The situation with Russia’s invasion of Ukraine has added a fresh bout of volatility to the markets.

But U.S. markets, as tracked by the SPDR S&P 500 ETF Trust (SPY), have not plunged far. The SPY fell to an intraday low of 410.64 on February 24 before rallying to finish the session with a gain.

The truth is: Stocks were already toying with a correction prior to the Ukrainian situation heating up.

Introduction

The situation with Russia’s invasion of Ukraine has added a fresh bout of volatility to the markets.

But U.S. markets, as tracked by the SPDR S&P 500 ETF Trust (SPY), have not plunged far. The SPY fell to an intraday low of 410.64 on February 24 before rallying to finish the session with a gain.

The truth is: Stocks were already toying with a correction prior to the Ukrainian situation heating up.

The SPY is a good illustration of how much uncertainty remains. Not only is the war a fast-developing event, but U.S. investors also face questions about the Federal Reserve and its pace of rate increases.

Investors had previously priced in a Fed Funds increase of 0.50% this month, but that appears less likely, at this juncture. However, a smaller increase may still be around the corner, when the Fed meets on March 15 and 16.

At this time, there is an overarching theme when it comes to your tactical ETFs: Playing defense.

This is where the Undiscovered Portfolio gives you an edge. These trades are based purely on technicals; however, it’s easy to see the underlying fundamental case and/or story behind each buy, sell or hold.

For example, after the trade alert sent out last Thursday, this portfolio consists of the following ETFs:

- 10%: ProShares Short MSCI EAFE (EFZ)

- 20%: Direxion Daily S&P 500 Bear 1X Shares (SPDN)

- 30%: SPDR SSGA U.S. Small Cap Low Volatility ETF (SMLV)

- 40%: Invesco Dow Jones Industrial Average Dividend ETF (DJD)

Let’s take a quick look at each of these.

ProShares Short MSCI EAFE (EFZ): This short ETF seeks a return that is the exact inverse the return of its underlying benchmark index, the MSCI EAFE, for a single day.

The MSCI EAFE index tracks performance of large and mid-cap securities across 21 developed markets, including countries in Europe, Australasia and the Far East, excluding the U.S. and Canada.

As you might imagine, the Ukraine war and resulting western sanctions are keeping a lid on European stocks. So this short fund is a good way to book some gains while the underlying index is trading lower.

Direxion Daily S&P 500 Bear 1X Shares (SPDN): This ETF seeks a return that is the inverse of the S&P 500 for a single day. It’s not a long-term buy-and-hold, but at a time when the S&P 500 continues to show volatility (for the same reasons the MSCI EAFE index is volatile), this is a potential way to add some juice to your return.

SPDR SSGA U.S. Small Cap Low Volatility ETF (SMLV): This ETF seeks investment results that correspond generally to the SSGA U.S. Small Cap Low Volatility Index. This index is designed to track performance of U.S. small-capitalization companies that exhibit low volatility. This ETF is trading higher in March, following a gain of 0.81% in February. During a time of high downside volatility, capturing even small gains can be a game-changer.

Invesco Dow Jones Industrial Average Dividend ETF (DJD): This ETF is based on the Dow Jones Industrial Average Yield Weighted Index. The index is designed to provide exposure to dividend-paying equities in the Dow, according to their dividend yield over the prior 12 months. Only securities with consistent dividend payments during that time are included. This ETF allows you to generate return through quality companies’ dividend payments, even during a broad market downturn.

| Symbol | Description | Allocation (%) |

| SMLV | SPDR SSGA US Small Cap Low Volatility ETF | 30% |

| EFZ | ProShares Short MSCI EAFE ETF | 10% |

| DJD | Invesco Dow Jones Industrial Average Dividend ETF | 40% |

| SPDN | Direxion Daily S&P 500 Bear 1X ETF | 20% |

Portfolios & Updates

Strategically Allocated Portfolios

This month, the long-term targeted-allocation portfolios have no changes. These are rebalanced at regular intervals, as needed.

But as we explained in the previous issue, these portfolios are designed for those who prefer to trade less, while generating a specific return over time.

Be aware: These portfolios are not intended to “beat the market” in any given year. Instead, they are designed to deliver a return within a specific range over time.

As noted in the descriptions below, the higher the equity concentration within a portfolio, the greater the potential for both gain and loss.

