This week, I wanted to share a couple good charts to show why I continue to be bullish on energy stocks.

First, energy still represents a very small weight in the S&P 500.

Energy as a percentage of the S&P 500 reached as high as 16% in 2009. Today it’s under 5%.

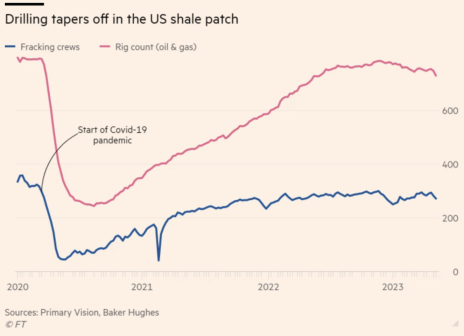

The number of drilling rigs is still below pre-COVID levels at 731.

During the shale boom, there were ~2,000 rigs drilling for oil and gas.

Energy companies have learned financial discipline.

There is a saying in the oil industry: “The best cure for low oil prices is low oil prices.”

Why?

There are two primary factors:

1) Supply and demand dynamics: When oil prices are low, it becomes less profitable for oil producers to extract and sell oil. As a result, some producers may reduce their production or even shut down operations altogether. This decrease in supply helps balance the market by reducing the excess oil inventory.

2) Exploration and investment slowdown: Low oil prices discourage new exploration projects and investments in oil production infrastructure. This reduction in future supply growth can help bring the market back into balance, as it limits the potential for a significant increase in supply once prices start to recover.

These same dynamics explain why drilling increases when energy prices are high which eventually leads to lower energy prices.

The difference that we’ve seen in the last five years is that an increase in oil prices has not resulted in increased drilling.

Energy companies have drilled new wells sparingly and have preferred to return cash to shareholders through buybacks and special dividends.

This bodes well for future sector outperformance.

My favorite energy names are Unit Corp (UNTC), Kistos (GB: KIST), and Epsilon Energy (EPSN).

This week was relatively quiet, but here is one update that I want to highlight:

1) Kistos PLC (GB: KIST) announced that it closed its Mime Petroleum acquisition.

The next issue of Cabot Micro-Cap Insider will be published on Wednesday, June 14. As always, if you have any questions, please email me at rich@cabotwealth.com.

Changes This Week

None.

Updates

Cogstate Ltd (COGZF) had no company news this week. On May 3, Eli Lilly (LLY) announced positive results for its Alzheimer’s drug, donanemab. Patients treated with the drug saw their Alzheimer’s progression slow by 27% versus placebo. Eli Lilly plans to proceed with regulatory submissions to get approval as quickly as possible. I expect FDA approval in late 2023 or early 2024. Cogstate worked with Eli Lilly for its phase III trial of donanemab. If the drug is approved, it will mean significantly more revenue for Cogstate as the additional studies are greenlit. Cogstate reported fiscal Q3 results on April 26. Revenue declined 15% y/y to $11MM. The revenue shortfall is due to slow patient enrollment in Alzheimer’s clinical trials. This isn’t lost revenue but revenue that has just been pushed out a year or so. Management also mentioned that smaller biotechs are a little more cautious spending money given the macro environment. In the near term, Cogstate has two significant catalysts: 1) Eisai’s LEQEMBI (Alzheimer’s) PDUFA date (FDA decision date) is July 6, 2023. 2) Potential approval for Eli Lilly’s donanemab (Alzheimer’s) in late 2023/early 2024. Positive news for either or both drugs would mean significantly more revenue for Cogstate due to the need for additional clinical trials to expand the drugs’ labels and to monitor the effectiveness of the drugs in real patients. Finally, Cogstate announced that it is actively buying back its own stock. It currently has a $13MM authorization (5% of market cap). While Cogstate’s performance has been disappointing, I remain confident in the long-term outlook. Original Write-up. Buy under 1.80

