Today, we are recommending a rapidly growing bank that is based in Nashville, Tennessee. It looks like a very attractive long-term holding:

- High insider ownership (insiders own ~20% of shares outstanding).

- Strong momentum (stock is near 52 week high).

- ~17%+ historical earnings growth.

- Low valuation: P/E ratio of 13x.

- ~43% upside to fair value.

All the details are inside this month’s Issue. Enjoy!

New Recommendation

A Correction in Micro-Cap Land

Many high-quality micro-caps have pulled back in the past month.

In aggregate, the iShares Micro-Cap ETF (IWC) is down ~12% from all-time highs in the last four weeks.

And some of our names are down even more than that.

While the benefit of micro-caps is they tend to generate higher returns, the negative is they tend to be more volatile.

Nonetheless, usually the “Santa Claus Rally” starts about now and it’s likely the year will end on a strong note.

Despite some volatility in my micro-cap recommendations, they all remain high conviction and well positioned to perform well in 2022.

Before last month, I hadn’t recommended a single financial. With this month’s recommendation, we will have added two financials to our recommendation list.

It’s never a goal to focus on a particular sector or industry, but I just happened to discover two very well positioned niche banks that – I believe – have great risk-adjusted return potential over the next few years.

This week’s recommendation has been a strong grower and has been a star performer over the past decade. And yet, it trades at a cheap multiple and is poised to perform well in the next decade.

Without further ado, let’s discuss this month’s micro-cap idea: Truxton Corp (TRUX).

New Recommendation

Truxton Corp: A Compounding Machine Trading at a Cheap Multiple

Company: Truxton Corporation

Ticker: TRUX

Price: 68

Market Cap: $137 million

Price Target: 111

Upside: 63%

Recommendation: Buy under 72

Recommendation Type: Rocket

Executive Summary

Truxton is a rapidly growing bank and wealth management business based in Nashville, Tennessee. Since its initial public offering nine years ago, revenue is up 325% while the stock has generated a 587% total return, beating the S&P 500 by more than 200%. Despite this impressive performance, the stock trades at just 13x earnings given its low liquidity. I expect strong performance to continue in the future and anticipate significant upside in the years ahead.

Company Overview

Background

Truxton Corporation is a bank holding company based in Nashville. Its primary subsidiary is Truxton Bank, which has just a single branch. It also has a wealth management arm, with a location in Nashville and one in Georgia.

Truxton went public via an initial public offering in 2011. Since then, revenue and net income have grown at a steady clip, as shown below.

Current Business

As noted above, Truxton serves the Nashville market. This is a good location as Nashville is benefiting from several secular tailwinds:

- Cost of living. Nashville has benefitted from many out-of-state people moving to the city due to its favorable cost of living. While the housing market in Nashville is booming, it’s still more affordable than most coastal cities.

- Low taxes. Tennessee is one of nine states with no income taxes.

- Favorable weather conditions with mild winters.

According to U.S. News and World Report’s recent report on the best cities to live in, Nashville was ranked #30 in the entire county. The ranking was based on desirability, job market, quality of life, and value.

As long as Nashville continues to grow, Truxton should continue to do well.

Truxton generates earnings through two segments: a traditional bank and wealth management business.

Traditional Bank

Truxton’s traditional bank is focused on serving wealthy individuals in the Nashville area. It provides mortgages to its customers and issues loans backed by its customers’ assets and/or businesses.

Through September 2021, 55% of revenue was generated by Truxton’s traditional bank. As shown below, assets have grown consistently since Truxton’s IPO.

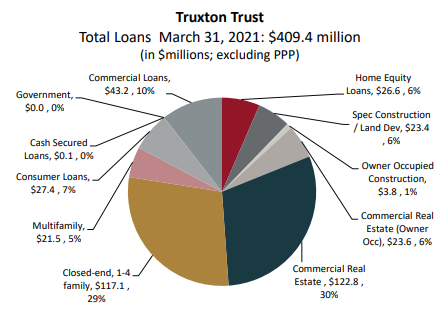

As of March 31, 2021, Truxton had $409MM in loans outstanding diversified with ~36% focused on commercial real estate. Approximately 34% of loans are focused on single-family or multi-family real estate.