There are two inherent problems with taking too much risk:

- Panic selling when markets are down: As a financial advisor, I routinely met people who were proud to claim they had a high risk tolerance. I suppose they thought it sounded good, but it’s not better or worse than a low risk tolerance. When markets tanked, it was frequently those with a self-proclaimed high tolerance who called begging to sell assets. It was my job to talk them into staying the course.

- Sequence of returns risk: Say you retire during a year when equity markets are down. You begin making withdrawals from your portfolio to cover living expenses. Well, if you are withdrawing from a mostly equity portfolio, you are selling stocks with losses; that erodes your spending power over time. On the other hand, if you hold some securities that are performing better than others, you can sell those with a gain (or even a smaller loss) and give the biggest losers time to regain ground.

Here are the descriptions and holdings for each of the strategic portfolios.

As a reminder, there are no changes to these at the moment.

Aggressive Growth Portfolio

This portfolio is designed for investors seeking portfolio growth through an all-equity ETF portfolio. Aggressive growth seeks to return the highest capital gains.

An all-equity portfolio will be more aggressive than a portfolio that also holds bonds or significant cash.

Investors will own both U.S. and international stocks, including those issued by companies in developed and emerging markets.

| Symbol | Description | Allocation (%) |

| IVV | iShares Core S&P 500 | 31 |

| IYE | iShares US Energy | 3 |

| USMV | iShares Edge MSCI Min Vol USA ETF | 2 |

| VLUE | iShares MSCI USA Value Factor | 2.5 |

| EFV | iShares MSCI EAFE Value | 12 |

| ESGE | iShares MSCI EM ESG Optimized ETF | 5 |

| EFG | iShares MSCI EAFE Growth | 9 |

| IXG | iShares Global Financials | 2 |

| IXN | iShares Global Tech | 2.5 |

| ESGU | iShares MSCI USA ESG Optimized ETF | 25 |

| IJR | iShares Core S&P Small-Cap | 4 |

| Cash / Money Market | 2 |

Moderate Growth Portfolio

The goal of the Moderate Growth Portfolio is to provide long-term growth, balanced with income. Investors will own both U.S. and international stocks, including those issued by companies in developed and emerging markets. You also have exposure to government and corporate bonds, to provide potential income through interest payments.

This portfolio holds some of the same funds as the all-equity portfolio, although balanced with fixed-income funds as well.

| Symbol | Description | Allocation (%) |

| IXN | iShares Global Tech | 1.5 |

| IUSB | iShares Core Total USD Bond Market | 16 |

| IJR | iShares Core S&P Small-Cap | 2.5 |

| USMV | iShares Edge MSCI Min Vol USA ETF | 1.5 |

| GOVT | iShares Core US Treasury Bond | 9 |

| COMT | iShares Commodities Select Strategy | 2.5 |

| VLUE | iShares MSCI USA Value Factor | 1.5 |

| ESGE | iShares MSCI EM ESG Optimized ETF | 3 |

| EFV | iShares MSCI EAFE Value | 8 |

| ESGU | iShares MSCI USA ESG Optimized ETF | 16 |

| IXG | iShares Global Financials | 1.5 |

| FALN | iShares Fallen Angels USD Bond ETF | 3 |

| Cash / Money Market | 2 | |

| TIP | iShares TIPS Bond | 2.5 |

| EFG | iShares MSCI EAFE Growth | 5.5 |

| IVV | iShares Core S&P 500 | 20.5 |

| TLH | iShares 10-20 Year Treasury Bond | 2 |

| IYE | iShares US Energy | 1.5 |

Conservative Portfolio

The chief objective of a conservative portfolio is to protect your principal, rather than aim for strong growth. In my experience, it’s easy to misunderstand this objective, especially in market cycles when equities stage strong rallies, leaving conservative investors disappointed that they didn’t get the same return.

