Today, we are recommending a micro-cap stock in the virtual lease-to-own market.

I think this stock has ~100% upside over the next year or so.

This company’s characteristics include:

- Secular revenue growth

- Significant operating leverage

- Company insiders own over 20% of shares outstanding

- Recent insider buying

All the details are inside this month’s Issue. Enjoy!

Cabot Micro-Cap Insider 1220

[premium_html_toc post_id="221335"]

Focus on the Fundamentals

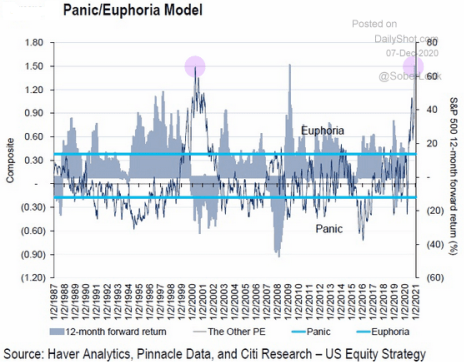

Sentiment indicators continue to suggest the market may be due for a pullback.

The Citi Panic/Euphoria model suggests sentiment is high right now.

Historically speaking, when this model sees “euphoria” in the market, 12-month forward returns look poor.

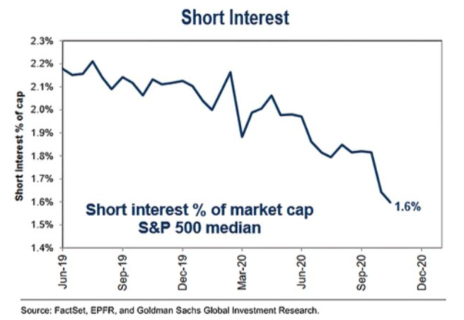

Another interesting sentiment data point is S&P 500 short interest. This chart shows the percentage of the S&P 500’s market cap that is held short.

As shown above, short interest is low, which suggests expectations are quite high and skepticism in the market is low.

In the current environment, it’s important to focus on the fundamentals and remember why we own the stocks that we own.

Let’s use Medexus Pharma (MEDXF) as an example.

Since we initially recommended the stock this spring, it is up over 100%. If the market pulls back, the stock will probably pull back with the market.

But we need to remember to focus on the fundamentals.

Despite huge price appreciation, the stock is only trading at 1.1x revenue and 10.0x free cash flow. It remains wildly undervalued relative to its fundamentals (43.9% revenue growth last quarter).

The company is executing well and remains cheap. Remembering the fundamentals will allow us to maintain our conviction in the stock even if the market hits an air pocket.

This week, our monthly webinar will take place on Thursday, December 10 at 2 p.m. ET. We will review all open recommendations and answer subscriber questions. Feel free to email questions to me ahead of time at rich@cabotwealth.com and I can answer them during the webinar.

Now let’s get into my newest recommendation: FlexShopper (FPAY).

New Recommendation

FlexShopper: Strong Grower Trading at 5x Forward Earnings

Company: FlexShopper

Ticker: FPAY

Price: 2.13

Market Cap: $46 million

Enterprise Value: $74 million

Price Target: 4.70

Upside: 121%

Recommendation: Buy Under 2.50

Recommendation Type: Rocket

Executive Summary

FlexShopper (FPAY) is a rapidly growing company in the virtual lease-to-own market. Despite rapid growth and margin expansion, it is only trading at 5.0x forward earnings. Importantly, the Chairman of FlexShopper owns over 20% of the company and has been buying more stock as fast as he can in the open market. I see 100%+ upside over the next year.

FlexShopper Overview

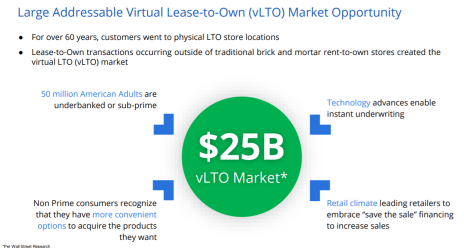

FlexShopper is a leader in the $25 billion virtual lease-to-own market.

FlexShopper generates revenue from three different sources:

- Sixty percent of sales come from the business to consumer (B2C) channel. It has an online marketplace at www.flexshopper.com, where customers can purchase a variety of goods through a lease-to-own payment plan. Items for purchase include furniture and a variety of electronics.