Copper Property Trust (CPPTL) had no news this week. It announced on May 5 that its latest distribution would be $0.100391 (to be paid out on May 9). The distribution is from cash flow that was generated from operations (no asset sales proceeds were included). As such, the run rate yield on the Trust is 11%. Pretty attractive. The Trust has pulled back, but this is largely due to rising interest rates which have impacted all real estate companies. Copper Property Trust continues to look attractive. I’m very happy to recommend a security that has no debt, is paying an 11% dividend yield, and is liquidating properties over time. Original Write-up. Buy under 14.00

Currency Exchange International (CURN) had no news this week. It reported another excellent quarter on March 15. Revenue grew 32% to $16.5MM, beating consensus expectations by ~$1MM. While we have grown accustomed to 100%+ revenue growth, typical seasonality is returning to the business (Q1 is typically the weakest quarter while Q3 is typically the strongest). Banknote revenue grew 26% while Payments revenue increased 60%. Currency Exchange’s valuation looks attractive at 9x forward earnings and 7x forward free cash flow. Original Write-up. Buy under 16.00

Epsilon Energy (EPSN) reported Q1 earnings on May 10, 2023. The company generated $3.6MM of free cash flow (excluding positive movements in working capital) in the quarter or $14.4MM annualized. EBITDA was $5.6MM in the quarter or $22.4MM annualized. Epsilon bought back 237k shares (1% of shares outstanding) at an average price of 5.72. It paid out $1.4MM in dividends. Despite both, net cash rose to $49.8MM. While depressed natural gas prices are negatively impacting Epsilon’s results, the company looks attractively valued even using draconian assumptions. In 2020, when natural gas prices were at similar levels, Epsilon generated $15.7MM of adjusted EBITDA. Thus, the stock is trading at just 3.6x 2020 (which I view as trough) EBITDA. This valuation appears compelling. Meanwhile, the company is paying a nice dividend and buying back stock. Downside is further limited given that cash represents 43% of Epsilon’s market cap. Original Write-up. Buy under 8.00

Esquire Financial Holdings (ESQ) had no news this week. The company reported a good quarter on April 25. Capital remains strong. Common equity tier 1 ratio stands at 14.89% and would be 12.97% including all after-tax unrealized losses. Tangible common equity to tangible assets stands at 11.77% and would be 11.38% including all after-tax unrealized losses. Credit losses remain low with no non-performing loans and a 1.34% allowance for credit losses. Total deposits increased $100MM to $1.3BN from December 31, 2022, to March 31. Uninsured deposits are just 33% of total deposits, and importantly, more than 90% of uninsured deposits represent clients with full relationship banking (loans, payment processing, and other service-oriented relationships). EPS came in at $1.47 or $5.88 on an annualized basis. As such, the stock is trading at just 6x earnings. Esquire looks compelling. Original Write-up. Buy under 45.00

IDT Corporation (IDT) had no news this week. It reported another solid quarter on March 8. Consolidated revenue decreased 7% due to continued tough comps, but NRS continues to grow like crazy (+103%) and net2phone does as well (+30%). The company generated $23.2MM of consolidated EBITDA. Thus, it’s trading at 6.2x consolidated annualized EBITDA. So, the stock now looks cheap on both a consolidated and SOTP basis. Given challenging market conditions for high-growth companies, IDT’s subsidiaries won’t be spun off soon, but we know that, ultimately, they will be monetized either through a sale or a spin-off. The investment case remains on track. Original Write-up. Buy under 45.00

Kistos PLC (KIST: GB) announced this week that it closed its deal to acquire Mime Petroleum, a Norwegian company. I love the structure of the deal. Kistos will pay US$1 plus issue up to 6 million warrants exercisable into new Kistos ordinary shares at a price of 385p each, which represents a premium of 31.4% to the last Kistos trading price. Kistos will assume ~$300MM of debt associated with Mime Petroleum, but after factoring cash both at Kistos and on the Mime balance sheet, net cash is expected to be €5MM. Kistos decided to diversify away from the U.K. and Dutch sectors as punitive windfall tax potential made it difficult for the company to commit capital in those geographies. I will need additional data to complete an updated valuation analysis, but I like the deal and continue to be excited by the prospects for Kistos. Original Write-up. Buy under 7.50