A conservative allocation no longer means the traditional all bonds “widows and orphans” portfolio. In today’s environment, especially as many investors are living longer, an all-bond portfolio simply won’t generate the necessary return in almost every case. Even if your prime objective, as determined by your plan (many factors go into that), you still need some exposure to stocks to bring growth and hedge against inflation.

| Symbol | Description | Allocation (%) |

| IGSB | iShares Short-Term Corporate Bond ETF | 1 |

| Cash / Money Market | 2 | |

| TIP | iShares TIPS Bond | 6 |

| EFV | iShares MSCI EAFE Value | 2.5 |

| EFG | iShares MSCI EAFE Growth | 2 |

| IVV | iShares Core S&P 500 | 8 |

| ESGE | iShares MSCI EM ESG Optimized ETF | 1 |

| GOVT | iShares Core US Treasury Bond | 19.5 |

| ICVT | iShares Convertible Bond ETF | 1.5 |

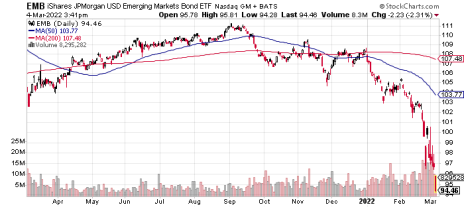

| EMB | iShares J.P. Morgan USD Emerging Markets Bond ETF | 1.5 |

| MBB | iShares MBS ETF | 8.5 |

| IUSB | iShares Core Total USD Bond Market | 27 |

| ESGU | iShares MSCI USA ESG Optimized ETF | 6.5 |

| IJR | iShares Core S&P Small-Cap | 1 |

| COMT | iShares Commodities Select Strategy | 2 |

| FALN | iShares Fallen Angels USD Bond ETF | 10 |

Additional ETFs Used in these Portfolios

iShares Core S&P 500 ETF (IVV)

Large-cap U.S stocks are the backbone of any portfolio. That’s true even for non-U.S. investors. The S&P 500 comprises about 70% to 80% of the total U.S. stock market, and by extension, about 35% to 40% of global market cap. The S&P 500 is something like a pantry staple, like coffee (if you’re in my house). Because large-cap U.S. stocks constitute such a large portion of worldwide market capitalization, it’s not an asset class you can ignore.

iShares MSCI USA ESG Optimized ETF (ESGU)

This ETF integrates environmental, social, and governance screening criteria into a broadly diversified, market-cap-weighted, domestic equity portfolio.

The fund tracks the MSCI USA Extended ESG Focus Index, which is designed to maximize exposure to positive environmental, social and governance (ESG) factors. The index screens for companies with high ESG ratings in each sector. Tobacco, controversial weapons, producers of or ties with civilian firearms, thermal coal and oil sands are not eligible for inclusion. Despite the ESG investment thesis, you’re not giving up performance, as returns are in line with the S&P 500.

iShares MSCI EAFE Growth ETF (EFG)

This ETF tracks the MSCI EAFE Growth Index, which comprises the faster-growing 50% of non-U.S. developed equity markets. The index focuses on stocks with rich valuation multiples, which you’ll commonly find among fast growers. It also screens for strong historical growth and estimated future growth.

While many investors have been trained to avoid stocks with high price-to-earnings ratios, those above-average P/Es can be a hallmark of stocks poised for further growth.

iShares MSCI EM ESG Optimized ETF (ESGE)

Emerging markets should be part of any diversified equity allocation. This fund not only tracks emerging-market stocks, but zeroes in on those with higher ESG ratings than those in the broad MSCI Emerging Markets Index. According to the fund’s constraints, sector and country weightings must fall within 5% of their allocation within the broader index. That means you won’t see a large drift into any particular area.

It’s true that non-U.S. funds have higher expense ratios, due to transaction costs, currency exchange costs and other factors, but this ETF’s expense ratio of 0.250% makes it an attractive holding.

iShares MSCI USA Value Factor (VLUE)

This ETF seeks out stocks trading at low multiples relative to others, while striving to eliminate typical value fund sector biases. Generally, financials, industrials, energy and consumer staples are considered value sectors. While tech is generally considered a growth sector, it comprises this fund’s largest sector weighting.

The fund weathered 2021 very well, down less than 1% for the year, not a bad achievement in an era when tech growth stocks are leading broad market performance.

iShares Global Tech (IXN)

This ETF tracks the S&P Global 1200 Information Technology Index. This fund tends to trade less than others in its category, which could keep investors’ costs low.

As you might imagine, the fund tilts heavily toward U.S. companies, as that’s where the bulk of quality tech names are headquartered. However, 20% of fund assets hail from outside the U.S. In fact, several of the top holdings are non-U.S. companies, including Taiwan Semiconductor (TSM), Samsung Electronics and ASML Holding (ASML).

iShares Edge MSCI Min Vol USA ETF (USMV)

Smoothing volatility, wherever you can, may help manage your expected return. This fund replicates the MSCI USA Minimum Volatility Index. The idea here is to construct the least-volatile portfolio from the components of the MSCI USA Index, a broad, cap-weighted benchmark of large- and mid-cap equities. Not only are the holdings screened for their intrinsic volatility, but also for how their performance correlates with other portfolio components.