- Thirty-five percent of sales come from the business to business (B2B) channel. FlexShopper’s biggest vertical is tires. Many retail tire companies direct customers who do not qualify for their in-house credit card to FlexShopper to finance their tire purchase through the lease-to-own option.

- Five percent of sales come from merchants using FlexShopper’s patented checkout plugin that allows consumers to select “lease-to-own” to finance their purchase.

FlexShopper allows subprime customers to purchase products with a lease-to-own solution.

Here’s how it works.

Say a customer wants to buy an Apple Macbook Air, which retails for $1,083, but she doesn’t have the cash available. That customer can order the computer from FlexShopper with a lease-to-own payment plan.

The customer will get immediate access to the computer and agrees to make 52 payments of $48 (total cost equals $2,496) through automatic ACH payments from their bank account. Once the customer has made all the payments, she owns the computer.

The customer is free to exercise her early payment option and is also free to return the item if she no longer wants it.

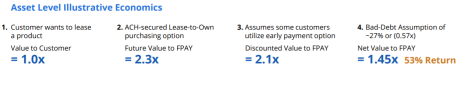

On an asset level, FlexShopper makes a 1.45x, or 53%, return on average on every sale, as demonstrated below. That obviously doesn’t account for corporate costs, but the unit economics of this business are very attractive.

Business Outlook

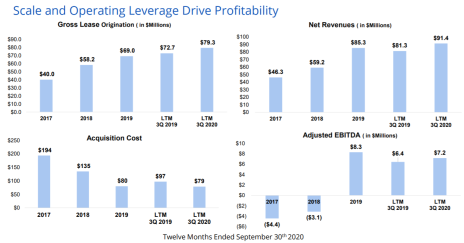

Historically, FlexShopper has grown very well, as shown below.

As discussed earlier, the company’s asset level economics are very attractive. However, on a corporate basis, FlexShopper wasn’t profitable until 2019.

Going forward, the company should be extremely profitable as it continues to leverage its fixed cost base.

Through September 2020, sales had only grown 9% year over year, a deceleration from 44% growth in 2019.

The slowdown was driven by two factors:

- A significant portion of FlexShopper B2B sales are tire sales, which are dependent on walk-in traffic. Given the reduction in walk-in traffic due to the pandemic, tire sales have lagged. However, they will come back given that tire wear and tear is directly related to miles driven, which have increased sharply since the start of the lockdown.

- Due to the pandemic, FlexShopper tightened its lending requirements from March through August. However, in recent months the company has gotten more comfortable with its customer base given all the data that it has collected regarding payment trends through the pandemic. As such, it increased origination volume sharply in the third quarter (+33%). This should bode well for revenue growth in Q4 2020 and 2021.

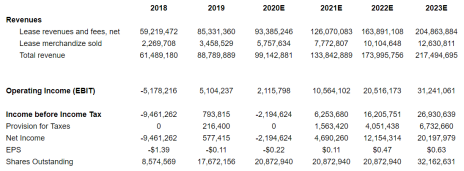

In light of positive trends in the business, I expect 35%, 30%, and 25% revenue growth in 2021, 2022, and 2023, respectively.

As the company continues to leverage its fixed costs, margins will expand, and I expect the company to generate EPS of $0.11 in 2021.

Customer Reviews

FlexShopper has excellent reviews from its customers at a variety of different locations, including: Sitejabber.com and Better Business Bureau.

All research that I’ve done indicates that customers like using FlexShopper and are likely to return for additional purchases. This is somewhat surprising given that customers pay more than twice the true cost of an item by leasing instead of buying it outright, but the lease-to-own solution is clearly an attractive option for certain customers with poor credit.

Regulatory Environment

One concern that I have is that the regulatory environment of the lease-to-own market will worsen. However, when Elizabeth Warren ran the Consumer Financial Protection Bureau, the lease-to-own market wasn’t high on her list of industries to attack. Further, if regulation increases, FlexShopper will be able to adjust its underwriting to factor in the new regulatory regime. It might decrease the growth rate of the market, but the market would still be profitable.

Valuation and Price Target

Currently, FlexShopper is trading at just 4.6x my estimate of 2022 EPS. I assume that the stock should be able to trade at 10.0x my 2022 EPS estimate of $0.47, which yields a price target of $4.70, over 100% upside. Given FlexShopper’s strong growth, a 10.0x PE multiple may be conservative.

