug portfolio (including recently licensed Treosulfan) has peak sales potential of $350MM to $400MM CAD. Assuming the company can trade at 3x this revenue estimate (the company will execute additional licensing deals so I expect revenue to ultimately grow even higher) in line with slower-growing peers, MEDXF would trade at ~24 per share, implying significant upside from here. Original Write-up. Buy under 8.00.

NamSys Inc. (NMYSF) recently reported positive full-year results. In the fiscal year, revenue increased 15% to $4.7MM. Free cash flow increased 34% to $1.9MM. Namsys is attractively valued, trading at 15.3x free cash flow. The biggest news remains that the company recently announced that it has terminated its long-term incentive plan. The plan was originally put in place in the mid-2010s to incentivize the team to help transition NamSys’ software from on-premise to a cloud-based offering. However, the long-term incentive plan had no limit as participants in the bonus plan are entitled to 15% of the value of the company, no matter how high it’s valued. The payout for the termination of the bonus plan will be made in cash and stock. This is a major positive as it will increase the company’s earnings growth rate going forward. Further, it’s possible that this announcement could be a prelude to a sale of the company. Despite historically growing revenue and earnings at a compound annual growth rate of 20%+, the stock only trades at 15.3x free cash flow. It has a pristine balance sheet with significant cash and no debt, and insiders own more than 40% of the company, ensuring strong alignment. Original Write-up. Buy under 0.80.

P10 Holdings (PIOE) was covered above.

U.S. Neurological Holdings (USNU) had another quiet week, but I expect it to report earnings within the next few weeks. It last reported earnings in November. Revenue grew 0.6% y/y and 11% q/q as procedures and price per procedure both rebounded. Year to date, the company has generated EPS of $0.05, or $0.067 on an annualized basis. As such the company is trading at just 5.1x earnings. In addition, the company has $1.5 million ($0.19 per share) of cash and no debt on its balance sheet. It also has $1.1MM (due from related parties) and has generated over $500,000 in free cash flow year to date. U.S. Neurological Holdings operates as a holding company in the United States. It is engaged in providing medical treatment and diagnostic services that include stereotactic radiosurgery centers, utilizing gamma knife technology, and it holds interests in radiological treatment facilities. Original Write-up. Buy under 0.25.

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, GLGI, HPTO, LSYN, MMMB, MEDXF, PIOE, FPAY, IDT, and APVO. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.