Well, December has been a drag.

No Santa Claus rally.

And my New England Patriots look awful.

With the Patriots’ comically bad loss to the Raiders on Sunday night, they aren’t mathematically eliminated from the playoffs. But they effectively are.

Even if they were to find a way to sneak into the playoffs, they would play the Chiefs or Bills on the road. It wouldn’t be pretty.

I’ve never seen a more appropriate meme than the below…

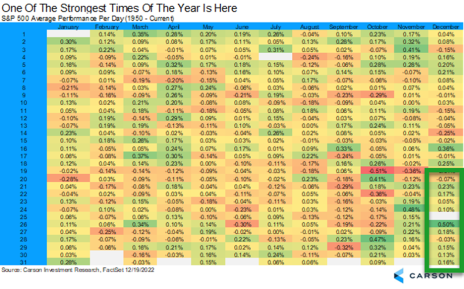

The good news is there is still hope for a Santa Claus Rally!

Typically, the December rally starts in mid-December. So it should have started by now.

But the strongest days are from now to year end.

In terms of our micro-cap portfolio, it was a quiet week.

No major updates!

I’m looking forward to celebrating Christmas this weekend with my extended family. I hope you have a wonderful holiday season!

The next issue of Cabot Micro-Cap Insider will be published on Wednesday, January 11. As always, if you have any questions, please email me at rich@cabotwealth.com.

Changes This Week

None.

Updates

Aptevo (APVO) had a volatile week. The company announced positive data for APVO436 in a phase 1b trial. In the trial 100% of patients showed clinical benefit and 50% of patients showed a complete response. As a result, the stock skyrocketed higher but then fell even further than where it started this week. Aptevo continues to be a high-risk/high-reward stock. It’s trading at a negative enterprise value but will likely have to raise cash within the next 12-18 months which could dilute shareholders. On the other hand, it could be acquired or strike a lucrative partnership with a large pharma company which could be worth multiples of the current stock price. Original Write-up. Buy under 7.50

Atento S.A. (ATTO) reported earnings on November 15. Revenue was flat but EBITDA margin increased 3.3 percentage points to 11.1% in the quarter driven by cost efficiencies. The company generated operating cash flow of $8MM in the quarter. It has a cash balance of $66MM with no near-term debt maturities. Investors were relieved with the quarter as the stock has almost doubled. Subsequent to the quarter, MCI Capital announced a tender offer to buy 1.5MM shares of Atento for 5 per share. It’s unlikely that any shareholders will accept this offer given the stock is trading well over the offer price. While Atento is in a turnaround, the stock is incredibly cheap and is not at risk of defaulting on its debt (no maturities until 2025). Thus, it makes sense to stick with the stock. Original Write-up. Buy under 10.00

Cipher Pharma (CPHRF) reported a solid quarter on November 10. Revenue increased 6% to $4.8MM. Adjusted EBIDTA increased 4% to $2.4MM. Cipher’s cash balance continues to grow. The company now has $27.5MM of cash on its balance sheet, more than 50% of its market cap. Management continues to buy back shares. Longer term, upside will be driven by Cipher’s two pipeline products (MOB-015 for nail fungus and Piclidenoson for psoriasis). Both drugs are progressing in Phase 3 trials. Original Write-up. Buy under 2.50

Cogstate Ltd (COGZF) had no news this week. The company got a boost when Esai and Biogen announced positive results for its Phase 3 Alzheimer’s trial on September 27. This is massively positive news as it will drive more Alzheimer’s trials (and revenue for Cogstate). Ultimately, Cogstate’s revenue potential this year and beyond will be determined by these three key Alzheimer’s drug read-outs which are expected this year and next year: 1) Lecanemab from Eisai (Phase 3 data: already announced and positive), 2) Gantenerumab from Roche (Phase 3 data expected in Q4 2022), and 3) Donanemab from Eli Lilly (Phase 3 data in mid-2023). The Cogstate thesis remains on track. Original Write-up. Buy under 1.80

