As I mentioned last week, the stock market is off to a great start with the S&P 500 at an all-time high.

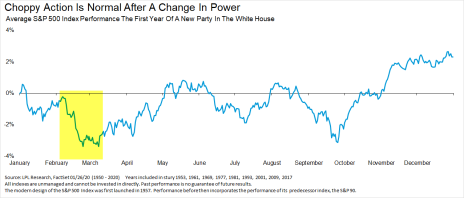

However, it’s important to remember that usually the market is choppy in February and March in the first year of a new party in the White House as shown below.

If the market does get choppy over the next couple of months, just know that it is completely normal and expected.

I would use it as an opportunity to add to high conviction ideas or to add to ideas that are trading above my buy limit.

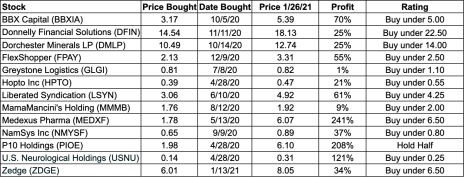

One example is Zedge Inc (ZDGE). My recommendation is to buy it at 6.50 or lower. Unfortunately, the stock shot up after I recommended it to above my buy limit so I didn’t have a chance to buy any shares. Zedge is a name that I will watch closely with an eye for adding if we see market weakness.

I will give an update on all my recommendations below, but I want to spend a few minutes in my introduction on Medexus Pharmaceuticals (MEDXF).

I hope you know by now that it’s my highest conviction idea and my largest personal holding.

Previously, the company had announced that it would explore upgrading its public listing from the Canadian stock exchange to the NASDAQ. Last week, the company announced that it has submitted its application to the NASDAQ and, based on a recent presentation by management, I believe the uplisting could occur by the end of March. This will be a major catalyst as peers trade at over 3x revenue.

If Medexus trades in line with peers, it could easily be a $15 stock. My recommendation is to buy it under 6.50.

The next issue of Cabot Micro-Cap Insider will be published on Wednesday, February 10, 2021. As always, if you have any questions, don’t hesitate to email me at rich@cabotwealth.com.

Changes This Week

No Change

Updates

BBX Capital (BBXIA) filed an 8-k recently which disclosed that Angelo Gordon owns 4.9% of the company and that BBX Capital had granted Angelo Gordon permission to buy up to 10% of the company. I view this as bullish given: 1) Angelo Gordon is a sophisticated investor and sees significant value and 2) management was open to taking on outside investment. I recently spent considerable time reviewing my investment thesis for BBX Capital. All in all, the investment case remains on track. Despite strong performance, the company trades at just 30% of book value. It should generate significant earnings and free cash flow in 2021. In October 2020, the company announced that it had authorized a $10 million share repurchase, representing 10% of its market cap. The company also recently announced that it has purchased Colonial Elegance, a supplier and distributor of building products, including barn doors, closet doors, and stair parts for 5.6x EBITDA, an attractive price. Despite poor historical corporate governance, we are aligned with management as the Levin family (controlling shareholders) own 42% of shares outstanding. I see 50%+ upside. Buy under 5.00.

Donnelly Financial Solutions (DFIN) had a quiet week with no news. Donnelley Financial Solutions (DFin) is a 2016 spin-off that has successfully executed a turnaround, transitioning from a mainly print focused business to a software/tech-enabled services business. Despite strong cash flow generation and debt paydown, the stock still trades at a draconian valuation. Simcoe Capital, an activist investor, owns 10% of the stock, ensuring we are well aligned with insiders. With modest earnings growth and multiple expansion, coupled with significant debt paydown, the stock should hit 40 by 2024, implying over 100% upside. The stock has performed well but still only trades at 9x free cash flow and 6.2x forward EBITDA. Buy under 22.50.