The fund has a tilt toward large blend, meaning it holds both value and growth stocks. This ETF ended 2021 in new high ground, as top holdings Accenture (ACN) and Cisco (CSCO) showed strong December gains.

iShares Core S&P Small-Cap (IJR)

Small cap stocks, over time, outperform large caps, although that was not the case in the past five years. However, there are notable periods of outperformance. For example, in the decade between 2000 and 2009, domestic small caps outpaced the S&P 500.

Because this ETF is market-cap weighted, its performance may be skewed toward the top components, such as Omnicell (OMCL), Innovative Industrial Properties (IIPR) and Exponent (EXPO). However, unlike the large-cap S&P 500, the top holdings represent a smaller percentage of all components.

iShares Core U.S. Treasury Bond (GOVT)

Treasury bonds are a way to stabilize portfolio returns, although this fund is not the one to deliver big gains. Treasuries are backed by the U.S. government, meaning the risk is minimized. The reason to hold this fund is to dampen risk elsewhere in the portfolio.

This fund tracks the ICE U.S. Treasury Core Bond Index, which constitutes Treasuries with at least one year to maturity. Holdings are weighted by market value.

This fund is extremely cost efficient, giving it an additional edge, even when compared to other Treasury ETFs. Its expense ratio is just 0.050%.

iShares Short-Term Corporate Bond ETF (IGSB)

The iShares Short-Term Corporate Bond ETF is pegged to the ICE BofA 1-5 Year U.S. Corporate Index. This index tracks domestic investment-grade corporate bonds that have one to five years before maturity. These short- and intermediate-term bonds are less sensitive to interest rate changes, but the tradeoff is a lower return, relative to longer-term fixed-income securities.

When it comes to credit quality, this ETF tilts toward bonds with A and BBB ratings, meaning at the lower end of the investment-grade universe. That tilt can juice up return somewhat, as investors demand to be paid more for bonds with a slightly lower credit quality.

iShares MBS ETF (MBB)

This ETF is focused on the investment-grade, mortgage-backed, pass-through securities issued or guaranteed by government agencies or quasi-governmental agency.

Because of the government backing, these securities are of a high credit quality. As with Treasury bonds, this mitigates risk. However, as with any vehicle designed to dampen portfolio volatility, don’t look to this fund for a big return; that comes from your equity allocation. The low expense ratio of 0.060% also makes this fund a compelling choice.

iShares Core Total USD Bond Market (IUSB)

This fund tracks the Bloomberg U.S. Universal Bond Index, which is composed of dollar-denominated, fixed-rate, taxable bonds of all credit qualities, with at least one year to maturity.

The fund has a tilt toward U.S. Treasuries, agency mortgage-backed securities, and corporate bonds, but as it encompasses all credit qualities, there is also some high-yield debt. As of December 31, high-yield bonds accounted for about 8% of total assets. Despite that tranche, interest-rate sensitivity is the real story of this ETF.

Its average duration, which is a way of measuring interest-rate sensitivity, stands at 6.37 years.

iShares Fallen Angels USD Bond ETF (FALN)

This small allocation tracks the Bloomberg U.S. High Yield Fallen Angel 3% Capped Index. That’s a mouthful, but it means this: The fund comprises high-yield corporate bonds that at one time were rated investment grade. There’s the “fallen angel” concept.

This strategy’s 12-month yield is 3.72%, lower than many comparable funds. That’s actually a good thing: A lower yield typically means the fund carries a lower credit risk. In fact, this portfolio has a tilt toward BB-rated bonds, which are at the higher end of the high-yield universe. This can help bolster returns in a bear market.

iShares TIPS Bond (TIP)

With inflation a major concern for investors these days, this is a good addition to your ETF allocation. This fund tracks the Bloomberg U.S. Treasury Inflation-Linked Bond Index, which includes treasury inflation-protected securities with at least a year to maturity.