Liberated Syndication (LSYN) is working to gain liquidity for shareholders. I spoke to the CEO on February 17 and got an update. He is pursuing any and all liquidity options for investors including: 1) partnering with a SPAC, 2) merging with another public NOL shell, 3) raising money through an IPO, and 4) taking on private equity. I don’t have a sense of timing in terms of when LSYN shareholders can expect liquidity, but I know it is a big focus for the company. From a financial perspective, Libsyn continues to grow strongly. Revenue grew from $42MM in 2021 to $57MM in 2022. On a pro forma basis (full-year contribution from the acquisition of Julep), revenues are over $60MM. Profitability is down as the company is focused on expanding into the podcasting advertising market which has lower profitability than the hosting business. Still, I’m optimistic that Libsyn has a bright future. Original Write-up. Hold

M&F Bancorp (MFBP) reported excellent earnings on May 5. EPS increased 82% to $0.89. ROE reached 32% vs. 12% a year ago. This windfall is due to M&F’s deployment of new capital from the Emergency Capital Investment Program. The bank’s CEO stated, “We are pleased with our results for the first quarter of 2023, which exceeded our expectations. We achieved significantly increased earnings available to stockholders of $1.8 million and achieved a 1.55% return on assets, which is outstanding.” The bank remains overcapitalized with stockholder’s equity representing 26.95% of total assets. Non-performing loans represent 0.19% of total assets. M&F is trading at just 6.5x annualized earnings. I expect EPS to grow to $4.74 in 2025 (this might happen by 2024). Assuming M&F continues to trade at its average P/E multiple of 9.3x, the stock should hit 44.00 by 2025, implying significant upside. Original Write-up. Buy under 21.00

Magenta Therapeutics (MGTA) had no news this week. It announced on May 3 that it plans to merge with Dianthus Therapeutics. The stock closed down ~20% but has recovered half the drop since then. The announcement is disappointing as I was hoping Magenta would pay out excess cash and then perhaps merge its public listing with another company that hoped to go public. Pre-merger Magenta shareholders are expected to own 21.3% of the new company. The new company is going to raise $70MM in capital from Fidelity, Venrock Healthcare, and several other institutional investors in conjunction with the merger. The new company will have $180MM of cash and several drugs in development focused on treating autoimmune diseases. I’m going to dig into Dianthus to try to determine how promising it is. At a bare-bones level, pre-merger Magenta shareholders will own 21.3% of $180MM of cash that the new company will have once the merger closes. That represents $39MM of value. Magenta’s current market cap is $43MM. Thus, the market is not giving Magenta much credit for Dianthus’s pipeline. I think it’s unlikely that the current merger gets approved by shareholders – I bet an improved deal will be reached. Therefore, I’m comfortable switching my rating from Hold to Buy under 0.75. Original Write-up. Buy under 0.75.

Medexus Pharma (MEDXF) had no news. On April 11, the company announced that it expects record fiscal year results. This is encouraging. On March 22, the company announced that it has secured a new licensing agreement to sell a topical treatment called Terbinafine. The product could be approved in Canada this year. Management hasn’t provided sales potential, but it will be a positive contributor. On March 8, Medexus announced that it has secured new credit facilities amounting to $58.5MM. The interest rate for the facilities is only 8.58%, an attractive rate. The new facilities include a $35 million loan, of which $30MM will be used to repay long-term debt, and an additional $5MM that can be used to pay off debentures. Additionally, there is a possibility of accessing an extra $20MM of uncommitted capital. Medexus plans to use this capital to repay convertible debentures in cash, which could potentially halve the dilution. Overall, this is a big positive. All in all, my conviction level remains high. The stock’s valuation looks cheap. Original Write-up. Buy under 3.50

Merrimack Pharma (MACK) had no news this week. It is a biotech company that has no employees. It relies on contractors to minimize costs. Its sole purpose is to receive milestone payments from Ipsen related to the drug Onivyde. Onivyde will likely be approved for first-line metastatic small-cell lung cancer in early 2024 which will trigger a $225MM royalty payment. Merrimack has committed to distributing any royalty proceeds to investors. I expect Merrimack to distribute $15 per share to investors within ~15 months, representing more than 125% of its current share price. Additional upside can be achieved through future milestone payments. Finally, insiders are buying stock in the open market. Original Write-up. Buy under 12.50