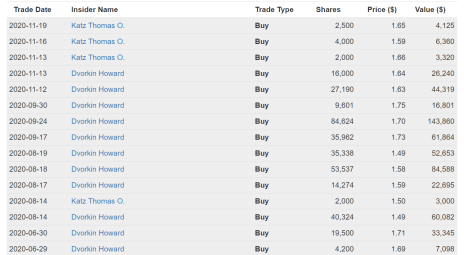

Importantly, we recently have seen significant insider buying, as shown below.

This insider buying is reassuring as it shows that company insiders see the same value that I do.

Further, Chairman Howard Dvorkin owns over 20% of the company, and this ensures that our interests are well aligned.

As is typical with most micro-caps, the stock is relatively illiquid. Therefore, let’s be patient as we buy the stock, and be sure to use limits. Buy under 2.50.

Risks

- Financial Regulation. It doesn’t appear that the rent-to-pay industry is a focus of financial regulation, but it’s a risk that I will continue to monitor.

- Debt. FlexShopper appears to have a high debt load; however, the vast majority of it is backed by inventory that the company has purchased and is currently leasing. Given strong asset level returns, I view this asset-backed debt as low risk.

Recommendation Updates

Changes This Week

Increase limit for DFIN to Buy under 17.00

Increase limit for DMLP to Buy under 12.00

Updates

BBX Capital (BBXIA) recently reported Q3 2020 earnings. On the heels of the recent spin-off, there were many moving pieces. But the key takeaway is BBX Capital continues to look attractive. The company recently announced that it has authorized a $10 million share repurchase, representing 14% of its market cap. This is a significant positive. The company also recently announced that it has purchased Colonial Elegance, a supplier and distributor of building products, including barn doors, closet doors, and stair parts. This purchase complements the company’s subsidiary, Renin Holdings, which manufactures and distributes sliding doors, door systems and hardware, and home décor products. BBX paid $39MM for the acquisition but that price includes $5.1MM of excess working capital. As a result, the purchase price goes down to $33.99MM. EBITDA in the past year was $8.1MM CAD, or $6.1MM USD. As such, BBX paid 5.6x EBITDA, which seems like a rather cheap purchase price. Factoring in a note receivable due within five years, it is trading at ~68% of its cash and notes receivable. Further, the company has valuable operating assets that generate positive free cash flow. Despite poor historical corporate governance, BBXIA shares trade far too cheaply. I see 100%+ upside. Buy under 5.00.

Donnelly Financial Solutions (DFIN) had a quiet week with no news, but the stock has performed well. Donnelley Financial Solutions (DFin) is a 2016 spin-off that has successfully executed a turnaround, transitioning from a mainly print focused business to a software/tech-enabled services business. Despite strong cash flow generation and debt paydown, the stock still trades at a draconian valuation. Simcoe Capital, an activist investor, owns 10% of the stock, ensuring we are well aligned with insiders. With modest earnings growth and multiple expansion, coupled with significant debt paydown, the stock should hit 40 by 2024, implying almost 200% upside. Because DFIN has appreciated above my original buy limit but is still very cheap, I’m increasing my buy limit from 15 to 17. Buy under 17.00.

Dorchester Minerals LP (DMLP) recently reported Q3 earnings. There were no surprises. Through September, the company has generated $32MM of free cash flow or $43MM on an annualized basis. As such, it is trading at 9.1x annualized free cash flow. This is an incredibly cheap valuation for a debt free royalty business that pays out all its income in dividends and will sky rocket if (when) energy markets recover. The last distribution of $0.33 was paid on November 12. This yield on an annualized basis works out to a yield of 11.7%. Given strong free cash flow generation and a reasonable valuation, we are increasing our buy limit from 11 to 12. Buy under 12.00.

Greystone Logistics (GLGI) had a quiet week. The company reported first-quarter fiscal 2021 earnings in October. In the quarter, sales declined by 6%. There was a ~16% increase in volume, but pricing structure and product mix drove the sales decline. Importantly, gross margin increased from 12.6% to 16.8%. This drastic gross margin expansion drove a 25% increase in gross profit despite the sales decline. The strong gross profit growth coupled with lower interest expense and preferred dividends drove 94.5% EPS growth. I’m conservatively estimating forward earnings of $0.13 (fiscal 2021). As such, the stock is trading at 7.3x forward earnings. This is too cheap for a company that has historically grown revenue at a four-year CAGR of 30.4%. Further, after the 10-Q was filed we saw significant insider buying from CEO and President Warren Kruger and a director. In total, Kruger owns over 30% of the company. As such, we are well aligned as we both will benefit from continued strong operational performance and stock price increases. Buy under 1.10.