Dorchester Minerals LP (DMLP) reported recent insider buying as the CFO purchased about $18,000 of stock in the open market at an average price of $10.92. While this purchase isn’t massive, it is nonetheless bullish. Back in November, the company reported Q3 earnings. There were no surprises. Through September, the company has generated $32MM of free cash flow or $43MM on an annualized basis. As such, it is trading at 10.6x annualized free cash flow. This is an incredibly cheap valuation for a debt-free royalty business that pays out all its income in dividends and will skyrocket if (when) energy markets recover. Dorchester’s next distribution of $0.24 will be paid on Feb 11. This yield on an annualized basis works out to a yield of 7.8%. The stock remains very cheap yet oil prices are back to $50 per barrel. Buy under 14.00.

FlexShopper (FPAY) has performed well even though there has been no new news. In December, the President and Co-founder Brad Bernstein resigned. This was not too surprising. Last year, the board had voted to bring in a new CEO (Richard House), and typically founders don’t stick around for too long after a new CEO is hired. In my mind, this is a non-issue. I continue to like the stock. It is a rapidly growing company in the virtual lease-to-own market. Despite rapid growth and margin expansion, it is only trading at 9.7x 2021 earnings. Importantly, the Chairman of FlexShopper owns over 20% of the company and has been buying more stock as fast as he can in the open market. Recently, H.C. Wainwright published an initiation report on the company with a $4.00 target. Also, I recently had a chance to talk to management (both the CEO and CFO), and it increased my conviction in the idea. Buy under 2.50.

Greystone Logistics (GLGI) reported earnings last week. The stock has been a little volatile, but I still have long term conviction in it. Revenue declined by 20% in the quarter. The biggest challenge that Greystone currently has is meeting demand from its customer base. As a result, one of the company’s customers (a major beer company) gave notice that it will be diversifying purchases of case pallets between Greystone and another vender. Greystone will continue to be the sole provider for the keg pallets. Greystone believes that it will not have a material impact on its financials. On the one hand, a 20% decline in revenue is worse than I had anticipated. But on the positive side, net income increased by 187%. How is that possible? The big driver was a strong improvement in the company’s gross margin. It increased from 11.0% last year to 19.9% in the most recent. Greystone has been investing in improving its manufacturing efficiency and clearly that has paid off. The gross margin expansion is all the more impressive given that revenue declined. Usually, gross margins shrink as revenue shrinks given diseconomies of scale. The key question in my mind is “Will revenue ever start growing again?” I have high conviction that it will. From 2016 to 2020, revenue grew at a compound annual growth rate of 30.4%. Once vaccines are broadly distributed and Greystone has its workforce back up to full capacity, the company should start growing quickly again. In the most recent quarter, the company generated $0.03 of EPS or $0.12 on an annualized basis. Thus, the stock is trading at a P/E of 8.0x. This represents a good value for a company with such a strong long-term growth outlook. Buy under 1.10.

HopTo Inc (HPTO) had no news this week, but the stock has generally been weak since reporting earnings in November. In the quarter, sales declined by 6%. However, just as we didn’t get too excited last quarter when sales jumped 49%, we aren’t going to get too down this quarter. On a quarterly basis, sales are lumpy. Year to date, revenue is up 3% and operating profit is up 5%. The stock has pulled back and looks attractive. I believe HTPO is worth ~0.86 per share. HopTo is currently trading at an EV/EBIT multiple of 6.6x. This is too cheap. To put it in perspective, the software and internet industry trades at an average EV/EBIT multiple of over 50x. Buy under 0.55.

Liberated Syndication (LSYN) was quiet this week. Over the past couple of months there has been significant insider buying as the CEO, CFO, and directors including activist investor Eric Shahinian of Camac Partners. Camac Partners currently owns 7.9% of shares outstanding ensuring strong alignment. Libsyn recently reported earnings. As expected, the quarter was a little messy due to compensation expenses related to the former CEO, Chris Spencer, leaving. Nonetheless, the long-term outlook looks great. Another interest thing to monitor is that Libsyn recently filed an 8-k disclosing that it is suing several of its largest shareholders to force them to forfeit their shares. The backstory is a little complicated but here is a good article that summarizes it. The key takeaway is it would be a huge positive for us if Libsyn won its lawsuit as shares outstanding would decline from 26.6MM to 19.4MM, a 27% decline. Buy under 4.25.

