Thoughts on Aptevo

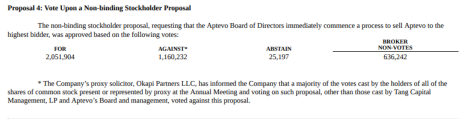

Aptevo filed an 8-K disclosing that Proposal 4 (Company Sale) passed.

However, as you can see in the screenshot below, the company made a special point in the footnote that the majority of non-Tang shareholders voted against the immediate sale.

As such, it looks like management might believe it can proceed without an immediate sale process. I’m not a fiduciary expert, but I would think the Board of Directors would open themselves up to all sorts of lawsuits if they ignore this shareholder vote (even though it’s non-binding) unless they are extremely confident that they can ultimately sell at a higher price later.

Where does it leave us?

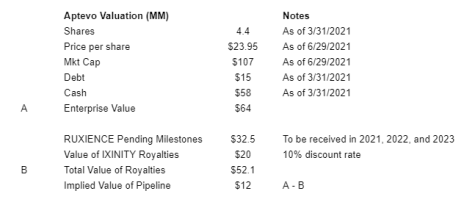

As of June 29, 2021, Aptevo has a market cap of $107MM and an EV of $64MM (see math below). It will receive another $32.5MM in milestone payments from its RUXIENCE sale. Further, I believe its IXINITY royalty payments could be sold for ~$20MM (assuming 10% discount rate).

As shown above, at Aptevo’s closing price on 6/28/2021, its pipeline is being valued by the market at $12MM. This seems too low given the promising results that APVO436 has shown in difficult to treat AML patients. Besides APVO436, Aptevo has a pipeline of other interesting assets.

I don’t know how it will play out, but I continue to believe APVO represents a good risk/reward opportunity with potential asymmetric upside.

Original Write-up. Buy under 40