HopTo Inc (HPTO) has generally been weak since reporting earnings recently. In the quarter, sales declined by 6%. However, just as we didn’t get too excited last quarter when sales jumped 49%, we aren’t going to get too down this quarter. On a quarterly basis, sales are lumpy. Year to date, revenue is up 3% and operating profit is up 5%. The stock has pulled back and looks attractive. I believe HTPO is worth ~0.86 per share. HopTo is currently trading at an EV/EBIT multiple of 6.3x. This is too cheap. To put it in perspective, the software and internet industry trades at an average EV/EBIT multiple of 60.0x. Buy under 0.55.

Liberated Syndication (LSYN) reported significant insider buying this week. Both the CFO (Richard Heyse) and the activist investor, Eric Shahinian of Camac Partners, bought in the open market at prices ranging from 3.58 to 3.80. Camac Partners currently owns 7.9% of shares outstanding ensuring strong alignment. Libsyn recently reported earnings. As expected, the quarter was a little messy due to compensation expenses related to the former CEO, Chris Spencer, leaving. Total revenue grew 4.7% to $6.5MM. Podcast hosting revenue growth accelerated from 11% to 15%, but website hosting revenue declined by 8%. Over the long term I would expect website hosting revenue to grow slightly and podcast hosting revenue to re-accelerated to a 20% annual growth rate. Positives: 1) Libsyn has bought back 9% of shares outstanding in 2020, 2) Libsyn will launch a new user interface (Libsyn 5) and advertising technology in 2021. Negatives: 1) Gross margins declined as Libsyn’s bandwidth usage increased due to increased podcast consumption; 2) Libsyn is spending more on technology, customer support, and selling. This is both a negative and a positive. In the near term, it will depress Libsyn’s EBITDA margin, but it should accelerate revenue growth longer term. In summary, the quarter doesn’t change our Libsyn investment thesis. Buy under 3.75.

MamaMancini’s Holdings (MMMB) has pulled back and looks attractive. In the most recent quarter, revenue growth of 28% was very impressive. Even more impressive, EPS grew 104% to $0.02 as the company continues to leverage its fixed costs. One area of weakness was in gross margins, which were lower than expected due to higher beef prices, but management commentary in the press release suggests that this pressure is starting to dissipate. MamaMancini’s continues to execute well and the investment case remains on track. It has historically grown revenue at a 24% CAGR yet only trades at a P/E of 16.4x. Management owns over 50% of the stock, ensuring that incentives are aligned. Further, the company has a clean balance sheet. Buy under 2.00.

Medexus Pharma (MEDXF) reported earnings recently. Medexus generated revenue of $23.6MM, which was up 44% but down 14% sequentially. The reason for the decline was ~$3MM of IXINITY (hemophilia drug) sales slipped from September to October. As such, I expect next quarter to be unusually strong. Year to date, Medexus has generated $4.0MM of free cash flow or $8.0MM annualized. As such, the stock is trading at 9.9x free cash flow, an incredibly cheap valuation for a rapidly growing company. On an EV/Revenue basis, MEDXF trades at 1.1x while slower growing peers trade at 3.6x. Given continued strong execution, I recently increased my buy limit to 4.50. Buy under 4.50.

NamSys Inc. (NMYSF) recently reported fiscal Q3 earnings (quarter ended July 31). Revenue grew 11.8%, which is impressive given pandemic related headwinds. Gross margins were under pressure due to an accrual of management bonuses as well as increased staffing related costs. I’m not concerned with the management bonus as it is based on continued strong execution. The increased staffing costs relate to the high demand and required salary for software engineers/programmers. I will monitor this going forward. The most important factor for NamSys is continued revenue growth. Despite historically growing revenue and earnings at a compound annual growth rate of 20%+, the stock only trades at 20.4x 2019 earnings. It has a pristine balance sheet with significant cash and no debt, and insiders own over 40% of the company, ensuring strong alignment. Buy under 0.80.