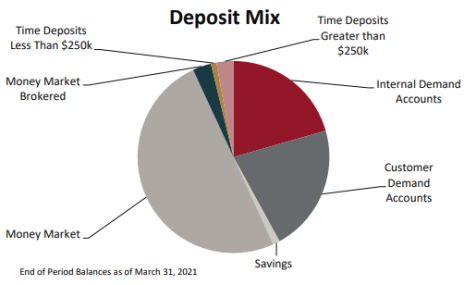

Truxton has a well-balanced deposit mix and ~27% of accounts are non-interest bearing.

Truxton’s net interest margin has been compressed recently as deposits have increased and the bank has taken time to diligently loan out the assets. Nonetheless, historically the bank has generated an attractive net interest margin of ~3% over time.

Wealth Management

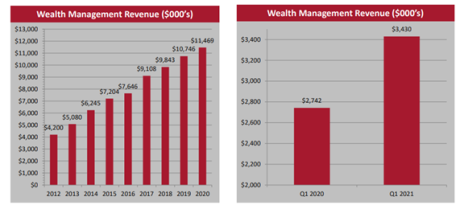

Truxton’s wealth management business accounts for 45% of total revenue and has been growing like crazy as Truxton builds out solutions that cater to its banking customers.

The wealth management business is especially attractive because it is sticky and because it is highly profitable and scalable (Truxton can increase assets under management by $1BN but won’t have to hire any additional employees).

The wealth management business has benefitted from the bull market in the U.S. equity markets and at some point there will be a pullback. Nevertheless, Truxton should be able to create organic growth over time as more of its customers utilize the company’s wealth management solutions.

Business Outlook

The biggest drive of future growth for Truxton will be continued strong population and business growth in the Nashville area. Nashville is booming and I expect that trend to continue.

Truxton gets good reviews from its employees and customers (Google reviews and Yelp).

Historically, assets have grown at a 12% compound annual growth rate while EPS has grown at a CAGR of 17.5%. I expect this growth to continue.

Insider Ownership

As Cabot Micro-Cap Insiders know, insider alignment is high on my checklist.

Truxton checks the box as management and the board of directors own ~20% of outstanding.

When I asked the CFO who owns the remainder of Truxton shares, here’s what he told me:

“We have a few small institutional holders, specialty bank partnerships, but these amount to 3% of shares outstanding. Most of our stock is still held by the original buyers from 2004, mostly Nashville individuals.”

I view this favorably as it suggests a loyal shareholder base.

Valuation and Price Target

Truxton has historically traded at a P/E ratio between 10.2x and 15.6x. Currently it’s trading at a price-to-annualized-earnings multiple of 13.1x.

This multiple strikes me as very reasonable for such a high-quality bank with a growing asset management business.

Given the consistency of its growth, I believe a 15x P/E is justified. Applying a 15x multiple to my 2023 EPS estimate of $7.40 gets me to a 111 price target.

I always mention this, but it’s particularly important with this recommendation: Please use limits when buying TRUX as the stock is very illiquid.

My initial buy limit is 72. I think it will pay to be patient with this name and slowly build out a position.

My official rating is Buy under 72.00.

As is always the case with micro-caps, use limits as volume is quite low.

Risks

- Geographic concentration. Truxton is focused on the Nashville, Tennessee area. This is a net positive given secular trends that are benefiting the region. Nonetheless, if those trends were to reverse, Truxton would suffer.

- Credit losses. As is the case with any bank, the biggest risk is bad loans.

- Historically, losses have been very low, and given that management owns so much of the stock, they do not have an incentive to just grow for growth’s sake.

Updates, Watch List and Ratings

Recommendation Updates

Changes This Week

None

Updates

Aptevo (APVO) continues to be very volatile and is almost all the way back to where it was prior to the positive news that a patient treated with APVO436 experienced a complete remission. There was a good article recently in the WSJ about the woes of the biotech market and how many biotech hedge funds are performing poorly or liquidating. Biotech cycles change quickly and 2022 could be a good year for the sector. Aptevo (APVO) continues to look incredibly cheap. It has an enterprise value of $1MM but if you include the value of Ruxience milestone payments ($32MM) and the value of the IXINITY payments (I estimate $20MM), the company is trading at a negative enterprise value. If Aptevo releases additional press releases with additional positive data, the stock could soar. Original Write-up. Buy under 15.00

Atento S.A. (ATTO) had no news this week. The company reported earnings in November. Revenue grew by 4.5% but missed consensus expectations. The revenue miss was driven by the non-renewal of lower margin contracts in Brazil. On the positive side, EBITDA margins expanded to 13.9%. Full-year sales guidance was maintained (mid-single-digit revenue growth and ~13% EBITDA margin). All in all, the investment case is on track. Original Write-up. Buy under 30.00