Copper Property Trust (CPPTL) paid out $0.28 on December 12 to certificate holders. On September 12, the trust announced that it sold seven of its properties for $65MM. The blended cap rate of the transactions was 7.3%. The trust on an aggregate basis is trading at a ~10% cap rate (the higher the cheaper). Copper Property Trust continues to look attractive. Original Write-up. Buy under 14.00

Currency Exchange International (CURN) had no news this week. It reported earnings on September 13. They looked great! Revenue increased 139% to $21MM, beating consensus expectations by $5MM. This was truly a massive beat. Revenue in the fiscal third quarter was 67% higher than 2019 FQ3 (pre-pandemic). The company’s Payments business grew revenue 65% to $3.6MM. Year to date, Currency Exchange has generated EPS of $1.15 or $1.53 on an annualized basis. As such, the stock is trading at just 9x earnings. The investment case remains on track. Original Write-up. Buy under 16.00

Epsilon Energy (EPSN) had no news this week. Epsilon reported an excellent quarter on November 10. Revenue increased 6% sequentially. In the quarter, Epsilon generated $9.6MM of net income and $11.2MM in free cash flow. This is quite significant for a company with a market cap of $170MM. The company continues to buy back shares and pay a dividend. Due to the strong cash generation in the quarter, Epsilon currently has $40MM of cash on its balance sheet and no debt. The stock continues to look attractive. Original Write-up. Buy under 8.00

Esquire Financial Holdings (ESQ) had no news this week. It reported earnings on October 25. EPS increased 21% to $0.94. Return on assets and equity were 2.48% and 20.60%, respectively. Credit metrics remain strong with nonperforming loans of 0.67% and a reserve for loan losses of 1.24%. I continue to believe Esquire dominates an attractive niche and is set to grow nicely for the foreseeable future. Despite 21% EPS growth and strong credit metrics, Esquire trades at just 11x forward earnings. Original Write-up. Buy under 42.00

IDT Corporation (IDT) reported another good quarter last week. Revenue was down 13% y/y, mainly due to tough comps from last year. The two most important value drivers continue to chug along. NRS revenue grew 107% y/y to $17.6MM. Net2phone subscription revenue increased 33% to $15.5MM. During the quarter, IDT repurchased 203,436 shares (~0.8% of shares outstanding). Eventually, both of these divisions will be monetized (either through a spin-off or an asset sale). The investment case remains on track and my price target is 55 based on an updated sum-of-the-parts analysis. Original Write-up. Buy under 45.00

Kistos PLC (KIST: GB) had no news this week. The company reported first-half 2022 results on September 7. They looked great. The company reported revenue growth of 745% and EBITDA growth of 768%. It generated free cash flow of £93MM, or $186MM annualized. Kistos has pulled back due to falling natural gas prices in Europe. As such, Kistos is currently trading at 0.7x annualized EBITDA and 1.8x annualized free cash flow. This is too cheap. Another risk is that the EU is considering instituting a windfall profit tax on energy companies. While this would be a negative, I think it’s reflected in Kistos’ valuation. Further, Kistos generated $89MM of EBITDA in 2021. Thus, it’s trading at just 3.5x “normalized” EBITDA, not a demanding valuation. I continue to see at least 100% upside ahead. Original Write-up. Buy under 7.50