MamaMancini’s Holdings (MMMB) reported earnings in early December. Revenue grew 6.8% while EPS grew 100% to $0.02 as the company continues to leverage its fixed cost base. Sales growth decelerated slightly due to COVID headwinds, but I’m confident sales will reaccelerate in 2021 and beyond. Additionally, the company is currently running a strategic review which could result in the company being sold. Whether or not the company is sold, I believe returns should be strong going forward given the company will continue to grow and generate strong earnings growth. It has historically grown revenue at a 24% CAGR yet only trades at 10x forward earnings. Management owns over 50% of the stock, ensuring that incentives are aligned. Further, the company has a clean balance sheet. Buy under 2.00.

Medexus Pharma (MEDXF). See above. Buy under 6.50.

NamSys Inc. (NMYSF) Last week, Namsys announced that it has terminated its long term incentive plan. The plan was originally put in place in the mid 2010’s to incentivize the team to help transition Namsys’s software from on-premise to a cloud-based offering. However, the long-term incentive plan had no limit as participants in the bonus plan are entitled to 15% of the value of the company, no matter how high it’s valued. The payout for the termination of the bonus plan will be made in cash and stock. This is a major positive as it will increase the company’s earnings growth rate going forward. Further, it’s possible that this announcement could be a prelude to a sale of the company. Despite historically growing revenue and earnings at a compound annual growth rate of 20%+, the stock only trades at 22x 2019 earnings. It has a pristine balance sheet with significant cash and no debt, and insiders own over 40% of the company, ensuring strong alignment. Buy under 0.80.

P10 Holdings (PIOE) recently closed its acquisition of Enhanced Capital Group, a premier impact investment platform. Since its inception, Enhanced has deployed over $2BN of capital into impact credit and impact equity investments. Areas of focus include small business lending in impact areas and to women and minority-owned businesses, renewable energy, and historic building rehabilitation. My estimate is that this transaction will increase run rate EBITDA to ~$75MM. As such, P10 is trading at an EV/EBITDA multiple of 14.0x. As I have said before, the stock is no longer dirt cheap. Nonetheless, it still trades at a sharp discount to its closest peer, Hamilton Lane (HLNE), which trades at an EV/forward EBITDA multiple of 30.4x. Catalysts for P10 Holdings going forward include: 1) additional deals and 2) a potential up-listing to a major exchange. Given the stock is not dirt cheap anymore, I recommend holding a half position. I want to keep exposure to the name but think it’s prudent to book some profits. Hold Half.

U.S. Neurological Holdings (USNU) reported earnings in November. Revenue grew 0.6% y/y and 11% q/q as procedures and price per procedure both rebounded. Year to date, the company has generated EPS of $0.05 or $0.067 on an annualized basis. As such the company is trading at just 3.9x earnings. In addition, the company has $1.5 million ($0.19 per share) of cash and no debt on its balance sheet. It also has $1.1MM (due from related parties) and has generated over $500,000 in free cash flow year to date. U.S. Neurological Holdings operates as a holding company in the United States. It is engaged in providing medical treatment and diagnostic services that include stereotactic radiosurgery centers, utilizing gamma knife technology, and it holds interests in radiological treatment facilities. Buy under 0.25.

Zedge (ZDGE) is my most recent recommendation. It is a leading app developer that is currently growing revenue at 85% yet trades at only 30x earnings. Insiders own over 11% of shares outstanding ensuring high shareholder alignment. The management team has turned around the business and growth is expected to stay strong for the foreseeable future. Even though the stock is near a 52-week high, it is still undervalued. I see 20%+ upside over the next year. Buy under 6.50.

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, GLGI, HPTO, LSYN, MEDXF, PIOE, and FPAY. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.