BBX Capital (BBXIA) announced that it spent $14.5MM to buy back 1.3MM share ($11.15 per share purchase price) from an affiliate shareholder (later revealed to be Angelo Gordon). On the one hand, this is a positive as the company is buying back stock below book value and is willing to buy back stock above the current price. On the other hand, you could view this negatively as “the adult has left the room.” The Levin family doesn’t have the best reputation from a corporate governance perspective and having Angelo Gordon as a minority investor made me more comfortable given their institutional pedigree. Net-net, I view this transaction positively as the company is aggressively shrinking its share count and taking shareholder-friendly actions. Book value per share ($19.73) before this transaction will go up given the buyback happened well below book value. Further, book value is probably understated given the strength of BBX’s real estate portfolio. The investment case remains on track. Original Write-up. Buy under 9.50

Cipher Pharma (CPHRF) reported a weak quarter as revenue declined sequentially. Nonetheless, revenue is still up 3% YTD and the stock remains extraordinarily cheap. The company has generated $9MM of free cash flow YTD, or $12MM on an annualized basis. As such, it’s trading at a price-to-FCF multiple of 4.6x. Further, it has $20MM of cash on its balance sheet and is buying back stock in the open market. Downside protection remains strong given no debt, strong free cash flow generation, and $0.65 of cash per share on the balance sheet. Original Write-up. Buy under 2.00

Dorchester Minerals LP (DMLP) has traded down as energy prices have pulled back. Still, the stock looks compelling. The dividend should remain at current levels which implies a yield of 11%. Original Write-up. Buy under 19.00

Epsilon Energy (EPSN) reported a strong quarter recently. It generated $3.3MM of free cash flow in the quarter. Going forward, free cash flow generation should increase given less of its gas sales are hedged. Year to date, the company has repurchased 2.2% of shares outstanding. Cash continues to build and the company currently has $20.6MM of cash on its balance sheet. Management wrote the following in its press release, “Once our 2022 development capital needs are defined, we will evaluate the appropriate amount of capital to retain in the business.” This seems to hint that management is likely to announce a special dividend or large accelerated share repurchase authorization. I see significant upside over the next 12 months as the company benefits from high natural gas prices. Original Write-up. Buy under 5.50

Esquire Financial Holdings (ESQ) has pulled back slightly with the market despite no company news. It is a niche bank focused on lawyers and the litigation industry. Due to its specialty and expertise, it has been able to grow very well. Lawyers are low credit risk, and consequently losses have been low. Despite strong growth, the stock trades at a very cheap valuation. Looking out a couple of years, Esquire should be trading significantly higher. Original Write-up. Buy under 35.00.

FlexShopper (FPAY) reported earnings recently. As I thought might be the case, we saw more insider buying following the quarter. While FlexShopper’s stock is not performing as well as I think it should, I’m reassured that every time there is weakness, insiders step up to buy shares in the open market. In the quarter, revenue grew 26% y/y to $30.9MM. Gross lease origination was down 30% which implies lower revenue in the future. However, given that government stimulus appears to be fading, I believe more consumers will need FlexShopper’s solutions which will enable originations to ramp up. All in all, I still believe in the FlexShopper story. One other interesting thing to note is insiders at several of FlexShopper’s competitors, PROG Holdings (PRG) and Rent-A-Center (RCII), are buying in the open market. This bodes well for the entire industry. My 12-month price target for FlexShopper is 4.70. Original Write-up. Buy under 2.50

IDT Corporation (IDT) has pulled back with the market on no news. The company reported a great quarter with strong growth across the board in October. Mobile Top-up revenue increased 41% y/y; this is the sixth consecutive quarter of 20%+ revenue growth. National Retail Solutions (NRS) revenue increased 76% y/y, with performance being driven by an increase in average revenue per user (ARPU) and terminal growth. Management expects continued upside in ARPU, driven by merchant services, advertising, and data. Net2phone subscription revenue increased 46% y/y, with 80%+ gross margin. Lastly, Traditional communications reported its third consecutive quarter of revenue growth and generated $29mm of EBITDA. Original Write-up. Buy under 45.00

