What the Charts Are Telling Us After the Fed Minutes

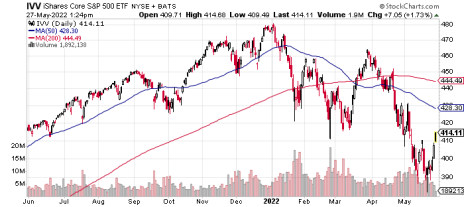

In this week’s update, I’ll focus on how ETFs are responding to the Federal Reserve minutes, released last week. These kindled some optimism in the stock market, as you see here on a chart of the S&P 500. One reason for the market uptick? The Fed gave no surprises, and the market doesn’t like surprises!

The minutes showed that the central bank plans to raise interest rates by a half percentage point each, in June and July.

So, what’s going on behind the scenes? Overall, an increase in rates means higher loan costs for businesses and consumers. Those higher rates will affect mortgages, credit cards and car loans, among other items. The Fed’s hope is: Higher borrowing costs will slow spending enough to tame inflation but without causing a recession.

Of course, we’ll see if that can actually happen, but the market cheered the news.

The initial phase of the rate increase will be good for stocks as it will reflect an improving economy – in theory anyway – and that could benefit cyclical sectors like technology, financials, consumer discretionary, and industrials.

A few ETFs got a nice bounce from the Fed minutes.

The Roundhill MEME ETF (MEME) is up about 5% for the week.

This ETF is designed to offer exposure to “meme stocks” by tracking the Solactive Roundhill Meme Stock Index, which consists of U.S. listed equities with a combination of elevated social media activity and high short interest.

It’s the first ETF globally that was specifically designed to track the performance of meme stocks. It holds 25 stocks in its basket with each making up less than 5% of the total assets, which is essentially equal-weighted, rather than market-cap weighted.

Meanwhile, a plain-vanilla S&P sector ETF also got a boost.

The SPDR S&P Retail ETF (XRT), which tracks the S&P large-cap retail sector, is up more than 9% for the week, indicating that investors believe the Fed’s plan for rate hikes signals economic strength, rather than a recession.

Again, I’m not necessarily agreeing with that stance, but it’s what the market thinks. My opinion – or yours – doesn’t matter. Look at what the market is telling us.

The Invesco S&P SmallCap Consumer Discretionary ETF (PSCD), which is a sister fund to our portfolio holding, the Invesco S&P SmallCap Energy ETF (PSCE), advanced more than 6% for the week.

This ETF tracks the small-cap segment of the broad consumer discretionary space, using the S&P SmallCap 600 Capped Consumer Discretionary Index.

So, does all this mean we’re in a market uptrend? By some measures, yes, as the S&P continues rising from its May 20 session low. Of course, that doesn’t mean it’s a long-term trend – although it may well be.

At this juncture, watch what the charts are telling you, and try to avoid the temptation of allowing your opinion or emotions to drive your investing and trading decisions. I’ll never give you the silly advice to be a “robot” when you trade, as humans are emotional creatures. However, if you catch yourself either making or avoiding a trade because of your opinion or emotions, be aware of that, then try to base your actions on what the charts are telling you.