P10 Holdings (PIOE) announced another transformative acquisition last week. In this transaction, P10 will be acquiring Enhanced Capital Group, a premier impact investment platform. Since its inception, Enhanced has deployed over $2BN of capital into impact credit and impact equity investments. Areas of focus include small business lending in impact areas and to women and minority-owned businesses, renewable energy, and historic building rehabilitation. As is typical for its transactions, P10 is paying for the deal with cash and convertible preferred equity. Full terms of the transaction have not been disclosed, but my estimate is that this transaction will increase run rate EBITDA to ~$75MM. As such, P10 is trading at an EV/EBITDA multiple of 12.5x pro forma for this deal. As I said above, the stock is no longer dirt cheap. Nonetheless, it still trades at a sharp discount to its closest peer, Hamilton Lane (HLNE), which trades at an EV/forward EBITDA multiple of 27.3x. Catalysts for P10 Holdings going forward include: 1) additional deals and 2) a potential up-listing to a major exchange. Given the stock is not dirt cheap anymore, I recommend holding a half position. I want to keep exposure to the name but think it’s prudent to book some profits. Hold Half

U.S. Neurological Holdings (USNU) reported earnings recently. Revenue grew 0.6% y/y and 11% q/q as procedures and price per procedure both rebounded. Year to date, the company has generated EPS of $0.05 or $0.067 on an annualized basis. As such the company is trading at just 5x earnings. In addition, the company has $1.5 million ($0.19 per share) of cash and no debt on its balance sheet. It also has $1.1MM (due from related parties) and has generated over $500,000 in free cash flow year to date. U.S. Neurological Holdings operates as a holding company in the United States. It is engaged in providing medical treatment and diagnostic services that include stereotactic radiosurgery centers, utilizing gamma knife technology, and it holds interests in radiological treatment facilities. Buy under 0.25.

Watch List

FitLife Brands (FTLF) sells nutritional products for health-conscious consumers. It has been growing quickly and trades at 5x earnings. The one area of concern is that 75% of sales go to GNC, which recently declared bankruptcy. Nonetheless, FitLife somehow has been able to grow sales slightly in 2020. This is a name that I will continue to track.

Waitr Holdings (WTRH) has been on my watch list for a while now, but I haven’t had the conviction to pull the trigger. Waitr recently announced Q3 earnings and revenue declined by about 20% from Q2. However, there has been insider buying by two insiders, which bodes well.

Recommendation RATINGS

| Stock | Price Bought | Date Bought | Price 12/9/20 | Profit | Rating |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 4.55 | 44% | Buy under 5.00 |

| Donnelly Financial Solutions (DFIN) | 14.54 | 11/11/20 | 17.51 | 20% | Buy under 17.00 |

| Dorchester Minerals LP (DMLP) | 10.49 | 10/14/20 | 11.30 | 11% | Buy under 12.00 |

| FlexShopper (FPAY) | 2.13 | 12/9/20 | 2.13 | 0% | Buy under 2.50 |

| Greystone Logistics (GLGI) | 0.81 | 7/8/20 | 0.96 | 19% | Buy under 1.10 |

| Hopto Inc (HPTO) | 0.39 | 4/28/20 | 0.50 | 28% | Buy under 0.55 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 4.16 | 36% | Buy under 3.75 |

| MamaMancini’s Holding (MMMB) | 1.76 | 8/12/20 | 1.94 | 10% | Buy under 2.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 4.50 | 153% | Buy under 4.50 |

| NamSys Inc (NMYSF) | 0.65 | 9/9/20 | 0.67 | 3% | Buy under 0.80 |

| P10 Holdings (PIOE) | 1.98 | 4/28/20 | 6.70 | 238% | Hold Half |

| U.S. Neurological Holdings (USNU) | 0.14 | 4/28/20 | 0.33 | 136% | Buy under 0.25 |

Glossary

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, HPTO, PIOE, MEDXF, LSYN, and GLGI. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on January 13, 2020.

Cabot Wealth Network

Publishing independent investment advice since 1970.

CEO & Chief Investment Strategist: Timothy Lutts

President & Publisher: Ed Coburn

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2020. All rights reserved. Copying or electronic transmission of this information is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. No Conflicts: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to its publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: All recommendations are made in regular issues or email alerts or updates and posted on the private subscriber web page. Performance: The performance of this portfolio is determined using the midpoint of the high and low on the day following the recommendation. Cabot’s policy is to sell any stock that shows a loss of 20% in a bull market or 15% in a bear market from the original purchase price, calculated using the current closing price. Subscribers should apply loss limits based on their own personal purchase prices.