Leatt Corporation (LEAT) reported a ridiculously good quarter recently. Revenue was up 94% to $22.1MM. EPS increased 163% to $0.79. It’s incredibly impressive that this growth was achieved despite supply chain bottlenecks. The stock has shot up but still looks reasonable, only trading at 10.6x annualized EPS. Perhaps 20x is a more appropriate multiple? As such, I’m increasing my limit to buy under 40. Original Write-up. Buy under 40.00

Liberated Syndication (LSYN) recently disclosed a cluster of insider buying from management. This bodes well for the stock and suggests that perhaps financials will be reinstated soon. When financials are revealed, I think they will show a fast-growing podcast company trading at a cheap valuation. Original Write-up. Buy under 5.00

Medexus Pharma (MEDXF) announced that it had a good Type A meeting with the FDA regarding the potential approval of Treosulfan. In the press release, the CEO said, “We are pleased with the outcome of medac’s productive Type A Meeting with the FDA. We believe this meeting provided medac with the information needed to allow it to resubmit the NDA for treosulfan within our previously anticipated time frame. Based on the discussions, it is our conclusion that there is a path towards approval that does not involve completing another Phase III study. As a result, we believe that medac will be positioned to resubmit the NDA to the FDA in the second quarter of calendar year 2022.” While this is positive, the part that I highlighted isn’t definitive and so it leaves me a little nervous. I did buy some more MEDXF stock on December 2, but want to review the meeting minutes (once they are available) before really backing up the truck. Original Write-up. Buy under 3.50

P10 Holdings (PX) recently reported a great quarter. Adjusted EBITDA increased 147% to $21.8MM. Adjusted EPS increased 66% to $0.15. Meanwhile, three brokers (JPMorgan, KBW, and UBS) all initiated coverage with Buy ratings. The investment case remains on track as fundamentals are strong yet the stock remains cheap on a relative and absolute basis. Original Write-up. Buy under 15.00

Watch List

American Outdoor Brands (AOUT) remains on my watch list. It is a recent spin-off that sells outdoor apparel and hunting paraphernalia. The stock looks cheap, trading at 9.8x forward earnings yet growing revenue 20% in the previous quarter. The low valuation is due to investor concern that the company benefitted from pandemic tailwinds which mute this year’s growth outlook. Nonetheless, I think the stock looks interesting and there has been recent insider buying. I’m going to continue to closely follow this stock.

MamaMancini’s (MMMB) is a name that we’ve successfully owned in the past. The stock has fallen sharply due to rising costs on inflation and freight, yet it’s trading at just 10x next year’s earnings which seems very attractive. Finally, insiders own over 40% of shares outstanding.

Nanophase Technologies (NANX) is a name that is remaining on my watch list. It is a fast-growing (~50%) skin care company that is trading at a reasonable valuation (30x 2022 EPS). It continues to execute and has performed very well despite other micro-caps falling.

Recommendation RATINGS

| Stock | Price Bought | Date Bought | Price 12/7/21 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 8.87 | -72% | Buy under 15.00 |

| Atento SA (ATTO) | 21.57 | 8/24/21 | 28.00 | 30% | Buy under 30.00 |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 9.90 | 212% | Buy under 9.50 |

| Cipher Pharma (CPHRF) | 1.80 | 9/8/21 | 1.38 | -23% | Buy under 2.00 |

| Dorchester Minerals LP (DMLP)* | 10.45 | 10/14/20 | 18.58 | 91% | Buy under 19.00 |

| Epsilon Energy (EPSN) | 5.00 | 8/11/21 | 5.49 | 10% | Buy under 5.50 |

| Esquire Financial Holdings (ESQ) | 34.10 | 11/10/21 | 31.28 | -8% | Buy under 35.00 |

| FlexShopper (FPAY) | 2.13 | 12/9/20 | 2.61 | 23% | Buy under 2.50 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 50.08 | 159% | Buy under 45.00 |

| Leatt Corporation (LEAT) | 24.00 | 10/13/21 | 31.75 | 32% | Buy under 40.00 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.80 | 24% | Buy under 5.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 2.16 | 21% | Buy under 3.50 |

| P10 Holdings (PX)** | 1.98 | 4/28/20 | 15.01 | 658% | Buy under 15.00 |

| Truxton Corp (TRUX) | New | — | 68.00 | — | Buy under 72.00 |

* Return calculation includes dividends

**Original Price adjusted for reverse split.

Glossary

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, PIOE, MEDXF, LSYN, IDT, FPAY, DMLP, and LEAT. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on January 12, 2021.