Sell Donnelley Financial (DFIN)

I recently downgraded Donnelley Financial (DFIN) to Hold as I had concerns that the company was overearning given buoyant capital market activities which tend to be cyclical.

After re-underwriting the investment, I’ve decided to close out my recommendation and lock in our profit of 129% over a period of 10 months.

They say to let your winners run and cut your losers so maybe I should let DFIN continue to run.

The problem is I don’t see much upside from a valuation perspective.

The stock looks very cheap based on current earnings. It is trading at 8.4x free cash flow and 5.7x forward EBITDA.

But the business is benefiting from buoyant capital market activities that won’t last forever.

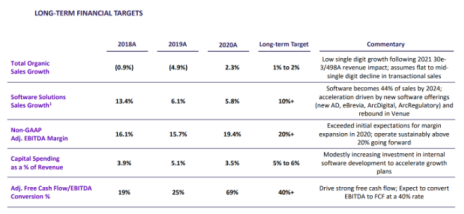

Management’s guidance is that it will grow 1% to 2% over the long term, generate 20%+ EBITDA margins, and convert 40% of EBITDA to free cash flow.

If you run the math based on that long-term guidance, the stock is trading at 7.8x EBITDA guidance and 14.4x free cash flow guidance.

This seems modestly cheap, but not compelling for a business that will growth 1% to 2% over the long term.

As such, I’m happy to close out our recommendation. If the stock pulls back considerably or the fundamentals improve (perhaps sustainable growth accelerates), I would be happy to recommend this name again.