Liberated Syndication (LSYN) has had no news recently. Libsyn’s plan was to “go public” again in September. Obviously, that didn’t happen. It isn’t too surprising given the market volatility. I’ve reached out to Libsyn’s CEO and hope to catch up with him soon. Libsyn has posted several press releases in the past couple of months. I remain optimistic about Libsyn’s prospects. Once financials are re-filed, I’m looking forward to seeing: 1) How Libsyn’s core hosting business is doing. Podcasting conferences were a key way that Libsyn marketed. When COVID shut down in-person events, it negatively impacted Libsyn’s new customer acquisition. Now that COVID is behind us, I expect the core business to accelerate. 2) Revenue growth for AdvertiseCast. This is an exciting business opportunity. Revenue grew 50% in 2021 for AdvertiseCast, and I expect continued strong growth going forward. 3) The growth of Glow. Libsyn acquired Glow in 2021. Glow enables podcast creators to offer premium shows (think substack but for podcasts). I think this is a big market opportunity. While Libsyn has been a frustrating stock, I think (and hope!) our patience will be rewarded. Original Write-up. Hold

M&F Bancorp (MFBP) is my newest recommendation. It had no news this week. M&F is taking advantage of an interesting opportunity (Emergency Capital Investment Program) available to many small banks. As a result, I expect EPS to grow from $1.36 in 2021 to $4.74 in 2025. Assuming M&F continues to trade at its average P/E multiple of 9.3x, the stock should hit 44.00 by 2025, implying almost 150% upside. Original Write-up. Buy under 21.00

Medexus Pharma (MEDXF) reported fiscal Q2 results on November 8. The report was excellent! Revenue grew 55% y/y and EBITDA was $4.2MM, a y/y improvement of $6.3MM. The company generated positive free cash flow and is actively exploring options to refinance its convertible debentures which come due next fall. The stock’s valuation looks cheap at 1.1x revenue and 7.6x adjusted EBITDA. The investment case remains on track. Original Write-up. Buy under 3.50

NexPoint (NXDT) filed its 10-Q to report earnings on November 14. The results looked good. Operating cash flow is healthy. NAV as of September 30, 2022, is $28.17 (I miscalculated NAV earlier) so the stock is still trading at a big discount to fair value. The company generated $0.55 of funds from operations in the quarter. As such, it’s trading at ~7x, a discount to peers who trade closer to 12x. The company also was recently added to the MSCI index. As such, there will be index fund buying throughout the rest of the month. Original Write-Up. Buy under 17.00

P10 Holdings (PX) announced Q3 2022 results on November 10. They were great. Adjusted EBITDA grew 28% in the quarter while adjusted net income grew 56%. Assets under management increased 17% to $19BN. The investment case remains on track. Despite very strong fundamentals, the stock is trading at just 12.5x adjusted earnings. Original Write-up. Buy under 15.00

RediShred (RDCPF) announced good quarterly results on November 27. Revenue grew 50% y/y to $14.7MM CAD (47% constant currency growth). EBITDA increased 27% to $3.6MM CAD. On an organic basis, EBITDA grew 13% y/y. Organic growth is being driven by increased demand for shredding by businesses. Higher fuel costs and driver costs hurt margins. However, the company plans to pass through price hikes which will help offset these headwinds. RediShred is also active on the acquisition front.

On November 2,, the company announced that it had acquired ProShred Philadelphia for $7.3MM to $8.3MM (depending on earn-outs). I estimate the acquisition took place at a 6x EV/EBITDA multiple. This is a good deal. The stock continues to look incredibly cheap at a 5.1x EV/EBITDA multiple and a 7.4x price to free cash flow multiple. I continue to see 100% upside over the next 12 months and significantly more upside looking out a few years. Original Write-up. Buy under 3.50

Transcontinental Realty Investors (TCI) filed its quarterly earnings on November 10. The sale of the joint venture (JV) has closed, and Transcontinental reported that it intends to use $182.9MM of the proceeds to “invest in income-producing real estate, pay down debt and for general corporate purposes.” The company hasn’t disclosed what it intends to do with the second installment of proceeds from the JV sale ($203.9MM). The company continues to look attractive with 96% of its market cap in cash. Insiders own 86% of the company and could make an imminent move to buy out remaining shareholders at a large premium to the current stock price. Original Write-up. Buy under 45.00

