While our Undiscovered Portfolio continues to lead the broader market, the dynamics have changed since the most recent ETF Strategist issue.

Last week marked the worst weekly return for the S&P 500 since March 2020, a move sparked by the most significant Federal Reserve interest-rate hike in a decade. The index is down 23.39% from its record close of 4,796.56 on Jan. 3, 2022.

Every sector has suffered losses since June 8. Energy, utilities, and materials have been the S&P 500’s worst-performing sectors recently.

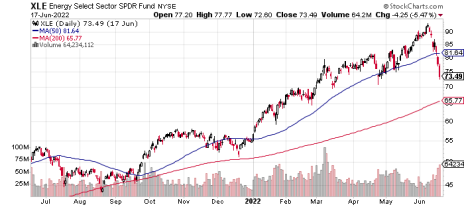

We may be witnessing some sector rotation: Energy is taking a big hit, with the Energy Select Sector SPDR ETF (XLE) down 12.38% this month, the largest sector decline. That follows a stellar year-to-date performance which sent the ETF soaring 32.41%. In fact, it remains the only sector with a year-to-date gain.

Analysts’ consensus estimates for the energy sector remain strong, but recent developments, such as the Biden administration’s emphasis on boosting production, may be having an effect on investor sentiment toward the sector.

Of course, it could also simply be a matter of taking profits in a sector that’s led the way all year.

Ultimately, the reasons don’t matter, although it’s interesting to speculate on what’s behind any price move.

It’s not just the S&P large-cap energy sector that’s getting clobbered. The Invesco S&P SmallCap Energy ETF (PSCE) skidded 21% last week. We’re keeping an eye on this holding to see whether it rebounds this week, or whether it undercuts its previous structure low of 8.92, reached on May 10.

Meanwhile, two other holdings, the AGFiQ US Market Neutral Anti-Beta Fund (BTAL) and the Direxion Daily S&P 500 Bear 1X Shares (SPDN), were up 2.43% and 5.83%, respectively, last week.

Brace yourself for the wild ride to continue. We may soon have more clarity on interest rates and the economic situation. Federal Reserve Chairman Jerome Powell will deliver his semi-annual monetary policy testimony before Congress Wednesday. He’s expected to reiterate the need to combat inflation through aggressive rate hikes.

We’ll continue to monitor the performance of our portfolio holdings, and send out special alerts when and if we make any trades.