NexPoint (NXDT) filed its 10-Q on May 12, 2023. A couple takeaways: 1) NexPoint’s current NAV (net asset value) is $24.43. As such, the stock is still trading at a massive discount. 2) NexPoint is trying to refinance its debt ($145MM) for its Cityplace Tower in Dallas. The debt was originally due in September, but the lender has agreed to extend the maturity. Management remains confident that it can complete the refinancing, but I’m watching this closely as Cityplace represents ~10% of NXDT’s NAV. 3) The company authorized a share repurchase agreement in October of $20MM over a two-year period. Unfortunately, the company has not bought back any stock. I believe this is because the company is retaining liquidity to support the Cityplace refinancing. Original Write-Up. Buy under 17.00

P10 Holdings (PX) had no news this week. The company filed a Form 4 statement on March 16 that seemed to indicate that an insider is selling. But it appears that the company repurchased those shares at an 8% discount to the market (privately negotiated transaction). What appears like a negative is actually a positive. P10 announced an excellent quarter on March 6. Fee-paying assets under management increased 23% y/y. Revenue increased 32% and adjusted EBITDA grew 29%. P10 continues to benefit from secular tailwinds in the private equity industry. Despite strong growth, P10 trades at just 12.9x EBITDA and just 13x cash earnings. This is too cheap a valuation. The investment case is on track. Original Write-up. Buy under 15.00

RediShred (RDCPF) had no news this week. It reported another excellent quarter on April 21. Revenue grew 57% to $57MM CAD while EBITDA grew 67% to $15.3MM. The strength was driven both by acquisitions and organic growth. Organic growth is being driven by increased demand for shredding by businesses. Higher fuel costs and driver costs hurt margins, but these are starting to moderate. The stock continues to look cheap at 5.8x forward EBITDA. I continue to see 100% upside over the next 12 months and significantly more upside looking out a few years. Original Write-up. Buy under 3.50

Transcontinental Realty Investors (TCI) had no news this week. The company announced on April 19 that its CEO had resigned. I’m not sure what this means. It could be a prelude to a sale but perhaps I’m just being optimistic. The company filed Q4 and 2022 results on March 24. The results look great. As of December 2022, Transcontinental has $471MM of cash and notes receivable on its balance sheet. Its current market cap is $362MM. The company does have some debt for which it has no recourse as it’s tied to additional real estate that Transcontinental owns. Long story short, this stock is very, very cheap. Unfortunately, there is no hard catalyst now and we don’t know what management is going to do with the stock, but we know that the stock is extremely cheap. Insiders are incentivized to buy out minority shareholders at a premium to the current stock price but at a discount to book value. Currently, the stock trades at a price to book value multiple of just 0.4x. Original Write-up. Buy under 45.00

Trinity Place Holdings (TPHS) is my newest recommendation. It is a high-risk, high-reward stock. I see a legitimate case for the stock to go up 7x. At the same time, the stock could decline by 100%. The company’s real estate is well-located and based in New York City. The stock represents an asymmetric opportunity with a 7:1 upside-to-downside ratio. Insiders own a significant portion of shares. Original Write-up. Buy under 0.45

Truxton (TRUX) reported earnings on April 20. The quarter was solid. EPS came in at $1.47. Asset quality remains high with $0 non-performing loans as of March 31, 2023. The bank’s capital position remains strong with Tier 1 leverage at 10.3%. The one negative in the quarter was that deposits decreased, albeit slightly (by 4%) from December 31, 2022, to March 31, 2023. I’m going to watch this trend closely to see if it continues. Truxton continues to look attractive at ~10x earnings. This isn’t the most exciting stock, but it’s a slow and steady winner. Original Write-up. Buy under 75.00