Truxton (TRUX) reported Q3 earnings on October 20. They were very good. Net income in the quarter of $1.49 grew 11% y/y. Net revenue also grew ~11%. Credit metrics remain excellent with $0 in non-performing loans. On an annualized basis, Truxton is generating $5.96 in EPS. It is trading at 10.4x annualized earnings. Historically it has traded at 13.5x. This isn’t the most exciting stock, but it’s a slow and steady winner. Original Write-up. Buy under 75.00

Unit Corp (UNTC) is a dirt-cheap energy company with 33% of its market cap in cash. It is gushing free cash flow yet trades at just 4.3x free cash flow, a dirt-cheap valuation. Insiders own over 30% of shares outstanding, and the company is buying back stock aggressively. It’s likely Unit will be broken up and sold to the highest bidder as the company has already hired an investment banker to evaluate strategic alternatives. Original Write-up. Buy under 65.00

Zedge, Inc. (ZDGE) reported Q1 2023 earnings on December 13. Revenue increased 14.5% y/y. However, EBITDA decreased 71% y/y to $1.0MM and operating cash flow decreased 60% y/y to $1.1MM. The decline was due to lower advertising costs and expenses related to the integration of GuruShots. The quarter was disappointing, but management commentary suggests that advertising rates have already improved. Further, the stock is ridiculously cheap. It trades at 3.0x annualized EBITDA and 9.5x FCF. Further it has 66% of its market cap in cash. Original Write-up. Buy under 6.00

| Stock | Price Bought | Date Bought | Price on 12/20/22 | Profit | Rating | |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 2.08 | -94% | Buy under 7.50 | |

| Atento SA (ATTO) | 21.57 | 4/14/21 | 4.14 | -81% | Buy under 10.00 | |

| Cipher Pharma (CPHRF) | 1.8 | 10/11/21 | 2.62 | 46% | Buy under 2.50 | |

| Cogstate Ltd (COGZF) | 1.7 | 4/13/22 | 1.15 | -32% | Buy under 1.80 | |

| Copper Property Trust (CPPTL) | 12.93 | 8/11/22 | 13.5 | 4% | Buy under 14.00 | |

| Currency Exchange (CURN) | 14.1 | 5/11/22 | 14.85 | 5% | Buy under 16.00 | |

| Epsilon Energy (EPSN) | 5 | 8/11/21 | 6.86 | 37% | Buy under 8.00 | |

| Esquire Financial Holdings (ESQ) | 34.11 | 10/10/21 | 42.46 | 24% | Buy under 42.00 | |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 27.89 | 44% | Buy under 45.00 | |

| Kistos PLC (KIST) | 4.79 | 7/13/22 | 4.3 | -10% | Buy under 7.50 | |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.75 | 23% | Hold | |

| M&F Bancorp (MFBP) | 19.26 | 11/9/22 | 19.65 | 2% | Buy under 21.00 | |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 1.36 | -24% | Buy under 3.50 | |

| NexPoint Diversified Real Estate Trust (NXDT) | 14.15 | 1/12/22 | 11.78 | -17% | Buy under 17.00 | |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 10.44 | 250% | Buy under 15.00 | |

| RediShred (RDCPF) | 3.3 | 6/8/22 | 3 | -9% | Buy under 3.50 | |

| Richardson Electronics (RELL) | -- | 9/14/22 | -- | --% | Sold | |

| Transcontinental Realty Investors (TCI) | 40.22 | 10/13/22 | 42 | --% | Buy under 45.00 | |

| Truxton Corp (TRUX)* | 72.25 | 12/8/21 | 65.51 | -8% | Buy under 75.00 | |

| Unit Corp (UNTC) | -- | NEW | -- | --% | Buy under 65.00 | |

| Zedge (ZDGE) | 5.73 | 3/9/22 | 1.85 | -68% | Buy under 6.00 | |

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in KIST:GB, LSYN, MEDXF, PX, IDT, APVO, NXDT, COGZF, RDCPD, TCI, ZDGE, and MFBP. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members.