TIPS offer an inflation hedge because their principal is pegged to the U.S. Consumer Price Index. The value of the holdings’ principal is adjusted higher when CPI is on the increase. That means higher coupon payments for holders. A TIPS fund’s return will often outpace that of a regular Treasury fund with a similar maturity date during times of higher-than-anticipated inflation.

iShares GSCI Commodity Dynamic Roll Strategy ETF (COMT)

The rationale for owning commodities is because a properly diversified portfolio should hold assets with different degrees of correlation. Commodities tend to underperform during times of equity-market rallies, and that’s been true in this case.

However, it’s also a truism that markets can shift relatively quickly, and having a broad allocation is a proven way of smoothing your return, and achieving the expected outcome.

This ETF tracks the S&P GSCI Dynamic Roll (USD) Total Return Index, which includes a range of commodity exposures. The term “dynamic roll” refers to the index’s process for adding and subtracting futures contracts. The aim is to avoid contango, which is not a fun dance, but a situation where a commodity’s futures pricing is higher than the current spot price. That’s a problem because a constantly rolling futures contract, in a contango environment, can erode returns.

You can view this ETF as an extra measure of protection relative to equity-market fluctuations.

iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB)

Emerging-market government bonds generally have higher yields than their developed-market peers due to greater possibility of default. More than 46% of holdings are rated below investment grade, while another 30.83% are rated BBB, the lower end of what’s considered investment grade.

Those numbers tell you there’s a higher degree of credit risk here. On the flip side, higher credit risk can mean higher return.

The fund tracks the JPMorgan EMBI Global Core Index, which includes government and quasi-governmental debt with a minimum of two years to maturity. Bonds must also have at least $1 billion in outstanding face value. The index limits exposure of the largest country weighting to twice the average country weighting throughout the portfolio. That’s a way to minimize country-specific risk.

iShares MSCI EAFE Value ETF (EFV)

This fund is comprised of stocks from the MSCI EAFE Index, which targets the largest 85% of companies from 21 non-U.S. developed markets. The cheapest companies, as determined by book/price, forward earnings/price, and dividend yield, are allocated intoto this index - hence the value designation.

This is a market-cap weighted index, with a distinct tilt toward large cap. However, mid-caps make up about 11% of the fund. This fund has a low turnover, which reins in transaction costs and keeps fees low for investors. It’s rebalanced twice a year.

iShares Convertible Bond ETF (ICVT)

This ETF tracks the Bloomberg U.S. Convertible Cash Pay Bond > $250MM Index. That’s a mouthful, but it amounts to a fund composed of dollar-denominated convertible securities, in particular, cash pay bonds, with outstanding issue sizes greater than $250 million.

Convertible bonds offer the growth potential of stocks, but with the added benefits of income and downside risk management. In a rising-rate environment, stocks tend to outperform bonds. However, unlike traditional bonds, convertible bond prices are influenced by the value of the underlying corporate stock price. This means they are often less sensitive to interest-rate changes than most fixed-income securities.

iShares U.S. Energy ETF (IYE)

The energy sector has been a leader in the past year and is still on the rise, with the outlook strong.

The ETF is pegged to the Russell 1000 Energy RIC 22.5/45 Capped Index, which includes domestic energy-sector equities. Use this fund to express a view that the energy sector will be a strong performer.

The portfolio of 37 stocks is broadly composed of giant, large and mid-cap holdings. The top ten holdings account for 69.05% of total fund assets. This fund trades less frequently than the average energy fund, which is generally an advantage to investors.

iShares Global Financials ETF (IXG)

This ETF seeks to track results of the S&P Global 1200 Financials Index.

It offers exposure to companies that provide financial services to enterprise and retail customers. The market capitalization tilts toward giant and large cap. However, there’s less market-cap concentration than in other funds, with the top 10 holdings accounting for just 28.54% of total fund assets.

The fund is split almost equally between U.S. and non-U.S. equities. This inherently offers some global diversification beyond the typical S&P large cap financials.

iShares 10-20 Year Treasury Bond ETF (TLH)

The iShares 10-20 Year Treasury Bond ETF tracks investment results of an index composed of U.S. Treasury bonds with remaining maturities ranging from 10 and 20 years. The effective maturity is 18.43 years.

As a Treasury bond fund, the prime purpose in your portfolio is to dampen volatility inherent in equities. You won’t get much return from a Treasury fund, so it’s best to view it as ballast. It’s a small portion of the overall allocation, but enough to balance out more aggressive and potentially risky assets.

The next Cabot ETF Strategist issue will be published on April 12, 2022.