Unit Corp (UNTC) had no news this week. I’ve done a lot of work on Unit over the past couple of weeks and believe the company will generate $92MM in free cash flow in 2023, even with depressed natural gas prices. As such, the stock looks compelling at a price to free cash flow multiple of 4.6x and an enterprise value to free cash flow multiple of 3.3x. My conversation with the Unit Corp. CFO in April confirmed that all my assumptions are reasonable/conservative. Here are the key takeaways: 1) Q2 dividend ($2.50) hasn’t been approved by the board yet, but they intend to pay it. They also intend to give a little bit of guidance as to what the quarterly dividend will be going forward. I mentioned that I was a little disappointed that the company wasn’t currently buying back stock at 4x FCF and 3x on an EV/FCF basis and the CFO responded with: “We are subject to earnings blackouts when we can’t buy back stock (current period)” and “the implied dividend yield if you annualize the Q2 dividend is very high.” This comment suggests to me that the Q2 dividend might in fact be a good proxy for the run-rate quarterly dividend. 2) While the strategic process to sell the upstream division is over, “everything is for sale at the right price.” 3) Day rate for BOSS rigs is low-to-mid-$30k range. Expect 100% utilization for 2023. SCR Rig utilization might be lower given the natural gas price pullback. All in all, it was a good update, and I bought more stock recently. Original Write-up. Buy under 65.00

William Penn (WMPN) reported strong quarterly results on April 19. Despite the turmoil in the banking market, William Penn grew deposits in the quarter. The bank remains well capitalized with a tangible common equity ratio of 19.7%. The company continues to aggressively repurchase shares. During the quarter, the Board of Directors authorized a fourth repurchase program to buy back up to 698,312 shares. The company is being quite aggressive. In the first half of April, it repurchased nearly 400,000 shares in the open market. Tangible book value is $12.54 so the stock is currently trading at 75% of book value. This looks like a compelling valuation. Downside is low given the stock is trading below liquidation value. Original Write-up. Buy under 12.50

| Stock | Price Bought | Date Bought | Price on 5/23/23 | Profit | Rating |

| Cogstate Ltd (COGZF) | 1.7 | 4/13/22 | 1.07 | -37% | Buy under 1.80 |

| Copper Property Trust (CPPTL) | 12.93 | 8/11/22 | 10.5 | -3% | Buy under 14.00 |

| Currency Exchange (CURN) | 14.1 | 5/11/22 | 17.09 | 21% | Buy under 16.00 |

| Epsilon Energy (EPSN) | 5 | 8/11/21 | 5.29 | 6% | Buy under 8.00 |

| Esquire Financial Holdings (ESQ) | 34.11 | 10/10/21 | 43.23 | 27% | Buy under 45.00 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 33.8 | 74% | Buy under 45.00 |

| Kistos PLC (KIST) | 4.79 | 7/13/22 | 2.67 | -44% | Buy under 7.50 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.75 | 23% | Hold |

| M&F Bancorp (MFBP) | 19.26 | 11/9/22 | 23.5 | 22% | Buy under 21.00 |

| Magenta (MGTA) | 0.79 | 4/12/23 | 0.64 | -19% | Buy under 0.75 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 0.92 | -48% | Buy under 3.50 |

| Merrimack Pharma (MACK) | 11.99 | 1/11/23 | 12.52 | 4% | Buy under 12.50 |

| NexPoint Diversified Real Estate Trust (NXDT) | 14.15 | 1/12/22 | 10.52 | -21% | Buy under 17.00 |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 10.96 | 268% | Buy under 15.00 |

| RediShred (RDCPF) | 3.3 | 6/8/22 | 2.81 | -15% | Buy under 3.50 |

| Transcontinental Realty Investors (TCI) | 40.22 | 10/13/22 | 38.6 | -4% | Buy under 45.00 |

| Trinity Place Holdings Inc. (TPHS) | -- | NEW | -- | --% | Buy under 0.45 |

| Truxton Corp (TRUX)* | 72.25 | 12/8/21 | 60 | -14% | Buy under 75.00 |

| Unit Corp (UNTC) | 57.44 | 12/14/22 | 44.8 | -3% | Buy under 65.00 |

| William Penn Bancorp (WMPN) | 11.91 | 3/8/23 | 10.01 | -8% | Buy under 12.50 |

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in KIST:GB, LSYN, MEDXF, PX, IDT, APVO, NXDT, COGZF, RDCPD, TCI, ZDGE, and MFBP. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members.